PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851102

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851102

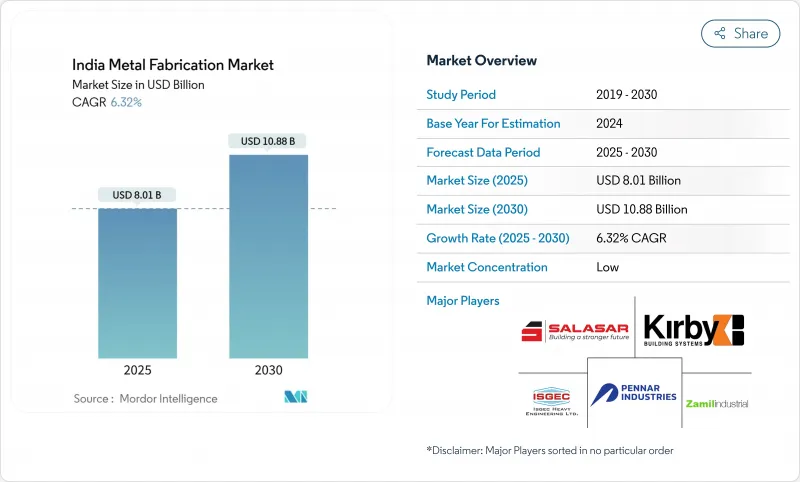

India Metal Fabrication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Metal Fabrication Market size stands at USD 8.01 billion in 2025 and is forecast to reach USD 10.88 billion by 2030 while advancing at a 6.32% CAGR.

Expansion is guided by large-scale infrastructure roll-outs under PM Gati Shakti, rising defense offsets, and the scale-up of renewable-energy equipment. Machining remains the dominant service, yet welding and aluminum processing are the fastest climbers as aerospace, data-center, and green-hydrogen projects demand lighter, high-precision assemblies. Southern fabrication clusters benefit from defense corridors and Industry 4.0 adoption, whereas Western hubs still attract the bulk of mega-steel and logistics investments. The India metal fabrication market continues to favor integrated players that can hedge volatile coking coal costs and comply with tightening environmental norms while supplying modular solutions for data centers and pre-engineered buildings.

India Metal Fabrication Market Trends and Insights

Surge in Renewable-Energy Equipment Manufacturing Demand

Domestic solar module capacity is set to hit 110 GW by 2026, ensuring a steady pipeline of mounting structures, trackers, and inverter housings that require precision fabrication. Steel demand increased 7.7% in 2024 on the back of renewable roll-outs. The National Green Hydrogen Mission earmarks INR 14.66 billion(USD 176.63 million) for green hydrogen integration, opening contracts for electrolyzer frames and pressure vessels. Wind turbine manufacturers, who already source 70-80% of components locally, keep tower and nacelle fabrication work onshore for export shipments to the United States. Collectively, these programs channel multi-year volumes to the India metal fabrication market as project developers prioritise short lead times and local content.

Government "Gati Shakti" Infrastructure Pipeline Accelerating Steel Fabrication

The master plan synchronises 200-plus projects, driving the need for bridge decks, station roofs, and overhead electrification gantries. Twelve new industrial nodes, cleared with INR 28,602 crore(USD 3.45 billion), promise ancillary orders for heavy and light fabrications across logistics parks and utility corridors. Steelmaking capacity is planned to triple to 500 million tonnes by 2047, ushering in incremental demand for plate cutting, rolling, and section welding. Progress on the Delhi-Mumbai Industrial Corridor has already secured anchor tenants such as Tata Electronics, broadening downstream fabrication contracts.

Volatile Coking-Coal Import Costs Inflating Input Prices

Coking-coal imports hit a six-year peak of 29.6 million tonnes in H1 FY25, and Russian cargoes surged 200% year-on-year as mills hunted discounts. Australian share slipped to 54% from 80% in FY 2022, yet reliance on seaborne coal still tops 85% of total demand. The government is exploring consortium-scale buying and Mongolian corridors to tame volatility, but near-term plate prices remain susceptible. Fabricators' gross margins drop by 80-120 basis points when hot-rolled coil prices spike, forcing them to pass costs to EPC clients or defer smaller orders. The India metal fabrication market thus faces temporary pressures yet benefits long-term from eventual domestic coke development.

Other drivers and restraints analyzed in the detailed report include:

- Defense Offsets & "Make in India" Stimulating Precision Fabrication

- Rapid Data-Center Build-outs Requiring Heavy Structural Modules

- Chronic Power-Supply Bottlenecks for MSME Fabricators

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Machining accounted for 33.4% of India metal fabrication market share in 2024, supplied by a network of multi-axis CNC shops that serve aerospace, automotive, and defense contracts. Adoption of AI-enabled CAM software, typified by Hurco's ChatCNC, cuts programming time and improves spindle utilization, letting shops respond quickly to export call-offs. Automation upgrades soften the skilled-labour deficit and allow lot-size-one production for high-value assemblies.

Welding, although smaller, registers the fastest 7.01% CAGR as high-rise infrastructure, wind towers, and LNG modules need specialized non-destructive-tested joints. Integrated players embed robotic MIG lines and real-time weld-pool analytics to meet both quality codes and compressed project schedules. Cutting services benefit from fiber-laser systems that slice 25 mm carbon steel at 3 m/min, while forming cells use servo-press brakes to bend advanced-high-strength steel. Punching, stamping, and finishing segments upgrade to inline dust-collection and water-borne paint booths to align with environmental norms. The SAMARTH Udyog Bharat 4.0 program backs these upgrades through experiential centres in Pune and Bengaluru, steering fresh orders to tech-ready workshops within the India metal fabrication market.

The India Metal Fabrication Market is Segmented by Service Type (Cutting, and Others), by Material (Carbon Steel, and Others), by End-User Industry (Construction & Infrastructure, and Others), and by Region (Western India, Southern India, Northern India, Eastern India, and Central India). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Larsen & Toubro Ltd

- Kirby Building Systems India

- Zamil Industrial Investment Co.

- ISGEC Heavy Engineering Ltd

- Pennar Industries Ltd

- Salasar Techno Engineering Ltd

- JSW Severfield Structures Ltd

- Godrej Process Equipment

- Diamond Engineering (India) Pvt Ltd

- TEMA India Ltd

- Novatech Projects (India) Pvt Ltd

- Karamtara Engineering Pvt Ltd

- Bharat Heavy Electricals Ltd (Fabrication Div.)

- Tata Projects Ltd

- Welspun Corp Ltd

- Hindustan Dorr-Oliver Ltd

- Jindal Stainless - Fabrication Unit

- Bharat Forge Ltd (Fabrication Business)

- Essar Heavy Engineering Services

- Techno-Fab Engineering Ltd*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Renewable-Energy Equipment Manufacturing Demand

- 4.2.2 Government "Gati Shakti" Infrastructure Pipeline Accelerating Steel Fabrication

- 4.2.3 Defence Offsets & "Make in India" Stimulating Precision Fabrication

- 4.2.4 Rapid Data-Center Build-outs Requiring Heavy Structural Modules

- 4.2.5 Adoption of Pre-Engineered Buildings in Tier-2 & 3 Cities

- 4.3 Market Restraints

- 4.3.1 Volatile Coking-Coal Import Costs Inflating Input Prices

- 4.3.2 Chronic Power-Supply Bottlenecks for MSME Fabricators

- 4.3.3 Fragmented Supply Chain Limits Export-Grade Quality Assurance

- 4.3.4 Environmental-Compliance (EPR & Carbon) Cost Burden

- 4.4 Value / Supply-Chain Analysis

- 4.5 Government Regulations & Key Initiatives

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Recent Global Disruptions on the India Metal Fabrication Market

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Service Type

- 5.1.1 Cutting

- 5.1.2 Forming / Bending

- 5.1.3 Welding

- 5.1.4 Machining

- 5.1.5 Punching / Stamping

- 5.1.6 Finishing / Surface Treatment

- 5.1.7 Others (Assembling, etc.)

- 5.2 By Material

- 5.2.1 Carbon Steel

- 5.2.2 Stainless & Alloy Steel

- 5.2.3 Aluminium

- 5.2.4 Others (Copper, Brass, Specialty Alloys, Sheet Metal (CRCA, GI, HR))

- 5.3 By End-User Industry

- 5.3.1 Construction & Infrastructure

- 5.3.2 Automotive & Auto Components

- 5.3.3 Railways & Metro

- 5.3.4 Power & Utilities

- 5.3.5 Aerospace & Defence

- 5.3.6 Oil, Gas & Refinery

- 5.3.7 Marine and Shipbuilding

- 5.3.8 Manufacturing (Heavy Machinery & Consumer Durables)

- 5.3.9 Others (Job shops, Agricultural Equipment, Electricals, Consumer Durables, etc.)

- 5.4 By Region

- 5.4.1 Western India (Maharashtra, Gujarat, and Goa)

- 5.4.2 Southern India (Tamil Nadu, Karnataka, Telangana, Andhra Pradesh, and Kerala)

- 5.4.3 Northern India (Delhi NCR, Haryana, Punjab, Uttar Pradesh, Uttarakhand, Himachal Pradesh, and Rajasthan)

- 5.4.4 Eastern India (West Bengal, Jharkhand, Odisha, and Bihar)

- 5.4.5 Central India (Madhya Pradesh and Chhattisgarh)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Larsen & Toubro Ltd

- 6.4.2 Kirby Building Systems India

- 6.4.3 Zamil Industrial Investment Co.

- 6.4.4 ISGEC Heavy Engineering Ltd

- 6.4.5 Pennar Industries Ltd

- 6.4.6 Salasar Techno Engineering Ltd

- 6.4.7 JSW Severfield Structures Ltd

- 6.4.8 Godrej Process Equipment

- 6.4.9 Diamond Engineering (India) Pvt Ltd

- 6.4.10 TEMA India Ltd

- 6.4.11 Novatech Projects (India) Pvt Ltd

- 6.4.12 Karamtara Engineering Pvt Ltd

- 6.4.13 Bharat Heavy Electricals Ltd (Fabrication Div.)

- 6.4.14 Tata Projects Ltd

- 6.4.15 Welspun Corp Ltd

- 6.4.16 Hindustan Dorr-Oliver Ltd

- 6.4.17 Jindal Stainless - Fabrication Unit

- 6.4.18 Bharat Forge Ltd (Fabrication Business)

- 6.4.19 Essar Heavy Engineering Services

- 6.4.20 Techno-Fab Engineering Ltd*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment