PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851026

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851026

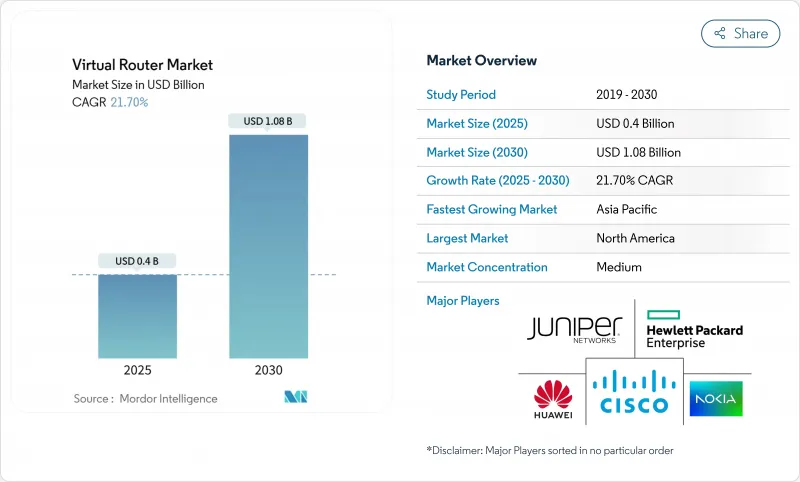

Virtual Router - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Virtual Router Market size is estimated at USD 0.4 billion in 2025, and is expected to reach USD 1.08 billion by 2030, at a CAGR of 21.70% during the forecast period (2025-2030).

Growth reflects the surge of cloud-native applications, the commercial rollout of private 5G, and the drive to trim capital outlays while boosting network agility. Enterprises prefer software-based routing because it scales rapidly, integrates with orchestration tools, and supports service velocity, enabling faster product rollouts and lower operating expenses. Competitive dynamics also favor the technology: open-source routing stacks now power many hyperscale data centers, while cloud providers embed virtual routing functions directly into infrastructure-as-a-service offerings, flattening barriers to entry. Regulatory scrutiny of large mergers, such as the contested HPE-Juniper deal, signals a maturing landscape where scale and portfolio depth increasingly decide winners.

Global Virtual Router Market Trends and Insights

Rising adoption of SDN and NFV architectures

Service providers and enterprises are shifting routing workloads onto software to consolidate infrastructure and cut operating expenses, achieving up to 60% savings when NFV replaces fixed hardware. The switch accelerates service rollouts because network functions spin up in minutes rather than weeks. Operators such as EOLO in Italy scaled thousands of base-station links with MANO-deployed virtual routers, proving the model works at a nationwide scale. SDN controllers also let providers introduce network slicing for 5G services that need isolation by latency or bandwidth profiles. As a result, companies pour investment into orchestration platforms and staff up software engineering teams, transforming network operations into agile software pipelines.

Growing need for network agility and scalable capacity

Hybrid work, video meetings, and cloud workloads stress legacy WAN architectures that route traffic back to a data center, adding latency and cost. Virtual routers, controlled by central policy engines, steer traffic directly to cloud applications, delivering a consistent user experience for remote staff. In Asia-Pacific, smart factories depend on low-latency links for robotics and IoT sensors, prompting manufacturers to deploy software-defined routing that can be re-provisioned during production shifts. These deployments highlight how the virtual router market supports dynamic reconfiguration without physical truck rolls, matching the speed of digital transformation programs.

Security vulnerabilities in multi-tenant VNFs

Multi-tenant hosting increases attack surfaces because virtual routers share compute layers and hypervisors. Researchers at Concordia University identified cross-layer attacks that can bypass tenant isolation. In response, ETSI updated its NFV security framework to include stronger capability assertions and encrypted management channels. Financial services and government agencies demand additional penetration testing and audit logging, which slows rollouts but ultimately strengthens platform security.

Other drivers and restraints analyzed in the detailed report include:

- Lower total cost of ownership vs. hardware routers

- Proliferation of cloud and edge-computing workloads

- Integration pain-points with legacy routing gear

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solution offerings generated 60.3% of virtual router market revenue in 2024, confirming that software licenses and virtual appliances remain the core purchase for enterprises seeking SD-WAN and NFV capabilities. This dominance is underpinned by the high value of routing code, the need for carrier-grade scale, and the critical role these licenses play in network modernization projects. Services, however, are the growth engine, rising at 24.5% CAGR through 2030 as organizations purchase design, migration, and managed operations expertise. Many federal agencies pursuing TIC 3.0 mandates rely on integrators to ensure compliance while migrating to software-defined routing.

Enterprises lack in-house NFV talent, so service providers package advisory and run-operate services to guarantee success. Managed offerings increasingly embed service-level agreements for uptime and performance, transferring operational risk away from customers. The pattern indicates a strategic pivot, in which vendors differentiate on lifecycle services instead of technical checklists, reinforcing the virtual router market's consultative sales motion.

Cloud-based deployment captured 68.7% of the virtual router market size in 2024 and also posted the fastest 25.01% CAGR. Enterprises value instant availability, pay-as-you-grow economics, and built-in high availability offered by hyperscale clouds. Microsoft's Virtual WAN Hub routing policies illustrate how software routing becomes a native cloud function rather than an external appliance. On-premise deployments remain common in highly regulated sectors requiring local data processing, but their growth lags cloud models as security frameworks mature.

Hybrid patterns emerge in which control planes reside in the cloud while data planes stay on-premises for latency reasons. Vendors respond with licensing that moves instances across sites without additional fees, reinforcing adoption. As bandwidth-intensive AI workloads proliferate, cloud bursting remains a major driver, positioning cloud-hosted routing as the default for new sites.

Virtual Router Market is Segmented by Component (Solution and Service), Deployment Type (Cloud-Based and On-Premise), End-User (Service Provider, Enterprise, and More), Application (SD-WAN and WAN Edge, VCPE/Edge Routing, VPN and Network Security, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest slice of the virtual router market revenue at 38.1% in 2024, boosted by cloud adoption and early SD-WAN rollouts. Telecom operators such as AT&T migrate core traffic to white-box routing, sending a clear signal that software routing is carrier-grade. Enterprises across the United States integrate virtual routers into zero-trust architectures, while Canadian service providers deploy virtual routers to extend broadband in rural regions. Federal agencies' push for TIC 3.0 compliance maintains spending momentum.

Asia-Pacific is the fastest mover at a 23.8% CAGR to 2030, supported by state-backed 5G build-outs in Japan, South Korea, and India. Private 5G networks in manufacturing and mining require localized routing to control autonomous machines, creating fertile ground for edge-ready virtual routers. The GSMA expects private 5G investment in the region to rise sharply, highlighting how digital transformation fuels this expansion.

Europe maintains steady growth as data-sovereignty laws encourage in-country cloud regions that need software-defined interconnects. Telecom operators deploy NFV to cut costs amid price regulation, and the EU's Gaia-X initiative promotes open digital infrastructure aligned with virtual routing. The Middle East and Africa invest in smart-city projects, inviting global vendors to pilot edge routing for public safety nets. Latin America experiences moderate progress, with adoption centered on financial hubs that demand reliable cloud connectivity for fintech applications.

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Hewlett Packard Enterprise Company

- Broadcom Inc.

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- Arista Networks, Inc.

- VMware, Inc.

- 6WIND S.A.S.

- VyOS (Sentrium S.L.)

- Netgate (Rubicon Communications)

- Arrcus, Inc.

- netElastic Systems, Inc.

- F5, Inc.

- Fortinet, Inc.

- Versa Networks, Inc.

- Ciena Corporation

- Telco Systems (BATM)

- Kaloom, Inc.

- Radisys Corporation

- Altiostar (Rakuten Symphony)

- Pluribus Networks, Inc.

- Mavenir Systems, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of SDN and NFV architectures

- 4.2.2 Growing need for network agility and scalable capacity

- 4.2.3 Lower total cost of ownership vs. hardware routers

- 4.2.4 Proliferation of cloud and edge-computing workloads

- 4.2.5 Open-source virtual routing stacks used by hyperscalers

- 4.2.6 Virtual routers enabling private 5G enterprise networks

- 4.3 Market Restraints

- 4.3.1 Security vulnerabilities in multi-tenant VNFs

- 4.3.2 Integration pain-points with legacy routing gear

- 4.3.3 Performance unpredictability under virtualization

- 4.3.4 Proprietary licensing and vendor lock-in

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 By Deployment Type

- 5.2.1 Cloud-based

- 5.2.2 On-Premise

- 5.3 By End-user

- 5.3.1 Service Provider

- 5.3.2 Enterprise

- 5.3.3 Data Center/Cloud Provider

- 5.3.4 Government and Public Sector

- 5.4 By Application

- 5.4.1 SD-WAN and WAN Edge

- 5.4.2 vCPE/Edge Routing

- 5.4.3 VPN and Network Security

- 5.4.4 Data Center Interconnect

- 5.4.5 Others (IoT Gateways, Residential)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Singapore

- 5.5.4.6 Malaysia

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems, Inc.

- 6.4.2 Juniper Networks, Inc.

- 6.4.3 Huawei Technologies Co., Ltd.

- 6.4.4 Nokia Corporation

- 6.4.5 Hewlett Packard Enterprise Company

- 6.4.6 Broadcom Inc.

- 6.4.7 Telefonaktiebolaget LM Ericsson

- 6.4.8 ZTE Corporation

- 6.4.9 Arista Networks, Inc.

- 6.4.10 VMware, Inc.

- 6.4.11 6WIND S.A.S.

- 6.4.12 VyOS (Sentrium S.L.)

- 6.4.13 Netgate (Rubicon Communications)

- 6.4.14 Arrcus, Inc.

- 6.4.15 netElastic Systems, Inc.

- 6.4.16 F5, Inc.

- 6.4.17 Fortinet, Inc.

- 6.4.18 Versa Networks, Inc.

- 6.4.19 Ciena Corporation

- 6.4.20 Telco Systems (BATM)

- 6.4.21 Kaloom, Inc.

- 6.4.22 Radisys Corporation

- 6.4.23 Altiostar (Rakuten Symphony)

- 6.4.24 Pluribus Networks, Inc.

- 6.4.25 Mavenir Systems, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment