PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851077

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851077

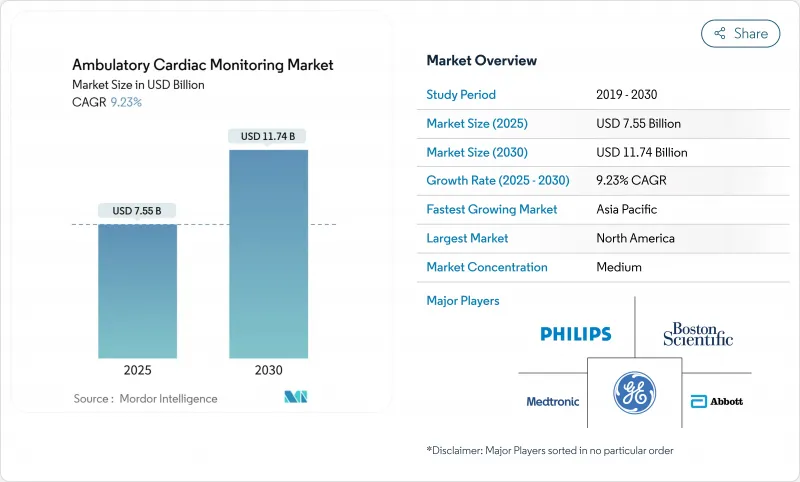

Ambulatory Cardiac Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ambulatory cardiac monitoring devices market size reached USD 7.55 billion in 2025 and is on track to attain USD 11.74 billion by 2030, reflecting a 9.23% CAGR.

Advances in artificial-intelligence diagnostics, the worldwide shift toward preventive care, and expanding reimbursement pathways are reinforcing this growth. Continuous monitoring is replacing episodic checks, while 5G connectivity and edge analytics bring real-time electrocardiogram (ECG) insights to clinicians. Asia-Pacific delivers the fastest regional pace, propelled by Japan's early adoption of AI-enabled monitors and India's expanding digital health ecosystem. Device miniaturization, home-care adoption, and hybrid consumer-clinical platforms continue to widen the ambulatory cardiac monitoring devices market opportunity.

Global Ambulatory Cardiac Monitoring Market Trends and Insights

Rising CVD & Arrhythmia Prevalence

Atrial fibrillation already drives 59.73% of monitoring use cases, and more than 33 million people live with the disorder worldwide. Aging populations and lifestyle risks intensify demand for long-term surveillance. Abbott's CE-marked Assert-IQ insertable monitor, offering six-year battery life, illustrates device responses to this epidemiologic pressure. Continuous data streams underpin the 9.23% CAGR as care models migrate from reactive treatment to proactive detection.

Miniaturization & AI-enabled Devices

Clinical-grade accuracy now fits in patch-based wearables, while machine-learning models interpret rhythms in real time. Medtronic's AI initiative for heart-disease prediction exemplifies this pivot from rhythm capture to risk forecasting. Embedded analytics also cut false positives that fuel alert fatigue among clinicians, lifting both provider confidence and patient adherence.

Implant/Patch-related Infection & Skin Issues

Contact dermatitis linked to methacrylate-based adhesives remains a well-documented barrier. FDA adverse-event files list pruritus, burning, and allergic responses for multiple wearables. Hypoallergenic polymers are under development, yet patients in humid climates or with sensitive skin still face limited wearing time.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Remote Patient Monitoring Models

- Integration with Consumer Wearables & Cloud ECG APIs

- Price-sensitive Procurement & Reimbursement Gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

ECG devices held 37.64% of ambulatory cardiac monitoring devices market share in 2024, underpinning diagnostic workflows across care settings. Mobile cardiac telemetry, though smaller today, is accelerating at 11.02% CAGR. The ambulatory cardiac monitoring devices market size for ECG remains buoyant as AI firmware lifts diagnostic yield, while implantable loop recorders extend surveillance windows to six years. A technology migration toward patch-free sensors signals future disruption but has yet to displace ECG's volume leadership. Continuous algorithm updates embedded in hardware differentiate vendors and mitigate clinician alert fatigue.

Meanwhile, mobile telemetry combines real-time transmission and cloud analytics, allowing automatic alerting for high-risk events. This immediacy aligns with hospital at-home models that depend on rapid clinical escalation pathways. Suppliers bundling telemetry hardware with interpretation services widen margins and reduce provider onboarding friction, sustaining segment growth.

OEM-linked platforms delivered 38.29% share of the ambulatory cardiac monitoring devices market size in 2024, reflecting integrated device-plus-service offerings. Independent Diagnostic Testing Facilities chart a 9.97% CAGR by providing cost-efficient interpretations, scalable staffing, and turnkey reimbursement expertise. Hospitals, while still major users, increasingly outsource to specialized providers to curb capital outlays.

Consolidation is reshaping this arena. PaceMate's pickup of Medtronic's Paceart Optima workflow tech reinforces IDTF capabilities and positions the firm as a one-stop data-management vendor. As reimbursement clarity strengthens, new IDTF entrants will likely focus on sub-specialty niches such as pediatric arrhythmia monitoring or heart-failure prognostics, elevating competitive differentiation.

The Report Covers Global Wearable Ambulatory Monitoring Devices Market Analysis and Companies. The Market is Segmented by Device Type (ECG Monitors, Event Recorders, Implantable Cardiac Loop Recorders, Mobile Cardiac Telemetry, and Other Devices) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Value is Provided in (USD Million) for the Above Segments.

Geography Analysis

North America commanded 43.38% of ambulatory cardiac monitoring devices market revenue in 2024, supported by established reimbursement and FDA's progressive digital-health framework. Early adoption of cloud-based analytics and 5G-enabled telemetry streamlines clinical workflows and secures payer confidence. Canada's publicly funded model similarly finances long-term monitoring for high-risk patients, and Mexico's modernization programs are expanding ECG infrastructure across specialty clinics.

Asia-Pacific is projected to record a 10.24% CAGR, the most rapid worldwide. Japan's 7.29% growth in digital health, paired with approval of iRhythm's AI monitor, positions it as a regional pioneer. India's health-tech market aims for USD 25 billion valuation by 2025, and OMRON's focus on combined blood-pressure and ECG devices targets a hypertensive population exceeding 220 million. China and South Korea utilize robust electronics manufacturing ecosystems and state incentives to accelerate domestic device output.

Europe maintains a stable 9.18% CAGR. GDPR mandates stricter cyber-security controls, increasing development costs but enhancing patient trust. Germany, France, and the United Kingdom integrate ambulatory ECG into primary-care pathways, while the European Society of Cardiology validated 5G-enabled remote diagnostics in 2024, underscoring commitment to telecardiology. Middle East & Africa, at 9.83% CAGR, show rising investments in cardiac centers of excellence amid growing cardiovascular disease burdens.

- Abbott Laboratories

- AliveCor

- Asahi Kasei Group

- Bardy Diagnostics Inc.

- Baxter

- BIOTRONIK

- Bittium Corporation

- Boston Scientific

- Cardiac Insight Inc.

- G Medical Innovations Holdings Ltd

- GE Healthcare

- iRhythm Technologies

- Koninklijke Philips

- Medicomp

- Medtronic

- MicroPort

- Nihon Kohden

- OSI Systems, Inc.

- Schiller

- VivaLNK Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising CVD & arrhythmia prevalence

- 4.2.2 Miniaturization & AI-enabled devices

- 4.2.3 Growth of remote patient monitoring models

- 4.2.4 Integration with consumer wearables & cloud ECG APIs

- 4.2.5 Expansion of IDTF reimbursement in key markets

- 4.2.6 Proliferation of 5G and edge-computing gateways enabling near-real-time ECG analytics

- 4.3 Market Restraints

- 4.3.1 Implant/patch-related infection & skin issues

- 4.3.2 Price-sensitive procurement & reimbursement gaps

- 4.3.3 Clinician alert fatigue from data overload

- 4.3.4 Cyber-security & patient-data privacy risks

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value/Volume)

- 5.1 By Device Type

- 5.1.1 ECG Devices

- 5.1.2 Event Recorders

- 5.1.3 Implantable Cardiac Loop Recorders

- 5.1.4 Mobile Cardiac Telemetry

- 5.1.5 Others

- 5.2 By Service Provider

- 5.2.1 Independent Diagnostic Testing Facilities (IDTFs)

- 5.2.2 OEM Remote Monitoring Services

- 5.2.3 Hospital-based Monitoring Services

- 5.3 By Indication

- 5.3.1 Atrial Fibrillation

- 5.3.2 Unexplained Syncope

- 5.3.3 Other Arrhythmias

- 5.4 By Connectivity

- 5.4.1 Wired Devices

- 5.4.2 Wireless Devices

- 5.5 By End-User

- 5.5.1 Hospitals

- 5.5.2 Ambulatory Surgical Centers

- 5.5.3 Homecare Settings

- 5.5.4 Other End-Users

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Abbott Laboratories

- 6.4.2 AliveCor Inc.

- 6.4.3 Asahi Kasei Group

- 6.4.4 Bardy Diagnostics Inc.

- 6.4.5 Baxter International Inc.

- 6.4.6 Biotronik SE & Co. KG

- 6.4.7 Bittium Corporation

- 6.4.8 Boston Scientific Corporation

- 6.4.9 Cardiac Insight Inc.

- 6.4.10 G Medical Innovations Holdings Ltd

- 6.4.11 GE HealthCare

- 6.4.12 iRhythm Technologies Inc.

- 6.4.13 Koninklijke Philips N.V.

- 6.4.14 Medicomp Inc.

- 6.4.15 Medtronic plc

- 6.4.16 MicroPort Scientific Corporation

- 6.4.17 Nihon Kohden Corporation

- 6.4.18 OSI Systems, Inc.

- 6.4.19 Schiller AG

- 6.4.20 VivaLNK Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment