PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851057

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851057

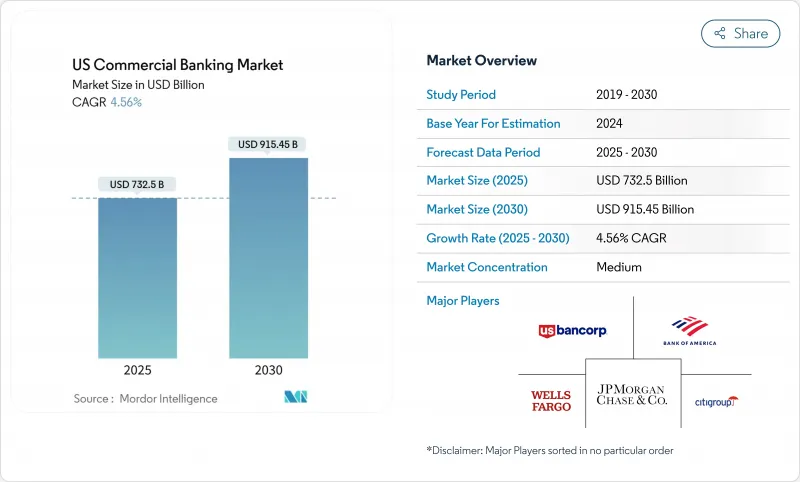

US Commercial Banking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US commercial banking market stands at USD 732.5 billion in 2025 and is forecasted to reach USD 915.45 billion by 2030, reflecting a 4.56% CAGR throughout the period.

Resilient GDP growth, expanding real-time payments infrastructure, and steady capital ratios under Federal Reserve stress-test assumptions collectively reinforce confidence in the sector's expansion. Banks are capturing structured-finance demand arising from on-shoring and federal infrastructure outlays, while fee-based products such as corporate treasury services are gaining momentum as net-interest margins stabilize near mid-cycle levels. Basel III "endgame" rules are nudging large institutions toward higher capital buffers, but disciplined cost management and broadening digital capabilities are preserving profitability. At the same time, embedded-finance platforms embedded in enterprise-resource-planning (ERP) systems pose disintermediation risks that require banks to accelerate open-API strategies and deepen advisory services.

US Commercial Banking Market Trends and Insights

Robust US GDP and Labor-Market Momentum

US GDP is set to grow 2.7% in 2025, buoyed by productivity gains and sturdy consumer spending that lift business revenues and, in turn, credit demand. Banks benefit as tighter labor markets elevate household earnings and enhance corporate cash flows, enabling stronger debt-service coverage ratios. A policy stance that holds the federal-funds rate near 4% sustains net-interest margins without compromising lending appetite. Portfolio credit costs remain in check, as unemployment hovers around multidecade lows. Productivity improvements registered since 2023 position corporate borrowers to fund expansion out of cash flow, lowering balance-sheet risk for lenders. Together, these elements create a favorable backdrop for the US commercial banking market through mid-decade.

Accelerating Adoption of Real-Time Payments & APIs

FedNow participation vaulted from 400 to more than 1,000 institutions between early 2024 and 2025. ISO 20022 messaging now underpins instant settlement, automated reconciliation, and rich data transfer that corporate treasurers demand. Banks embedding APIs into corporate ERP suites see rising fee income per account from programmable treasury services such as automated sweeps and dynamic cash forecasting. Community banks leverage third-party API partners to match the capabilities of larger rivals, extending the US commercial banking market relevance into rural economies. As real-time payments become table stakes, institutions that master interoperability and data analytics gain a durable share of operating deposits. The shift also yields operating-expense savings via straight-through processing, enhancing cost-income ratios.

Escalating Cybersecurity & Fraud Costs

Bank IT budgets hit USD 107.8 billion in 2024, with a rising share directed at threat detection, zero-trust architectures, and real-time fraud interdiction. Treasury analysis warns that generative-AI tools empower fraudsters to craft adaptive malware, forcing banks to adopt similarly advanced analytics. Smaller institutions lack the scale to amortize escalating security spend, increasing merger pressure, or pushing them into managed-service arrangements. Elevated costs squeeze efficiency ratios, particularly when combined with declining overdraft and interchange income. Customer experience also suffers if multifactor authentication adds friction, giving fintechs an opening to capture transactional relationships. The drag on earnings, though moderate, subtracts from the US commercial banking market growth trajectory.

Other drivers and restraints analyzed in the detailed report include:

- Federal Infrastructure-Spending-Led Loan Demand

- Federal Cannabis-Banking Reform Unlocking New Fee Pools

- Basel III "End-game" Capital Tightening

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Commercial lending retained the largest 44.34% slice of the US commercial banking market activity in 2024, yet it provides slower growth as capital rules tighten. Nevertheless, robust capex tied to on-shoring and infrastructure projects sustains baseline volumes. Syndicated credits and capital-markets distribution diversify risk and free capital for incremental growth. Trade-finance, supply-chain, and foreign-exchange products, grouped under Other Products, draw strength from complex cross-border commerce. The combined product mosaic underscores banks' strategy to balance capital-intensive lending with scalable fee services, ensuring the US commercial banking market remains profitable across rate environments.

The treasury management segment is projected to rise 6.79% CAGR to 2030, outpacing every other line as corporates migrate from paper-based processes to real-time liquidity tools. The segment's share of the US commercial banking market size is projected to climb considerably by 2030, reflecting a decisive pivot toward non-interest income. Middle-market firms deploy API-enabled dashboards that consolidate multi-bank positions, prompting banks to add predictive cash-flow models, automated investment sweeps, and foreign-exchange hedging within single portals. Treasury fees thus become stickier than spread-dependent loan revenue, reducing earnings volatility. Community banks with assets above USD 3 billion are entering the field using white-label fintech platforms that collapse implementation costs, enlarging the addressable client base for the US commercial banking market.

Large enterprises commanded 62.51% of the US commercial banking market share in 2024, leveraging wide credit facilities, multicurrency treasury centers, and global cash pooling. Their sheer volume stabilizes the US commercial banking market during economic shifts and supplies predictable cross-sell revenue across custody, FX, and derivatives. Yet these clients increasingly self-fund routine working capital and tap capital markets directly, pressuring banks to focus on bespoke advisory and structured solutions that embed added value.

Small and medium enterprises are set to expand at a 7.23% CAGR through 2030, rapidly adopting digital onboarding, AI-driven underwriting, and low-touch working-capital lines. Cost-efficient technology allows banks to adjudicate credit in minutes, winning share from alternative lenders that once served the segment. Improved digital satisfaction has 95% of interactions occurring through mobile or web, although complex matters still trigger in-person consultations, reinforcing the hybrid ethos of the US commercial banking market. Banks that master scalable SME underwriting not only unlock growth but also diversify loan books traditionally concentrated in large corporate exposures.

The US Commercial Banking Market Report is Segmented by Product (Commercial Lending, Treasury Management, Syndicated Loans, Capital Markets, and Other Products), by Client Size (Large Enterprises, and Small & Medium Enterprises (SME)), by Channel (Online Banking and Offline Banking), and by End-User Industry Vertical (IT & Telecommunication, Manufacturing, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- JPMorgan Chase & Co.

- Bank of America Corp.

- Wells Fargo & Co.

- Citigroup Inc.

- U.S. Bancorp

- PNC Financial Services Group

- Truist Financial Corp.

- Goldman Sachs Group Inc.

- Morgan Stanley

- Capital One Financial Corp.

- Regions Financial Corp.

- M&T Bank Corp.

- Huntington Bancshares Inc.

- Fifth Third Bancorp

- KeyCorp

- Citizens Financial Group Inc.

- Comerica Inc.

- First Citizens BancShares Inc.

- BNY Mellon Corp.

- State Street Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust US GDP and labor-market momentum

- 4.2.2 Accelerating adoption of real-time payments & APIs

- 4.2.3 Federal infrastructure-spending-led loan demand

- 4.2.4 Federal cannabis-banking reform unlocking new fee pools

- 4.2.5 On-shoring-driven middle-market capex financing

- 4.2.6 Tax-credit monetisation (IRA) creating structured-finance niches

- 4.3 Market Restraints

- 4.3.1 Escalating cybersecurity & fraud costs

- 4.3.2 Basel III "End-game" capital tightening

- 4.3.3 Fed climate-stress-test capital allocation limits

- 4.3.4 Embedded-finance disintermediation via ERP ecosystems

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Commercial Lending

- 5.1.2 Treasury Management

- 5.1.3 Syndicated Loans

- 5.1.4 Capital Markets

- 5.1.5 Other Products

- 5.2 By Client Size

- 5.2.1 Large Enterprises

- 5.2.2 Small & Medium Enterprises (SME)

- 5.3 By Channel

- 5.3.1 Online Banking

- 5.3.2 Offline Banking

- 5.4 By End-User Industry Vertical

- 5.4.1 IT & Telecommunication

- 5.4.2 Manufacturing

- 5.4.3 Retail And E-Commerce

- 5.4.4 Public Sector

- 5.4.5 Healthcare And Pharmaceuticals

- 5.4.6 Other Industry Verticals

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 JPMorgan Chase & Co.

- 6.4.2 Bank of America Corp.

- 6.4.3 Wells Fargo & Co.

- 6.4.4 Citigroup Inc.

- 6.4.5 U.S. Bancorp

- 6.4.6 PNC Financial Services Group

- 6.4.7 Truist Financial Corp.

- 6.4.8 Goldman Sachs Group Inc.

- 6.4.9 Morgan Stanley

- 6.4.10 Capital One Financial Corp.

- 6.4.11 Regions Financial Corp.

- 6.4.12 M&T Bank Corp.

- 6.4.13 Huntington Bancshares Inc.

- 6.4.14 Fifth Third Bancorp

- 6.4.15 KeyCorp

- 6.4.16 Citizens Financial Group Inc.

- 6.4.17 Comerica Inc.

- 6.4.18 First Citizens BancShares Inc.

- 6.4.19 BNY Mellon Corp.

- 6.4.20 State Street Corp.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment