PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850996

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850996

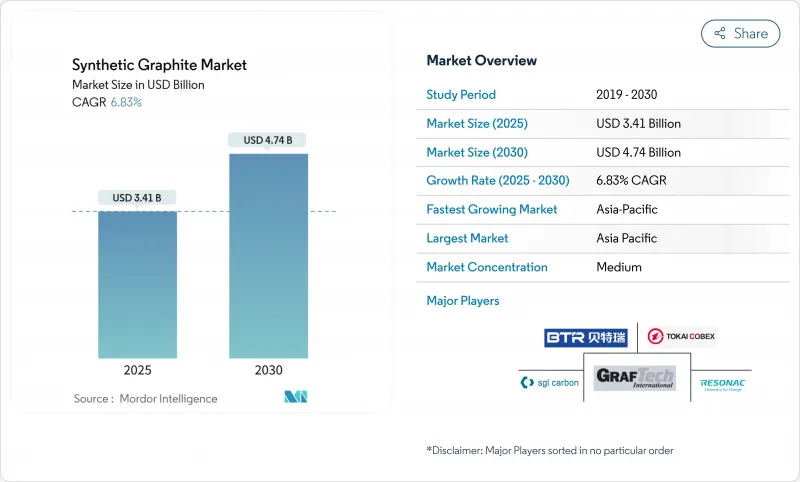

Synthetic Graphite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The synthetic graphite market size is valued at USD 3.41 billion in 2025 and is forecast to reach USD 4.74 billion by 2030, reflecting a 6.83% CAGR over 2025-2030.

Demand is advancing because high-performance electric vehicles and grid storage batteries require anode materials that permit faster charging, longer range, and consistent cycle life. At the same time, electric-arc-furnace (EAF) steelmakers rely on graphite electrodes that tolerate 3,000 °C process temperatures, locking in a large volume baseline for the synthetic graphite market. Manufacturers also target small modular reactors' nuclear-grade components, pushing specialty grades into new revenue pools. Asia-Pacific dominates current production capacity and end-use consumption, while North America is mobilizing public-funded projects to build domestic supply chains. The dual pull of energy transition and metallurgical modernization keeps the synthetic graphite market expanding even though producers face cost inflation and mounting decarbonization pressure.

Global Synthetic Graphite Market Trends and Insights

Increasing Demand for Electric Vehicles

Automakers are ramping battery output to meet tightening emissions rules, driving a steep demand for synthetic graphite anodes that deliver uniform particle size, low impurity levels, and stable performance across thousands of cycles. The U.S. Department of Energy projects a six-fold increase in domestic battery capacity by 2035, a trajectory underpinning NOVONIX's 31,500 t pa Tennessee plant backed by a USD 754 million conditional loan. Panasonic Energy has already locked in a four-year off-take for 10,000 t of North American material to shorten supply lines and curb Scope 3 emissions. New cell chemistries that raise charging rates above 4C count on ultra-pure synthetic particles with tailored porosity, invigorating the premium sub-segment of the synthetic graphite market. Heightened geopolitical risk around Chinese supply is prompting parallel investments in Europe and South Korea, reinforcing multi-regional growth momentum in battery-grade output.

Growing Utilization of Electric ARC Furnace Process for Steel Production

Steelmakers worldwide are shifting away from blast furnaces to electric-arc furnaces to cut operational CO2 intensity, and each EAF relies on consumable graphite electrodes. Regional capex pipelines in India, Vietnam, and the Gulf Cooperation Council add dozens of furnaces rated above 150 t per heat, translating to steady electrode off-take over the next decade. Proper handling, inspection, and alignment remain critical because cracks or oxidation raise specific consumption rates and hinder melt shop yields. Electrode vendors are bundling maintenance advisory services, deepening customer lock-in while capturing incremental revenue. This metallurgical modernization anchors a stable, long-cycle foundation under the synthetic graphite market even as battery demand injects high-growth upside.

High Cost of Production of Graphite

Synthetic graphite prices hover near USD 20,000 t, reflecting the high-temperature graphitization step that consumes energy at 3,000 °C over several weeks. Battery cell designers have responded by blending natural and synthetic grades to cap anode cost while retaining critical rate capability. Producers are investigating new low-temperature catalytic routes such as NETL's coal-waste-derived process that forms turbostratic carbon at 1,500 °C, promising sharper cost curves for future capacity. In the interim, the steep cost delta with natural flake graphite creates margin pressure, especially for mid-tier cell makers competing on price in mass-market vehicles.

Other drivers and restraints analyzed in the detailed report include:

- Faster-Charging Premium EV Models Requiring Ultra-High-Purity Anodes

- Surge in Ultra-High-Power EAF Installations in Asia and the Middle-East and Africa

- Strict Environmental Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metallurgy retained 49% of the synthetic graphite market size in 2024, underpinned by steady electrode consumption in long-cycle steel production. Each tonne of liquid steel in an EAF consumes 1.8-2.2 kg of electrodes, guaranteeing recurrent replacement demand. Yet batteries represent the fastest-growing application, posting an 8.39% CAGR outlook as EV and stationary storage installations rise. Battery demand is moving anode quality specifications higher, accelerating continuous-mixing and micron-level classification investments at synthetic graphite plants.

The Synthetic Graphite Market Report Segments the Industry by Application (Batteries, Metallurgy, and More ), Product Type (Graphite Anode, Graphite Block, and Other Types), End-User Industry (Automotive, Steel and Metals, Energy and Power, Electronics and Electrical, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific commands 56% of the synthetic graphite market and is expanding at a 7.67% CAGR through 2030, sustained by China's 77% share of global graphite output in 2023 and regional EAF expansions. Beijing's late-2023 export licensing regime for high-purity graphite has heightened supply-chain risk, motivating South Korean, Japanese, and Indian cell makers to secure alternative sources.

North America is experiencing an unprecedented re-shoring wave. The U.S. Department of Energy's conditional USD 754 million loan to NOVONIX enables a 31,500-t pa Tennessee plant that can serve 325,000 EVs annually, reducing import reliance. Parallel research and development at the National Energy Technology Laboratory converts coal waste to battery-grade graphite at lower temperatures, hinting at a cost-competitive, vertically-integrated supply chain.

Europe focuses on sustainability leadership. Vianode's renewable-powered pilot line in Norway records emissions of 1.9 kg CO2 kg-1 today and targets 1.0 kg by 2030. Germany and France are nurturing lignin-to-carbon programs that could introduce bio-based feedstocks, diversifying raw-material risk and reinforcing the synthetic graphite market's low-carbon pivot.

- Anovion LLC

- Asbury Carbons

- BTR New Material Group Co., Ltd.

- GrafTech International

- Graphit Kropfmuhl GmbH

- Graphite India Limited

- HEG Limited

- Imerys

- Mersen

- Mitsubishi Chemical Group Corporation

- Nippon Carbon Co Ltd.

- NOVONIX Ltd.

- Resonac Holdings Corporation

- SGL Carbon

- Shanghai PTL New Energy Technology Co., Ltd.

- Shanghai Shanshan Technology Co., Ltd.

- Superior Graphite

- Tokai COBEX GmbH

- Vianode

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Electric Vehicles

- 4.2.2 Growing Utilization of Electric ARC Furnace Process for Steel Production

- 4.2.3 Faster-Charging Premium EV Models Requiring Ultra-High-Purity Anodes

- 4.2.4 Surge in Ultra-High-Power EAF Installations in Asia and Middle East Africa

- 4.2.5 Advanced Modular Reactors Reviving Nuclear-Grade Graphite Demand

- 4.3 Market Restraints

- 4.3.1 High Cost of Production of Graphite

- 4.3.2 Price Gap with Natural Graphite Driving OEM Anode Blends

- 4.3.3 Strict Environmental Regulations

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Application

- 5.1.1 Batteries

- 5.1.2 Metallurgy

- 5.1.3 Parts and Components

- 5.1.4 Nuclear

- 5.1.5 Others

- 5.2 By Product Type

- 5.2.1 Graohite Anode

- 5.2.2 Graphite Block

- 5.2.3 Other Types

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Steel and Metals

- 5.3.3 Energy and Power

- 5.3.4 Electronics and Electrical

- 5.3.5 Chemical and Petrochemical

- 5.3.6 Aerospace and Defense

- 5.3.7 Others

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Indonesia

- 5.4.1.6 Malaysia

- 5.4.1.7 Thailand

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordics

- 5.4.3.7 Russia

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Anovion LLC

- 6.4.2 Asbury Carbons

- 6.4.3 BTR New Material Group Co., Ltd.

- 6.4.4 GrafTech International

- 6.4.5 Graphit Kropfmuhl GmbH

- 6.4.6 Graphite India Limited

- 6.4.7 HEG Limited

- 6.4.8 Imerys

- 6.4.9 Mersen

- 6.4.10 Mitsubishi Chemical Group Corporation

- 6.4.11 Nippon Carbon Co Ltd.

- 6.4.12 NOVONIX Ltd.

- 6.4.13 Resonac Holdings Corporation

- 6.4.14 SGL Carbon

- 6.4.15 Shanghai PTL New Energy Technology Co., Ltd.

- 6.4.16 Shanghai Shanshan Technology Co., Ltd.

- 6.4.17 Superior Graphite

- 6.4.18 Tokai COBEX GmbH

- 6.4.19 Vianode

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Bio-graphite as a Sustainable Resource for Battery Material