PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851105

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851105

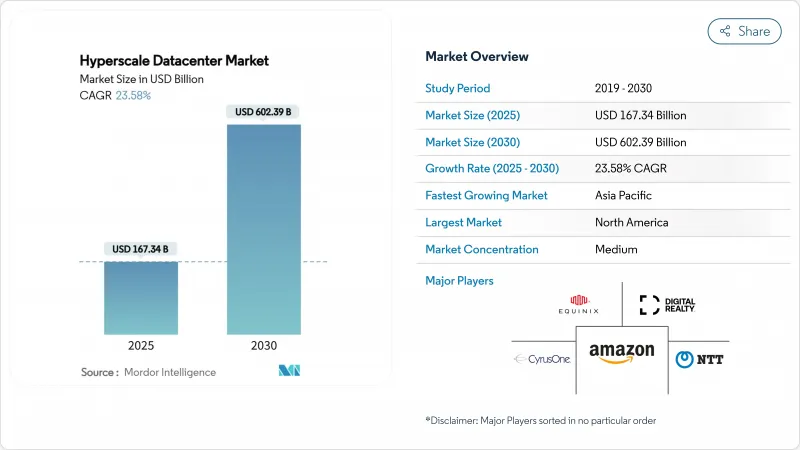

Hyperscale Datacenter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hyperscale data center market is valued at USD 167.34 billion in 2025 and is forecast to reach USD 602.39 billion by 2030, reflecting a robust 23.58% CAGR.

Scale economics, AI-centric hardware demand, and sovereign-cloud regulations are re-shaping facility design, with GPU racks routinely exceeding 50 kW power density. Accelerated regional build-outs in Europe and Asia-Pacific, combined with real-time payment mandates in key fintech hubs, sustain a construction pipeline that exceeds 3 GW of new capacity annually. Operators are pivoting from air to direct-to-chip liquid cooling, while regulatory heat taxes in the Netherlands and Singapore heighten focus on carbon-aware site selection. Strategic land banking and multi-year GPU supply agreements have become decisive competitive levers as silicon shortages and long utility lead times converge.

Global Hyperscale Datacenter Market Trends and Insights

Exploding GPU-centric AI/ML workloads requiring more than 50 kW racks in the U.S. & China

AI training clusters are re-engineering facility layouts, with Google already fielding 1 MW racks that draw +/- 400 VDC power. Silicon scarcity has prompted operators to lock in multi-year GPU contracts, elevating build-times and capital intensity. xAI's 200,000-GPU campus in Memphis highlights the scale of transformation, compelling data center teams to redesign power distribution, network fabrics, and liquid cooling loops around racks that consume 160% more energy than legacy servers. The United States and China dominate deployments thanks to supportive AI funding ecosystems and agile permitting frameworks.

Hyperscale cloud providers' sovereign-cloud roll-outs in Europe

European data-residency laws require "EU-only" operational control, leading AWS to invest EUR 7.8 billion (USD 8.5 billion) in a German sovereign cloud by 2040. Deutsche Telekom's 8ra initiative-targeting 10,000 edge nodes-signals local incumbents' intent to narrow dependency on U.S. cloud stacks. Sovereign models extend beyond compliance, fostering indigenous AI R&D and catalyzing regional hardware supply chains. Momentum is already visible in France through Orange and Capgemini's Bleu platform, foreshadowing similar requirements in the Middle East and parts of APAC.

Water-usage restrictions for evaporative cooling in Western U.S. & Spain

California's regulators now mandate refrigerant-based systems that cut water draw, inflating capex by up to 20%. Arizona reports a 1 MW facility can consume 6.75 million gallons annually, placing data centers under scrutiny alongside agriculture and housing. Spanish droughts trigger similar curbs, steering developers toward coastal plots with desalination pipelines or inland campuses using closed-loop liquid cooling.

Other drivers and restraints analyzed in the detailed report include:

- FinTech real-time payment mandates accelerating Tier IV demand in Singapore & India

- 5G edge-core consolidation creating regional hub requirements in Nordics & Oceania

- GPU supply-chain bottlenecks limiting rack-level density expansion

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Self-build operators accounted for 70.2% of hyperscale data center market share in 2024, riding capital-intensive programs such as Amazon's USD 150 billion multiyear roadmap. Control over design enables bespoke power trains and proprietary network fabrics tuned for AI clusters. Yet hyperscale colocation is forecast to deliver a 25.6% CAGR, narrowing the ownership gap as speed-to-market trumps asset control in new regions.

Colocation providers secure land and power in advance to offer modular suites on 12-month lead-times, compressing occupancy ramp-up for cloud entrants. Vantage's USD 9.2 billion equity raise underpins this expansion, indicating private-equity appetite for recurring revenue tied to long-term hyperscale contracts. As more sovereign-cloud deals stipulate local partners, colocation gains strategic relevance across emerging markets.

The segment generated 48% of the hyperscale data center market size from IT Infrastructure purchases in 2024, with GPUs, DDR5 memory, and NVMe storage driving wallet share. Electrical back-up systems such as 30 MW lithium-ion farms now feature in standard bill-of-materials. Software & Services is rising at 27.1% CAGR, reflecting demand for AI-driven resource orchestration that yields power and rack-density gains.

Security stacks integrated with zero-trust frameworks outpace baseline monitoring tools as multi-tenant AI workloads elevate risk profiles. Over the forecast period, automated workload placement is projected to defer 8-10 GW of new build by maximizing existing utilization-underscoring a shift from brute-force expansion to intelligent capacity management.

The Hyperscale Data Center Market is Segmented by Data Center Type (Enterprise / Hyperscale Self-Build, Hyperscale Colocation), Component (IT Infrastructure, Electrical Infrastructure, and More), Tier Standard (Tier III, Tier IV), End-User Industry (Cloud Service Providers, BFSI, Social Media and Digital Content, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest regional revenue, accounting for 43.3% of the hyperscale data center market in 2024. Virginia's "Data Center Alley" alone cleared 2 GW of new substation requests last year, yet grid congestion now steers demand to Ohio, Pennsylvania, and North Carolina where Amazon is injecting USD 30 billion across multiple AI-ready campuses. Utility interconnection timelines stretching up to seven years are prompting inter-regional diversity strategies and renewable power purchase agreements that hedge carbon exposure.

Asia-Pacific is the clear growth engine with a projected 29.1% CAGR. Japan anchors investment on the back of AWS's JPY 2.26 trillion (USD 15.1 billion) expansion, while Oracle and NTT add capacity to meet domestic AI and gaming workloads. India's tax incentives and digital-public-goods framework propel nationwide hyperscale corridors from Mumbai to Hyderabad. Singapore, despite a temporary moratorium, re-opened its approvals under a sustainability scorecard, unlocking fresh Tier IV pipeline to service ASEAN fintech flows.

Europe enjoys steady inflows, bolstered by sovereignty mandates and Nordic renewables. Brookfield's USD 10 billion Swedish campus and Google's EUR 600 million (USD 650 million) Norwegian build illustrate how cool climates and green grids cut operational PUE below 1.15. Heat taxes in the Netherlands and power caps around Dublin create supply discipline, nudging operators toward continental tier-two cities. Future growth hinges on harmonizing environmental constraints with the Digital Decade's cloud adoption targets.

- Digital Realty Trust, Inc.

- Equinix, Inc.

- CyrusOne Inc.

- NTT Ltd.

- Quality Technology Services (QTS)

- Vantage Data Centers LLC

- Amazon Web Services, Inc.

- Microsoft Corporation

- Alphabet Inc. (Google)

- Meta Platforms Inc.

- Alibaba Group Holding Ltd.

- Tencent Holdings Ltd.

- Baidu, Inc.

- Oracle Corporation

- International Business Machines Corp.

- Switch, Inc.

- STACK Infrastructure

- Flexential Corp.

- Iron Mountain Data Centers

- OVHcloud

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exploding GPU-centric AI/ML Workloads Requiring more than 50 kW Racks in the U.S. and China drives the market

- 4.2.2 Hyperscale Cloud Providers' 'Sovereign Cloud' Roll-outs in Europe Drives the Market

- 4.2.3 FinTech Real-Time Payment Mandates Accelerating Tier IV Demand in Singapore and India Drives the Market

- 4.2.4 5G Edge-Core Consolidation Creating Regional Hub Requirements in Nordics and Oceania Drives the Market

- 4.3 Market Restraints

- 4.3.1 Water-Usage Restrictions for Evaporative Cooling in Western U.S. and Spain

- 4.3.2 GPU Supply Chain Bottlenecks Limiting Rack-Level Density Expansion

- 4.3.3 Rising Heat-Tax and Carbon Levies in Netherlands, Singapore and Germany Hinders the Market

- 4.4 Value-Chain Analysis

- 4.5 Regulatory and Compliance Outlook

- 4.6 Technological Outlook (Liquid Cooling, Direct-to-Chip, Modular Builds)

- 4.7 Assessment of Macro Economic Trends on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Data Center Type

- 5.1.1 Enterprise / Hyperscale Self-build

- 5.1.2 Hyperscale Colocation

- 5.2 By Component

- 5.2.1 IT Infrastructure

- 5.2.2 Electrical Infrastructure

- 5.2.3 Mechanical and Cooling Infrastructure

- 5.2.4 Software and Services

- 5.3 By Tier Standard

- 5.3.1 Tier III

- 5.3.2 Tier IV

- 5.4 By End-user Industry

- 5.4.1 Cloud Service Providers

- 5.4.2 BFSI

- 5.4.3 Social Media and Digital Content

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Government and Public Sector

- 5.4.6 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 Netherlands

- 5.5.2.4 France

- 5.5.2.5 Ireland

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Singapore

- 5.5.3.4 Japan

- 5.5.3.5 Australia

- 5.5.3.6 Indonesia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Chile

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Digital Realty Trust, Inc.

- 6.4.2 Equinix, Inc.

- 6.4.3 CyrusOne Inc.

- 6.4.4 NTT Ltd.

- 6.4.5 Quality Technology Services (QTS)

- 6.4.6 Vantage Data Centers LLC

- 6.4.7 Amazon Web Services, Inc.

- 6.4.8 Microsoft Corporation

- 6.4.9 Alphabet Inc. (Google)

- 6.4.10 Meta Platforms Inc.

- 6.4.11 Alibaba Group Holding Ltd.

- 6.4.12 Tencent Holdings Ltd.

- 6.4.13 Baidu, Inc.

- 6.4.14 Oracle Corporation

- 6.4.15 International Business Machines Corp.

- 6.4.16 Switch, Inc.

- 6.4.17 STACK Infrastructure

- 6.4.18 Flexential Corp.

- 6.4.19 Iron Mountain Data Centers

- 6.4.20 OVHcloud

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment