PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851103

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851103

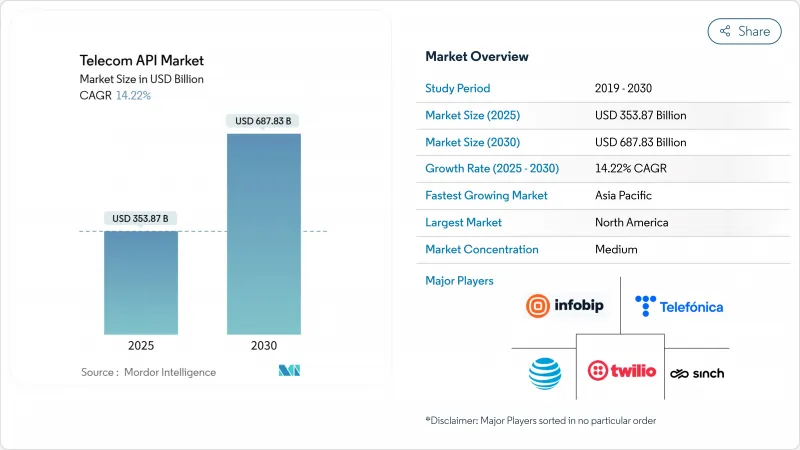

Telecom API - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Telecom API Market size is estimated at USD 353.87 billion in 2025, and is expected to reach USD 687.83 billion by 2030, at a CAGR of 14.22% during the forecast period (2025-2030).

Uptake reflects the telecom sector's pivot to programmable networks, monetization of 5G capabilities, and the rapid spread of Communications Platform as a Service (CPaaS). Key forces behind growth include standardization efforts such as GSMA Open Gateway, the proliferation of quality-on-demand APIs for 5G network slicing, and enterprise demand for embedded real-time communications. Competitive intensity has prompted consolidation: equipment vendors and carriers have formed joint ventures to pool network APIs, while CPaaS specialists scale through enterprise acquisition strategies. The market also benefits from hybrid cloud deployments that balance cloud agility with data-sovereignty requirements, positioning operators to quickly expose network functions to developer ecosystems.

Global Telecom API Market Trends and Insights

Surge in CPaaS adoption among enterprises

Enterprises continue embedding omnichannel communications into customer workflows, illustrated by Twilio's Q1 2025 revenue of USD 1.17 billion and an active customer base exceeding 335,000. Operators improve internal efficiency as well: AT&T's MuleSoft-centered program cut onboarding cycles from one year to six weeks and saved 2 million work hours annually. The economic payoff from API reuse reinforces management's focus on developer experience and continuous integration pipelines. Generative-AI-powered coding assistants lower entry barriers for in-house teams, and personalized messaging fuels sustained traffic on SMS, RCS, and voice channels.

Open Gateway and CAMARA standardization of network APIs

Forty-nine operator groups now back GSMA Open Gateway, signaling an industry consensus on unified interfaces for capabilities such as device verification, latency control, and location services. Telefonica's commercial launch shows developers integrating telecom features into fintech and streaming apps while retaining privacy controls. T-Mobile's CAMARA-compliant Quality-on-Demand APIs enable low-latency deployments in healthcare, logistics, and retail. Standardization lowers integration costs for software firms and accelerates time-to-market for network-aware applications.

Escalating API-security breaches and signaling fraud

API call volumes leapt 167% in 2024, exposing platforms to attack vectors that resulted in breaches at Dell, GitHub, and TracFone, the latter paying USD 16 million in penalties. Research shows 95% of organizations faced API security incidents, with 23% suffering data loss. Telecom players remain high-value targets because subscriber identity and signaling systems traverse multiple domains. Effective mitigations include zero-trust policies, continuous runtime protection, and threat-intelligence sharing between carriers and cloud providers.

Other drivers and restraints analyzed in the detailed report include:

- Monetization pressure on 5G driving QoS-on-demand APIs

- Edge-computing workloads need low-latency slicing APIs

- Legacy OSS/BSS upgrade bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Messaging APIs retained 35.67% Telecom API market share in 2024, anchored by enterprise A2P traffic that reached 2.2 trillion messages. The Telecom API market size for messaging is forecast to expand steadily as businesses prioritize SMS, MMS, and Rich Communication Services for authentication and promotions. RCS growth is striking: Infobip projects A2P RCS revenue climbing to USD 4.2 billion by 2029. Meanwhile, Payment APIs are scaling fastest at 17.45% CAGR because embedded finance models blend telecom reach with fintech capabilities. Voice, IVR, and WebRTC APIs retain relevance as enterprises integrate multi-modal support into customer-experience platforms. Developers also leverage subscriber-identity and fraud-detection APIs to boost security for mobile transactions.

Demand patterns continue shifting toward value-added functionality. Generative-AI chatbots drive contextual messaging, and location-based APIs enable hyperlocal marketing in smart-city rollouts. As regulation tightens against spam, operators charge premiums for verified sender IDs, reinforcing revenue diversification. Close collaboration with cloud contact-center vendors keeps messaging APIs central to enterprise transformation agendas across healthcare, banking, and retail.

Hybrid environments captured 49.85% market share in 2024 and delivered the highest growth trajectory at 15.45% CAGR, underscoring operator priorities around sovereignty and latency. Telecom API market size for hybrid deployments is projected to expand as network cores stay on-premises while microservices for billing, analytics, and exposure layers move to public cloud. Operator examples include VIVA Bahrain's hybrid cloud core and PCCW Global's multi-cloud strategy for wholesale APIs. Regulatory mandates for local data storage in APAC further sustain hybrid uptake.

Operators favor cloud-agnostic container orchestration to avoid vendor lock-in and to dynamically shift workloads for cost optimization. Edge nodes extend hybrid topologies, offering developers single-digit-millisecond latency for AI inference and computer-vision tasks. Pure public-cloud models remain suitable for greenfield MVNOs, but integration complexity and unpredictable egress fees limit broad adoption for tier-one operators. On-premises-only strategies persist for security-sensitive government networks yet lack the elasticity required for large-scale API economies.

The Telecom API Market Report is Segmented by Service Type (Messaging/SMS-MMS-RCS API, Voice/IVR & Voice Control API, and More), Deployment Type (Hybrid, Multi-Cloud, and Other Deployment Modes), End-User (Enterprise Developer, Internal Telecom Developer, Partner Developer, and Long-Tail Developer), Business Model (Direct Carrier Exposure, Aggregator-Led CPaaS, Platform-As-A-Service [PaaS], and More), and Geography.

Geography Analysis

North America accounted for 34.06% of 2024 revenue, reflecting high CPaaS penetration and extensive 5G coverage. Collaboration among AT&T, T-Mobile, and Verizon in the Aduna venture allows unified access to Number Verification and SIM Swap APIs that raise security for fintech and healthcare applications. Twilio's USD 4.46 billion 2024 revenue underscores robust enterprise spending on programmable communications, while developer-first cultures spur quick uptake of new network features. Government frameworks that encourage technology sandboxes support continuous experimentation in the Telecom API market.

Asia-Pacific is forecast to register the fastest 17.51% CAGR through 2030 as mobile-first economies escalate 5G rollouts and digital-services adoption. Combined regional telco revenue hit USD 147.7 billion in Q2 2024, with 72% of operators reporting positive growth. China's projected 88% 5G subscription rate by 2028 and initiatives in Australia, Japan, and South Korea to expose quality-on-demand APIs illustrate aggressive expansion. Government mandates for smart manufacturing and e-governance increase demand for low-latency and security features, making the Telecom API market the backbone of regional digital agendas.

Europe shows steady growth because GDPR-aligned security practices elevate customer trust in API services. Deutsche Telekom's AI-phone roadmap demonstrates regional operator interest in converging devices, AI, and telecom capabilities. Collaborative projects among European carriers and hyperscalers accelerate edge deployments and standardized CAMARA APIs. Emerging markets in the Middle East, Africa, and Latin America ride similar trajectories, backed by network-modernization investments and cloud-partnership strategies that lower time-to-market for digital-service launches.

- ATandT Inc.

- Telefonica SA

- Twilio Inc.

- Infobip Ltd.

- Sinch AB

- Verizon Communications Inc.

- Orange SA

- Deutsche Telekom AG

- Ribbon Communications

- Huawei Technologies Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Cisco Systems Inc.

- Google LLC (Apigee)

- Vodafone Group Plc

- Nokia Corp.

- Vonage Holdings Corp.

- MessageBird B.V.

- Bandwidth Inc.

- Telnyx LLC

- Syniverse Technologies LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in CPaaS adoption among enterprises

- 4.2.2 Open Gateway and CAMARA standardisation of network APIs

- 4.2.3 Monetisation pressure on 5G driving QoS-on-demand APIs

- 4.2.4 Edge-computing workloads need low-latency slicing APIs

- 4.2.5 IoT fleet expansion demanding ID and billing APIs

- 4.2.6 Gen-AI-assisted dev-tools lowering entry barriers

- 4.3 Market Restraints

- 4.3.1 Escalating API-security breaches and signalling fraud

- 4.3.2 Legacy OSS/BSS upgrade bottlenecks

- 4.3.3 Margin compression from OTT CPaaS competitors

- 4.3.4 Unclear revenue-share models with hyperscalers

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

- 4.8 Macroeconomic Impact Analysis

- 4.9 API Use Cases in Telecom Industry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Messaging/SMS-MMS-RCS API

- 5.1.2 Voice/IVR and Voice Control API

- 5.1.3 Payment API

- 5.1.4 WebRTC API

- 5.1.5 Location and Mapping API

- 5.1.6 Subscriber ID Mgmt and SSO API

- 5.1.7 Other Services

- 5.2 By Deployment Type

- 5.2.1 Hybrid

- 5.2.2 Multi-cloud

- 5.2.3 Other Deployment Modes

- 5.3 By End-User

- 5.3.1 Enterprise Developer

- 5.3.2 Internal Telecom Developer

- 5.3.3 Partner Developer

- 5.3.4 Long-tail Developer

- 5.4 By Business Model

- 5.4.1 Direct Carrier Exposure

- 5.4.2 Aggregator-led CPaaS

- 5.4.3 Platform-as-a-Service (PaaS)

- 5.4.4 API Marketplace/Exchange

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 South America

- 5.5.3 Europe

- 5.5.4 Asia Pacific

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Vendor Capability Matrix

- 6.5 Key Case Studies of Major Vendors

- 6.6 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.6.1 ATandT Inc.

- 6.6.2 Telefonica SA

- 6.6.3 Twilio Inc.

- 6.6.4 Infobip Ltd.

- 6.6.5 Sinch AB

- 6.6.6 Verizon Communications Inc.

- 6.6.7 Orange SA

- 6.6.8 Deutsche Telekom AG

- 6.6.9 Ribbon Communications

- 6.6.10 Huawei Technologies Co. Ltd.

- 6.6.11 Telefonaktiebolaget LM Ericsson

- 6.6.12 Cisco Systems Inc.

- 6.6.13 Google LLC (Apigee)

- 6.6.14 Vodafone Group Plc

- 6.6.15 Nokia Corp.

- 6.6.16 Vonage Holdings Corp.

- 6.6.17 MessageBird B.V.

- 6.6.18 Bandwidth Inc.

- 6.6.19 Telnyx LLC

- 6.6.20 Syniverse Technologies LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment