PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851048

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851048

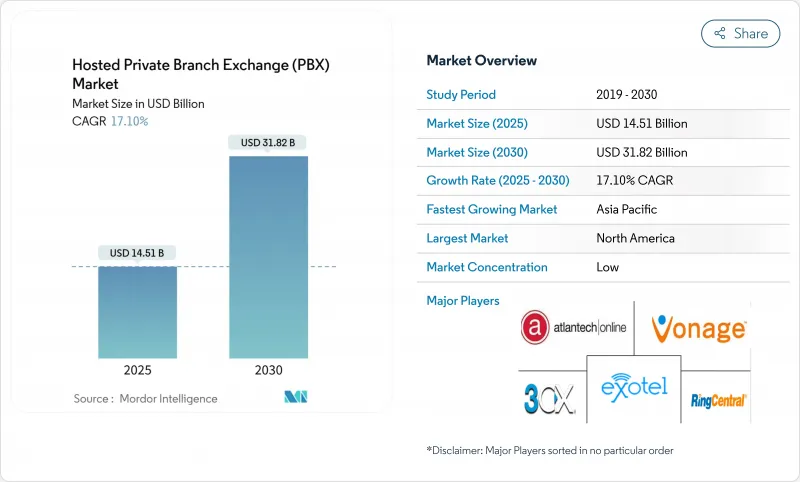

Hosted Private Branch Exchange (PBX) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hosted private branch exchange market is valued at USD 14.51 billion in 2025 and is predicted to reach USD 31.82 billion by 2030, reflecting a 17.1% CAGR.

Demand is rising as organizations swap capital-heavy on-premises switches for flexible cloud voice that scales with distributed workforces. Mid-market firms view hosted PBX as a route to lower operating costs and easy integration of AI analytics, multi-channel routing, and mobility features. Vendors are bundling PBX with wider UCaaS suites, giving enterprises a single platform for voice, video, messaging, and collaboration. Growth is further lifted by 5G rollouts, SIP trunk migration, and fixed-mobile convergence that lets employees keep a secure business identity on any device.

Global Hosted Private Branch Exchange (PBX) Market Trends and Insights

Surge in BYOD-Driven Demand Reshapes Enterprise Mobility Strategy

Mid-market firms in the United States are retiring desk phones in favor of mobile-first cloud voice that keeps corporate numbers on personal handsets. Cavell Group forecasts mobile-enabled cloud seats rising from 1 million in 2022 to 7.3 million by 2027, confirming that the hosted private branch exchange market is now shaped by smartphones rather than handsets. Businesses see fixed-mobile convergence as an essential feature because it simplifies compliance and preserves call quality while staff work remotely. AT&T's Cloud Voice with Webex Go shows how carriers integrate network reach with collaboration software to remove the divide between office and field users.

5G Networks Eliminate QoS Barriers to Cloud Voice Adoption

Standalone 5G is cutting latency below 10 ms and delivering the guaranteed bandwidth that mission-critical voice needs. Enterprises in China, South Korea, and India expect up to 20% returns from 5G-enabled Industry 4.0 use cases, which fuels the adoption of hosted PBX for shop-floor coordination. The hosted private branch exchange market gains because reliable wireless links remove the last objection to cloud calling in factories and logistics hubs. Communications service providers now package PBX seats with 5G slices so a single contract covers connectivity and voice.

Data Sovereignty Requirements Challenge Multi-Tenant Architectures

The EECC Directive and GDPR oblige providers to store voice recordings inside the EU and to furnish detailed consent workflows. Multi-tenant PBX architectures must carve out country-specific data zones or risk fines up to 4% of global turnover. Vendors in the hosted private branch exchange market respond by opening regional data centers and offering customer-managed encryption keys, which raises operating costs yet preserves feature parity across borders.

Other drivers and restraints analyzed in the detailed report include:

- SIP Trunking Migration Delivers Transformative Cost Benefits

- Hybrid Work Models Drive Comprehensive Communication Refresh

- Infrastructure Gaps Impede Quality Service Delivery in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions continued to command a 67% revenue share of the hosted private branch exchange market in 2024, thanks to evergreen demand for core call control, auto-attendant, and voicemail. However, services are set to grow 18.1% annually as enterprises seek advisory and managed support to weave cloud voice into complex application stacks. Professional services teams run readiness assessments, port numbers, and train users, while managed services teams monitor quality of service and enforce policy. This shift broadens the hosted private branch exchange industry from pure SaaS toward outcome-based contracts, aligning providers with customer success metrics.

AI now automates provisioning and anomaly detection, letting service partners guarantee 99.999% uptime even at a global scale. 8x8's eXperience Communications Platform demonstrates how a single management pane unifies voice, video, SMS, and APIs; such consolidation bolsters attach rates for managed services [eclipsewholesale.co.uk]. The hosted private branch exchange market size for managed services is projected to expand from USD 4.9 billion in 2025 to USD 11.4 billion by 2030, reflecting this demand-led swing toward expertise backed by SLAs.

SMEs with 51-250 seats held 62% of 2024 revenue because cloud voice removes the capital spikes that traditionally deterred smaller firms. Fixed monthly pricing covers upgrades and security, letting finance teams predict cash flow. As these firms open branch offices, administrators add seats in minutes, keeping productivity high. Large enterprises now show the fastest growth at 17.3% CAGR as global IT departments consolidate dozens of local PBXs into a single tenant that enforces consistent policies worldwide.

The hosted private branch exchange market size for large enterprises is forecast to reach USD 8.2 billion by 2030, closing the historical gap with mid-market spending. Micro-enterprises remain underserved; yet analysts peg average monthly revenue at USD 40-50 per seat, proving profitability when onboarding is automated. New entrants use freemium trials and self-service setup to attack this niche, preventing incumbents from coasting on top-tier accounts.

The Hosted Private Branch Exchange (PBX) Market is Segmented by Component (Solutions and Services), Enterprise Size (Small and Medium Enterprises and Large Enterprises), Application (Unified Communication and Collaboration, Mobility and BYOD Enablement, and More), End-User Industry (BFSI, Manufacturing, Retail and E-Commerce, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 35% of 2024 revenue, buoyed by mature broadband, permissive BYOD policies, and cloud-first procurement. U.S. regulators compel PSTN fall-back for emergency calls, adding cost but cementing trust. Providers answer with geo-redundant trunks and E911 provisioning that complies out of the box. AI-driven voice analytics gain rapid traction, turning customer conversations into data that fuels service improvements.

Asia Pacific is the fastest climber at a 17.5% CAGR. Mass 5G coverage in China and South Korea removes latency complaints, while India's digital-first start-ups sign monthly subscriptions instead of buying gear. Japanese conglomerates insist on open APIs to avoid lock-in, pushing the hosted private branch exchange market toward standards-based extensions. Government stimulus packages that co-fund cloud adoption amplify uptake across Southeast Asia.

Europe balances opportunity with regulation. TDM switch shut-offs and expensive ISDN lines push SMBs toward SIP trunks and hosted dial plans, yet GDPR forces providers to invest in in-region storage and lawful intercept. Despite the burden, the hosted private branch exchange market size in Europe will grow from USD 4.3 billion in 2025 to USD 8.4 billion in 2030. National broadband plans that extend fiber to rural zones promise to shrink the urban-rural quality divide by the second half of the decade.

- Mitel Networks Corp

- Avaya Inc

- Amazon Web Services (Amazon.com Inc)

- Microsoft Corporation

- 3CX

- Exotel Techcom Pvt Ltd

- Vonage

- RingCentral Inc

- Atlantech Online Inc

- Clearly Core Inc

- OnePipe Telecom

- Zaplee Inc

- G12 Communications LLC

- Yeastar Information Technology Co Ltd

- 8x8 Inc

- Cisco Systems Inc

- Nextiva Inc

- Twilio Inc

- Zoom Video Communications Inc

- Ooma Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in BYOD-driven demand for mobile-integrated PBX among North-American mid-market firms

- 4.2.2 Roll-out of 5G standalone networks enabling QoS-sensitive cloud voice in Asia

- 4.2.3 Migration from TDM to SIP trunking across European SMBs lowering total cost of ownership

- 4.2.4 Post-pandemic hybrid-work policies accelerating cloud communication refresh cycles in ANZ enterprises

- 4.2.5 UCaaS bundling incentives offered by tier-1 carriers in the Middle-East driving hosted seat uptake

- 4.2.6 AI-powered voice analytics embedded in hosted PBX attracting contact-centres in Latin-America

- 4.3 Market Restraints

- 4.3.1 Data-residency mandates under EU GDPR restricting multi-tenant voice storage

- 4.3.2 Limited last-mile fiber penetration outside Tier-1 Indian cities causing QoS issues

- 4.3.3 Persistent PSTN-fallback regulatory requirements inflating compliance cost in the U.S.

- 4.3.4 Vendor lock-in concerns linked to proprietary APIs among Japanese large enterprises

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Segmentation by Component

- 5.1.1 Solution

- 5.1.2 Services

- 5.1.2.1 Managed Services

- 5.1.2.2 Professional Services

- 5.1.2.3 Network and IT Services

- 5.2 Segmentation by Enterprise Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 Segmentation by Application

- 5.3.1 Unified Communication and Collaboration

- 5.3.2 Mobility and BYOD Enablement

- 5.3.3 Contact Center

- 5.3.4 SIP Trunking and Call Routing

- 5.4 Segmentation by End-Use Industry

- 5.4.1 BFSI

- 5.4.2 Manufacturing

- 5.4.3 Retail and E-commerce

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Government and Public Sector

- 5.4.6 IT and Telecom

- 5.4.7 Education

- 5.4.8 Logistics and Transportation

- 5.4.9 Hospitality

- 5.4.10 Other Industries

- 5.5 Segmentation by Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Nordics

- 5.5.4.1 Sweden

- 5.5.4.2 Norway

- 5.5.4.3 Denmark

- 5.5.4.4 Finland

- 5.5.4.5 Iceland

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Israel

- 5.5.5.5 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Egypt

- 5.5.6.4 Kenya

- 5.5.6.5 Rest of Africa

- 5.5.7 Asia Pacific

- 5.5.7.1 China

- 5.5.7.2 India

- 5.5.7.3 Japan

- 5.5.7.4 South Korea

- 5.5.7.5 ASEAN

- 5.5.7.6 Rest of Asia Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Mitel Networks Corp

- 6.4.2 Avaya Inc

- 6.4.3 Amazon Web Services (Amazon.com Inc)

- 6.4.4 Microsoft Corporation

- 6.4.5 3CX

- 6.4.6 Exotel Techcom Pvt Ltd

- 6.4.7 Vonage

- 6.4.8 RingCentral Inc

- 6.4.9 Atlantech Online Inc

- 6.4.10 Clearly Core Inc

- 6.4.11 OnePipe Telecom

- 6.4.12 Zaplee Inc

- 6.4.13 G12 Communications LLC

- 6.4.14 Yeastar Information Technology Co Ltd

- 6.4.15 8x8 Inc

- 6.4.16 Cisco Systems Inc

- 6.4.17 Nextiva Inc

- 6.4.18 Twilio Inc

- 6.4.19 Zoom Video Communications Inc

- 6.4.20 Ooma Inc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment