PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851061

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851061

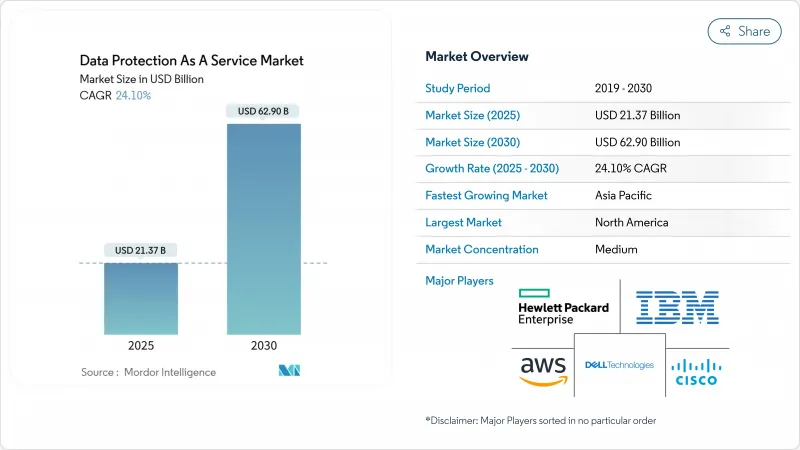

Data Protection As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Data Protection As A Service Market size is estimated at USD 21.37 billion in 2025, and is expected to reach USD 62.90 billion by 2030, at a CAGR of 24.10% during the forecast period (2025-2030).

Growth is propelled by a surge in unstructured data, zero-trust mandates, and rising board-level concern over ransomware exposure. Enterprises are rapidly replacing capital-intensive, on-premises backup hardware with cloud-delivered subscriptions that offer usage-based pricing and elastic scale. Sovereign-cloud investments, quantum-safe encryption pilots, and cyber-insurance requirements are converging to reshape product roadmaps, while vendor consolidation is compressing market structure and accelerating feature integration.

Global Data Protection As A Service Market Trends and Insights

Stringent Data-Sovereignty Regulations Reshape Global Protection

The roll-out of GDPR look-alike frameworks from Brazil to India is forcing firms to localize storage, adopt precise data-mapping, and build policy-based controls that govern cross-border flows. The EU Digital Operational Resilience Act took effect in January 2025, mandating near-real-time incident reporting for financial institutions. In the United States, new rules restrict sensitive data transfers to foreign adversaries, adding complexity for multinationals. As a result, procurement teams now rank sovereignty controls alongside RPO/RTO metrics when selecting DPaaS vendors. Providers are responding with region-specific key management, double-encryption options, and in-region recovery vaults that satisfy both national regulators and internal risk committees.

Edge Computing Revolutionizes Protection Architectures

Edge deployments move processing closer to sensor endpoints and branch locations, allowing workloads to meet latency targets without routing traffic back to centralized data hubs. Forty percent of large enterprises plan to run mission-critical applications at the edge by end-2025; that shift necessitates lightweight, policy-driven backup agents capable of executing locally and synchronizing asynchronously. Emerging offerings embed AI-based anomaly detection at edge gateways, reducing dwell time for ransomware incursions. Healthcare systems are piloting these capabilities in hospital campuses to comply with strict patient-data localization rules while ensuring immediate access for clinicians.

Hidden Cloud Costs Undermine Multi-Cloud Strategies

Variable traffic fees and per-API call pricing can inflate budgets, especially for analytics-heavy or regulatory inquiries that require frequent restores. Enterprises with limited negotiation leverage in smaller cloud regions feel the pinch most acutely. FinOps teams are investing in cost-observability dashboards, yet fragmented billing across storage tiers and hot-cold transitions remains a budgetary hazard.

Other drivers and restraints analyzed in the detailed report include:

- Ransomware Resilience Becomes a Board Priority

- Cloud-Native Recovery Vaults Transform Resilience Economics

- Proprietary Formats Create Vendor Lock-In

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Disaster-Recovery-as-a-Service segment recorded a 29.5% CAGR outlook through 2030, outpacing other offerings as leadership teams elevate ransomware readiness to a strategic metric. More than 70% of enterprises intend to integrate DRaaS with SIEM telemetry by 2026, enabling automated failover based on threat scoring. Continuous data protection streams shrink recovery-point objectives to seconds, appealing to finance and healthcare workloads where data loss equates to compliance fines. Storage-as-a-Service, though still capturing 43.2% of the 2024 data protection as a service market share, is evolving toward intelligent tiering and policy-based immutability that aligns with zero-trust architectures. Converged platforms now bundle BaaS, STaaS, and DRaaS under unified policy engines, easing procurement and governance.

While DRaaS enthusiasm rises, storage subscriptions remain foundational. Object-store growth stays strong due to AI model training sets and video analytics that balloon unstructured data volumes. In response, providers are pushing petabyte-scale deduplication and compression to control the footprint. Full-stack offerings from cloud hyperscalers now integrate autonomous threat scanning, meaning that ransomware reels only the affected blocks rather than entire volumes. Such feature alignment signals a longer-term move toward platform-centric purchasing in which recovery automation, data classification, and compliance mapping exist inside a single control plane.

Hybrid models show the fastest expansion at 31.5% CAGR. Regulators endorse architectures that keep sensitive datasets on local private clouds while allowing burstable analytics in regulated public regions. These patterns are especially evident among European banks subject to the Digital Operational Resilience Act, which mandates documented contingency arrangements for third-party services. Policy automation selects storage targets based on data-classification labels, optimizing both latency and compliance. The data protection as a service market size for hybrid solutions is forecast to double by 2028 as enterprises modernize legacy tape archives into cloud-connected vaults.

Private-cloud deployments retain a 43.7% share, favored by defense, utilities, and healthcare agencies that must assert custody over encryption keys. Vendors supplying private-cloud appliances increasingly embed FIPS-validated HSMs, role-based access, and air-gapped configuration management. Public-cloud approaches remain popular among digital-native firms that value region diversity over full sovereignty. However, sovereign-cloud initiatives, such as the AWS European Sovereign Cloud, blur lines: they deliver public-cloud agility under local legal control, pulling regulated workloads into environments previously deemed off-limits.

Data Protection As A Service Market is Segmented by Service Type (Storage-As-A-Service, Backup-As-A-Service, and Disaster-Recovery-As-A-Service), Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Organization Size (Large Enterprises and Small and Medium-Sized Enterprises), End-User Industry (BFSI, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America preserves a 37.8% revenue share, anchored by robust cloud adoption and federal directives such as CISA Binding Operational Directive 25-01, which compels agencies to apply secure configuration baselines for SaaS. The Protecting Americans' Data from Foreign Adversaries Act restricts cross-border transfers of sensitive personal data, spurring demand for in-country vaults and key escrow. Enterprises prioritize compliance mapping features that generate automated attestation reports for auditors.

Asia-Pacific posts the fastest trajectory at 31.4% CAGR as digital-government programs in Japan, India, and Korea push data-localization rules. The Indian Digital Personal Data Protection Act codifies explicit localization for critical personal information, pressuring cloud providers to launch domestic recovery zones. Hyperscalers partner with domestic telecom carriers to establish sovereign facilities that allow foreign backup services while respecting legal custody constraints. Start-ups in Singapore and Australia roll out DPaaS offerings that combine secure local storage with global failover options, appealing to mid-market exporters balancing trade and compliance.

Europe remains a sophisticated adopter shaped by GDPR, DORA, the Cyber Resilience Act, and the EU Data Act, effective September 2025. National programs such as France's Cloud de Confiance and Germany's Gaia-X channel funding into federated, standards-based infrastructure that prizes transparency and vendor portability. Providers differentiate by offering in-region metadata processing, EU resident-only operations staff, and exportable audit trails. Sovereign options reduce regulatory friction, driving higher attach rates among public-sector entities.

Emerging markets in Latin America, the Middle East, and Africa register rising adoption from smaller bases. Gulf Cooperation Council governments finance sovereign-cloud platforms to diversify economies and lure fintech start-ups. Brazilian banks pilot quantum-safe encryption on cross-border replication links, anticipating future cryptographic requirements. African telcos deploy SaaS backup to protect rapidly expanding mobile money platforms, offsetting limited local data-center capacity.

- IBM Corporation

- Amazon Web Services Inc.

- Hewlett Packard Enterprise Company

- Dell Technologies Inc.

- Cisco Systems Inc.

- Oracle Corporation

- VMware Inc.

- Commvault Systems Inc.

- Veritas Technologies LLC

- Asigra Inc.

- Quantum Corporation

- Quest Software Inc.

- NxtGen Datacenter & Cloud Technologies Pvt Ltd

- Hitachi Vantara LLC

- Acronis International GmbH

- Rubrik Inc.

- Druva Inc.

- Cohesity Inc.

- HYCU Inc.

- Backblaze Inc.

- Wasabi Technologies Inc.

- NetApp Inc.

- Zerto LLC

- N-able Inc.

- Arcserve LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent data-sovereignty regulations (GDPR, CCPA, DORA, etc.)

- 4.2.2 Explosive growth of unstructured data across edge and cloud

- 4.2.3 Board-level focus on ransomware resiliency

- 4.2.4 Cloud-native cyber-recovery vaults tied to cyber-insurance pricing

- 4.2.5 Sovereign-cloud build-outs in Middle-East and APAC hyperscaler

- 4.2.6 Quantum-safe encryption pilots driving refresh of DPaaS contracts

- 4.3 Market Restraints

- 4.3.1 Hidden egress and API costs in multi-cloud storage

- 4.3.2 Vendor lock-in due to proprietary backup formats

- 4.3.3 AI-driven compression reducing backup volumes, delaying upgrades

- 4.3.4 Data-residency clauses in bilateral trade pacts limiting cross-border DRaaS

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 Storage-as-a-Service (STaaS)

- 5.1.2 Backup-as-a-Service (BaaS)

- 5.1.3 Disaster-Recovery-as-a-Service (DRaaS)

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium-sized Enterprises (SMEs)

- 5.4 By End-User Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Government and Defense

- 5.4.4 IT and Telecom

- 5.4.5 Retail and E-commerce

- 5.4.6 Manufacturing

- 5.4.7 Other End-User Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Malaysia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Amazon Web Services Inc.

- 6.4.3 Hewlett Packard Enterprise Company

- 6.4.4 Dell Technologies Inc.

- 6.4.5 Cisco Systems Inc.

- 6.4.6 Oracle Corporation

- 6.4.7 VMware Inc.

- 6.4.8 Commvault Systems Inc.

- 6.4.9 Veritas Technologies LLC

- 6.4.10 Asigra Inc.

- 6.4.11 Quantum Corporation

- 6.4.12 Quest Software Inc.

- 6.4.13 NxtGen Datacenter & Cloud Technologies Pvt Ltd

- 6.4.14 Hitachi Vantara LLC

- 6.4.15 Acronis International GmbH

- 6.4.16 Rubrik Inc.

- 6.4.17 Druva Inc.

- 6.4.18 Cohesity Inc.

- 6.4.19 HYCU Inc.

- 6.4.20 Backblaze Inc.

- 6.4.21 Wasabi Technologies Inc.

- 6.4.22 NetApp Inc.

- 6.4.23 Zerto LLC

- 6.4.24 N-able Inc.

- 6.4.25 Arcserve LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment