PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851050

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851050

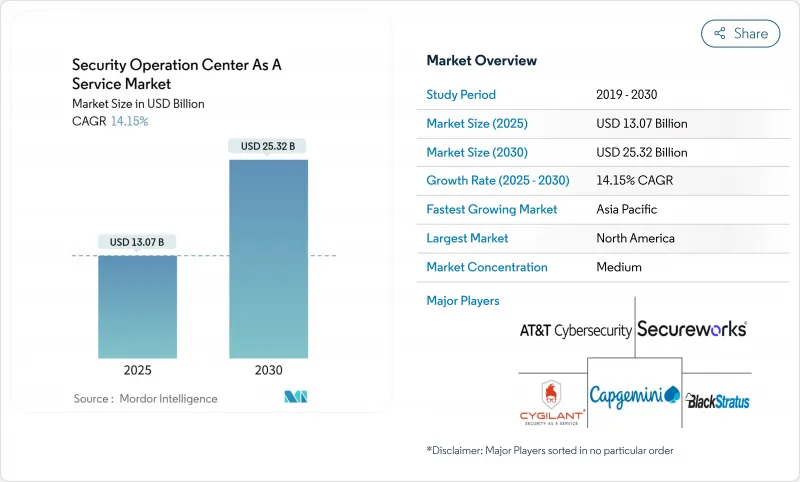

Security Operation Center As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Security Operations Center as a Service market is valued at USD 13.07 billion in 2025 and is forecast to reach USD 25.32 billion by 2030, expanding at a 14.15% CAGR.

Rapid growth springs from the shift away from reactive defenses toward always-on, AI-driven detection and response. Outsourced models solve the dual pressure of intensifying multi-vector attacks and an acute talent shortage while aligning with tougher disclosure rules that demand round-the-clock coverage. Large enterprises remain the principal buyers, yet cost-efficient, subscription-based services now open the door for smaller firms to secure enterprise-grade protection. Public cloud delivery dominates because it speeds deployment, although hybrid architectures are gaining traction as customers balance sovereignty requirements with flexibility. Consolidation, highlighted by Sophos acquiring Secureworks, points to an industry moving toward unified platforms that fuse log management, advanced analytics, and autonomous response.

Global Security Operation Center As A Service Market Trends and Insights

Exponential Rise in Multi-Vector Cyber-Attacks

Attacks now span cloud workloads, industrial controls, and employee endpoints, forcing enterprises to correlate billions of events daily. Operational technology breaches rose 73% year over year, and downtime can cost manufacturers USD 1 million per day.Ransomware-as-a-Service platforms further lower the barrier for adversaries, which pushes buyers toward AI-powered SOCaaS to catch unknown patterns in real time. Autonomous investigation cuts human effort, and unified threat telemetry reduces dwell time.

Escalating Cybersecurity-Talent Shortage

Thirty-two percent of European firms still cannot fill critical security roles, especially architecture and engineering positions. Salary inflation leaves many organizations unable to staff 24/7 coverage. Outsourced SOCs supply certified analysts, while automation tools such as Microsoft Security Copilot's 11 AI agents redirect scarce personnel toward strategy tasks.

Data-Sovereignty and Log-Residency Concerns

More than 100 jurisdictions now restrict cross-border log storage, forcing providers to stand up regional data nodes and sovereign cloud instances. These extra facilities raise costs and can delay onboarding, particularly in sectors with granular audit rules such as public administration in Germany or healthcare in Australia.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Cloud and Hybrid IT Attack Surface

- Regulatory Push for Real-Time Incident Disclosure

- Integration Complexity with Legacy Tooling

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large enterprises represented 62.3% of the Security Operations Center as a Service market size in 2024. They rely on outsourced SOCs as force multipliers that free internal specialists for architecture work. The same period saw small and medium enterprises adopt services at a 15.7% CAGR, signalling that subscription pricing between USD 64 and USD 250 per user each month finally fits mid-market budgets. SMEs embrace curated playbooks because they lack in-house incident response expertise.

Continuous analyst shortages make external SOC coverage an operational necessity. Smaller businesses also value bundled regulatory tooling that eases ISO 27001 or HIPAA compliance without major capex. Meanwhile, multinational conglomerates integrate SOCaaS outputs into existing SIEM workflows to accelerate root-cause analysis. Both cohorts gain from cloud-native dashboards that prioritize threats by business impact, yet customization depth still differentiates premium offerings for the top end of the market.

Security Monitoring and Log Management commanded 34.5% of 2024 revenue. Managed Detection and Response is now growing at 14.3% and is positioned to overtake legacy monitoring because it supplies proactive hunting, not just compliance records. BlueVoyant clients recorded a 210% ROI after consolidating tools under MDR, which cut false positives and breach frequency.

MDR platforms use machine learning to correlate user, network, and cloud telemetry. Integrated incident response tuning trims mean time to resolution to single-digit minutes, a key selling point for regulated sectors. Complementary threat-hunting subscriptions address advanced persistent threats that elude automatic detection. Consulting add-ons such as tabletop exercises and purple-team testing round out full-spectrum portfolios for mature buyers.

Security Operations Center As A Service (SOCaaS) Market is Segmented by Enterprise Size (SMEs and Large Enterprises), Service Type (Managed Detection and Response (MDR), Incident Response and Threat Hunting, and More), Deployment Model (Public Cloud, Private Cloud, and More), End-User Industry (BFSI, Manufacturing, and More), by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 26.5% of 2024 spending. Early cloud adoption, mature cyber-insurance markets that mandate monitored controls, and strong venture funding create an ecosystem favorable to SOCaaS. United States regulations, including the SEC's incident disclosure rule, push even mid-cap firms to contract 24/7 coverage. Canada follows a similar path but places extra weight on data-residency clauses when selecting providers.

Asia-Pacific is projected to lead growth with a 15.2% CAGR through 2030. Public-cloud revenue in the region nearly doubled between 2022 and 2024, broadening the customer pool. Governments from Japan to India are harmonising breach-notification timelines, encouraging platform-agnostic SOC uptake. Apollo Hospital's adoption of a regional SOCaaS framework shows how emerging-market health providers secure operations while meeting local privacy laws.

Europe remains a strategic market thanks to the NIS2 Directive. Essential service operators must prove continuous monitoring, risk management, and rapid notification. Average security budgets reached EUR 15 million in 2024, reinforcing the opportunity for regional SOC players. Strict data sovereignty drives demand for providers willing to set up facilities in the country. South America, the Middle East, and Africa maintain smaller bases today, yet present rising demand as digital payments, e-government, and critical-infrastructure projects increase cyber-risk exposure.

List of Companies Covered in this Report:

- SecureWorks

- IBM Security

- ATandT Cybersecurity

- Arctic Wolf Networks

- Trustwave (Singtel)

- Atos

- BAE Systems

- Capgemini

- Symantec (Broadcom)

- Thales

- Fujitsu

- NTT Security

- CenturyLink (Lumen)

- Alert Logic

- Cygilant

- BlackStratus

- Digital Guardian

- Rapid7

- Securonix

- FireEye (Trellix)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exponential rise in multi-vector cyber-attacks

- 4.2.2 Escalating cybersecurity-talent shortage

- 4.2.3 Expanding cloud and hybrid IT attack surface

- 4.2.4 Regulatory push for real-time incident disclosure

- 4.2.5 Cyber-insurance mandates for 24/7 MDR

- 4.2.6 OT/IoT convergence demanding unified visibility

- 4.3 Market Restraints

- 4.3.1 Data-sovereignty and log-residency concerns

- 4.3.2 Integration complexity with legacy tooling

- 4.3.3 Limited organization-specific context in outsourced SOC

- 4.3.4 Alert-fatigue from high false-positive rates

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Enterprise Size

- 5.1.1 Small and Medium Enterprises (SMEs)

- 5.1.2 Large Enterprises

- 5.2 By Service Type

- 5.2.1 Managed Detection and Response (MDR)

- 5.2.2 Incident Response and Threat Hunting

- 5.2.3 Security Monitoring and Log Management

- 5.2.4 Others

- 5.3 By Deployment Model

- 5.3.1 Public Cloud

- 5.3.2 Private Cloud

- 5.3.3 Hybrid Cloud

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 IT and Telecom

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Manufacturing

- 5.4.5 Government and Public Sector

- 5.4.6 Retail and E-commerce

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SecureWorks

- 6.4.2 IBM Security

- 6.4.3 ATandT Cybersecurity

- 6.4.4 Arctic Wolf Networks

- 6.4.5 Trustwave (Singtel)

- 6.4.6 Atos

- 6.4.7 BAE Systems

- 6.4.8 Capgemini

- 6.4.9 Symantec (Broadcom)

- 6.4.10 Thales

- 6.4.11 Fujitsu

- 6.4.12 NTT Security

- 6.4.13 CenturyLink (Lumen)

- 6.4.14 Alert Logic

- 6.4.15 Cygilant

- 6.4.16 BlackStratus

- 6.4.17 Digital Guardian

- 6.4.18 Rapid7

- 6.4.19 Securonix

- 6.4.20 FireEye (Trellix)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment