PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850990

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850990

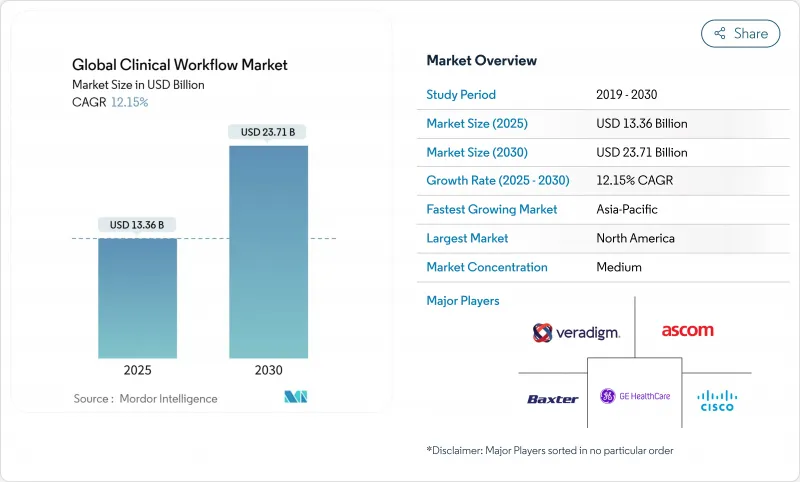

Global Clinical Workflow - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The clinical workflow market size reached USD 13.36 billion in 2025 and is projected to climb to USD 23.71 billion by 2030, reflecting a brisk 12.15 % CAGR.

Rising operating costs, tighter staffing pools and the march toward value-based reimbursement are encouraging providers to automate repetitive tasks and connect data silos. Cloud-friendly platforms and mandated interoperability standards are reshaping buying priorities, nudging hospitals to shift budgets from maintaining legacy code toward subscription-style services that promise continual upgrades. Large vendors are broadening portfolios through acquisitions and partnerships, while younger specialists are capturing attention with niche tools that solve workflow pain points for specific departments. Regional spending patterns hint that North America will keep its lead for now. Yet, the faster investment pace in Asia-Pacific suggests the competitive gap could narrow before the end of the forecast window.

Global Clinical Workflow Market Trends and Insights

Mandated Global Interoperability Standards Accelerating Adoption

Health-level Seven Fast Healthcare Interoperability Resources (HL7 FHIR) moved from pilot phase to production reality in a growing share of health systems, catalyzing broader acceptance of standards-based application-programming interfaces (APIs). Peer-reviewed research shows that most digital health firms already rely on a mix of standards-based and proprietary APIs to ensure business continuity during transitions. A direct consequence is that integration budgets, previously set aside for custom interfaces, are now being redirected toward new analytical features, indicating an implicit cost shift within project portfolios. An additional inference is that vendors able to demonstrate pre-certified FHIR interfaces can shorten sales cycles by addressing one of the most common procurement hurdles.

Escalating Worldwide Healthcare Workforce Shortages Prompting Automation

A projected shortfall of millions of nurses and allied professionals by 2026 has elevated automation from optional to mission-critical status in the clinical workflow market. Industry associations note a rapid uptick in AI tools aimed at documentation, staffing, and predictive rostering, with reported adoption in medical groups more than doubling year on year. This surge signals that frontline staff increasingly influence purchasing committees, as burnout metrics become board-level key performance indicators. A corollary inference is that software addressing human-factor pain points, rather than purely administrative ones, will enjoy enduring demand because it aligns directly with workforce-retention goals.

High Integration & Training Costs

Despite evident benefits, the cost and complexity of integrating new platforms into fragmented legacy environments remain leading barriers to adoption. Training budgets often lag behind technology spend, leading to inconsistent utilization and muted return on investment (ROI). The pattern implies that vendors offering embedded change-management services can command a premium because they help customers realize value faster.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Value-Based Care Requiring End-to-End Workflow Visibility

- Proliferation of Connected Medical Devices Generating Real-Time Data Streams

- Fragmented Legacy IT Ecosystems Hindering Seamless Interoperability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The software segment accounted for the most significant clinical workflow market size at 71.89% in 2024, underpinning digitization initiatives across hospitals. Four consecutive years of capital budgets favoring platform upgrades indicate that software remains the entry point for modernizing processes. Nonetheless, services are forecast to post a 14.62% CAGR from 2025 to 2030, outpacing software expansion as providers seek implementation expertise and continuous optimization. An inference is that knowledge transfer, not code alone, now drives sustainable performance gains, encouraging vendors to embed consultancy teams into subscription contracts.

The services upswing is particularly visible among mid-sized hospitals, where IT resources are limited and external guidance accelerates go-live timelines. As pay-for-performance penalties grow, leadership is willing to fund advisory support to reduce the risk of regulatory non-compliance. Consequently, merger activity among service specialists and platform vendors is likely to intensify, suggesting that integrated offerings will appeal to buyers seeking a single accountability point.

Data integration solutions held 30.42% of the clinical workflow market in 2024, reflecting their role as the connective tissue for disparate electronic health record (EHR) modules. However, care collaboration tools are projected to expand at a 15.21% CAGR through 2030, pointing to a shift toward team-centric delivery models. The pandemic accelerated demand for secure messaging, shared task lists, and cross-site communication; this behavioral change has persisted even as emergency conditions eased. The observation implies that collaboration platforms have crossed the threshold from convenience to clinical necessity.

Advances in AI are further boosting collaboration utilities, providing predictive suggestions about which specialist to engage and when. Vendors embedding such intelligence report higher renewal rates, indicating that clinical users value context-aware recommendations over static messaging functions. The inference here is that differentiation will increasingly reside in decision-support depth rather than interface polish alone.

The Clinical Workflow Market Report is Segmented by Component (Software and Services), Product Type (Data-Integration Solutions, Real-Time Communication Solutions, and More), Delivery Mode (On-Premise, Cloud-Based, and Hybrid), Organization Size (Large Enterprises and SMEs), End-User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America produced 44.09% of global revenue in 2024, buoyed by mature IT infrastructure, substantial per-capita healthcare spending, and regulatory incentives that reward technology use in quality reporting. Large health systems partnered with technology giants to pilot advanced AI tools; for instance, Sutter Health's multi-year collaboration aims to inject AI-driven insights into imaging workflows. One inference is that early adopter networks serve as reference sites, accelerating procurement decisions among peers wary of being left behind.

Asia-Pacific is forecast as the fastest-growing territory with a 13.56% CAGR between 2025 and 2030, underpinned by public funding for digital hospitals in China, India, and Indonesia. A recent memorandum between Siloam Hospitals and Philips to advance AI diagnostics exemplifies regional appetite for leapfrog solutions that circumvent legacy constraints. Given that many facilities are still in the first or second EHR generation, vendors can embed modern standards from inception, potentially reducing long-term integration debt-an implicit cost advantage relative to Western counterparts.

Europe maintains solid penetration, with General Data Protection Regulation (GDPR) shaping privacy-by-design architectures. Although national markets differ, leading institutions in Germany and the United Kingdom experiment with AI-enabled scheduling and ambient documentation. The inference is that stringent data rules push vendors to refine consent management modules, which can later be repurposed as value-adds in less regulated markets. Emerging regions in the Middle East, Africa, and South America are earlier in the adoption curve but exhibit high interest in telehealth and cloud solutions, suggesting they may skip the on-premise phases entirely.

- Alcidion Group

- Ascom

- Baxter

- Cisco Systems

- CliniComp Intl.

- EvidenceCare

- GE HealthCare Technologies Inc.

- GetWellNetwork

- iMDsoft

- Imprivata Inc.

- Infor

- Koninklijke Philips

- Lumeon Ltd.

- Mckesson

- Oracle

- Picis Clinical Solutions

- Sectra

- SONIFI Health

- Stryker

- Veradigm Inc

- Wolters Kluwer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandated Global Interoperability Standards (HL7 FHIR, ISO/IEEE) Accelerating Adoption

- 4.2.2 Escalating Worldwide Healthcare Workforce Shortages Prompting Automation

- 4.2.3 Shift to Value-Based Care Requiring End-to-End Workflow Visibility

- 4.2.4 Proliferation of Connected Medical Devices Generating Real-Time Data Streams

- 4.2.5 Rapid Uptake of Cloud-Native Hospital Information Systems Enabling SaaS Deployment

- 4.2.6 Pandemic-Driven Demand for Remote Clinical Collaboration & Command Centers

- 4.3 Market Restraints

- 4.3.1 High Integration & Training Costs

- 4.3.2 Limited Digital Literacy Among Clinical Staff Impeding Transformation

- 4.3.3 Fragmented Legacy IT Ecosystems Hindering Seamless Interoperability

- 4.3.4 Data-Privacy & Cyber-Security Concerns Hampering Cloud Adoption

- 4.4 Regulatory Outlook

- 4.5 Technological Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Product Type

- 5.2.1 Data-Integration Solutions

- 5.2.2 Real-Time Communication Solutions

- 5.2.3 Workflow-Automation Solutions

- 5.2.4 Care-Collaboration Solutions

- 5.2.5 Enterprise Reporting & Analytics Solutions

- 5.3 By Delivery Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud-Based

- 5.3.3 Hybrid

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 SMEs

- 5.5 By End-User

- 5.5.1 Hospitals

- 5.5.2 Long-Term Care Facilities

- 5.5.3 Other End-Users

- 5.6 By Geography (Value)

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Portfolio Analysis

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Alcidion Group

- 6.4.2 Ascom Holding AG

- 6.4.3 Baxter International

- 6.4.4 Cisco Systems Inc.

- 6.4.5 CliniComp Intl.

- 6.4.6 EvidenceCare

- 6.4.7 GE HealthCare Technologies Inc.

- 6.4.8 GetWellNetwork Inc.

- 6.4.9 iMDsoft

- 6.4.10 Imprivata Inc.

- 6.4.11 Infor Inc.

- 6.4.12 Koninklijke Philips N.V.

- 6.4.13 Lumeon Ltd.

- 6.4.14 McKesson Corporation

- 6.4.15 Oracle Corporation

- 6.4.16 Picis Clinical Solutions

- 6.4.17 Sectra AB

- 6.4.18 SONIFI Health

- 6.4.19 Stryker Corporation

- 6.4.20 Veradigm Inc

- 6.4.21 Wolters Kluwer N.V.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment