PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851017

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851017

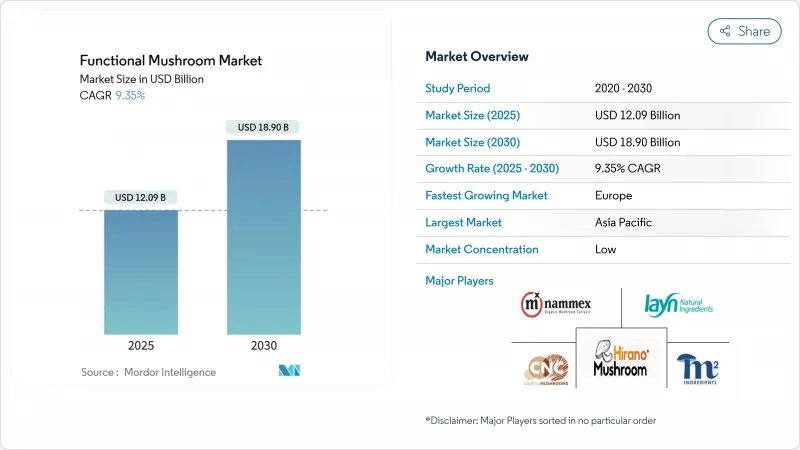

Functional Mushroom - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The functional mushroom market size reached USD 12.09 billion in 2025 and is forecast to climb to USD 18.90 billion by 2030, advancing at a 9.35% CAGR.

This growth trajectory reflects the convergence of consumer wellness priorities with scientific validation of bioactive compounds, particularly as regulatory frameworks evolve to accommodate novel food applications. Furthermore, strong consumer interest in preventive health, combined with mounting scientific evidence on beta-glucans, ergothioneine, and other bioactives, underpins steady demand for functional mushrooms. Moreover, the European Food Safety Authority's updated novel food guidance, effective February 2025, provides clearer pathways for mushroom-based ingredients seeking market entry. Technology upgrades, notably supercritical CO2 extraction and precision fermentation, are improving yield, purity, and sustainability. Additionally, vertical integration in Asia-Pacific and stricter European quality standards reshape competitive dynamics in the functional mushroom market.

Global Functional Mushroom Market Trends and Insights

Demand for immune-boosting mushroom supplements

Consumers are increasingly seeking natural immunity aids- functional mushrooms, popular for their polysaccharides and beta-glucans, are rising in demand. Mushrooms also support immunity, stress resiliency, energy, and cognitive clarity, appealing to wellness-minded consumers. This growth combines increased health awareness following the pandemic with scientific validation of polysaccharide mechanisms, specifically the immunomodulatory effects of beta-glucans. The FDA's (Food and Drug Administration) evaluation of lentinan nasal drops for COVID-19 variants in clinical trials indicates expanding regulatory acceptance of mushrooms' therapeutic applications beyond supplements, as reported by NCBI (National Center for Biotechnology Information - NCBI). The rising demand for such supplements is a result of a powerful convergence of health consciousness, and increasing scientific validation. Functional mushrooms for immune-boosting are well-positioned as a lasting trend in the wellness and nutraceuticals markets. This creates market opportunities for manufacturers focusing on health-focused demographics driving sustained interest in immune support and holistic well-being.

Growth of mushroom-based skincare products

Cosmetic applications leverage mushrooms' antioxidant and anti-inflammatory properties, with research demonstrating significant increases in skin proteins like CYGB (Cytoglobin) that support vascularization and aging prevention. The personal care segment's growth reflects growing consumer preference for natural ingredients with scientifically validated benefits over synthetic alternatives. Phellinus linteus and other medicinal mushrooms show particular promise in periorbital treatments, addressing specific aging concerns through targeted protein modulation mechanisms. However, formulation challenges around stability and bioavailability require sophisticated delivery systems, creating barriers for smaller players while favoring companies with advanced research and development capabilities. The premium positioning of mushroom-based skincare products enables higher margins compared to traditional cosmetic ingredients, attracting investment in extraction and processing technologies.

Growing competition from alternative products

The availability of synthetic ergothioneine and laboratory-produced beta-glucans creates cost-effective alternatives for functional mushroom products. These synthetic options appeal to price-sensitive consumers in developed markets, reducing the premium pricing potential of natural mushroom ingredients. The synthetic compounds often match the molecular structure of natural mushroom compounds at a fraction of the cost, making them attractive to manufacturers looking to optimize production costs. In response, mushroom product manufacturers emphasize the benefits of whole-mushroom compounds and their natural cultivation processes, supported by comprehensive traceability systems. Additionally, companies highlight their sustainable farming practices, organic certifications, and rigorous quality control measures to justify premium pricing and maintain market share against synthetic competition.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of mushrooms in plant-based diets

- Rise of mushrooms in sports performance nutrition

- Higher production costs compared to conventional supplements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Reishi maintains its dominant position with 35.52% market share in 2024, leveraging extensive clinical validation and established supply chains that provide competitive advantages in quality consistency and regulatory compliance. R beta-glucans and triterpenes in eishi boost immune cell activity and enhance immune regulation. With its antioxidant richness and anti-inflammatory properties, eishi appeals to individuals dealing with chronic inflammation, joint problems, or skin ailments.

Cordyceps emerges as the fastest-growing segment with 12.02% CAGR through 2030, driven by sports nutrition applications and clinical evidence of performance benefits, including demonstrated effects on stem cell recruitment and muscle recovery. Lion's Mane captures significant momentum in cognitive health applications, while Turkey Tail benefits from cancer support research and immune system applications. Shiitake leverages its dual positioning in culinary and functional markets, providing volume stability amid premium segment volatility. Chaga faces supply chain challenges from wild harvesting dependencies, creating opportunities for cultivation technology developers.

Conventional mushroom products held a dominant 56.15% revenue share in 2024, supported by established supply chains and competitive pricing. Conventional mushrooms pack a nutritional punch, boasting essential vitamins, antioxidants, fiber, and protein, all while being low in calories. Their umami flavor and meaty texture have made them a favored substitute for meat, often blended into burgers, sausages, and meatloafs.

The organic segment is projected to expand at an 11.66% CAGR, driven by increasing consumer willingness to pay premium prices for pesticide-free and regeneratively grown mushrooms. The USDA's proposed regulations requiring organic spawn and enhanced composting protocols will increase operational costs but may strengthen consumer trust. With organic certification held by fewer than 15% of US producers, significant opportunities exist for existing growers to transition and new players to enter the market.

The Functional Mushroom Market Report is Segmented by Product Type (Reishi, Cordyceps, Lions Mane, Turkey Tail, and More), Nature (Conventional and Organic), Form (Powder, Liquid, and Others), Application (Dietary Supplements, and More), and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominates with 51.12% market share in 2024, leveraging traditional medicine heritage and established cultivation infrastructure that provides cost advantages and quality consistency across major mushroom species. China's Ministry of Science and Technology launched 7 synthetic biology projects focused on mushroom cultivation and alternative protein production in 2024, signaling state-level commitment to innovation and market leadership according to Frontiers in Microbiology.

Europe emerges as the fastest-growing region with 14.57% CAGR through 2030, driven by regulatory harmonization through EFSA's updated novel food guidance and rising consumer health consciousness that prioritizes natural ingredients over synthetic alternatives. The region's stringent quality standards create barriers for lower-quality imports while favoring local producers and established international suppliers with robust compliance capabilities. The European Food Safety Authority's approval of vitamin D2 mushroom powder as a novel food in 2024 establishes precedents for broader mushroom ingredient acceptance according to European Food Safety Authority

North America maintains strong market positioning through innovation leadership and premium consumer segments, as younger demographics drive adoption across supplements and functional foods. South America and Middle East & Africa represent emerging opportunities with growing health consciousness and expanding distribution infrastructure, though regulatory frameworks remain less developed compared to established markets.

- Nammex

- Hirano Mushroom LLC

- CNC Exotic Mushrooms

- M2 Ingredients

- Aloha Medicinals

- KAAPA Biotech

- ETChem

- Layn Natural Ingredients

- Monterey Mushrooms

- Sempera Organics

- Verygrass

- Yukiguni Maitake Co.

- Naturalin Bio-Resources Co., Ltd.

- Qingdao Dacon Trading Co., Ltd.

- Xi'an DN Biology Co.,Ltd

- Green Source Organics

- BioFungi GmbH

- Bioway Organic Ingredients CO., Ltd.

- Herbo Nutra Extract Pvt. Ltd.

- Xi'an Greena Biotech Co.,Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for immune-boosting mushroom supplements

- 4.2.2 Adoption of mushrooms in plant-based diets

- 4.2.3 Growth of mushroom-based skincare products

- 4.2.4 Demand for cognitive-enhancing mushroom supplements

- 4.2.5 Rise of mushrooms in sports performance nutrition

- 4.2.6 Popularity of convenient mushroom-infused beverages

- 4.3 Market Restraints

- 4.3.1 Raw material supply volatility

- 4.3.2 Higher production costs compared to conventional supplements

- 4.3.3 Storage and shelf-life limitations of mushroom products

- 4.3.4 Competition from alternative products

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Reishi

- 5.1.2 Cordyceps

- 5.1.3 Lions Mane

- 5.1.4 Turkey Tail

- 5.1.5 Shiitake

- 5.1.6 Chaga

- 5.1.7 Other Product Types

- 5.2 By Nature

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Form

- 5.3.1 Powder

- 5.3.2 Liquid

- 5.3.3 Others

- 5.4 By Application

- 5.4.1 Dietary Supplements

- 5.4.2 Food and Beverage

- 5.4.3 Personal Care

- 5.4.4 Pharmaceutical

- 5.4.5 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Nammex

- 6.4.2 Hirano Mushroom LLC

- 6.4.3 CNC Exotic Mushrooms

- 6.4.4 M2 Ingredients

- 6.4.5 Aloha Medicinals

- 6.4.6 KAAPA Biotech

- 6.4.7 ETChem

- 6.4.8 Layn Natural Ingredients

- 6.4.9 Monterey Mushrooms

- 6.4.10 Sempera Organics

- 6.4.11 Verygrass

- 6.4.12 Yukiguni Maitake Co.

- 6.4.13 Naturalin Bio-Resources Co., Ltd.

- 6.4.14 Qingdao Dacon Trading Co., Ltd.

- 6.4.15 Xi'an DN Biology Co.,Ltd

- 6.4.16 Green Source Organics

- 6.4.17 BioFungi GmbH

- 6.4.18 Bioway Organic Ingredients CO., Ltd.

- 6.4.19 Herbo Nutra Extract Pvt. Ltd.

- 6.4.20 Xi'an Greena Biotech Co.,Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK