PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851099

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851099

5G In Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

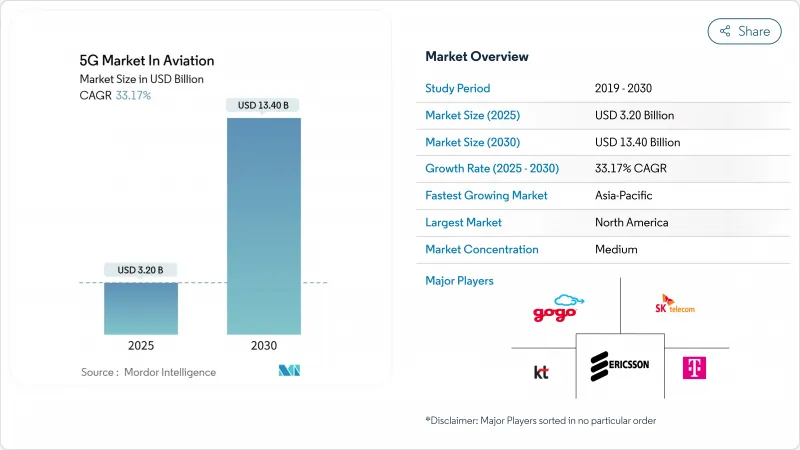

The 5G Market In Aviation Industry is expected to grow from USD 3.20 billion in 2025 to USD 13.40 billion by 2030, at a CAGR of 33.17% during the forecast period (2025-2030).

The 5G aviation market size stood at USD 3.2 billion in 2025 and is forecast to reach USD 13.4 billion by 2030, reflecting a 33.17% CAGR. This rapid climb underscores how 5G is reshaping every layer of aviation, from passenger connectivity and predictive maintenance to data-driven air-traffic management. Rising travellers expectations for seamless inflight broadband, airport digitization programs, and the need for real-time analytics across aircraft and ground assets are converging to propel adoption. A growing backlog of connected-aircraft retrofits, expanding drone corridors, and the promise of latency cuts for safety-critical links add further momentum to the 5G aviation market. North America currently anchors deployment on the strength of mature telecom rollouts and supportive regulation, yet Asia Pacific is quickly matching the overall growth pace through aggressive infrastructure investment and flagship private-network projects at megahubs.

Global 5G Market Trends and Insights

Proliferation of IFEC demand

Seventy-seven percent of passengers now rank onboard Wi-Fi as a deciding factor when booking flights, turning connectivity into a core service benchmark. Qatar Airways' 2024 launch of Starlink inflight Wi-Fi delivered peak speeds of 500 Mbit/s, narrowing the technology gap between cabin and ground experiences. Gogo's aviation-specific 5G network, due in 2025, promises consistent 25 Mbps average speeds for business jets, rising to 75-80 Mbps bursts, reshaping cabin entertainment and real-time collaboration.

Airport digital-transformation programs

Airports are shifting from fragmented legacy systems to unified 5G platforms that link thousands of sensors, cameras, and handheld terminals. Frankfurt Airport's private network reduces blind spots caused by metal airframes and supports secure point-of-sale, automated baggage tracking, and real-time video analytics, cutting mishandled-bag incidents and communication latency.

High CAPEX for private 5G network build-out

Airport-wide 5G installations often call for USD 3-10 million outlays, covering ruggedized radios, fiber backhaul, and spectrum-access fees. Alternative models are emerging: Brazil-based Atech offers "ATC-as-a-service," letting navigation service providers tap advanced traffic-management tools without heavy upfront spend, achieving 40% cost savings over traditional projects.

Other drivers and restraints analyzed in the detailed report include:

- Rapid expansion of aviation IoT sensors and edge computing

- National 5G spectrum auctions and aviation testbeds

- Aviation-grade cybersecurity and safety certification hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-to-ground links commanded 46% of the 5G aviation market size in 2024, benefiting from established tower infrastructure and immediate passenger-service needs. Air-to-air connectivity, however, is accelerating at a 45% CAGR. Direct aircraft-to-aircraft data exchange eliminates ground relays, shaving latency by 65% for collision-avoidance messages and enabling fuel-optimized formation flying. EchoStar's hybrid satellite-5G contracts with Turkish AJet and Delta Airlines show commercial appetite for continuous, route-agnostic coverage.

Moving toward mesh networks marks a profound design shift, replacing hub-and-spoke traffic flows with dynamic peer links. SESAR's 5G-AirSky trials recorded sub-12-millisecond delays, validating readiness for safety-critical messaging

Service contracts spanning radio-planning, rollout, and managed operations held 38.5% of the 5G aviation market share in 2024. Yet, software revenues are set for a 35% CAGR through 2030 as airlines favor virtual upgrades over hardware swaps. Gogo's 5G protocol-stack emulation lets engineers fine-tune algorithms before airborne installation, preserving capital and accelerating feature releases.

Edge computing and network-slicing tools allow bespoke lanes for air-traffic data, cargo tracking, or passenger streaming without physical network duplication. Eurocontrol's 2024 CNS Evolution Plan projects 15-20% efficiency gains for early adopters that embrace cloud-delivered services and AI-assisted automation.

5G Market in Aviation Report is Segmented by Connectivity Type (Ground-To-Ground Communication, Air-To-Ground Communication, Air-To-Air Communication), Offering (Hardware, Software, Services), Application (Passenger Experience, Airport Operations, Flight Operations, and More), Deployment Model (Public 5G Networks, Private 5G Networks, Hybrid Networks), Stakeholder (Airlines, Airports, and More) and Geography.

Geography Analysis

North America led the 5G aviation market with 37% share in 2024, equivalent to USD 1.18 billion. The FAA earmarked USD 43.4 million in 2025 for airport-technology research, reinforcing public-sector commitment to integrated 5G testbeds. Commercial momentum is equally strong: Gogo's planned nationwide aviation-only 5G network will upgrade more than 250 towers and blend licensed and unlicensed spectrum for resilient in-flight coverage.

Asia Pacific is matching the broader 33.18% CAGR, buoyed by national-scale 5G deployments and rising data-center capacity. China's build-out and Hong Kong International Airport's private network showcase position the region as a laboratory for connected ground-service vehicles and dynamic resource allocation. GSMA forecasts 5G will inject USD 130 billion into the regional economy by 2030, with aviation capturing a meaningful share.

Europe positions itself as an innovation hub through coordinated R&D and regulatory alignment. The UK's 5G Innovation Regions program seeds airport pilots, while EASA's Research Agenda 2025 prioritizes performance metrics for ATM ground equipment and spectrum coexistence frameworks vital to 5G deployment.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Huawei Technologies Co. Ltd

- Deutsche Telekom AG

- SK Telecom Co. Ltd

- KT Corporation

- Gogo LLC

- SmartSky Networks LLC

- AeroMobile Communications Ltd

- Inseego Corp.

- Telia Company AB

- Verizon Communications Inc.

- ATandT Inc.

- ZTE Corporation

- Qualcomm Technologies Inc.

- Panasonic Avionics Corporation

- Thales Group

- Collins Aerospace

- Intelsat S.A.

- OneWeb Ltd

- Eutelsat S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of IFEC (In-flight Entertainment and Connectivity) demand

- 4.2.2 Airport digital-transformation programs

- 4.2.3 Rapid expansion of aviation IoT sensors and edge computing

- 4.2.4 National 5G spectrum auctions and aviation testbeds

- 4.2.5 5G-enabled Advanced Air Mobility corridors

- 4.2.6 Real-time 8K cabin analytics for ancillary-revenue upselling

- 4.3 Market Restraints

- 4.3.1 High CAPEX for private 5G network build-out

- 4.3.2 Aviation-grade cybersecurity and safety certification hurdles

- 4.3.3 Interference risks with radio-altimeters in mmWave bands

- 4.3.4 Limited 5G device refresh cycles in legacy aircraft fleets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 5G in Aviation Use Cases

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Connectivity Type

- 5.1.1 Ground-to-Ground Communication

- 5.1.2 Air-to-Ground Communication

- 5.1.3 Air-to-Air Communication

- 5.2 By Offering

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Application

- 5.3.1 Passenger Experience

- 5.3.1.1 In-flight Wi-Fi

- 5.3.1.2 AR/VR Entertainment

- 5.3.2 Airport Operations

- 5.3.2.1 Baggage and Cargo Tracking

- 5.3.2.2 Smart Security and Border Control

- 5.3.3 Flight Operations

- 5.3.3.1 Real-time Flight Tracking

- 5.3.3.2 Predictive Maintenance Telemetry

- 5.3.4 Drone and Urban Air Mobility Operations

- 5.3.1 Passenger Experience

- 5.4 By Deployment Model

- 5.4.1 Public 5G Networks

- 5.4.2 Private 5G Networks

- 5.4.3 Hybrid Networks

- 5.5 By Stakeholder

- 5.5.1 Airlines

- 5.5.2 Airports

- 5.5.3 MRO Providers

- 5.5.4 ANSPs

- 5.5.5 OEMs

- 5.5.6 Passengers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Telefonaktiebolaget LM Ericsson

- 6.4.2 Nokia Corporation

- 6.4.3 Huawei Technologies Co. Ltd

- 6.4.4 Deutsche Telekom AG

- 6.4.5 SK Telecom Co. Ltd

- 6.4.6 KT Corporation

- 6.4.7 Gogo LLC

- 6.4.8 SmartSky Networks LLC

- 6.4.9 AeroMobile Communications Ltd

- 6.4.10 Inseego Corp.

- 6.4.11 Telia Company AB

- 6.4.12 Verizon Communications Inc.

- 6.4.13 ATandT Inc.

- 6.4.14 ZTE Corporation

- 6.4.15 Qualcomm Technologies Inc.

- 6.4.16 Panasonic Avionics Corporation

- 6.4.17 Thales Group

- 6.4.18 Collins Aerospace

- 6.4.19 Intelsat S.A.

- 6.4.20 OneWeb Ltd

- 6.4.21 Eutelsat S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment