PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851068

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851068

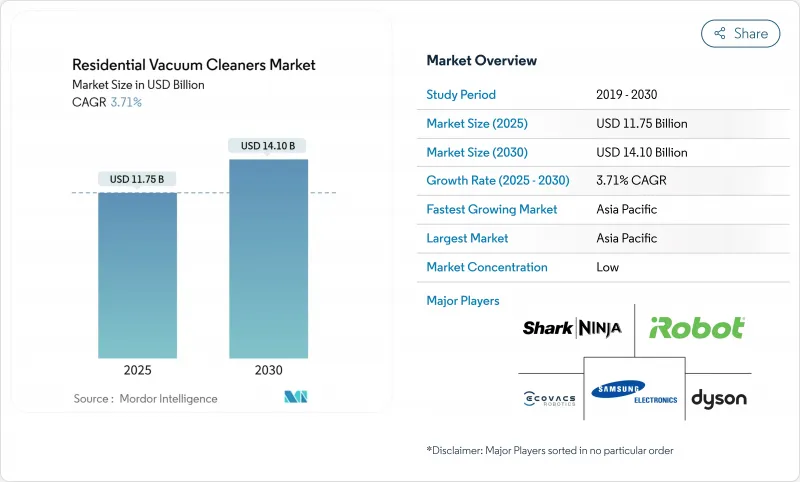

Residential Vacuum Cleaners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The residential vacuum cleaners market is valued at USD 11.75 billion in 2025 and is forecast to reach USD 14.10 billion by 2030, producing a 3.71% CAGR.

This expansion follows three structural shifts. First, smart-home connectivity is redefining product value, letting vacuums act as data-rich nodes within broader IoT ecosystems. Second, battery advances push cordless runtimes toward the 60-minute mark, turning mobility into a primary buying criterion. Third, e-commerce grows faster than any other channel, lowering search costs and inviting digital-native entrants that intensify price transparency. Collectively, these forces accelerate the residential vacuum cleaners market away from commodity suction wars and toward software-driven differentiation, subscription attachments, and ecosystem lock-ins.

Global Residential Vacuum Cleaners Market Trends and Insights

Dual-Income Households Seeking Time-Saving Cleaning Solutions

Two-earner families devote less discretionary time to chores, steering purchasing toward autonomous devices that clean in the owner's absence. Robotic models scheduled via smartphone apps convert idle floor hours into productive cycles, translating convenience into a tangible productivity dividend. Brands highlight low-noise operation, under-bed height compatibility, and remote status alerts to address this segment. Peer-reviewed work in Ecological Economics indicates a modest energy rebound effect, nudging manufacturers to embed eco-modes that limit watt draw while preserving suction. As dual-income penetration rises, repeat purchases of specialised accessories broaden the spend per household within the residential vacuum cleaners market.

Li-ion Battery Energy-Density Gains Reducing Cordless Vacuum Weight

Higher energy density lets designers shrink battery packs without sacrificing suction power, taking weight from 3 kg ranges toward sub-2 kg levels on some stick models. Cycle life improvements-moving from 1,200 to nearly 10,000 charge cycles in emerging chemistries-stretch product lifespans and lower replacement frequency. Samsung's new Bespoke AI Jet Ultra proves the point, packing 400 W of sustained suction into a slim frame that is easy to lift stairs or reach ceiling corners. A high-efficiency motor, optimized airflow path, and lighter lithium battery let the unit outclean many corded uprights while still weighing little more than a small carry-on bag. Add AI-powered floor detection that automatically adjusts power, and the appliance delivers deep-carpet performance without draining the battery on hardwood. For busy households seeking one device that can tackle daily crumbs and weekend deep cleans alike, this blend of power and portability sets a fresh benchmark in the cordless category. As hardware differentials narrow, software-driven user experience and intuitive interfaces rise on the buying criteria list. Weight reductions also enable multipoint cleaning-stairs, cars, upholstery-supporting one-product-for-all claims that reposition cordless units as primary rather than secondary vacuums. Supply-chain access to new battery formats therefore becomes a strategic sourcing priority for OEMs.

High Battery-Pack Replacement Cost Hindering Lifetime Value

The substantial cost of battery replacement is emerging as a critical barrier to long-term customer satisfaction in the cordless vacuum segment, with replacement packs often representing 30-40% of the original purchase price. This cost structure creates a strategic dilemma for manufacturers: designing for easy battery replacement improves customer lifetime value but potentially reduces replacement unit sales. Forward-thinking brands are responding with innovative business models, including battery subscription services and trade-in programs that reduce upfront costs while creating recurring revenue streams-approaches that may reshape industry economics if widely adopted.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Global E-commerce Fueling Direct-to-Consumer Brands

- Smart-Home IoT Integration Upselling Connected Vacuums

- Macroeconomic Uncertainty Shifting Demand to Manual Cleaning Tools

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The upright segment accounted for a 55% residential vacuum cleaners market share in 2024, reflecting strong suction performance and brand familiarity. Yet the robotic category is advancing at a 5.7% CAGR, riding innovations such as foldable mechanical arms that lift light obstacles before vacuuming and bionic legs that elevate the unit for rug transition. The residential vacuum cleaners market size for robotic units is therefore on track to close the gap with uprights by the end of the decade. Canisters still serve multi-floor dwellings where hose reach complements compact storage, while central systems retain a niche among luxury new-builds where installation costs fold into the construction budget.

Wet-and-dry hybrids gain notice in households with mixed hard-floor and carpet layouts, likely increasing the number of appliances per home. Drum vacuums keep relevance in garages and workshops, driven by high debris volumes rather than daily floor dust. Continuous feature spill-over between categories blurs boundaries: detachable mop plates, heated water jets, or mechanical arms now appear in segments once seen as distinct. Brands that manage portfolio complexity without overstretching R&D budgets strengthen competitive positions inside the residential vacuum cleaners market.

Corded models secured a 55% share in 2024 as they suit deep-clean sessions where run-time limitations are unacceptable. The residential vacuum cleaners market size for cordless units grows faster, supported by lighter batteries offering up to 60 minutes on standard power and quick-swap packs for larger homes. Quick spill pick-up needs drive many households to own both formats, lifting overall device density per dwelling. First-generation stick vacuums suffered suction fade as batteries depleted; the latest generation counters this with regulated power output that stays constant until depletion.

Manufacturers articulate differentiation by aligning specifications with task frequency: cordless for mid-week touch-ups, corded for weekend thorough cleaning. Accessories such as wall docks and car-detail kits reinforce separate use cases, letting brands cross-sell add-on revenue. Cost pressures remain as users compare cordless price tags that sometimes exceed corded flagships despite shorter product life cycles. Firms that close the durability gap will accelerate cordless uptake and cement loyalty within the residential vacuum cleaners market.

The Vacuum Cleaners Market is Segmented by Product Type (Upright, Canister, Central, Drum, Wet/Dry, and More), by Cord Type (Corded, and Cordless), by Power Source (Battery Powered, and Electric), by Distribution Channel (Multi-Brand Stores, Exclusive Brand Outlets, and More), by Geography (North America, South America, Europe, Asia-Pacific, and the Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with a 46% share in 2024 and is projected to post a 5.2% CAGR to 2030, driven by urbanization and income growth. China provides a global manufacturing scale and a large domestic base, allowing local brands to iterate models rapidly and push aggressive price-performance ratios.

North America ranks second in revenue, characterized by demand for premium features such as HEPA filtration and smartphone control. Home sizes in the region favor high-capacity uprights and advanced robots capable of whole-level mapping. Europe follows closely, with strong policy emphasis on energy efficiency and recyclability shaping product requirements; the United Kingdom stands out for high cordless adoption and rising attachment rate of pet-hair tools.

South America and the Middle East & Africa contribute smaller but rising shares, each influenced by regional conditions. Brazil benefits from rapid urban housing growth and dual-income households that value time-saving tools. In the Gulf states, high disposable incomes and dust-prone environments spur demand for enhanced filtration and automated filter-cleaning cycles. Manufacturers that tailor filters to fine dust and design motors tolerant of high ambient temperatures can gain share.

- Dyson Ltd.

- iRobot Corporation

- Ecovacs Robotics Co., Ltd.

- SharkNinja (JS Global Lifestyle Co., Ltd.)

- TTI Floor Care North America

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Miele & Cie. KG

- BSH Hausgerate GmbH

- Electrolux AB

- BISSELL Homecare, Inc.

- Panasonic Holdings Corporation

- Koninklijke Philips N.V. (Versuni)

- Haier Group

- Neato Robotics Inc.

- Roborock Technology Co., Ltd.

- Xiaomi Corporation

- Groupe SEB (Rowenta)

- Vorwerk & Co. KG:

- ILIFE Innovation Ltd.

- Proscenic Technology Co., Ltd.

- Puppyoo Cleaning Appliances

- Tineco Intelligent Technology Co., Ltd.

- Eureka Forbes Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Dual-Income Households Seeking Time-Saving Cleaning Solutions

- 4.2.2 Li-ion Battery Energy-Density Gains Reducing Cordless Vacuum Weight

- 4.2.3 Expansion of Global E-commerce Fueling Direct-to-Consumer Brands

- 4.2.4 Smart-Home IoT Integration Upselling Connected Vacuums

- 4.2.5 Rising Awareness of Indoor Air Quality Driving HEPA-Equipped Sales

- 4.3 Market Restraints

- 4.3.1 High Battery-Pack Replacement Cost Hindering Lifetime Value

- 4.3.2 Macroeconomic Uncertainty Shifting Demand to Manual Cleaning Tools

- 4.3.3 Stricter E-waste Rules Elevating Compliance Costs for OEMs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Upright

- 5.1.2 Canister

- 5.1.3 Central

- 5.1.4 Drum

- 5.1.5 Wet and Dry

- 5.1.6 Robotic

- 5.2 By Cord Type

- 5.2.1 Corded

- 5.2.2 Cordless

- 5.3 By Power Source

- 5.3.1 Battery Powered

- 5.3.2 Electric

- 5.4 By Distribution Channel

- 5.4.1 Multi-brand Stores

- 5.4.2 Exclusive Brand Outlets

- 5.4.3 Online

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 Canada

- 5.5.1.2 United States

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Aisa Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.5.4.7 Rest of Asia Pacific

- 5.5.5 Middle East And Africa

- 5.5.5.1 United Arab of Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East And Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Dyson Ltd.

- 6.4.2 iRobot Corporation

- 6.4.3 Ecovacs Robotics Co., Ltd.

- 6.4.4 SharkNinja (JS Global Lifestyle Co., Ltd.)

- 6.4.5 TTI Floor Care North America

- 6.4.6 Samsung Electronics Co., Ltd.

- 6.4.7 LG Electronics Inc.

- 6.4.8 Miele & Cie. KG

- 6.4.9 BSH Hausgerate GmbH

- 6.4.10 Electrolux AB

- 6.4.11 BISSELL Homecare, Inc.

- 6.4.12 Panasonic Holdings Corporation

- 6.4.13 Koninklijke Philips N.V. (Versuni)

- 6.4.14 Haier Group

- 6.4.15 Neato Robotics Inc.

- 6.4.16 Roborock Technology Co., Ltd.

- 6.4.17 Xiaomi Corporation

- 6.4.18 Groupe SEB (Rowenta)

- 6.4.19 Vorwerk & Co. KG:

- 6.4.20 ILIFE Innovation Ltd.

- 6.4.21 Proscenic Technology Co., Ltd.

- 6.4.22 Puppyoo Cleaning Appliances

- 6.4.23 Tineco Intelligent Technology Co., Ltd.

- 6.4.24 Eureka Forbes Limited

7 Market Opportunities & Future Outlook

- 7.1 AI & SLAM Navigation Accelerating Robotic Vacuum Adoption