PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851120

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851120

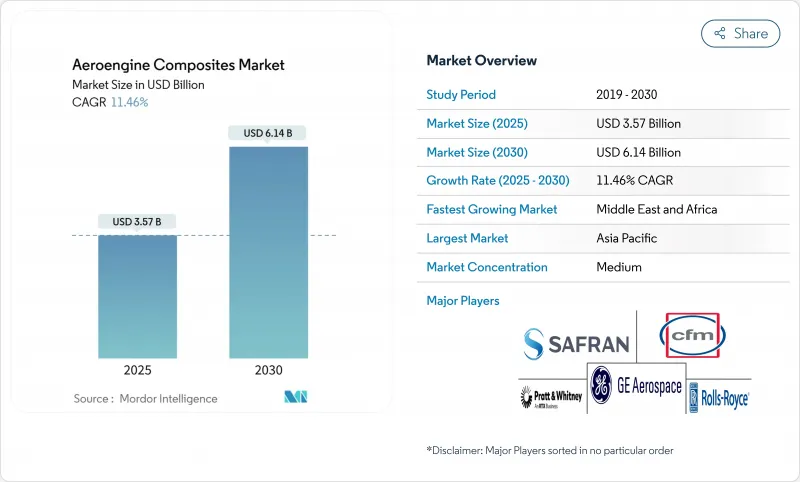

Aeroengine Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aeroengine composites market is valued at USD 3.57 billion in 2025 and is forecasted to reach a market size of USD 6.14 billion by 2030, advancing at an 11.46% CAGR.

Growing fleet renewal, decarbonization mandates, and rising fuel prices push airlines and engine makers toward lighter propulsion systems that cut fuel burn by up to 20% while meeting stricter emission limits. Ceramic matrix composites (CMC) now withstand 1,300°C, allowing higher core temperatures and improved thermal efficiency. Automated fiber-placement and out-of-autoclave curing are lowering the cost per pound by nearly 30%, making composites economically viable for narrowbody programs. Supply-chain resilience remains critical after GE Aerospace's 10% delivery shortfall in 2024 exposed bottlenecks in high-pressure turbine blade sourcing.

Global Aeroengine Composites Market Trends and Insights

Shift toward lightweight, fuel-efficient propulsion systems

Airlines need 15-20% fuel savings to offset volatile fuel prices, driving a rapid pivot toward composites that cut nacelle weight and boost bypass ratios. GE Aerospace's RISE open-fan demonstrator targets 20% CO2 reductions using carbon-fiber fan blades with bypass ratios up to 60. Airbus is flight-testing carbon-fiber reinforced thermoplastic structures that pair with 100% sustainable aviation fuel and promise 20% fuel burn cuts. Narrowbody output above 100 aircraft per month heightens the urgency for scalable, automated composite production.

Ramp-up of LEAP and next generation aircraft engine production volumes

Over 4,000 aircraft fly with LEAP engines, prompting Safran to invest EUR 1 billion (USD 1.16 billion) in new MRO facilities in Brussels, Hyderabad, Queretaro, and Casablanca to handle 1,200 annual shop visits by 2028. GE earmarked EUR 64 million (USD 74.05 million) for European test cells and tooling that support the LEAP and GE9X programs. Component shortages, chiefly high-pressure turbine blades, trimmed 2024 engine deliveries by 10% despite USD 26.9 billion in commercial revenue, underscoring the need for diversified composite supply chains.

Brittleness and inspection complexity of CMCs

CMC fan blades risk foreign object damage because their ceramic microstructure can crack under impact loads. Traditional ultrasonic or X-ray methods struggle to detect microcracks, forcing OEMs to invest in computed-tomography scanning and specialist training. New machining methods using polycrystalline diamond tools cut processing time by 70%, raising capital costs and making adoption harder for smaller suppliers.

Other drivers and restraints analyzed in the detailed report include:

- Decarbonization roadmaps driving high-temperature CMC demand

- Shifting aftermarket spend toward composite replacement parts

- Protracted qualification cycles under FAA/EASA Part 21 rules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Commercial engines captured 70.05% of the aeroengine composites market share in 2024 because thousands of LEAP and GEnx units integrate composite fan blades and cases that deliver up to 20% fuel savings. The aeroengine composites market size tied to military programs will expand the fastest at a 12.74% CAGR through 2030 as XA100-class propulsion and hypersonic demonstrators adopt CMC shrouds.

Business jets and regional aircraft operators are beginning to retrofit composite-rich engines as technology migrates downstream. Partnerships like GE Aerospace and Kratos Defense plan small-class engines that marry CMC turbines with affordable production methods, widening the customer base. This diffuses risk across civil and defense budgets, improving supplier order stability.

Fan blades retained 37.98% of 2024 revenue because carbon-fiber construction delivers high stiffness-to-weight and reduces inertia for better thrust response. Fan cases are projected to grow at 13.48% CAGR, lifting the aeroengine composites market size for containment hardware as regulatory containment tests favor composite shells.

Integrating shrouds, guide vanes, and O-ring seals into monolithic composite structures will keep margins healthy by reducing part count and assembly hours. Suppliers with AFP capability can machine complex aerofoils in a single pass, enhancing performance consistency.

The Aeroengine Composites Market Report is Segmented by Application (Commercial Aircraft, Military Aircraft, and General Aviation), Component (Fan Blades, Fan Case, Guide Vanes, Shrouds, and Other Components), Material Type (Polymer Matrix Composites and Ceramic Matrix Composites), End-User (OEM and Aftermarket), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held a 32.18% share in 2024 as China accelerated Indigenous programs like the CJ-1000 for the C919 and the 35-ton-thrust CJ-2000, which are rich in composite hot-section parts. China's turbine blades now tolerate 1,700 °C through single-crystal casting and 3D-printed cooling channels. Japan and South Korea supply high-strength fibers and prepregs, while India's widebody orders boost regional demand.

North America remains a technology leader. GE Aerospace's USD 26.9 billion commercial engines revenue in 2024 stemmed from composite-laden LEAP and GEnx programs, though material shortages cut deliveries by 10%. NASA's HyTEC initiative is coating CMC airfoils to raise single-aisle efficiency, sustaining R&D pipelines.

The Middle East and Africa is projected to witness the fastest growth at 13.15% CAGR as the Gulf carriers add composite-rich engines and regional forces invest in next-generation fighters. Safran-MTU's EURA engine will anchor European helicopter upgrades, while EU Clean Aviation's open-fan demonstrator supports 20% CO2 cuts via large-diameter composite fans.

- GE Aerospace (General Electric Company)

- CFM International

- Rolls-Royce plc

- Pratt & Whitney (RTX Corporation)

- Safran SA

- GKN Aerospace

- FACC AG

- Spirit AeroSystems Inc.

- Hexcel Corporation

- Toray Industries, Inc.

- Solvay

- Albany International Corp.

- Meggitt PLC

- General Dynamics Corporation

- SGL Carbon

- Renegade Materials Corporation

- Materion Corporation

- IHI Corporation

- MTU Aero Engines AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward lightweight, fuel-efficient propulsion systems

- 4.2.2 Ramp-up of LEAP and GEnx engine production volumes

- 4.2.3 Decarbonization roadmaps driving high-temperature CMC demand

- 4.2.4 Shifting aftermarket spend toward composite replacement parts

- 4.2.5 Cost reductions from automated manufacturing processes

- 4.2.6 Increasing funding for hypersonic and 6th-gen fighter manufacturing

- 4.3 Market Restraints

- 4.3.1 Brittleness and inspection complexity of CMCs

- 4.3.2 Limited high-temperature resin supply base

- 4.3.3 Volatile build-rates deferring CAPEX on new lines

- 4.3.4 Protracted 5- to 7-year material/process qualification cycles under FAA/EASA Part 21 rules

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Commercial Aircraft

- 5.1.1.1 Narrow-Body

- 5.1.1.2 Wide-Body

- 5.1.1.3 Regional Jet

- 5.1.2 Military Aircraft

- 5.1.3 General Aviation Aircraft

- 5.1.3.1 Business Jet

- 5.1.3.2 Others

- 5.1.1 Commercial Aircraft

- 5.2 By Component

- 5.2.1 Fan Blades

- 5.2.2 Fan Case

- 5.2.3 Guide Vanes

- 5.2.4 Shrouds

- 5.2.5 Other Components

- 5.3 By Material Type

- 5.3.1 Polymer Matrix Composites (PMC)

- 5.3.2 Ceramic Matrix Composites (CMC)

- 5.4 By End-User

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 France

- 5.5.2.3 Germany

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 GE Aerospace (General Electric Company)

- 6.4.2 CFM International

- 6.4.3 Rolls-Royce plc

- 6.4.4 Pratt & Whitney (RTX Corporation)

- 6.4.5 Safran SA

- 6.4.6 GKN Aerospace

- 6.4.7 FACC AG

- 6.4.8 Spirit AeroSystems Inc.

- 6.4.9 Hexcel Corporation

- 6.4.10 Toray Industries, Inc.

- 6.4.11 Solvay

- 6.4.12 Albany International Corp.

- 6.4.13 Meggitt PLC

- 6.4.14 General Dynamics Corporation

- 6.4.15 SGL Carbon

- 6.4.16 Renegade Materials Corporation

- 6.4.17 Materion Corporation

- 6.4.18 IHI Corporation

- 6.4.19 MTU Aero Engines AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment