PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851044

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851044

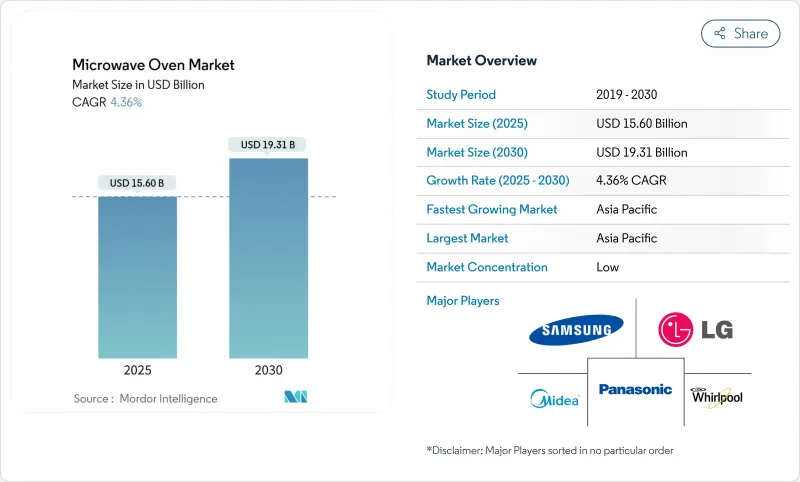

Microwave Oven - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The microwave oven market stands at USD 15.60 billion in 2025 and is projected to reach USD 19.31 billion by 2030, delivering a 4.36% CAGR over the forecast horizon.

Growth reflects steady replacement demand triggered by stricter energy-efficiency mandates, premium kitchen renovations, and the roll-out of smart-home platforms. Penetration in the United States is already mature at 96% of households, so value gains now hinge on higher average selling prices rather than first-time purchases. Forthcoming U.S. Department of Energy rules that cap standby draw at 0.6 W (microwave-only) and 1.0 W (convection) from June 2026 are expected to save consumers USD 1.6 billion in utility costs over 30 years, accelerating the shift toward compliant models . Asia-Pacific retains the largest regional share, aided by China's USD 27.9 billion trade-in subsidy program, which had benefited 29.64 million customers by December 2024. Globally, demand is also buoyed by rising frozen-meal consumption, the expansion of ghost kitchens, and growing preference for space-efficient appliances in nuclear households.

Global Microwave Oven Market Trends and Insights

Rising Disposable Income & Kitchen Renovation Trends

The shift toward integrated kitchen designs favors built-in and over-the-range models, which command higher margins and align with smart home ecosystems. Rising disposable incomes in emerging markets are democratizing access to premium features previously confined to developed economies. The top decile of remodelers spends more than USD 180,000, supporting premium replacements that lift margins. As incomes rise, consumers opt for convection or grill variants that combine speed with browning, reinforcing an upscale trajectory for the microwave oven market.

Growing Demand for Ready-to-Eat Meals & Convenience Cooking

Convenience cooking is becoming a lifestyle necessity rather than a luxury, driven by urbanization, longer working hours, and changing household structures. According to a Houzz survey of 1,620 U.S. homeowners, sixty-five percent of households want sensor reheat or automated cooking programs, prompting brands to embed AI assistants, for instance, Panasonic's HomeCHEF 4-in-1 platform. Convenience culture, longer working hours, and micro-families anchor a durable appetite for quick-serve appliances-traits directly boosting the microwave oven market.

Intense Price Competition Compressing Manufacturer Margins

The competitive pressure stems from multiple sources, like Chinese manufacturers expanding globally with cost-competitive products, tariff impacts that raise input costs, and consumer resistance to price increases amid economic uncertainty. LG's record revenue of KRW 87.73 trillion (USD 61.4 billion) in 2024, despite operating profit declines, demonstrates how volume growth cannot compensate for margin erosion.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Urbanization & Nuclear Households in Emerging Markets

- Utility-Sponsored Rebates for Ultra-Low-Standby-Power Models

- Consumer Health Concerns Over Nutrient Loss & Radiation Myths

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Convection units held 21.6% of 2024 revenue. This slice of the microwave oven market appeals to households wanting traditional browning without a separate oven. Grill variants post the top 5.8% CAGR as crispy finishing gains favor with younger foodies. Solo ovens remain vital entry products for price-sensitive sectors and quick-service restaurants that prioritize reliability.

High-end sellers embed Wi-Fi diagnostics and firmware updates through Samsung's Smart Forward ecosystem, keeping models current by software rather than hardware swaps. Other products, including compact and specialty models, serve niche applications but face pressure from multifunctional alternatives that offer better value propositions.

Countertop designs commanded 54.8% revenue in 2024 due to low installation barriers. Yet, built-in ovens grow 6.0% CAGR as remodelers favor unified cabinetry lines and flush aesthetics. Manufacturers standardize chassis dimensions, so the same internal platforms suit both placements, lowering tooling costs while widening model counts.

Housing trends and consumer lifestyle changes increasingly influence structural preferences. Samsung's showcase of built-in kitchen appliances at EuroCucina 2024, emphasizing connectivity and AI capabilities, illustrates how manufacturers are positioning integrated models as premium solutions. However, the rental market's growth, driven by high mortgage rates affecting home purchases, supports continued demand for portable countertop models that tenants can relocate.

The Microwave Oven Market Report is Segmented by Product (Grill, Solo, and More), by Structure(Countertop, Built-In / Wall, and More), by Control Feature (Button, and Dial), by Capacity(Up To 19 Liters, 20 To 24 Liters, and More), by Application (Residential, and Commercial), by Distribution Channel (B2C, and B2B), and by Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 34% of the global microwave oven market revenue in 2024 and is forecast to have a 6.1% CAGR through 2030. China's trade-in stimulus catalyzes replacements, while rising urban middle classes in India, Indonesia, and Vietnam embrace compact convection variants. Manufacturers such as Haier and Midea convert domestic cost leadership into export strength, deepening original-brand penetration in Latin America and Africa.

North America is a replacement-heavy territory with 96% household penetration, focusing growth on premium connected ovens and ultra-low-standby designs. The DOE standard taking effect in 2028 underpins a new cycle of compliant appliances expected to cut consumer energy outlays by USD 1.6 billion. At the same time, tariffs on imported finished goods raised average appliance prices 4.3% in May 2025 and could climb a further 19-31% if new duties are enacted. Manufacturers respond by concentrating on higher-margin SKUs, which remain widely available even as budget lines thin out

Europe posts steady gains as smart-home ecosystems and stringent energy labels steer buyers to built-in AI-ready ovens showcased at EuroCucina 2024. Utility rebates in Germany, France, and the Nordics reward ultra-low-standby designs, accelerating turnover. Latin America, the Middle East, and Africa offer emerging potential. Urban migration and electrification raise first-time ownership, while e-commerce addresses distribution gaps. These regions add incremental volume that supports global economies of scale within the microwave oven market.

- Samsung Electronics Co. Ltd.

- LG Electronics Inc.

- Whirlpool Corp.

- Panasonic Corp.

- Guangdong Galanz Enterprises Co. Ltd.

- Midea Group Co. Ltd.

- Sharp Corp.

- Electrolux AB

- Haier Smart Home Co. Ltd.

- Bosch Hausgerate GmbH

- Illinois Tool Works (Amana Commercial)

- Breville Group Ltd.

- Toshiba Lifestyle Products & Services

- SMEG S.p.A

- Kenmore (Transform co)

- Daewoo Electronics Corp.

- Vestel Ticaret A.S.

- Hisense Group Co. Ltd.

- Glen Dimplex Home Appliances

- Winia Daewoo Electronics

- Siemens Home Appliances (BSH Hausgerate GmbH)

- Bajaj Electricals Ltd.

- IFB Industries Ltd

- De'Longhi S.p.A

- Magic Chef (CNA International Inc.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Disposable Income & Kitchen Renovation Trends

- 4.2.2 Growing Demand For Ready-To-Eat Meals & Convenience Cooking

- 4.2.3 Rapid Urbanization & Nuclear Households In Emerging Markets

- 4.2.4 Utility-Sponsored Rebates For Ultra-Low-Standby-Power Models

- 4.2.5 Ghost-Kitchen Adoption Of High-Wattage Inverter Microwaves

- 4.3 Market Restraints

- 4.3.1 Intense Price Competition Compressing Manufacturer Margins

- 4.3.2 Consumer Health Concerns Over Nutrient Loss & Radiation Myths

- 4.3.3 Raw Material Price Volatility Inflating BOM (Bill of Materials) Costs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Solo

- 5.1.2 Grill

- 5.1.3 Convection

- 5.1.4 Other Products

- 5.2 By Structure

- 5.2.1 Countertop

- 5.2.2 Built-in / Wall

- 5.2.3 Over-the-Range

- 5.3 By Control Feature

- 5.3.1 Button Controls

- 5.3.2 Dial Controls

- 5.4 By Capacity

- 5.4.1 Up to 19 litres

- 5.4.2 20 to 24 litres

- 5.4.3 25 to 29 litres

- 5.4.4 30 litres & above

- 5.5 By Application

- 5.5.1 Residential

- 5.5.2 Commercial

- 5.6 By Distribution Channel

- 5.6.1 B2C/Retail

- 5.6.1.1 Multi-brand Stores

- 5.6.1.2 Exclusive Brand Outlets

- 5.6.1.3 Online

- 5.6.1.4 Other Distribution Channels

- 5.6.2 B2B/Directly from the Manufacturers

- 5.6.1 B2C/Retail

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 Canada

- 5.7.1.2 United States

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Peru

- 5.7.2.3 Chile

- 5.7.2.4 Argentina

- 5.7.2.5 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Spain

- 5.7.3.5 Italy

- 5.7.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.7.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.7.3.8 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 India

- 5.7.4.2 China

- 5.7.4.3 Japan

- 5.7.4.4 Australia

- 5.7.4.5 South Korea

- 5.7.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.7.4.7 Rest of Asia Pacific

- 5.7.5 Middle East And Africa

- 5.7.5.1 United Arab of Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 South Africa

- 5.7.5.4 Nigeria

- 5.7.5.5 Rest of Middle East And Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Samsung Electronics Co. Ltd.

- 6.4.2 LG Electronics Inc.

- 6.4.3 Whirlpool Corp.

- 6.4.4 Panasonic Corp.

- 6.4.5 Guangdong Galanz Enterprises Co. Ltd.

- 6.4.6 Midea Group Co. Ltd.

- 6.4.7 Sharp Corp.

- 6.4.8 Electrolux AB

- 6.4.9 Haier Smart Home Co. Ltd.

- 6.4.10 Bosch Hausgerate GmbH

- 6.4.11 Illinois Tool Works (Amana Commercial)

- 6.4.12 Breville Group Ltd.

- 6.4.13 Toshiba Lifestyle Products & Services

- 6.4.14 SMEG S.p.A

- 6.4.15 Kenmore (Transform co)

- 6.4.16 Daewoo Electronics Corp.

- 6.4.17 Vestel Ticaret A.S.

- 6.4.18 Hisense Group Co. Ltd.

- 6.4.19 Glen Dimplex Home Appliances

- 6.4.20 Winia Daewoo Electronics

- 6.4.21 Siemens Home Appliances (BSH Hausgerate GmbH)

- 6.4.22 Bajaj Electricals Ltd.

- 6.4.23 IFB Industries Ltd

- 6.4.24 De'Longhi S.p.A

- 6.4.25 Magic Chef (CNA International Inc.)

7 Market Opportunities & Future Outlook

- 7.1 Advances in Smart, Energy-Efficient & Iot-Enabled Microwaves