PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851062

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851062

The United Kingdom Home Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

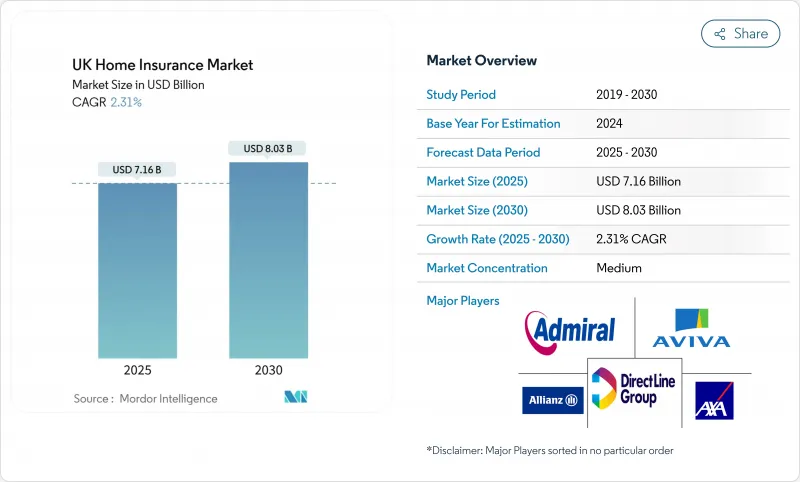

The UK home insurance market is valued at USD 7.16 billion in 2025 and is forecast to reach USD 8.03 billion by 2030, reflecting a 2.31% CAGR over the period.

UK home insurance market is on a steady growth trajectory, buoyed by premium adjustments that offset rising claims costs, climate-induced damages, and construction inflation post-Brexit. England plays a pivotal role in the market's overall performance. Regulatory shifts curbing "price walking" and tech-driven underwriting advancements are stabilizing profit margins. Additionally, the Bank of England's base-rate cut in May 2025 is spurring mortgage approvals, expanding the pool of insured properties. On another front, the rise of smart-home technologies and integrated insurance solutions is paving the way for enhanced risk assessment and distribution, enabling insurers to harness data for greater efficiency and scalability.

The United Kingdom Home Insurance Market Trends and Insights

Climate-Driven Surge in Severe Weather Claims Accelerating Combined-Policy Uptake in Coastal England

More intense storms and floods are reshaping risk appetites across coastal regions. Natural catastrophes generated USD 417 billion of global economic losses in 2024, with insured coverage at only 37%. About 5 million people in England and Wales live in flood-risk zones, and severe events could translate into insured losses that exceed GBP 20 billion. AXA has mapped several East Coast communities facing heightened exposure. As a result, households are migrating to combined policies that provide a single deductible and broader protection. Insurers are refining catastrophe models, layering reinsurance, and lobbying for public-private flood-mitigation schemes that can temper long-run loss ratios.

FCA "GIPP" Pricing-Practice Reform Boosting Customer Switching & Policy Upgrades

The FCA's "GIPP" pricing reform is reshaping the UK home insurance landscape, spurring more customer switches and policy upgrades. The 2022 rules, which prevent renewal prices from surpassing new-business quotes, have effectively eradicated loyalty penalties. This change led to a notable uptick in activity on comparison sites. As a result, average premiums saw an initial rise of over 10% in 2024. However, by year's end, competitive pricing from new entrants tempered these rates. Insurers are now pivoting towards enhanced offerings, like zero-deductible policies and broader home-emergency coverage, to bolster customer retention. While larger carriers have swiftly adapted, smaller intermediaries are still fine-tuning their compliance documentation, fueling a wave of consolidation in the sector.

Claims Inflation from Post-Brexit Building-Material Cost Spikes

Post-Brexit surges in building-material costs are putting a strain on the United Kingdom home insurance market. Key inputs, such as steel and timber, have seen steep price hikes, leading to average claims that outstrip premium adjustments and squeeze insurer profits. Supply chain volatility has been heightened by trade disruptions and import tariffs. Meanwhile, labor shortages-worsened by a decline in EU migration-are extending repair timelines and inflating costs for alternative accommodations. This pressure is felt most acutely in Southeast England, where elevated property values and significant rebuild demands intensify the financial challenges for insurers.

Other drivers and restraints analyzed in the detailed report include:

- Penetration of Smart-Home IoT Devices Enabling Telematics-Style Premium Discounts in London

- Embedded Insurance Partnerships with Digital-Only Banks Capturing First-Time Buyers

- Under-Insurance Gap Widening Amid Volatile Rebuild-Cost Index

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Combined buildings & contents cover generated 70% of written premiums in 2024 and is expanding at a 3.2% CAGR to 2030. The UK home insurance market size for this segment is forecast to surpass USD 5 billion by the end of the period. Uptake is driven by value-seeking homeowners who prefer one renewal date and fewer coverage gaps. Heightened flood events and burglary concerns accelerate migration from standalone products as bundled options often include emergency assistance add-ons.

The building-only line, though smaller, experienced 14.9% premium inflation in 2023 as rebuild indices spiked. Mortgage lenders insist on adequate building sums insured, anchoring demand even during economic slowdowns. Content-only cover remains underpenetrated; 25% of households hold no contents policy, exposing a latent growth pocket for insurers that can package affordable, modular products with low deductibles for renters.

Homeowners hold a 60.1% premium share, benefiting from bank-driven insurance requirements at mortgage origination. The UK home insurance market share for landlords is rising as property investors restructure portfolios post-Section 24 tax changes. These landlords increasingly select enhanced loss-of-rent extensions that protect cash flow during repair-related vacancies.

Tenants represent an untapped revenue pool. Embedded offers at digital-rent platforms and in-app personal-property add-ons are starting to boost penetration. Flexible monthly contracts appeal to house sharers and remote workers who shift residences frequently. Insurers that streamline proof-of-address and payment options stand to win loyalty in this mobile demographic.

The United Kingdom Home Insurance Market is Segmented by Coverage (Building, Content, Combined Building and Content), Customer Type (Homeowner, Tenants and More), Property Type (Detached, Semi-Detached, Terraced, Flat and Apartments), Distribution Channel (Direct, Bancassurance, Brokers, Aggregators and More), and Region (England, Scotland, Wales, Norther Ireland). The Market Forecasts are Provided in Terms of Value (USD)

List of Companies Covered in this Report:

- Aviva plc

- Admiral Group plc

- Direct Line Insurance Group plc

- AXA Insurance UK Ltd

- Allianz Holdings (LV=)

- RSA Insurance Group Ltd (More Than)

- Ageas (UK) Ltd

- Hastings Group Holdings plc

- Zurich Insurance plc

- Hiscox Ltd

- NFU Mutual

- Saga plc

- Covea Insurance plc

- Policy Expert (QMetric Group)

- Tesco Bank Home Insurance (underwritten by Ageas)

- HomeProtect (Avantia Group)

- Urban Jungle Services Ltd

- Endsleigh Insurance Services Ltd

- Churchill Insurance (RBSI)

- Post Office Money Home Insurance (underwritten by Ageas UK)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Climate-Driven Surge in Severe Weather Claims Accelerating Combined-Policy Uptake in Coastal England

- 4.2.2 FCA 'GIPP' Pricing-Practice Reform Boosting Customer Switching & Policy Upgrades

- 4.2.3 Penetration of Smart-Home IoT Devices Enabling Telematics-Style Premium Discounts in London

- 4.2.4 Embedded Insurance Partnerships with Digital-Only Banks Capturing First-Time Buyers

- 4.2.5 Growth in Buy-to-Let Sector as Landlords Seek Loss-of-Rent Cover Post Section-24 Tax Changes

- 4.2.6 Mortgage Lending Rebound Post-BoE Rate Cuts Expanding Buildings-Cover Demand

- 4.3 Market Restraints

- 4.3.1 Claims Inflation from Post-Brexit Building-Material Cost Spikes

- 4.3.2 Under-Insurance Gap Widening Amid Volatile Rebuild-Cost Index

- 4.3.3 Flood-Risk Zoning Exclusions in East Anglia Limiting Cover Availability

- 4.3.4 Aggregator-Driven Price Competition Compressing Underwriting Margins

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook (FCA, PRA, Flood Re)

- 4.6 Technological Outlook (Smart Devices, AI, GEO data)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, GBP mn)

- 5.1 By Coverage

- 5.1.1 Buildings Insurance

- 5.1.2 Contents Insurance

- 5.1.3 Combined Buildings & Contents Insurance

- 5.2 By Customer Type

- 5.2.1 Homeowners

- 5.2.2 Landlords

- 5.2.3 Tenants/Renters

- 5.3 By Property Type

- 5.3.1 Detached Houses

- 5.3.2 Semi-Detached Houses

- 5.3.3 Terraced Houses

- 5.3.4 Flats & Apartments

- 5.4 By Distribution Channel

- 5.4.1 Direct (Insurer Websites & Call-centres)

- 5.4.2 Bancassurance (Banks & Building Societies)

- 5.4.3 Brokers & Independent Advisers

- 5.4.4 Aggregators / Price-Comparison Websites

- 5.4.5 Affinity & Retailer Partnerships

- 5.4.6 Digital-Only / Insurtech Carriers

- 5.5 By Region

- 5.5.1 England

- 5.5.2 Scotland

- 5.5.3 Wales

- 5.5.4 Northern Ireland

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, Embedded-Insurance Deals)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Aviva plc

- 6.4.2 Admiral Group plc

- 6.4.3 Direct Line Insurance Group plc

- 6.4.4 AXA Insurance UK Ltd

- 6.4.5 Allianz Holdings (LV=)

- 6.4.6 RSA Insurance Group Ltd (More Than)

- 6.4.7 Ageas (UK) Ltd

- 6.4.8 Hastings Group Holdings plc

- 6.4.9 Zurich Insurance plc

- 6.4.10 Hiscox Ltd

- 6.4.11 NFU Mutual

- 6.4.12 Saga plc

- 6.4.13 Covea Insurance plc

- 6.4.14 Policy Expert (QMetric Group)

- 6.4.15 Tesco Bank Home Insurance (underwritten by Ageas)

- 6.4.16 HomeProtect (Avantia Group)

- 6.4.17 Urban Jungle Services Ltd

- 6.4.18 Endsleigh Insurance Services Ltd

- 6.4.19 Churchill Insurance (RBSI)

- 6.4.20 Post Office Money Home Insurance (underwritten by Ageas UK)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment