PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851034

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851034

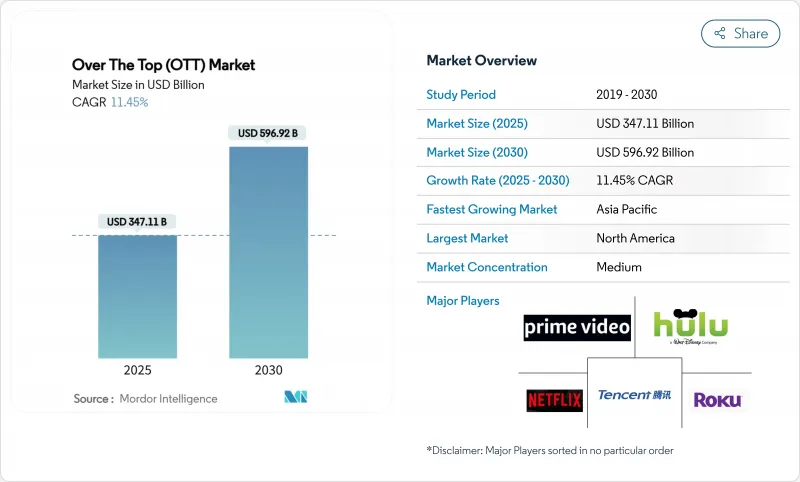

Over The Top (OTT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The OTT market size is estimated at USD 347.11 billion in 2025 and is projected to reach USD 596.92 billion by 2030, expanding at an 11.45% CAGR as richer connectivity, device proliferation, and escalating advertising migration keep propelling online video toward the core of global entertainment.

Growth momentum rests on broadband upgrades that bring full-HD and 4K streaming to mainstream households, while ubiquitous smartphones unlock incremental viewing hours during commutes and breaks. Advertisers, lured by addressable targeting and outcome-based metrics, are re-allocating linear TV budgets, widening the overall revenue pie for platforms. Heightened rivalries are pushing services to combine live sports, premium scripted franchises, and user-generated clips in a single interface, simultaneously raising customer expectations and diversifying monetization. Established broadcasters are accelerating direct-to-consumer (DTC) launches that leverage deep program libraries, effectively erasing the historical wall between linear and streaming, while localization of interfaces, dubbing, and subtitles quietly improves retention by making content culturally resonant.

Global Over The Top (OTT) Market Trends and Insights

Telco-OTT Bundling: Unlocking Growth in Emerging Markets

Partnerships between mobile operators and streaming providers are widening the OTT market by embedding entertainment in prepaid data packs, lowering acquisition costs for both parties. Telkomsel's alliance with Catchplay+ in Indonesia taps ubiquitous 4G coverage to bypass limited fixed-line reach, expanding first-time streamer penetration while boosting data usage for the carrier. Integrated pricing within mobile top-ups reduces involuntary churn and feeds transaction insights into recommendation engines that quickly adapt to local tastes. Operators benefit from incremental revenue that cushions shrinking voice margins, while platforms gain swift scale among price-sensitive users.

Sports Rights Inflation: Reshaping Premium Economics

The NBA's 11-year USD 76 billion media pact with ESPN, NBCUniversal, and Amazon signposts the growing strategic value of live events. Expensive rights forge a defensive moat that few services can finance alone, spurring joint ventures such as the ESPN-FOX-Warner Bros. Discovery consortium to spread risk yet maintain portfolio breadth. Rising valuations intensify interest in regional or niche sports whose rights carry lower premiums but still retain audiences, thereby filling content calendars without denting margins. Tiered offers-season passes, pay-per-view, and bundled flagship tiers-monetize superfans while preserving broader packages for casual viewers.

Content Acquisition Costs: The Profitability Challenge

Escalating bidding wars for marquee titles have compressed margins, especially for mid-scale players. Studios now enforce stricter green-light criteria that rate projects on franchise potential, merchandise viability, and cross-platform game adaptations, ensuring returns extend beyond first-window streaming. Shorter exclusivity periods allow second-window syndication that offsets cash burn, while AI-driven demand forecasts trim sunk-cost risk by flagging low-resonance concepts earlier in development. Investors increasingly focus on blended operating margins rather than raw subscriber adds, nudging management to favor disciplined capital allocation.

Other drivers and restraints analyzed in the detailed report include:

- AVOD and FAST Growth: Advertising's Streaming Renaissance

- Content Quotas: Regulatory Catalysts for Local Production

- Subscription Stacking: The Churn Challenge

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

AVOD and FAST constituted 13% of the OTT market size in 2024. This cohort is forecast to rise at 13.4% CAGR through 2030, notably faster than the overall OTT market path, as inflation pressures heighten price sensitivity while advertisers chase addressable audiences. Netflix's ad tier captured a sizable slice of new sign-ups within its debut year . Enhanced measurement standards raise advertiser confidence, driving higher fill rates that fund broader original slates without eroding premium SVOD bundles. Platforms benefit from a dual revenue stream in which advertising uplifts average revenue per user while subscriptions secure base income. In parallel, FAST channels recycle deep libraries into lean, linear-style programming that appeals to habitual channel surfers, helping reduce content amortization costs.

Continued AVOD traction proves decisive for the broader OTT industry because it widens the accessible user base in emerging markets where disposable income constrains pure subscription adoption. As hybrid monetization matures, tiered entry points emerge: free-with-ads for casual viewers, discounted ad-lite models for budget watchers, and premium ad-free tiers for households demanding maximal convenience. Given its 13.4% forecast cadence, ad-supported streaming is positioned to shoulder a larger share of future content investments, reinforcing its importance in the competitive toolkit.

The OTT Market is Segmented by Service Type (SVOD, AVOD, TVOD, Hybrid (Subscription + Ads)), Device Platform (Smartphones and Tablets, Smart and Connected TVs, Laptops and Desktops, Streaming Media Players, and More), Content Genre (Entertainment and Movies, Sports, News and Information, Education and Learning, and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 37% of 2024 revenue, benefiting from near-universal broadband and entrenched cord-cutting habits. Growth now hinges more on ARPU lifts than fresh subscriber gains, pushing platforms to introduce password-sharing surcharges, price rises, and bundled offerings that stretch perceived value. Joint ventures face U.S. antitrust scrutiny that may slow mega-mergers but tactically tighten content licensing, preserving individual brand identities even within shared ecosystems. Robust sports rights expenditures-NFL, NBA, MLB-ensure continued stickiness, though they heighten margin pressures that necessitate diversified income streams such as merchandising or theatrical windows.

Asia-Pacific posts the fastest regional CAGR at 10.3% for 2025-2030 as smartphone affordability and low-cost data unlock incremental viewing hours. Indigenous platforms like India's JioCinema and Tencent-backed WeTV craft interfaces around local languages and micro-payment options, deepening engagement across varied income brackets. International giants respond with region-specific originals-short seasons, anthology formats-that fit local budgets yet carry global export potential. Telco partnerships, bundled prepaid plans, and cash vouchers mitigate credit-card penetration gaps, broadening the bankable audience.

Latin America and the Middle East & Africa together accounted for under 15% of 2024 revenue but present meaningful headroom as macroeconomic conditions stabilize and young populations enter consumption age. Regional broadcasters such as Televisa and MBC modernize legacy libraries through hybrid AVOD models that keep advertiser funds within domestic ecosystems. Payment innovation spanning mobile wallets, cash top-ups, and telco billing further expands reach. As fiber and 5G deployments gain momentum, these regions could stretch their contribution to global OTT market revenue in the next decade.

- Netflix Inc.

- Google LLC (YouTube)

- Amazon.com Inc. (Prime Video)

- The Walt Disney Company (Disney+ & Hulu)

- Tencent Holdings Ltd (Tencent Video)

- Apple Inc. (Apple TV+)

- Warner Bros. Discovery (Max)

- Comcast Corp. (Peacock)

- Paramount Global (Paramount+)

- DAZN Group Ltd.

- Roku Inc.

- PCCW Media Group (Viu)

- Baidu Inc. (iQIYI)

- Alibaba Pictures (Youku Tudou)

- Zee Entertainment (ZEE5)

- Viacom18 Media (JioCinema)

- MBC Group (Shahid)

- Canal+ Group (myCanal)

- Rakuten Group (Rakuten TV)

- NHK World-Japan

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Bundled telco-OTT partnerships accelerating low-ARPU subscriber uptake in South & Southeast Asia

- 4.2.2 Record live-sports media rights inflation driving premium pricing for D2C OTT in North America & Europe

- 4.2.3 Connected-TV advertising demand shift fueling AVOD & FAST revenue growth in US & UK

- 4.2.4 Government domestic-content quotas (EU 30% rule, etc.) stimulating local originals spend

- 4.3 Market Restraints

- 4.3.1 Escalating content-acquisition costs eroding profitability in mature SVOD markets

- 4.3.2 High churn amid subscription stacking in North America

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Macro-Economic Factors on the OTT and TV Industry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 SVOD

- 5.1.2 AVOD

- 5.1.3 TVOD

- 5.1.4 Hybrid (Subscription + Ads)

- 5.2 By Device Platform

- 5.2.1 Smartphones and Tablets

- 5.2.2 Smart and Connected TVs

- 5.2.3 Laptops and Desktops

- 5.2.4 Streaming Media Players

- 5.2.5 Others

- 5.3 By Content Genre

- 5.3.1 Entertainment and Movies

- 5.3.2 Sports

- 5.3.3 News and Information

- 5.3.4 Education and Learning

- 5.3.5 Others (Documentary, Reality)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 South Korea

- 5.4.4.4 India

- 5.4.4.5 Australia

- 5.4.4.6 New Zealand

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.3.1 Netflix Inc.

- 6.3.2 Google LLC (YouTube)

- 6.3.3 Amazon.com Inc. (Prime Video)

- 6.3.4 The Walt Disney Company (Disney+ & Hulu)

- 6.3.5 Tencent Holdings Ltd (Tencent Video)

- 6.3.6 Apple Inc. (Apple TV+)

- 6.3.7 Warner Bros. Discovery (Max)

- 6.3.8 Comcast Corp. (Peacock)

- 6.3.9 Paramount Global (Paramount+)

- 6.3.10 DAZN Group Ltd.

- 6.3.11 Roku Inc.

- 6.3.12 PCCW Media Group (Viu)

- 6.3.13 Baidu Inc. (iQIYI)

- 6.3.14 Alibaba Pictures (Youku Tudou)

- 6.3.15 Zee Entertainment (ZEE5)

- 6.3.16 Viacom18 Media (JioCinema)

- 6.3.17 MBC Group (Shahid)

- 6.3.18 Canal+ Group (myCanal)

- 6.3.19 Rakuten Group (Rakuten TV)

- 6.3.20 NHK World-Japan

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment