PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851046

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851046

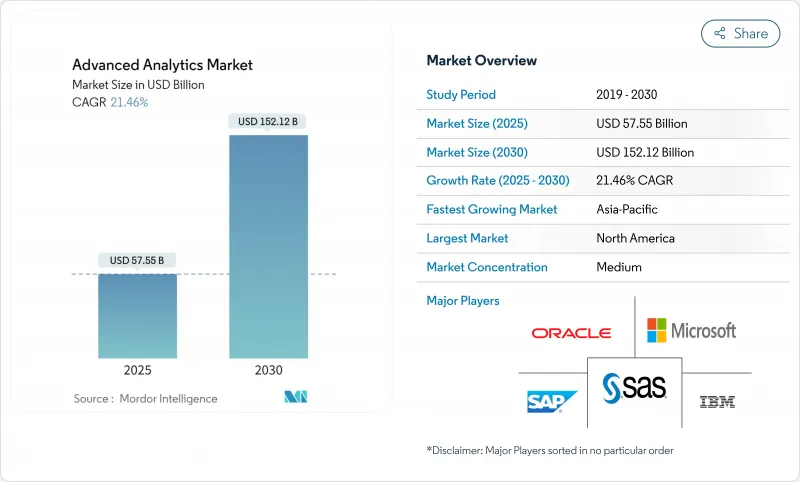

Advanced Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The advanced analytics market stands at USD 57.55 billion in 2025 and is forecast to reach USD 152.22 billion by 2030, reflecting a 21.46% CAGR.

Surging data volumes, falling AI infrastructure costs, and urgent requirements for real-time decision support continue to expand adoption across industries. Rising fraud sophistication is accelerating demand for predictive, risk, and graph analytics, while platform consolidation is reducing customer switching costs and encouraging multi-function deployments. Edge processing is now critical for latency-sensitive use cases such as autonomous systems and industrial automation, lifting edge-analytics growth ahead of other segments. Simultaneously, explainable AI regulation in the EU is redirecting investment toward transparent, auditable models, granting compliant vendors an early-mover advantage.

Global Advanced Analytics Market Trends and Insights

Escalating Fraud-Detection Needs

Financial institutions face highly sophisticated fraud threats that outpace rule-based systems. U.S. regulators urge AI-driven monitoring, and machine-learning models already lift detection accuracy by 40% while halving false positives. IBM research shows 95% classification accuracy when large-scale transaction data is analysed in near real time. Hybrid cloud-edge architectures satisfy sub-second latency requirements and create opportunities for providers bundling fraud analytics, compliance dashboards, and model governance into unified platforms.

Big-Data Volume & Complexity Explosion

Enterprises generated 328.77 million TB daily in 2024, overwhelming traditional BI tooling. Nearly half now employ hybrid storage and data-fabric approaches to integrate siloed sources for advanced analytics market deployments. By 2025, more than 50% of critical processing is expected outside conventional data centers, reinforcing the need for automated data preparation and augmented analytics that expose insights to non-technical business users.

Data Integration & Connectivity Gaps

Fragmented architectures often trap data across aging on-premises, cloud, and operational-technology systems. Organizations allocate 64% of engineering time to integration rather than analysis, delaying returns and dampening enthusiasm for large-scale projects. Industrial firms battle proprietary protocols that complicate analytics linkages, reinforcing the premium placed on data-fabric and no-code integration solutions.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise Digital-Transformation Wave

- Regulatory Push for Explainable AI

- Shortage of Data-Science Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Edge Analytics owns a 28.70% CAGR to 2030, reflecting its role in latency-critical IoT scenarios. In contrast, Predictive Analytics retained 24.22% advanced analytics market share in 2024 as the mainstream choice for forecasting. Edge devices perform localized inference, cutting network costs and ensuring data sovereignty, which is vital for regulated verticals. Automotive, energy, and manufacturing players are embedding compact inference chips to enable anomaly detection and autonomous control loops. Vendors differentiate through federated-learning capabilities that train global models without raw-data egress. Text and Visual Analytics hold steady adoption as unstructured data volumes balloon, while Prescriptive and Risk Analytics are spurred by demand for optimization and scenario modelling.

The advanced analytics market size for Edge Analytics is poised to expand rapidly as 5G coverage broadens. Critical infrastructure owners shift from centralized clouds to distributed mesh fabrics that push decision logic to turbines, substations, and vehicles. Meanwhile, established predictive platforms are integrating real-time data streams to avoid obsolescence, illustrating the market's pivot toward hybrid cloud-edge designs

On-Premises architectures, favored by banks and public agencies, accounted for 54% revenue in 2024 largely due to data-sovereignty mandates. Still, Cloud deployment is rising at 24.80% CAGR as enterprises pursue elastic scaling and pay-as-you-go economics. Hyperscalers prioritize GPU fleet expansion, though intermittent capacity shortfalls create openings for specialized analytics clouds and colocation-edge hybrids.

Security improvements and confidential-compute services steadily erode customer objections. The advanced analytics market size for cloud workloads gains further lift from managed model-ops suites that automate drift detection, versioning, and governance. Hybrid scenarios blend sensitive on-premises data processing with burst-to-cloud training cycles, ensuring compliance without capping innovation. Regional data-residency laws now shape provider buildouts, particularly in the EU and APAC, where in-country zones address privacy statutes.

The Advanced Analytics Market is Segmented by Type (Statistical Analysis, Text Analytics, and More), Deployment Mode (On-Premises, Cloud, Hybrid), Component (Solutions and Services), Business Function (Sales & Marketing, Finance & Risk, and More), End-User Industry, Organization Size (Large Enterprises, Smes), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America continued to command 41% of advanced analytics market revenue in 2024. Venture capital channelled USD 109.1 billion into AI, including USD 33.9 billion for generative models, expanding startup ecosystems and enterprise experimentation. U.S. hyperscalers address prior capacity constraints by injecting new GPU clusters, with Amazon's USD 20 billion Pennsylvania build-out illustrating the scale of investment. Regulatory initiatives, though numerous, remain fragmented, prompting demand for governance add-ons that interpret divergent federal and state requirements.

APAC posts the highest 23.10% CAGR, propelled by manufacturing automation, 5G rollouts, and government smart-city grants. Chinese AI-model enhancements create competitive domestic alternatives, while India's IT-services exports deliver implementation talent to regional manufacturers. Japan and South Korea push deep into edge-analytics applications for industrial robotics and autonomous mobility. Lower total-cost-of-ownership and public-sector digitalization policies expand the advanced analytics market across Southeast Asian nations integrating ecommerce, fintech, and logistics platforms.

Europe grows steadily under rigorously evolving policy. The EU AI Act accelerates purchases of explainable platforms to satisfy transparency rules, especially in critical sectors. Germany's automotive and machinery firms adopt predictive and prescriptive analytics for Industry 4.0, while Nordic utilities embed sustainability analytics to optimize renewables. United Kingdom financial institutions invest in risk-model governance post-Brexit. The advanced analytics market size in Europe benefits from cross-border data-space initiatives that harmonize sharing standards among member states, yet compliance workloads elongate deployment cycles.

- IBM Corporation

- Microsoft Corporation

- SAS Institute Inc.

- SAP SE

- Oracle Corporation

- Amazon Web Services (AWS)

- Google LLC

- Salesforce Inc. (Tableau)

- Teradata Corporation

- QlikTech International AB

- MicroStrategy Incorporated

- Alteryx Inc.

- KNIME AG

- RapidMiner Inc.

- TIBCO Software Inc.

- Altair Engineering Inc.

- Sisense Inc.

- Domo Inc.

- Fair Isaac Corporation (FICO)

- Avanade Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating fraud-detection needs

- 4.2.2 Big-data volume and complexity explosion

- 4.2.3 Enterprise digital-transformation wave

- 4.2.4 Rapid AI/ML and cloud cost declines

- 4.2.5 Edge analytics for real-time decisions

- 4.2.6 Regulatory push for explainable AI

- 4.3 Market Restraints

- 4.3.1 Data integration and connectivity gaps

- 4.3.2 Shortage of data-science talent

- 4.3.3 Sustainability limits on compute energy

- 4.3.4 Vendor lock-in to hyperscale clouds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Statistical Analysis

- 5.1.2 Text Analytics

- 5.1.3 Risk Analytics

- 5.1.4 Predictive Analytics

- 5.1.5 Prescriptive Analytics

- 5.1.6 Visual Analytics

- 5.1.7 Network Analytics

- 5.1.8 Geospatial Analytics

- 5.1.9 Social Media Analytics

- 5.1.10 Edge Analytics

- 5.1.11 Other Types

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.3 By Component

- 5.3.1 Solutions

- 5.3.2 Services

- 5.3.2.1 Consulting

- 5.3.2.2 Managed Services

- 5.4 By Business Function

- 5.4.1 Sales and Marketing

- 5.4.2 Finance and Risk

- 5.4.3 Operations and Supply-Chain

- 5.4.4 Human Resources

- 5.4.5 Customer Support

- 5.5 By End-User Industry

- 5.5.1 BFSI

- 5.5.2 Retail and Consumer Goods

- 5.5.3 Healthcare and Life Sciences

- 5.5.4 IT and Telecommunication

- 5.5.5 Transportation and Logistics

- 5.5.6 Government and Defense

- 5.5.7 Manufacturing

- 5.5.8 Energy and Utilities

- 5.5.9 Media and Entertainment

- 5.5.10 Other Industries

- 5.6 By Organization Size

- 5.6.1 Large Enterprises

- 5.6.2 Small and Mid-Sized Enterprises (SMEs)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East

- 5.7.5.1 Israel

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 United Arab Emirates

- 5.7.5.4 Turkey

- 5.7.5.5 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Egypt

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 SAS Institute Inc.

- 6.4.4 SAP SE

- 6.4.5 Oracle Corporation

- 6.4.6 Amazon Web Services (AWS)

- 6.4.7 Google LLC

- 6.4.8 Salesforce Inc. (Tableau)

- 6.4.9 Teradata Corporation

- 6.4.10 QlikTech International AB

- 6.4.11 MicroStrategy Incorporated

- 6.4.12 Alteryx Inc.

- 6.4.13 KNIME AG

- 6.4.14 RapidMiner Inc.

- 6.4.15 TIBCO Software Inc.

- 6.4.16 Altair Engineering Inc.

- 6.4.17 Sisense Inc.

- 6.4.18 Domo Inc.

- 6.4.19 Fair Isaac Corporation (FICO)

- 6.4.20 Avanade Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment