PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851122

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851122

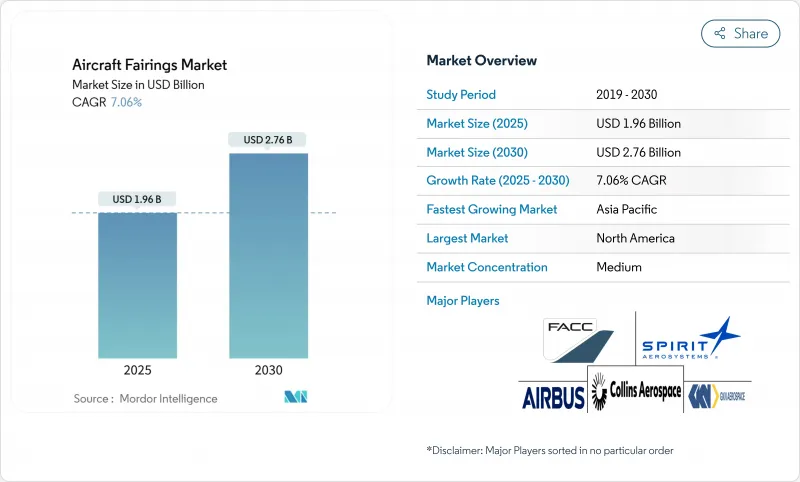

Aircraft Fairings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aircraft fairings market stands at USD 1.96 billion in 2025 and is on track to reach a market size of USD 2.76 billion by 2030, reflecting a 7.06% CAGR over the forecast horizon.

Robust production backlogs exceeding 15,000 commercial jets, rising fuel-efficiency mandates, and an accelerated push to replace aging fleets provide long-term demand visibility. Composite innovation is central to this growth pattern: carbon-fiber-reinforced polymer (CFRP) already accounts for 70% of fairing materials in service, a shift that cuts structural weight and improves corrosion resistance. Rising dependence on narrow-body programs, which contributed 48% of volumes in 2024, favors suppliers that can scale production while controlling costs. Meanwhile, the surge of UAV and eVTOL concepts-each prioritizing rapid prototyping and small-batch runs-creates premium niches that command higher margins per unit. As a result, the aircraft fairings market keeps bifurcating into high-volume commercial programs and fast-moving advanced-air-mobility demand pools, compelling suppliers to hedge capacity across both segments.

Global Aircraft Fairings Market Trends and Insights

Surging Composite Adoption to Meet Fuel-Efficiency Targets

Airlines under acute fuel-cost pressure are switching from aluminum to CFRP fairings, lifting composite content on next-generation aircraft from 13% on legacy A330s to more than 50% today. Airbus' Multifunctional Fuselage Demonstrator shows that thermoplastic skins can cut a further 10% weight while supporting automated welding for 100-per-month build rates. Economic benefits remain compelling: lifetime fuel savings can offset 15-20% of an aircraft's purchase price when installed composite fairings. Yet this transition demands heavy capital outlays for autoclaves, robotic lay-up cells, and specialized labor, heightening entry barriers and prompting OEMs to favor partners owning mature composite ecosystems

Rapid Fleet-Wide Replacement of Aging Aircraft

More than 700 jets retire yearly, triggering component harvesting and refurbishment demand that enlarges the retrofit market. Wide-body fairings see sharper wear from long-haul cycles, pushing operators toward aerodynamic upgrade kits rather than new-build orders amid delivery delays. Circular-economy programs that reclaim composite fairings for secondary markets, exemplified by Sumitomo's tie-up with Werner Aero, are gaining traction but face the hard reality that CFRP recycling is limited and cost-intensive.

High and Volatile Prices of Carbon-Fiber, Epoxy, and High-Temperature Resins Compress Supplier Margins

Carbon-fiber demand in aerospace is projected to grow 17% annually, but capacity additions require expensive, long-cycle investments. Geopolitical tension and tariff exposure complicate price forecasting, prompting suppliers to adopt cost-plus contracts yet forcing smaller firms into untenable working-capital positions.

Other drivers and restraints analyzed in the detailed report include:

- Hybrid-Electric Aircraft Programs Spur New Fairing Designs

- Record Commercial Single-Aisle Backlog Underpins Production Visibility

- Stringent Certification Cycles Delaying New Fairing Technologies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fuselage fairings generated 33.24% of the aircraft fairings market size in 2024, thanks to their complex wing-body junction geometries and high OEM integration hurdles. Demand remains sticky because any design change obliges full aerodynamic retesting, making incumbent suppliers difficult to displace. Landing-gear fairings are accelerating at 7.15% CAGR, propelled by tighter airport noise limits and eVTOL program requirements for retractable struts. Wing-body and control-surface fairings stay aligned with mainstream build rates, whereas engine fairings pick up incremental growth from hybrid-electric demonstrators that mandate cooled fairing shells.

Emerging mobility platforms skew design briefings toward rapid manufacturing. Wichita State University's research shows UAV operators prefer printable modular fairings in days, not weeks. Deutsche Aircraft's D328eco contract bundling fuselage and landing-gear doors into a single award underlines OEM moves toward integrated supplier packages. Such bundling favors vendors with broad design toolsets and test-article capacity.

CFRP's 63.48% share underscores its entrenched status across wide-body, narrow-body, and even rotorcraft programs. Yet thermoplastic composites and additively manufactured polymers-growing 9.39% annually-remove autoclave bottlenecks and enable part-count consolidation that slashes assembly labor. For lightweight UAV fairings, cost sensitivity keeps glass fiber viable, while critical damage-tolerant locations (such as lower fuselage chine panels) still rely on aluminum-lithium alloys.

Hexcel's HexAM PEKK-laser-sintering platform prints complex fairing brackets that are impossible to machine conventionally, cutting scrap and weight simultaneously. EU-funded DOMMINIO efforts extend this digital thread by embedding structural-health sensors into thermoplastic fairings, bringing predictive integrity monitoring directly to line-fit installations. Over time, blended material stacks that mate laminated CFRP skins to printed thermoplastic ribs could dominate the aircraft fairings market.

The Aircraft Fairings Market Report is Segmented by Application (Fuselage, Landing Gear, Wings, Control Surfaces, and Engine), Material (Glass-Fiber Composites, Metal Alloys, Thermoplastic Composites, and More), Aircraft Type (Commercial, Military, and More), Sales Channel (OEM Production and Aftermarket MRO), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 36.54% of the aircraft fairings market share in 2024, supported by Boeing's production recovery and a USD 1 billion GE Aerospace manufacturing commitment that boosts composite capacity in multiple US states. Long-established clusters in Washington and South Carolina give suppliers a mature ecosystem, although tariff policies and skilled-labor gaps continue to strain cost bases. RTX's USD 2 billion facilities expansion highlights OEM faith in sustained demand even as the near-term operating environment remains inflationary.

Asia-Pacific is the fastest-growing region, showing 8.83% CAGR to 2030. Indigenous programs such as China's C919 or India's HTT-40 intensify localization mandates, drawing Western tier-1s into joint-venture factories. Strata Manufacturing recorded 38% output growth, exporting 11,774 structures across Airbus and Boeing models, signaling the Gulf's ambition to become a composites powerhouse. Hanwha Aerospace's new 100,000 m2 Vietnam site for GE and Rolls-Royce components further validates the shift.

Europe benefits from Airbus' production tempo and focuses on green materials. Airbus' bio-based carbon-fiber feasibility trials for helicopter fairings mark early steps toward carbon-neutral supply chains. Japan preserves a niche as a high-grade carbon-fiber supplier, with Mitsubishi Chemical targeting 12% composite growth on future mobility programs. Meanwhile, Middle East and Africa markets leverage free-trade zones and proximity to long-haul routes to win offset work from OEMs. However, achieving certification parity with Western peers remains an ongoing task.

- Airbus Aerostructures (Airbus SE)

- Boeing Aerostructures Australia (The Boeing Company)

- Collins Aerospace (RTX Corporation)

- FACC AG

- GKN Aerospace

- Spirit AeroSystems, Inc.

- Saab AB

- Strata Manufacturing PJSC

- LATECOERE S.A

- Kaman Corporation

- CTRM Sdn. Bhd.

- ShinMaywa Industries, Ltd.

- Royal Engineered Composites

- FDC Composites Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging composite adoption to meet fuel-efficiency targets

- 4.2.2 Rapid fleet-wide replacement of aging aircraft

- 4.2.3 Proliferation of UAV, advanced air mobility, and eVTOL platforms

- 4.2.4 Growth of aftermarket MRO expenditure on replacement fairings

- 4.2.5 Hybrid-electric aircraft programs spur new fairing designs

- 4.2.6 Record commercial single-aisle backlog underpins production visibility

- 4.3 Market Restraints

- 4.3.1 High and volatile prices of carbon fiber, epoxy, and high-temperature resins

- 4.3.2 Stringent certification cycles delaying new fairing technologies

- 4.3.3 Supply-chain consolidation reducing sourcing optionality and compressing margins

- 4.3.4 Geopolitical trade tensions and tariffs inflating raw-material costs

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Fuselage

- 5.1.2 Landing Gear

- 5.1.3 Wings

- 5.1.4 Control Surfaces

- 5.1.5 Engine

- 5.2 By Material

- 5.2.1 Carbon-Fiber Reinforced Polymer (CFRP)

- 5.2.2 Glass-Fiber Composites

- 5.2.3 Metal Alloys

- 5.2.4 Thermoplastic Composites

- 5.2.5 Additively-Manufactured Thermoplastics

- 5.3 By Aircraft Type

- 5.3.1 Commercial

- 5.3.1.1 Narrow-Body Commercial Aircraft

- 5.3.1.2 Wide-Body Commercial Aircraft

- 5.3.2 Military

- 5.3.2.1 Combat

- 5.3.2.2 Non-Combat

- 5.3.3 General Aviation

- 5.3.4 Unmanned Systems

- 5.3.1 Commercial

- 5.4 By Sales Channel

- 5.4.1 OEM Production

- 5.4.2 Aftermarket MRO

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Airbus Aerostructures (Airbus SE)

- 6.4.2 Boeing Aerostructures Australia (The Boeing Company)

- 6.4.3 Collins Aerospace (RTX Corporation)

- 6.4.4 FACC AG

- 6.4.5 GKN Aerospace

- 6.4.6 Spirit AeroSystems, Inc.

- 6.4.7 Saab AB

- 6.4.8 Strata Manufacturing PJSC

- 6.4.9 LATECOERE S.A

- 6.4.10 Kaman Corporation

- 6.4.11 CTRM Sdn. Bhd.

- 6.4.12 ShinMaywa Industries, Ltd.

- 6.4.13 Royal Engineered Composites

- 6.4.14 FDC Composites Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment