PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851020

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851020

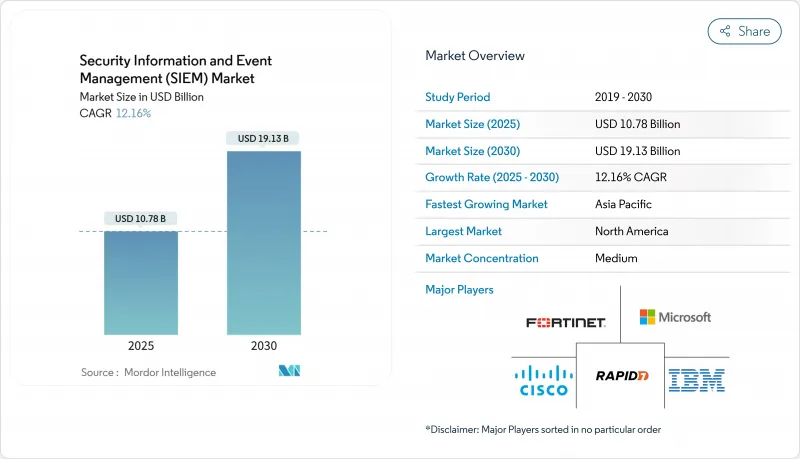

Security Information And Event Management (SIEM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global SIEM market stood at USD 10.78 billion in 2025 and is forecast to climb to USD 19.13 billion by 2030, advancing at a 12.16% CAGR.

A surge in cloud workload telemetry, strict regulatory mandates, and rapid vendor consolidation are the primary growth catalysts. Large enterprises continue to expand log ingestion as attack surfaces widen, while small and medium-sized businesses enter the market through cloud-native consumption models. North American demand is buoyed by SOX and PCI DSS rules, whereas European spending accelerates in response to NIS2 and DORA. Vendor roadmaps now revolve around AI-powered analytics, unified data pipelines, and simplified licensing, themes that spur refresh cycles following Cisco's landmark acquisition of Splunk in 2024.

Global Security Information And Event Management (SIEM) Market Trends and Insights

Exponential growth of security telemetry

Enterprises generate terabytes of logs each day from endpoints, cloud services, and operational technology. The volume strains traditional ingestion models yet unlocks richer context for threat hunting. CPFL Energia monitors more than 50,000 smart-grid devices through a modern SIEM that routes high-value events to a data lake for cost control. Cloud-native elasticity permits burst processing during incident spikes, and selective retention keeps storage fees predictable. Vendors that integrate low-cost object storage with query¬able metadata gain traction as customers balance coverage and cost.

Escalating regulatory penalties and audits

Europe's NIS2 obliges operators of essential services to log, monitor, and retain events for incident reconstruction, pushing security budgets up to 9.0% of IT spending. In finance, DORA compels real-time detection and reporting. Bank Leumi lowered false positives by 70% after a SIEM upgrade tailored to audit evidence generation. Health providers face HIPAA-driven breach fines that now average USD 4.88 million, a cost that underscores the need for continuous monitoring.

High total cost of ownership

Traditional per-event licenses force buyers to cap ingestion, creating security blind spots. Hardware tariffs raised appliance costs by as much as 20% during 2024, adding budget strain. Hidden cloud fees for storage, egress, and premium analytics surprise first-time adopters. Vendors now push pipeline off-load tiers and flat-rate pricing to restore predictability.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated cloud and hybrid adoption

- AI and ML-driven analytics

- Shortage of skilled SOC analysts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise deployments held 55.75% of SIEM market share in 2024. The segment remains favored by industries bound to strict data-sovereignty policies, yet growth is subdued as hardware costs rise and skills shortages deepen. The cloud cohort advances at 13.40% CAGR, propelled by elastic scaling and pay-as-you-go fees that widen access to advanced analytics. Hybrid designs act as a bridge, placing regulated data on local nodes while streaming telemetry to low-cost object storage in the cloud.

Cloud adoption shifts upgrade cycles from multi-year appliance refreshes to continuous feature delivery. Siemens uses a hybrid pattern that runs OT parsers on premises while enriching events in the cloud for threat intelligence correlation. As licensing shifts to data usage, buyers gain transparency on the SIEM market size for each deployment choice. Vendor consolidation accelerates moves away from aging on-prem stacks toward modern SaaS offerings hosted by hyperscalers.

Legacy platforms represented 46.20% revenue share in 2024, yet they lose ground as query performance and rule tuning falter under data scale. Next-generation cloud-native engines are forecast to rise at 18.10% CAGR, the fastest among architectural types. These systems decouple storage from compute and embed machine learning at ingestion, reducing mean time to detect.

Palo Alto Networks folded QRadar SaaS into Cortex XSIAM and booked more than USD 90 million in the first post-deal quarter. Open-source stacks carve a budget niche but demand deep engineering skills. Migration utilities and compatibility layers ease the shift from traditional rule syntax to schema-on-read models. The SIEM market aligns behind architectures that treat telemetry as big data rather than event streams.

The SIEM Market Report Segments the Industry by Deployment (On-Premise, and More), SIEM Architecture ( Traditional SIEM, Next-Gen SIEM, and More), Component (Platform / Software, Professional Services, and Managed SIEM Services (MSSP)), Organization Size (Small and Medium Enterprises, and Large Enterprises), End-User Industry (Banking, Financial Services and Insurance (BFSI), Retail and E-Commerce, and More), and Geography.

Geography Analysis

North America accounted for 39.20% of the SIEM market revenue in 2024, underpinned by mature breach notification statutes and high cyber insurance premiums. Budget allocations remain robust as boards tie security controls to fiduciary risk. The region's cloud adoption and early AI experimentation reinforce its leadership. Despite a saturated base, upsell to integrated observability keeps growth in mid-single digits.

Asia-Pacific is projected to post 11.80% CAGR, the fastest globally. China's Multi-Level Protection Scheme and India's Digital Personal Data Protection Act spur mandatory logging for critical information infrastructure. Domestic cloud vendors team with global SIEM players to satisfy localisation rules. Japanese conglomerates favour hybrid SIEM that parks raw events in Tokyo regions while outsourcing analytics to global clouds, balancing sovereignty and capability.

Europe maintains a sizeable stake on the back of GDPR and the incoming NIS2. Boards face fines reaching 2% of global turnover for monitoring lapses, incentivising investment. Data sovereignty drives preference for regional clouds such as OVHcloud and Deutsche Telekom. The Digital Operational Resilience Act imposes real-time threat detection in finance, fuelling premium SIEM demand.

- Cisco Systems, Inc. (Splunk)

- International Business Machines Corporation

- Microsoft Corporation (Azure Sentinel)

- Google LLC (Chronicle Security Operations)

- Fortinet, Inc.

- LogRhythm, Inc.

- Exabeam, Inc.

- Rapid7, Inc.

- OpenText Corporation (ArcSight)

- RSA Security LLC

- Securonix, Inc.

- CrowdStrike Holdings, Inc.

- Elastic N.V.

- ATandT Cybersecurity (AlienVault)

- Micro Focus International plc

- SolarWinds Corporation

- Graylog, Inc.

- Logpoint A/S

- ManageEngine (Zoho Corp.)

- Hewlett Packard Enterprise Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exponential growth of security telemetry volumes

- 4.2.2 Escalating regulatory penalties and audit frequency

- 4.2.3 Accelerated cloud and hybrid adoption of enterprise workloads

- 4.2.4 AI/ML-infused analytics improve signal-to-noise ratios

- 4.2.5 Emergence of security-data-pipeline layer reduces SIEM TCO

- 4.2.6 Vendor mega-deals (Cisco-Splunk, Exabeam-LogRhythm) trigger refresh cycles

- 4.3 Market Restraints

- 4.3.1 High total cost of ownership and licensing complexity

- 4.3.2 Shortage of skilled SOC analysts

- 4.3.3 Data-sovereignty barriers to central log aggregation

- 4.3.4 Overlap with XDR/SOAR platforms delays budget approval

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.1.3 Hybrid

- 5.2 By SIEM Architecture

- 5.2.1 Legacy / Traditional SIEM

- 5.2.2 Cloud-native / Next-Gen SIEM

- 5.2.3 Open-source SIEM

- 5.3 By Component

- 5.3.1 Platform / Software

- 5.3.2 Professional Services

- 5.3.3 Managed SIEM Services (MSSP)

- 5.4 By Organization Size

- 5.4.1 Small and Medium Enterprises

- 5.4.2 Large Enterprises

- 5.5 By End-user Industry

- 5.5.1 Banking, Financial Services and Insurance (BFSI)

- 5.5.2 Retail and E-commerce

- 5.5.3 Government and Defense

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Manufacturing

- 5.5.6 Energy and Utilities

- 5.5.7 Telecom and IT

- 5.5.8 Others

- 5.6 By Application

- 5.6.1 Threat Detection and Analytics

- 5.6.2 Compliance and Audit Management

- 5.6.3 Incident Response and Forensics

- 5.6.4 Log Management and Reporting

- 5.6.5 Cloud-Workload Security Monitoring

- 5.6.6 IoT / OT Security Monitoring

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Nordics

- 5.7.3.7 Rest of Europe

- 5.7.4 Middle East and Africa

- 5.7.4.1 Middle East

- 5.7.4.1.1 Saudi Arabia

- 5.7.4.1.2 United Arab Emirates

- 5.7.4.1.3 Turkey

- 5.7.4.1.4 Rest of Middle East

- 5.7.4.2 Africa

- 5.7.4.2.1 South Africa

- 5.7.4.2.2 Egypt

- 5.7.4.2.3 Nigeria

- 5.7.4.2.4 Rest of Africa

- 5.7.5 Asia-Pacific

- 5.7.5.1 China

- 5.7.5.2 India

- 5.7.5.3 Japan

- 5.7.5.4 South Korea

- 5.7.5.5 ASEAN

- 5.7.5.6 Australia

- 5.7.5.7 New Zealand

- 5.7.5.8 Rest of Asia-Pacific

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems, Inc. (Splunk)

- 6.4.2 International Business Machines Corporation

- 6.4.3 Microsoft Corporation (Azure Sentinel)

- 6.4.4 Google LLC (Chronicle Security Operations)

- 6.4.5 Fortinet, Inc.

- 6.4.6 LogRhythm, Inc.

- 6.4.7 Exabeam, Inc.

- 6.4.8 Rapid7, Inc.

- 6.4.9 OpenText Corporation (ArcSight)

- 6.4.10 RSA Security LLC

- 6.4.11 Securonix, Inc.

- 6.4.12 CrowdStrike Holdings, Inc.

- 6.4.13 Elastic N.V.

- 6.4.14 ATandT Cybersecurity (AlienVault)

- 6.4.15 Micro Focus International plc

- 6.4.16 SolarWinds Corporation

- 6.4.17 Graylog, Inc.

- 6.4.18 Logpoint A/S

- 6.4.19 ManageEngine (Zoho Corp.)

- 6.4.20 Hewlett Packard Enterprise Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment