PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851121

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851121

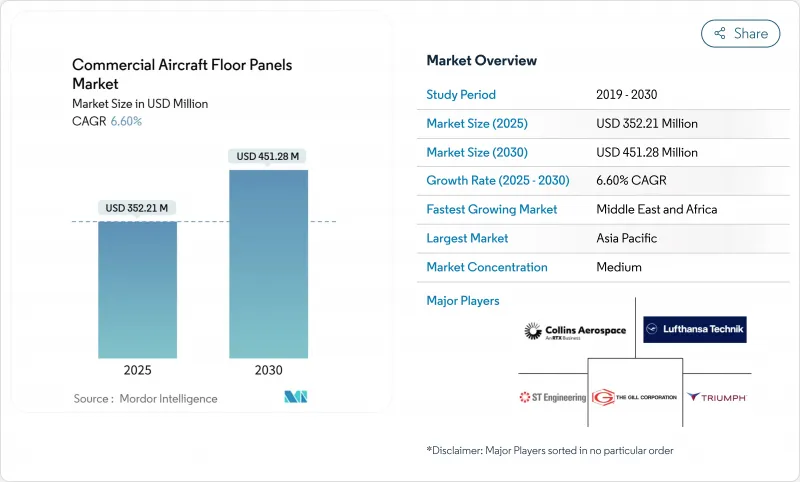

Commercial Aircraft Floor Panels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The commercial aircraft floor panels market is valued at USD 352.21 million in 2025 and is forecasted to reach a market size of USD 451.28 million by 2030, advancing at a 6.6% CAGR.

Growing aircraft backlogs, stringent fire-safety rules, and the industry-wide shift toward lighter cabin interiors underpin this expansion. Airlines are accelerating retrofit programs to lower fuel burn, while next-generation wide-body platforms adopt composite-rich structures that rely on advanced floor panels for weight parity. Supply-chain consolidations such as Boeing's purchase of Spirit AeroSystems and Airbus's buyout of Spirit's European assets realign sourcing power and help de-bottleneck panel deliveries. Meanwhile, recyclable thermoplastic honeycomb cores move from prototype to line-fit status as operators pursue circular-economy targets.

Global Commercial Aircraft Floor Panels Market Trends and Insights

Surge in Narrowbody Aircraft Production Backlog

Narrowbody order books now span nearly 13 years of output, locking in sustained demand for commercial aircraft floor panels market installations. Each single-aisle jet needs 15-20 panels across the cabin and belly compartments, so every incremental production slot translates into tangible material volumes. The B737 MAX production restart and the Airbus A320neo family's targeted 75-per-month cadence intensify sourcing pressures even as select component suppliers still struggle with electronics, forgings, and honeycomb cores. The US Government Accountability Office notes that nine 15 tier-one vendors cite labor and material shortages as persistent constraints, extending lead times and prompting airframers to dual-source qualified panel lines where possible. Operators in Asia-Pacific and North America absorb the bulk of fresh deliveries, reinforcing the geographic skew toward those supply corridors.

Airline Retrofit Cycles Focused on Lightweight Cabin Refurbishment

Cabin refresh intervals sit between eight and 12 years, and the current wave coincides with record fuel-price volatility. Airlines, therefore, prioritize mass-reduction options, making lightweight floor systems a core feature of retrofit kits. Collins Aerospace displayed an integrated seating-plus-floor concept at Aircraft Interiors Expo that re-uses structural seat rails yet replaces original panels with next-generation phenolic-resin laminates. Safran's interiors division booked 25.2% revenue growth in 2024, underpinned by similar retrofit demand as carriers such as Delta Air Lines chose smart-cabin modules over full fleet reconfigurations. Regulatory updates to FAR 25.853 test protocols also force older panels out of service sooner, lifting near-term replacement volumes in North America and several EU jurisdictions.

Volatile Nomex and Carbon-Fiber Pricing Compressing Supplier Margins

Nomex paper and aerospace-grade carbon fiber pivot on petroleum-based feedstocks and specialized precursor capacity, exposing prices to crude swings and energy spikes. Hexcel trimmed its 2025 revenue outlook to USD 1.88-1.95 billion, citing rising raw-material bills and elongated receivable cycles as airframers pace deliveries. DuPont likewise signals continued cost pass-through for its Nomex portfolio after capacity outages at select meta-aramid plants. Tier-two panel assemblers operate on thinner margins and often lack long-term supply contracts, forcing them to hedge or absorb volatility and diluting capital available for R&D.

Other drivers and restraints analyzed in the detailed report include:

- Ramp-Up of Composite-Rich Models Requiring Advanced Floor Panel Solutions

- Rising Adoption of Recyclable Thermoplastic Honeycomb Cores for Circularity Goals

- Persistent Supply-Chain Constraints for Aerospace-Grade Honeycomb Cores

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nomex honeycomb held a 66.78% slice of the commercial aircraft floor panels market in 2024, reflecting decades of compliance with FAR 25.853 flammability rules and broad line-fit approvals. Nomex's low smoke toxicity and favorable handling encourage continued use, anchoring baseline demand even as weight-saving pressures intensify. Hexcel and DuPont supply most aramid paper worldwide, granting them scale economics that small rivals struggle to match. However, the segment's growth plateaus as operators pivot toward higher specific-modulus alternatives for premium cabins and long-range jets.

Carbon-fiber honeycomb combines thinner cell walls with superior compressive strength, unlocking cabin weight reductions of up to 10 kg per aircraft. Research published in the Journal of Sandwich Structures and Materials demonstrates that thicker-walled carbon cores avert shear-type instability under service loads, sustaining fatigue life across 90,000 flight cycles. The commercial aircraft floor panels market size for carbon-fiber cores is forecast to widen at an 8.85% CAGR. However, qualification costs and resin-film-adhesive compatibility still limit penetration on legacy narrowbody fleets. Aluminum cores remain relevant for cargo floors where impact tolerance outweighs fuel-saving potential, while emerging thermoplastic and bio-derived variants test recycling pathways crucial to European circular-economy mandates.

The innovation frontier centers on thermoplastic honeycomb options like EconCore's ThermHex, which integrates recycled polypropylene feedstock and passes vertical burn tests without phenolics. Panel makers pair these cores with PEI or PPS skins to produce fully weldable assemblies that airlines can shred and re-melt after decommissioning. Full-scale static and dynamic load trials on 9-g tie-down seats confirm equivalent structural margins, clearing an early hurdle toward line-fit status. As regulatory bodies fine-tune cradle-to-grave emissions accounting, the commercial aircraft floor panels market may progressively reward suppliers that offer transparent recycling certificates alongside performance guarantees.

The Commercial Aircraft Floor Panels Market Report is Segmented by Core Material (Nomex Honeycomb, Aluminum Honeycomb, Carbon-Fiber Honeycomb, and Others), Fitment (OEM and Aftermarket), Aircraft Type (Narrowbody, Widebody, and Regional Jets), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained a 31.10% share of the commercial aircraft floor panels market in 2024, underpinned by aggressive fleet growth across China, India, Indonesia, and Japan. Airbus projects the region's aircraft services spending to surge from USD 52 billion in 2025 to USD 129 billion by 2043, with maintenance sub-spend alone climbing to USD 109 billion. Large narrow-body backlogs, a vibrant low-cost-carrier sector, and offset agreements that favor local composites production extend procurement cycles for panel suppliers in Tianjin, Hyderabad, and Nagoya. Government-backed R&D documents stress heightened digital design adoption and highlight cost gaps versus Western peers, signaling further localization of floor panel finishing and inspection activities.

The Middle East and Africa deliver the fastest forecast expansion at 7.34% CAGR through 2030. Boeing foresees 2,370 new-build aircraft worth USD 470 billion entering the region by 2031, 69% of which will stem from passenger traffic growth and hub-and-spoke network maturation. Emirates, Qatar Airways, and Saudia collectively hold more than 880 widebody airframes on order or option, translating into high-value panel kits tailored for premium-class cabins. Concurrent investments in MRO free zones at Jeddah and Addis Ababa shorten turnaround times and foster localized panel repairs, reinforcing the region's complete value chain.

North America ranks third by revenue but commands significant technical influence because many panel design approvals sit with US or Canadian authorities. Consolidation via Boeing's USD 8.3 billion Spirit AeroSystems takeover brings strategic stockholding of honeycomb core capacity onshore, smoothing OEM deliveries yet rearranging competitive bidding for independent shops. Europe maintains a strong sustainability bent, championing recyclable thermoplastic adoption through ECO-COMPASS grants and mandating clearer life-cycle-analysis labels, pushing suppliers to co-develop closed-loop recovery hubs adjacent to Hamburg and Toulouse assembly lines. Collectively, these mature regions stabilize the commercial aircraft floor panels market by balancing cyclical production swings with predictable retrofit cycles.

- The Gill Corporation

- Collins Aerospace (RTX Corporation)

- Safran S.A.

- Triumph Group Inc.

- Singapore Technologies Engineering Ltd.

- LATECOERE

- Aeropair Ltd.

- Elbe Flugzeugwerke GmbH

- VINCORION Advanced Systems GmbH

- Satair (Airbus SE)

- Lufthansa Technik AG

- Hexcel Corporation

- Jamco Corporation

- Diab Group

- Plascore Inc.

- Euro-Composites S.A.

- FACC AG

- SEKISUI Aerospace

- Showa Aircraft Industry Co. Ltd.

- Honeycomb Company of America, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in narrowbody aircraft production backlog

- 4.2.2 Airline retrofit cycles focused on lightweight cabin refurbishment

- 4.2.3 Ramp-up of composite-rich models requiring advanced floor panel solutions

- 4.2.4 Rising adoption of recyclable thermoplastic honeycomb cores for circularity goals

- 4.2.5 Expansion of integrated MRO and PMA supply chains shortening global TAT

- 4.2.6 Stricter flammability regulations accelerating phase-out of legacy panels

- 4.3 Market Restraints

- 4.3.1 Volatile Nomex and carbon-fiber pricing compressing supplier margins

- 4.3.2 Persistent supply-chain constraints for aerospace-grade honeycomb cores

- 4.3.3 Lengthy certification and qualification cycles for new core materials and bonding processes

- 4.3.4 Adhesive-bond delamination and moisture-ingress incidents triggering fleet-wide inspection directives

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Core Material

- 5.1.1 Nomex Honeycomb

- 5.1.2 Aluminum Honeycomb

- 5.1.3 Carbon-Fiber Honeycomb

- 5.1.4 Others

- 5.2 By Fitment

- 5.2.1 OEM

- 5.2.2 Aftermarket

- 5.3 By Aircraft Type

- 5.3.1 Narrowbody Aircraft

- 5.3.2 Widebody Aircraft

- 5.3.3 Regional Jets

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 The Gill Corporation

- 6.4.2 Collins Aerospace (RTX Corporation)

- 6.4.3 Safran S.A.

- 6.4.4 Triumph Group Inc.

- 6.4.5 Singapore Technologies Engineering Ltd.

- 6.4.6 LATECOERE

- 6.4.7 Aeropair Ltd.

- 6.4.8 Elbe Flugzeugwerke GmbH

- 6.4.9 VINCORION Advanced Systems GmbH

- 6.4.10 Satair (Airbus SE)

- 6.4.11 Lufthansa Technik AG

- 6.4.12 Hexcel Corporation

- 6.4.13 Jamco Corporation

- 6.4.14 Diab Group

- 6.4.15 Plascore Inc.

- 6.4.16 Euro-Composites S.A.

- 6.4.17 FACC AG

- 6.4.18 SEKISUI Aerospace

- 6.4.19 Showa Aircraft Industry Co. Ltd.

- 6.4.20 Honeycomb Company of America, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment