PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851043

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851043

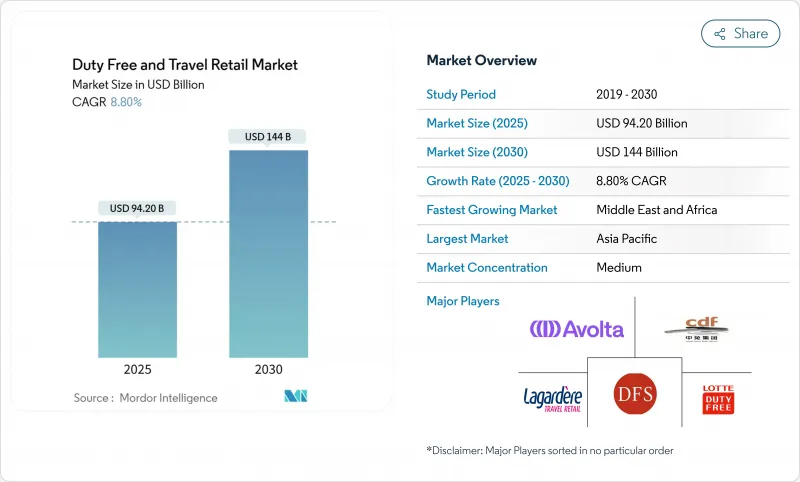

Duty Free And Travel Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The duty-free & travel retail market stood at USD 94.20 billion in 2025 and is forecast to reach USD 144.00 billion by 2030, translating into an 8.80% CAGR.

Growth is propelled by the rebound in international passenger volumes, a premiumization shift that raises average transaction values, and operators' rapid embrace of omnichannel services that capture spending before, during, and after the trip. Asia-Pacific retained its clear lead thanks to Hainan's booming offshore stores and strong intra-Asian tourism, while the Middle East advanced fastest on the back of sovereign infrastructure projects and hub-airport expansion. Airports remain the primary shopping venue, yet double-digit gains in e-commerce pre-order channels reveal how digital convenience is resetting consumer expectations. Competitive dynamics are intense but fragmented; the top ten groups hold nearly half the market share, leaving space for regional specialists, state-backed entrants, and tech-driven disruptors. Security-processing efficiency is emerging as a critical revenue lever, with around 80% of passengers indicating they would spend more if screening were faster.

Global Duty Free And Travel Retail Market Trends and Insights

Expansion of Offshore Duty-Free Zones and Free-Trade Islands Boosting Shopper Footfall

In 2024, Hainan's offshore stores achieved revenue of CNY 43.76 billion (USD 6.13 billion), reflecting a 25.40% year-on-year growth driven by the increased spending cap of CNY 100,000 per traveler . The extension of shopping hours reduced the pressure of flight-connection schedules, allowing consumers to engage more deeply with brands and make higher-value purchases. Saudi Arabia's Public Investment Fund adopted a similar strategy by launching a state-owned duty-free company, which is expected to serve as a cornerstone for the development of new free-trade zones. These strategic measures are redefining location planning by prioritizing proximity to densely populated areas as a critical factor, alongside passenger traffic volumes. This shift underscores the evolving dynamics of consumer behavior and the growing importance of accessibility in driving retail performance.

Airport Privatization & Non-Aeronautical Revenue Focus Expanding Retail Floor Plates

The USD 35 billion expansion of Dubai's Al Maktoum International Airport is strategically designed to incorporate larger luxury precincts, aiming to optimize commercial revenue streams. This development reflects a calculated approach to enhancing the airport's overall profitability by leveraging high-value retail spaces . The adoption of the single-till model, which integrates aeronautical and retail income, represents a significant shift in aligning the financial interests of airports and retailers. This model fosters a synergistic relationship, ensuring mutual benefits and driving sustained growth in the duty-free and travel retail market. Such initiatives underscore the long-term potential of this market segment, supported by innovative revenue-sharing frameworks and strategic infrastructure investments.

Progressive Plain-Packaging & Marketing Curbs on Tobacco Products Shrinking Margins

In October 2024, the UK implemented an increase in duty rates by RPI + 2%, with an additional 0% adjustment for hand-rolling tobacco, reflecting a strategic fiscal approach to tobacco regulation . Indonesia's 2024 Regulation 28 introduced comprehensive restrictions on advertising and expanded smoke-free zones, signaling a robust regulatory stance against tobacco consumption. Thailand's decision to close duty-free stores at airport arrivals demonstrates a deliberate policy shift aimed at curbing tobacco retail opportunities in high-traffic areas. These regulatory measures collectively indicate a global trend toward stricter tobacco control policies, compelling operators to reassess their retail strategies. Consequently, businesses are reallocating resources and prioritizing higher-margin product categories to mitigate the impact of these regulatory changes.

Other drivers and restraints analyzed in the detailed report include:

- Recovery of Long-Haul Leisure Travel Reviving Fragrance & Beauty Spend

- Rise of Omnichannel Pre-Order / Click-and-Collect Elevating Conversion Rates

- Currency Volatility in Emerging Tourism Economies Eroding Perceived Price Advantage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Perfumes & cosmetics held a 31.40% duty-free & travel retail market share in 2024, and the duty-free & travel retail market size for this segment is projected to rise alongside leisure travel recovery. Strong emotional appeal, gifting relevance, and brand exclusives sustain demand even during macro-volatility. Luxury goods & fashion accessories display an 11.60% CAGR, propelled by millennial and Gen Z shoppers who equate travel with lifestyle curation. Wines & spirits remain resilient as craft distillers and prestige cuvees command price premiums that fit the premiumization narrative. Tobacco's share erodes due to regulatory headwinds, while confectionery gains traction among tourists seeking local specialties to share with friends and relatives. Electronics occupies a niche, serving tech-savvy travelers needing accessories, yet faces margin pressure from competitive domestic pricing.

The product-mix evolution mirrors broader retail shifts toward experiential consumption. Brands design airport-exclusive lines, such as Sol de Janeiro's interactive Brazil-themed fixtures that encourage social-media sharing and drive footfall. Category managers now allocate more square footage to high-margin beauty and fashion, integrating digital try-on tools to elevate engagement and maintain basket size as other categories flatten.

Airport shops captured 68.70% of 2024 sales, underscoring their importance in the duty-free & travel retail market despite rising digital alternatives. Sensory-driven items-fragrance blotters, cosmetics swatches, liquor tastings-thrive in this tactile setting, anchoring impulse conversion. Yet the duty-free & travel retail market size attributed to omnichannel pre-order is expanding at a 14.70% CAGR as operators open digital storefronts that extend the sales window. On-board aircraft retail faces service-time limits and reduced cabin crews, capping upside. Cruise-line and seaport stores benefit from multi-day dwell and affluent passenger mix, though exposure remains tied to itinerary scheduling. Downtown and border outlets continue serving price-savvy shoppers in Asia's megacities, while railway hubs remain underdeveloped but promising in regions betting on high-speed rail.

Digital integration accelerates: Auckland Airport's centralized collection points let travelers finalize purchases anytime and retrieve goods on arrival, boosting convenience. Robotic fulfillment at Oslo streamlines click-and-collect, trimming pick-up waits and enhancing satisfaction. These advances reposition the channel mix toward seamless journeys that merge online discovery with hands-on verification at the gate.

The Duty Free & Travel Retail Market Report Segments the Industry Into by Product Type (Perfumes & Cosmetics, Wines & Spirits, and More), by Distribution Channel (Airport Shops, On-Board Aircraft, and More), by Price Range (Premium & Luxury, Mid-Tier, and More), by Geography (North America, South America, and More), and More Segments. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held a commanding 53.60% share in 2024, lifted by China's domestic tourism and Hainan's offshore model that booked CNY 43.76 billion (USD 6.13 billion) in sales. Currency shifts and resumed outbound Chinese travel introduce competitive tension, yet policy support sustains growth. India and Southeast Asian nations add incremental passengers through new terminals and rising disposable incomes, while Japan and Korea focus on refined merchandising to maintain spending per head.

The Middle East posts the fastest 10.30% CAGR to 2030. Dubai Duty Free earned USD 2.16 billion in 2024, with perfumes leading receipts, and the USD 35 billion Al Maktoum expansion will further enlarge retail footprints. Saudi Arabia's Vision 2030 funnels investment into new airports, with a sovereign duty-free firm accelerating roll-out. Qatar Duty Free's accolades at the 40th Frontier Awards confirm service excellence in a region positioning itself as the preferred global transit corridor.

Europe registers steady gains despite stringent regulations. Privatized hubs like Heathrow and Fiumicino reconfigure space toward experiential precincts, and Travel Retail Norway's low-carbon store at Oslo exemplifies the region's sustainability push. North America benefits from robust domestic travel but must contend with security bottlenecks that curb dwell. South America and Africa present 8.00% and 9.50% CAGRs as middle classes grow; however, foreign-exchange volatility and political risk necessitate agile inventory and pricing.

- Avolta AG (Dufry)

- China Duty Free Group Co. Ltd.

- Lagardere Travel Retail

- DFS Group (LVMH)

- Lotte Duty Free

- Dubai Duty Free

- Heinemann SE & Co. KG

- Qatar Duty Free

- King Power International (Thailand)

- Aer Rianta International

- 3Sixty Duty Free

- Flemingo International

- WHSmith Travel

- Shilla Duty Free

- Bahrain Duty Free

- Duty Free Americas

- Delhi Duty Free

- JR/Duty Free (Australia)

- Beirut Duty Free

- Nuance Group

- Mumbai Travel Retail

- London Heathrow - World Duty Free

- Alpha Airport Shopping

- Qatar Airways In-flight Retail

- ANA Trading Duty Free

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of offshore duty-free zones and free-trade islands boosting shopper footfall

- 4.2.2 Airport privatization & non-aeronautical revenue focus expanding retail floor plates

- 4.2.3 Recovery of long-haul leisure travel reviving fragrance & beauty category spend

- 4.2.4 Rise of omni-channel pre-order / click-and-collect elevating conversion rates

- 4.2.5 Premiumization trend in duty-free liquor targeting millennial traveler segments

- 4.2.6 Introduction of arrival-hall duty-free formats unlocking incremental purchases

- 4.3 Market Restraints

- 4.3.1 Progressive plain-packaging & marketing curbs on tobacco products shrinking margins

- 4.3.2 Currency volatility in emerging tourism economies eroding perceived price advantage

- 4.3.3 Lengthening security & immigration wait-times reducing passenger dwell-time for shopping

- 4.3.4 Ingredient-specific regulatory bans narrowing cosmetics & sunscreen assortments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Perfumes & Cosmetics

- 5.1.2 Wines & Spirits

- 5.1.3 Fashion & Accessories

- 5.1.4 Tobacco Products

- 5.1.5 Confectionery & Fine Foods

- 5.1.6 Electronics & Gadgets

- 5.2 By Distribution Channel

- 5.2.1 Airport Shops

- 5.2.2 On-board Aircraft

- 5.2.3 Seaport & Cruise Line Stores

- 5.2.4 Border & Downtown Duty-Free

- 5.2.5 Railway Stations

- 5.2.6 E-commerce / Omnichannel Pre-order

- 5.3 By Price Range

- 5.3.1 Premium & Luxury

- 5.3.2 Mid-tier

- 5.3.3 Economy

- 5.4 By Consumer Profile

- 5.4.1 Leisure Travelers

- 5.4.2 Business Travelers

- 5.4.3 VFR & Expat Shoppers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Avolta AG (Dufry)

- 6.4.2 China Duty Free Group Co. Ltd.

- 6.4.3 Lagardere Travel Retail

- 6.4.4 DFS Group (LVMH)

- 6.4.5 Lotte Duty Free

- 6.4.6 Dubai Duty Free

- 6.4.7 Heinemann SE & Co. KG

- 6.4.8 Qatar Duty Free

- 6.4.9 King Power International (Thailand)

- 6.4.10 Aer Rianta International

- 6.4.11 3Sixty Duty Free

- 6.4.12 Flemingo International

- 6.4.13 WHSmith Travel

- 6.4.14 Shilla Duty Free

- 6.4.15 Bahrain Duty Free

- 6.4.16 Duty Free Americas

- 6.4.17 Delhi Duty Free

- 6.4.18 JR/Duty Free (Australia)

- 6.4.19 Beirut Duty Free

- 6.4.20 Nuance Group

- 6.4.21 Mumbai Travel Retail

- 6.4.22 London Heathrow - World Duty Free

- 6.4.23 Alpha Airport Shopping

- 6.4.24 Qatar Airways In-flight Retail

- 6.4.25 ANA Trading Duty Free

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment