PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851047

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851047

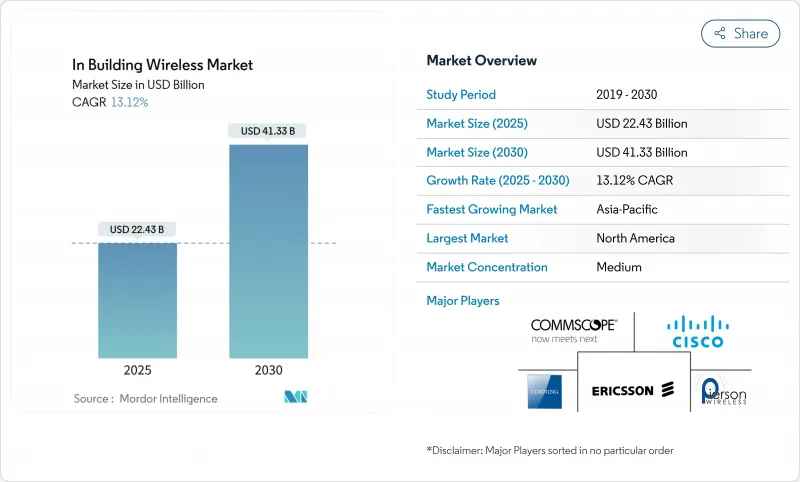

In Building Wireless - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The In Building Wireless Market size is estimated at USD 22.43 billion in 2025, and is expected to reach USD 41.33 billion by 2030, at a CAGR of 13.12% during the forecast period (2025-2030).

Sustained demand for always-available indoor connectivity, the transition to 5G-ready buildings, and rising smart-facility mandates are driving this momentum. Enterprises now treat indoor coverage as core infrastructure, investing in cellular-first architectures that pair private 5G with next-generation Wi-Fi to guarantee application uptime. Supply-chain inflation has nudged deployment costs higher, yet cost pressures are partially offset by neutral-host designs and AI-based optimisation that lower life-cycle expenses. Vendor consolidation is reshaping the In-Building Wireless market as equipment makers pursue end-to-end solution portfolios capable of spanning radio, transport, and cloud management layers.

Global In Building Wireless Market Trends and Insights

Rising mobile-data consumption indoors

Roughly 80% of all mobile traffic now originates inside buildings, overwhelming legacy Wi-Fi whenever video, AR training, or high-density IoT workloads spike. Retail chains such as Tractor Supply adopted 5G across more than 2,000 outlets after Wi-Fi could not support real-time inventory and customer-engagement applications. In healthcare, a single children's hospital installed 900 tri-radio APs to safeguard tele-medicine and imaging traffic without patient disruption, underscoring the capacity gap that indoor 5G plus Wi-Fi 6E is filling. Growing video collaboration and edge analytics workloads will intensify the demand curve, reinforcing the revenue outlook for the In-Building Wireless market.

5G spectrum allocations for indoor use

Regulators are carving out dedicated indoor spectrum, shifting enterprise design from outdoor-to-indoor overlay to private cellular from day one. In the United States, the CBRS auction channelled USD 4.6 billion into 3.5 GHz licences aimed at enterprise and venue deployments, with one Tier-1 carrier alone spending USD 1.89 billion. Europe authorised 480-500 MHz in the 6 GHz band, enabling 320 MHz-wide channels critical for stadiums, airports, and universities. China Mobile earmarked USD 416 million for 5G-Advanced rollouts across 300 cities to accelerate factory automation at scale. Such allocations ensure long-term spectrum certainty, lifting confidence and capex commitment across the In-Building Wireless market.

Data-privacy and cybersecurity concerns

Enterprises remain cautious about exposing operational traffic to broader cellular ecosystems. GDPR compliance elevates scrutiny of location-tracking functions in Europe, prolonging procurement cycles for smart-office projects. Healthcare providers mandate Protected Management Frames and advanced encryption before approving new radios because patient data moves over the same air interface. The US "rip-and-replace" rules for insecure equipment add unexpected swap-out costs but ultimately harden the security posture of the In-Building Wireless market.

Other drivers and restraints analyzed in the detailed report include:

- Demand for uninterrupted enterprise connectivity

- Smart-building mandates for gigabit Wi-Fi

- High capex of multi-operator DAS deployments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Distributed Antenna Systems held 38% of 2024 revenue, anchoring the In-Building Wireless market through deep penetration in stadiums, airports, and Class-A offices. Private-5G small cells, however, are advancing at a 13.89% CAGR, signaling a pivot toward agile cellular networks that enterprises can own and manage. Rising fibre and coax prices push integrators to favour active DAS or small-cell architectures that minimise cabling runs and facilitate remote software upgrades.

Antenna innovation now prioritises multi-band, multi-operator designs that collapse Wi-Fi and cellular coverage into one form factor, trimming roof-space requirements. Repeater use is declining as small-cell clusters deliver stronger uplinks without RF noise penalties. Vendor consolidation, illustrated by Amphenol's USD 2.1 billion acquisition of CommScope's mobility assets, bundles cabling, connectors, and radio components to streamline procurement. As neutral-host demand grows, single backbone infrastructures capable of carrying public and private slices simultaneously will reshape capital-allocation patterns across the In-Building Wireless market.

4G/LTE retained 65% share in 2024, underpinned by a mature device ecosystem and proven stability for voice and data. Yet 5G NR is expanding at a 14.67% CAGR, driven by industrial automation projects that need deterministic latency below 10 ms. Wi-Fi 6E is also scaling, but Wi-Fi 7 introduces 320 MHz channels, multi-link operation, and 4K-QAM, giving enterprises a non-cellular path to ultra-high throughput.

Hybrid deployments blending 5G and Wi-Fi 7 are emerging as the reference architecture in hospitals, smart factories, and higher-education campuses. Manufacturing plants use 5G for mobile robotics and safety-critical telemetry, while Wi-Fi handles bulk data offload for tablets and laptops. China's 5G-Advanced roll-out validates the technology's readiness for indoor broadband, fuelling component demand from active DAS and small-cell vendors. With each additional private licence granted, the In-Building Wireless market deepens its shift from operator-led to enterprise-controlled networks.

The in Building Wireless Market Report is Segmented by Component Type (Antenna, Distributed Antenna Systems, Cables, Repeaters, and Small Cells), Technology (4G/LTE, 5G NR, Wi-Fi 6/6E, and Wi-Fi 7), Frequency Band (Less Than 1 GHz, 1 - 6 GHz, and More Than 6 GHz), End-User Industry (Commercial, Residential, Industrial, and Public-Safety and Government), and Geography.

Geography Analysis

North America led the In-Building Wireless market with 34% revenue share in 2024, aided by CBRS spectrum liberalisation and FirstNet's USD 8 billion public-safety investment that funded 1,000 new cell sites. Enterprises in the United States adopt neutral-host architectures to consolidate carrier relationships and future-proof private-network ambitions. Wi-Fi 7 launches from multiple vendors accelerate refresh cycles, while Canada and Mexico leverage their automotive and aerospace clusters to justify private cellular rollouts inside plants.

Asia-Pacific is expanding at a 14.60% CAGR to 2030. China already hosts 4.4 million 5G base stations and plans to exceed 4.5 million within the forecast horizon as it digitalises manufacturing and logistics. Japan's licence regime supports sub-6 and mmWave hybrids in smart factories, and South Korea channels state incentives into campus networks at semiconductor fabs. India's electronic-manufacturing drive is supported by antenna localisation partnerships that trim import costs and shorten deployment lead times.

Europe shows steady uptake influenced by regulatory stringency around data privacy and building emissions. The 6 GHz allocation enlarges Wi-Fi capacity for dense venues, and French cities demonstrate the cost advantage of private 5G for municipal camera backhaul. German, British, and French enterprises lead adoption, while Central-Eastern manufacturers pilot private 5G to support Industry 4.0. Strict GDPR compliance requirements nudge buyers toward on-premises core networks and secure device-identity frameworks, shaping a security-first approach within the In-Building Wireless market.

- CommScope Holding Co.

- Cisco Systems Inc.

- Corning Inc.

- Ericsson AB

- Nokia Corp.

- ATandT Inc.

- Verizon Communications Inc.

- Pierson Wireless Corp.

- Cobham PLC

- Cambium Networks

- TE Connectivity Ltd.

- Dali Wireless Inc.

- Airspan Networks

- American Tower Corp.

- Boingo Wireless Inc.

- Extreme Networks Inc.

- Juniper Networks Inc.

- HPE (Aruba Networks)

- Samsung Electronics (Co. Networks)

- Huawei Technologies Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising mobile data consumption indoors

- 4.2.2 5G spectrum allocations for indoor use

- 4.2.3 Growing demand for uninterrupted enterprise connectivity

- 4.2.4 Smart-building mandates for gigabit-grade Wi-Fi

- 4.2.5 Corporate net-zero targets driving low-power neutral-host DAS

- 4.2.6 Retail media networks monetising in-store footfall analytics

- 4.3 Market Restraints

- 4.3.1 Data-privacy and cybersecurity concerns

- 4.3.2 High capex of multi-operator DAS deployments

- 4.3.3 Skilled-labour shortage for CBRS/Private-5G integration

- 4.3.4 Radio-frequency transparency rules in heritage buildings

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component Type

- 5.1.1 Antenna

- 5.1.2 Distributed Antenna Systems (Active DAS, Passive DAS)

- 5.1.3 Cables (Coax, Fiber)

- 5.1.4 Repeaters

- 5.1.5 Small Cells (Femtocell, Picocell, Microcell)

- 5.2 By Technology

- 5.2.1 4G/LTE

- 5.2.2 5G NR

- 5.2.3 Wi-Fi 6/6E

- 5.2.4 Wi-Fi 7

- 5.3 By Frequency Band

- 5.3.1 Less than 1 GHz (Low-band)

- 5.3.2 1 - 6 GHz (Mid-band incl. CBRS)

- 5.3.3 More than 6 GHz (mmWave)

- 5.4 By End-user Industry

- 5.4.1 Commercial

- 5.4.1.1 Offices

- 5.4.1.2 Retail

- 5.4.1.3 Healthcare

- 5.4.1.4 Hospitality

- 5.4.2 Residential

- 5.4.2.1 MDU

- 5.4.2.2 Single-family

- 5.4.3 Industrial

- 5.4.3.1 Manufacturing

- 5.4.3.2 Warehousing

- 5.4.3.3 Oil and Gas

- 5.4.4 Public-Safety and Government

- 5.4.1 Commercial

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Nigeria

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 CommScope Holding Co.

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Corning Inc.

- 6.4.4 Ericsson AB

- 6.4.5 Nokia Corp.

- 6.4.6 ATandT Inc.

- 6.4.7 Verizon Communications Inc.

- 6.4.8 Pierson Wireless Corp.

- 6.4.9 Cobham PLC

- 6.4.10 Cambium Networks

- 6.4.11 TE Connectivity Ltd.

- 6.4.12 Dali Wireless Inc.

- 6.4.13 Airspan Networks

- 6.4.14 American Tower Corp.

- 6.4.15 Boingo Wireless Inc.

- 6.4.16 Extreme Networks Inc.

- 6.4.17 Juniper Networks Inc.

- 6.4.18 HPE (Aruba Networks)

- 6.4.19 Samsung Electronics (Co. Networks)

- 6.4.20 Huawei Technologies Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment