PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851013

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851013

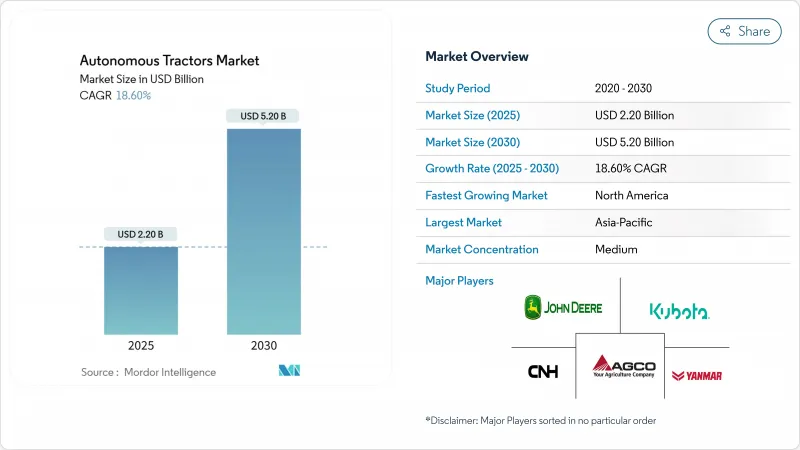

Autonomous Tractors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The autonomous tractor market touched USD 2.2 billion in 2025 and is forecast to reach USD 5.2 billion by 2030, sustaining an 18.6% CAGR.

The upswing stems mainly from an acute farm-labor crisis, rapid precision-agriculture uptake, and a widening set of government incentives that shorten payback periods for connected low-carbon machinery. Large commercial growers are already converting labor savings of 20% into higher margins, while continuous 24-hour field operation raises seasonal output. Software-centric revenue models, retrofit kits, and electric powertrains further expand addressable demand, signaling that the autonomous tractor market is entering a mainstream growth phase that transcends niche adoption.

Global Autonomous Tractors Market Trends and Insights

Rising Farm-Labor Shortages and Wage Inflation

A shrinking rural workforce is colliding with rising average farmer age, leaving half of open agricultural roles unfilled. Wage inflation amplifies the strain during peak field windows, particularly for harvest, where autonomous grain-cart systems now run round-the-clock without operators. Growers report productivity gains of 30-40% during critical windows, confirming that the autonomous tractor market is filling a structural gap rather than adding discretionary convenience. The urgency has reframed autonomy as core infrastructure required for long-term farm viability.

Accelerated adoption of precision agriculture and IoT connectivity

Cloud farm-management platforms already link well over 1 million machines, converting tractors into roaming data hubs that feed soil, yield, and asset information into real-time decision systems. Advanced sensor fusion, GPS, machine vision, and radar enable centimeter-level guidance, variable-rate input placement, and full-field obstacle avoidance.

High upfront cost and uncertain ROI for small farms

A single electric autonomous tractor can exceed USD 88,000, a steep outlay for holdings under 100 hectares. Connectivity upgrades, on-premise data infrastructure, and service subscriptions add further load. Models show that profitable deployment often begins above 500 hectares unless external grants offset capital expense, leaving many family farms to rely on co-operative ownership or hire services until prices fall.

Other drivers and restraints analyzed in the detailed report include:

- Government incentives for smart and low-carbon equipment

- Orchard and vineyard shift to narrow-row autonomous tractors

- Data-privacy and cybersecurity concerns in connected fleets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Current demand centers on tractors above 31-100, which accounted for 39.5% of the autonomous tractor market share in 2024. The mid-range 31-100 HP bracket serves as a pivotal bridge, blending horsepower sufficient for moderate tillage with manageable capital requirements. Modular add-ons, vision kits, telematics, and implementing automation allow progressive autonomy upgrades. Dealers report that growers trial a semi-autonomous retrofit on an existing 75 HP tractor before purchasing a larger 200 HP flagship machine, illustrating a stepped adoption curve.

Yet the spotlight is shifting to more than 100 HP, the fastest-growing slice at 24.0% CAGR. These machines suit broad-acre tillage, seeding, and heavy draft implements on large farms. Compact units up to 30 HP empower horticulture, dairy, and mixed-crop holdings to automate repetitive tasks such as mowing or spraying. Fleet concepts that deploy multiple lightweight robots instead of one heavy tractor lower soil compaction, reduce field entry barriers, and democratize precision technology for smallholders.

Semi-autonomous configurations, where an operator remains in the cab or oversees the machine remotely, commanded 68.2% market share in 2024. Farmers value immediate labor savings yet retain manual fallback. Over the forecast period, fully autonomous solutions will outpace all others, expanding at 23.1% CAGR. The step-wise path of remote steering aids, task-specific autonomy, and then full fleet orchestration mirrors the automotive sector's evolution. Real-time kinematic GPS, multi-camera perception, and redundant safety layers underpin Level 4 capabilities now entering commercial fields.

Confidence builds as growers witness a combine run autonomously for 12 straight hours without intervention. Regulators are drafting performance-based guidelines rather than prescribing technology, easing deployment. Insurance carriers have started to offer premium discounts for validated autonomous systems that reduce accident risk.

The Autonomous Tractors Market is Segmented by Horsepower (Up To 30HP, and More), by Automation Level (Fully Automated and Semi-Automated), by Drive Type (Diesel, and More), by Application (Tillage, and More), by Component (GPS/GNSS, and More), by Farm Size (Small, Medium, and Large) and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific preserved its leadership with a 46.3% share in 2024, underpinned by sizable land holdings and robust public funding. China's multi-trillion-dollar pledge to modernize farming injects capital into equipment subsidies, AI research hubs, and rural 5G roll-outs. Japan's smart-farming drive counters a rapidly aging farmer demographic, while Australia directs grants toward autonomous solutions suited to vast dryland operations. These aligned policies sustain a deep opportunity pool for the autonomous tractor market across the region.

North America is the fastest-expanding arena at 23.2% CAGR. High labor costs, abundant venture capital, and active OEM R&D pipelines speed commercialization. The United States dominates precision agriculture connectivity projects, yet only 27% of farms have adopted them, implying sizable headroom. Federal programs that require minimum broadband speeds per farm accelerate digital foundations needed for autonomy. Canada leans on clean-tech subsidies, and Mexico's mechanization push spreads automation southward.

Europe follows a steady growth path, supported by Common Agricultural Policy reforms that reward digital, low-carbon farming. Germany, France, and Spain lead deployments through established machinery makers and strict emission standards that favor electric drive. Eastern Europe offers upside as large tracts of contiguous farmland suit fleet-scale autonomy. Subsidized carbon-credit schemes and energy-transition funds lower the financial hurdle, cementing Europe as a vital segment of the autonomous tractor market.

- Deere & Company

- AGCO Corporation (Fendt, Massey Ferguson)

- CNH Industrial (Case IH, New Holland)

- Kubota Corporation

- Mahindra & Mahindra

- Monarch Tractor

- AutoNext Automation

- YANMAR HOLDINGS CO., LTD.

- CLAAS KGaA mbH

- TYM Corporation

- SDF Group

- Kioti (daedong)

- ISEKI & Co., Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising farm-labor shortages and wage inflation

- 4.2.2 Accelerated adoption of precision agriculture and IoT connectivity

- 4.2.3 Government incentives for smart and low-carbon equipment

- 4.2.4 Orchard and vineyard shift to narrow-row autonomous tractors

- 4.2.5 OEM open-API ecosystems enabling retro-fit autonomy

- 4.2.6 Carbon-credit monetization for electric autonomous units

- 4.3 Market Restraints

- 4.3.1 High upfront cost and uncertain ROI for small farms

- 4.3.2 Data-privacy and cybersecurity concerns in connected fleets

- 4.3.3 Patchy rural 5G/edge connectivity

- 4.3.4 Evolving liability regulations for driver-less machinery

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Horsepower

- 5.1.1 Up to 30 HP

- 5.1.2 31 - 100 HP

- 5.1.3 Above 100 HP

- 5.2 By Automation Level

- 5.2.1 Semi-Autonomous

- 5.2.2 Fully Autonomous

- 5.3 By Drive Type

- 5.3.1 Diesel

- 5.3.2 Hybrid

- 5.3.3 Battery-Electric

- 5.4 By Application

- 5.4.1 Tillage

- 5.4.2 Sowing

- 5.4.3 Harvesting

- 5.4.4 Orchard and Vineyard Operations

- 5.5 By Component

- 5.5.1 GPS/GNSS

- 5.5.2 Sensors and Vision Systems

- 5.5.3 LiDAR and Radar Modules

- 5.5.4 Control and Navigation Software

- 5.6 By Farm Size

- 5.6.1 Small (Less than 100 ha)

- 5.6.2 Medium (100-500 ha)

- 5.6.3 Large (More than 500 ha)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Spain

- 5.7.3.5 Russia

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 Australia

- 5.7.4.5 South Korea

- 5.7.4.6 Rest of Asia-Pacific

- 5.7.5 Middle East

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 UAE

- 5.7.5.3 Turkey

- 5.7.5.4 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Rest of Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Deere & Company

- 6.3.2 AGCO Corporation (Fendt, Massey Ferguson)

- 6.3.3 CNH Industrial (Case IH, New Holland)

- 6.3.4 Kubota Corporation

- 6.3.5 Mahindra & Mahindra

- 6.3.6 Monarch Tractor

- 6.3.7 AutoNext Automation

- 6.3.8 YANMAR HOLDINGS CO., LTD.

- 6.3.9 CLAAS KGaA mbH

- 6.3.10 TYM Corporation

- 6.3.11 SDF Group

- 6.3.12 Kioti (daedong)

- 6.3.13 ISEKI & Co., Ltd

7 Market Opportunities and Future Outlook