PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851059

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851059

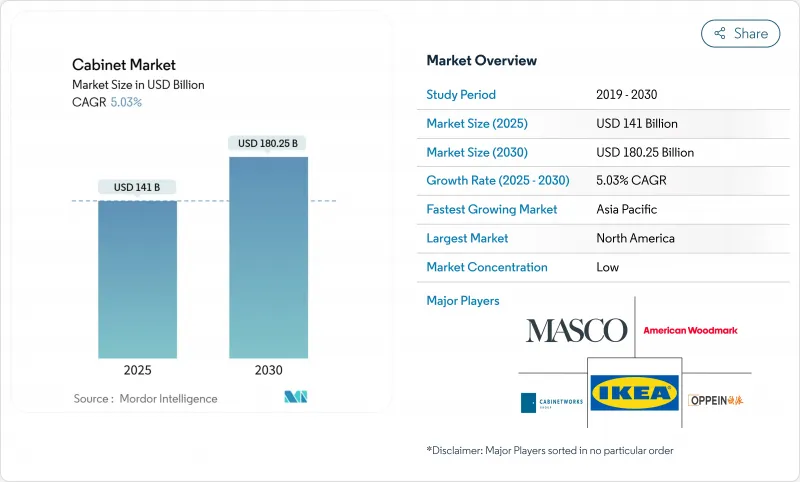

Cabinet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Cabinet Market stands at USD 141.00 billion in 2025 and is projected to reach USD 180.25 billion by 2030, growing at a CAGR of 5.03% during the forecast period.

The cabinet market continues to expand as frameless and modular kitchens influence residential and commercial interiors worldwide. Demand for semi-custom designs remains high because they balance personalization with manageable lead times, while ready-to-assemble (RTA) options attract cost-sensitive buyers and large-scale multifamily projects. Digital visualization tools and augmented-reality apps are accelerating online sales, shrinking the role of traditional showrooms. Regionally, North America benefits from an aging housing stock and a strong renovation culture, whereas Asia-Pacific posts the fastest gains thanks to urbanization and rising disposable incomes. Material choices are also evolving: wood remains dominant, yet metal and hybrid constructions grow as owners seek durability, outdoor suitability, and contemporary aesthetics. Whereas, smart cabinets equipped with IoT features and manufactured through sustainable processes are opening fresh market space and raising consumer expectations. The change is most visible in China, where studies show that perceived innovation and product value strongly shape user satisfaction and loyalty toward interactive cabinets .

Global Cabinet Market Trends and Insights

Rapid Global Adoption of Frameless & Modular Kitchen Designs

Frameless configurations now appear in new urban kitchens in 2025, as homeowners seek clean sightlines and flexible storage. Developers of multifamily units prefer frameless carcasses because they optimize usable space behind the door. European styling influences North American manufacturers, which have re-tooled production lines to meet the wave of slab-front and handle-less door orders. The shift supports premium hardware sales-soft-close hinges and drawer glides are almost standard on mid-price cabinets. Strong acceptance of modular base units also dovetails with the DIY mindset, letting owners add specialized pull-outs or pet-feeding stations without full remodels.

Surge in Multifamily Housing & Renovation Driving Stock & RTA Demand

The multifamily housing sector is creating outsized demand for standardized cabinet solutions, with ready-to-assemble (RTA) and stock cabinets emerging as cost-effective options for developers facing compressed timelines. This renovation wave is further amplified by aging housing stock in established markets, with cabinets typically being replaced every 15-20 years. Developers favor suppliers able to stage cartons by building core, accelerating installation, and reducing on-site waste. As a result, several U.S. fabricators have expanded flat-pack output floors and now market direct-to-site shipping bundles.

Volatile Lumber & Panel Prices Compressing Manufacturer Margins

Tariffs on Canadian softwood lumber stand at 14.5% as of March 2025, and could climb to 39.5%, while particleboard mills report resin cost spikes. Mid-size fabricators with thin working capital shorten price-lock windows to 15 days, irritating contractors who manage multimonth projects. Some brands hedge by purchasing futures or pre-buying veneer flitches when rates dip. Engineered substrates-medium-density fiberboard or plywood with formaldehyde-free resins-offer a partial cushion because their prices move less sharply than solid stock.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating E-commerce Penetration in Bathroom & Kitchen Furniture Categories

- Sustainability Mandates Steering Demand for Certified Wood & Recycled Materials

- Global Shortage of Skilled Joinery Labor Increasing Lead Times

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Semi-custom lines generated the largest share in 2024, capturing 40% of the cabinet market, as they allow size tweaks and door selections without custom shop lead times. RTA units, expanding at 5.8% CAGR, benefit from flat-pack logistics and value positioning. 2025 pricing data underscores the divergence: cabinet market size for RTA orders stood at USD 150 per linear foot, whereas semi-custom averaged USD 350, widening consumer appeal among budget renovators. Custom cabinetry, at USD 700 per foot, retains prestige appeal but loses ground where skilled craft labor is scarce. From Europe to North America, frameless construction permeates each tier, signaling a long-term structural shift toward simpler box manufacturing and clip-in hardware solutions.

Semi-custom producers add digital ordering portals that lock component codes, lowering mistakes and speeding plant scheduling. RTA specialists partner with e-commerce marketplaces to supply home-improvement influencers who publish assembly tutorials. The cabinet industry's increasingly bimodal nature-premium bespoke versus mass flat-pack-pressures stock lines to sharpen differentiation through guaranteed on-hand inventories and tight relationships with regional dealers.

Kitchens still account for 65% of the cabinet market size in 2024, reflecting their higher average linear footage and central role in property valuation. Open-concept living pushes islands and tall pantries into sightlines, encouraging upgrades to concealed-hinge frameless doors and anti-slam drawer boxes. Bathroom cabinetry advances at a faster 5.5% CAGR as households add en-suite and powder rooms, each demanding vanity storage and mirror cabinets. Designers now align bath finishes with adjacent bedroom wardrobes for visual continuity, elevating order values.

Laundry rooms and mudrooms, falling under "other applications," gain attention in suburban houses where dedicated drop-zones support remote-work lifestyles. Garage organizers employ powder-coated steel to address temperature swings and heavy-duty usage. This cross-room harmonization drives whole-home packages, letting suppliers bundle kitchens, baths, and ancillary rooms under single purchase agreements, smoothing production schedules.

The Cabinet Market is Segmented by Type (RTA Kitchen Cabinets, Pre-Assembled, Semi-Custom Cabinets, and More), Application (Kitchen Cabinets, Bathroom Cabinets, and More), Material (Wood, Metal, and More), End User (Residential, and Commercial), Distribution Channel (Online, and Offline), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 35% of global revenue in 2024, anchored by a sizeable stock of aging kitchens and baths. The cabinet market responds to brisk remodeling despite 2025 mortgage rates holding near recent highs. Tariff uncertainty and lumber volatility add cost noise, yet U.S. consumers still prioritize kitchen updates because real-estate agents highlight them during listing pitches. Canadian softwood tariffs of 14.5% continue to influence mill shipments and contract negotiations. Skilled-labor shortages remain acute; more than half of firms report difficulty recruiting experienced installers. Factory automation investments accelerate, and colleges expand woodworking certificate programs to address the gap.

Asia-Pacific delivers the fastest regional CAGR at 6.1% through 2030. Rising urban incomes in China, India, and Southeast Asian economies lift discretionary spending on home interiors. In China, mass-produced smart cabinets with embedded lighting and voice-controlled lifts earn positive satisfaction scores, confirming technology's pull on purchase decisions. Domestic brands scale production to serve both export and local e-commerce festivals, benefiting from logistics clusters near coastal ports. Foreign brands partner with local assemblers to skirt import duties and capture design-oriented metropolitan consumers.

Europe retains influence over global styling and sustainability agendas. German and Italian manufacturers drive frameless adoptions and handle-less push-to-open systems. Stringent environmental rules encourage bio-based finishes and recycled board cores, supporting high-value exports to markets that trust EU certifications. Refurbishment of housing from the 1970s onward fuels replacement sales in France and the United Kingdom, while demographic stagnation tempers new-build volumes. Eastern Europe offers cost-competitive panel production that feeds Western Europe's premium assembly plants.

The Middle East and Africa register steady gains as oil-rich Gulf states commission luxury villas with outdoor kitchens and walk-in wardrobes. South America, led by Brazil, sees cabinet demand linked to political stability and construction financing availability; import barriers spur local laminate board production.

- IKEA

- Masco Corporation

- American Woodmark Corporation

- Cabinetworks Group

- Oppein Home Group Inc.

- Hanssem Co., Ltd.

- MasterBrand Inc.

- Nobilia Holding GmbH

- Nobia AB

- Howdens Joinery Group PLC

- Hacker Kuchen GmbH

- Leicht Kuchen AG

- Porcelanosa Group

- Poggenpohl Mobelwerke GmbH

- GoldenHome Cabinets

- Wellborn Cabinet Inc.

- Fabuwood Cabinetry Corp.

- Crystal Cabinet Works, Inc.

- Wood-Mode LLC USA

- Schrock Cabinetry

- CliqStudios

- J&K Cabinetry

- Merillat Cabinetry

- JPD Kitchen Depot

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Global Adoption of Frameless & Modular Kitchen Designs

- 4.2.2 Surge in Multifamily Housing & Renovation Driving Stock & RTA Cabinet Demand Worldwide

- 4.2.3 Accelerating E-commerce Penetration in Bathroom & Kitchen Furniture Categories

- 4.2.4 Hospitality & Outdoor Living Trends Elevating Demand for Weather-Resistant Outdoor Cabinets

- 4.2.5 Sustainability Mandates Steering Demand for Certified Wood & Recycled Materials in Cabinetry

- 4.3 Market Restraints

- 4.3.1 Volatile Lumber & Panel Prices Compressing Manufacturer Margins

- 4.3.2 Global Shortage of Skilled Joinery Labor Increasing Lead Times for Custom Cabinets

- 4.3.3 Trade Tariffs & Anti-Dumping Actions Creating Supply Chain Uncertainty for RTA Imports

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Ready-to-Assemble (RTA) Kitchen Cabinets

- 5.1.2 Pre-Assembled/Stock Cabinets

- 5.1.3 Semi-Custom Cabinets

- 5.1.4 Custom Cabinets

- 5.2 By Application

- 5.2.1 Kitchen Cabinets

- 5.2.2 Bathroom Cabinets

- 5.2.3 Other Applications

- 5.3 By Material

- 5.3.1 Wood

- 5.3.2 Metal

- 5.3.3 Other Raw Materials

- 5.4 By End User

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.5 By Distribution Channel

- 5.5.1 Online

- 5.5.2 Offline

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 Canada

- 5.6.1.2 United States

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Peru

- 5.6.2.3 Chile

- 5.6.2.4 Argentina

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 India

- 5.6.4.2 China

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 South Korea

- 5.6.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East And Africa

- 5.6.5.1 United Arab of Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East And Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 IKEA

- 6.4.2 Masco Corporation

- 6.4.3 American Woodmark Corporation

- 6.4.4 Cabinetworks Group

- 6.4.5 Oppein Home Group Inc.

- 6.4.6 Hanssem Co., Ltd.

- 6.4.7 MasterBrand Inc.

- 6.4.8 Nobilia Holding GmbH

- 6.4.9 Nobia AB

- 6.4.10 Howdens Joinery Group PLC

- 6.4.11 Hacker Kuchen GmbH

- 6.4.12 Leicht Kuchen AG

- 6.4.13 Porcelanosa Group

- 6.4.14 Poggenpohl Mobelwerke GmbH

- 6.4.15 GoldenHome Cabinets

- 6.4.16 Wellborn Cabinet Inc.

- 6.4.17 Fabuwood Cabinetry Corp.

- 6.4.18 Crystal Cabinet Works, Inc.

- 6.4.19 Wood-Mode LLC USA

- 6.4.20 Schrock Cabinetry

- 6.4.21 CliqStudios

- 6.4.22 J&K Cabinetry

- 6.4.23 Merillat Cabinetry

- 6.4.24 JPD Kitchen Depot

7 Market Opportunities & Future Outlook

- 7.1 Shift Towards Modern Aesthetics and Functional Designs

- 7.2 Growing Influence of Social Media and Focus on Home Interiors