PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851098

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851098

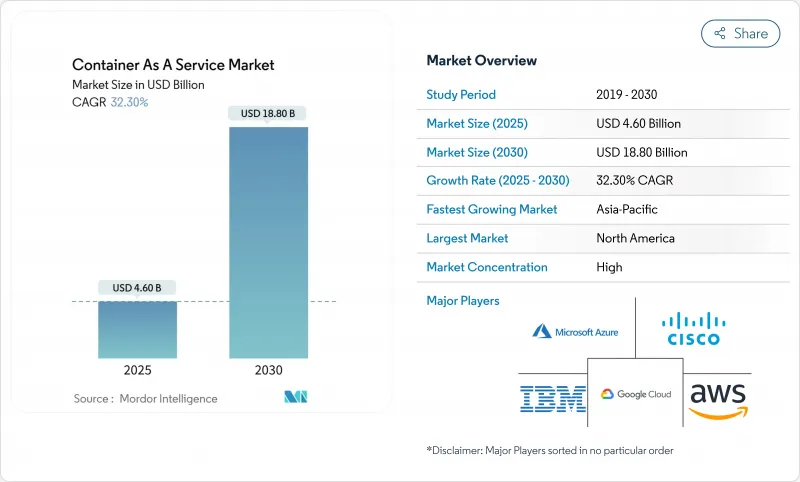

Container As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Container-as-a-Service market size stands at USD 4.6 billion in 2025 and is forecast to reach USD 18.8 billion by 2030, expanding at a 32.3% CAGR.

Strong demand for cloud-native agility, rising multi-cloud strategies and granular resource allocation are reshaping enterprise infrastructure decisions. Sovereign-cloud directives in Asia-Pacific and Europe, together with mandatory software bill of materials (SBOM) rules, are widening adoption beyond classic lift-and-shift migrations. Cloud deployment still represents 78% of revenue, but on-premise deployment is accelerating at a 34% CAGR as regulated industries embrace hybrid models. Managed services, which hold 54% share, are taking on security scanning and compliance automation tasks once handled internally. Small and medium enterprises now form the fastest-growing customer group, reflecting the appeal of pay-per-use billing and low entry costs. Manufacturing is the leading growth vertical, leveraging lightweight orchestration to operate AI-enabled edge workloads that support Industry 4.0 initiatives.

Global Container As A Service Market Trends and Insights

Cloud-agnostic Kubernetes Platforms Avert Lock-in

Enterprises increasingly deploy cloud-agnostic orchestration to avoid vendor dependency and negotiate favorable pricing. Platforms that run identical clusters across providers simplify workload portability and reduce migration downtime by 77% in stateful microservices tests. Vendors such as HPE integrate virtual machines and containers within one control plane, strengthening hybrid strategies.

Pay-per-use Transparency Grows SME Adoption

Consumption pricing eliminates capital expenditure barriers for smaller firms. AWS Fargate and EKS cost-visibility tools help SMEs deploy production clusters without dedicated DevOps teams. Automated rightsizing and spot-instance use further align expenses with fluctuating traffic, supporting the 36.7% CAGR recorded for SMEs.

Shortage of Certified K8s Operators

The talent gap delays deployments and raises operating risk. Enterprises in emerging markets often rely on costly consultants, lengthening project timelines. Training pipelines have yet to match demand for service-mesh, GitOps and edge cluster skills.

Other drivers and restraints analyzed in the detailed report include:

- DevSecOps SBOM Mandates Accelerate Managed CaaS

- AI/ML GPU-ready Clusters Surge

- Kernel-level Escape and eBPF Attack Vectors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise clusters are forecast to grow at a 34% CAGR even though cloud maintains dominant share. This reflects compliance needs, local-processing latency advantages and a desire to modernize existing hardware rather than relocate every workload. HPE GreenLake offers consumption-based private-cloud pricing that mirrors public-cloud economics, demonstrating how suppliers adapt to hybrid demand.

Organizations usually run development and bursting workloads in the cloud while retaining latency-sensitive or regulated applications on-site. The Container-as-a-Service market supports seamless workload migration through unified control planes, allowing teams to shift containers in response to performance or sovereignty requirements. As hybrid maturity rises, placement decisions hinge on measurable cost and compliance variables rather than a default cloud-first stance.

Managed offerings hold 54% share and are expanding at 34.5% CAGR as enterprises offload day-two operations. Providers integrate AI-driven resource tuning and automated patching, ensuring uptime while lowering internal headcount needs. T-Mobile adopted a managed Red Hat OpenShift stack for telco cloud functions, validating the approach for mission-critical 5G workloads.

Professional services remain essential for migrations and complex integrations, but revenue is episodic. Over time, recurring managed contracts outpace project work. The Container-as-a-Service market reflects this shift as new features-SBOM automation, supply-chain security and FinOps dashboards-are bundled into subscription tiers that deliver measurable outcomes.

Containers As A Service Market Report Segments the Industry Into by Deployment (On-Premise, Cloud), by Service Type (Professional Services, Managed Services), Enterprise Size (Small and Medium Enterprises, Large Enterprises), End-User Application (BFSI, Retail, IT & Telecommunications, Manufacturing, Other End-User Applications), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America earns 38.5% of 2024 revenue, benefitting from established hyperscale ecosystems and aggressive enterprise modernization. Major providers posted double-digit cloud revenue growth in 2025, reinforcing regional dominance. Skills shortages in Kubernetes operations, however, are creating a drag that fuels demand for managed services.

Asia-Pacific is forecast to grow at 39.4% CAGR, the fastest worldwide, due to sovereign-cloud rules and state-funded AI infrastructure. India allocated USD 1.3 billion for compute capacity, including 10,000 GPUs earmarked for public-private AI clusters. China's ecosystem, led by Alibaba Cloud, Tencent Cloud and Huawei Cloud, is expanding hybrid-cloud deployments, with Huawei Cloud Stack reporting 106% revenue growth in emerging Asia-Pacific markets.

Europe faces distinctive dynamics under the EU Data Act, effective September 2025, which mandates cloud portability and removes switching fees by 2027. Providers with genuinely cloud-agnostic architectures appear better positioned, while sovereignty clauses are likely to spur regional CaaS platforms. Germany, France and the United Kingdom lead adoption, but regulatory complexity could slow purchase cycles until certification schemes settle.

- Amazon Web Services

- Microsoft Azure

- Google Cloud (GKE)

- IBM Corp (Red Hat OpenShift)

- Alibaba Cloud

- VMware Tanzu

- Cisco Systems

- SUSE Rancher

- Oracle Container Engine

- Hewlett Packard Enterprise (Ezmeral)

- Mirantis

- D2iQ

- Platform9 Systems

- Akamai (Linode)

- DigitalOcean

- Rackspace Technology

- Nutanix

- Canonical

- HashiCorp

- Huawei Cloud

- Tencent Cloud

- OVHCloud

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-agnostic Kubernetes platforms avert lock-in

- 4.2.2 Pay-per-use transparency grows SME adoption

- 4.2.3 DevSecOps SBOM mandates accelerate managed CaaS

- 4.2.4 AI/ML GPU-ready clusters surge

- 4.2.5 5G edge micro-DC roll-outs need lightweight CaaS

- 4.2.6 Sovereign-cloud mandates spur domestic CaaS

- 4.3 Market Restraints

- 4.3.1 Shortage of certified K8s operators

- 4.3.2 Kernel-level escape and eBPF attack vectors

- 4.3.3 Unpredictable cloud egress fees

- 4.3.4 Fragmented observability licensing costs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-Premise

- 5.2 By Service Type

- 5.2.1 Managed Services

- 5.2.2 Professional Services

- 5.3 By Enterprise Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Application

- 5.4.1 BFSI

- 5.4.2 Retail

- 5.4.3 IT and Telecommunications

- 5.4.4 Manufacturing

- 5.4.5 Healthcare

- 5.4.6 Government

- 5.4.7 Others (Media, Gaming, EdTech)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Israel

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Turkey

- 5.5.5.5 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Nigeria

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services

- 6.4.2 Microsoft Azure

- 6.4.3 Google Cloud (GKE)

- 6.4.4 IBM Corp (Red Hat OpenShift)

- 6.4.5 Alibaba Cloud

- 6.4.6 VMware Tanzu

- 6.4.7 Cisco Systems

- 6.4.8 SUSE Rancher

- 6.4.9 Oracle Container Engine

- 6.4.10 Hewlett Packard Enterprise (Ezmeral)

- 6.4.11 Mirantis

- 6.4.12 D2iQ

- 6.4.13 Platform9 Systems

- 6.4.14 Akamai (Linode)

- 6.4.15 DigitalOcean

- 6.4.16 Rackspace Technology

- 6.4.17 Nutanix

- 6.4.18 Canonical

- 6.4.19 HashiCorp

- 6.4.20 Huawei Cloud

- 6.4.21 Tencent Cloud

- 6.4.22 OVHCloud

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment