PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851123

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851123

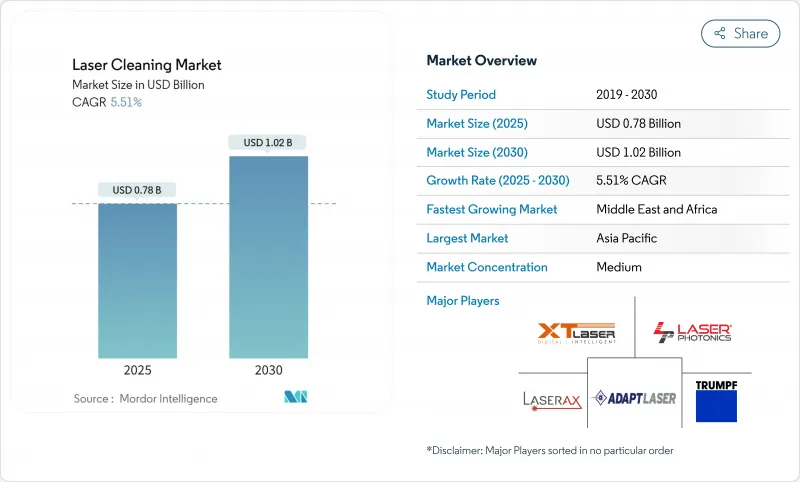

Laser Cleaning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The laser cleaning market size stands at USD 0.78 billion in 2025 and is forecast to reach USD 1.02 billion by 2030, reflecting a 5.51% CAGR.

Growth is propelled by strict limits on chemical solvents in Europe and North America, falling cost-per-watt of fiber lasers in Asia, and rising demand for contact-free surface preparation across automotive, aerospace, and semiconductor plants. Rapid integration with robotics is reshaping production lines, while ultrashort-pulse technology broadens precision applications in micro-electronics and cultural heritage restoration. Capital spending is easing as component prices decline, yet high-power systems remain cost-intensive in developing regions.

Global Laser Cleaning Market Trends and Insights

Stringent Environmental Regulations Replacing Chemical Solvents

EPA restrictions on perchloroethylene, finalized in December 2024, prohibit most industrial uses and accelerate the shift from chemical cleaning to lasers.Similar limits on hazardous air pollutants introduced in January 2025 add compliance pressure. Laser solutions generate no secondary waste, trimming disposal fees and reporting burdens for plants that once relied on solvents. The policy environment therefore shortens payback periods for laser installations and directly fuels laser cleaning market growth. Suppliers are aligning products with government rebate programs that support low-emission equipment upgrades.

Rising Automation Demand for Non-contact Surface Preparation

High-volume factories now pair fiber lasers with collaborative robots to cut labor time and achieve consistent surface quality. IPG Photonics' LightWELD robotic cell launched in May 2024 illustrates a plug-and-play system that toggles between welding and cleaning at the tap of a screen.Automotive body shops adopt similar cells for seam preparation before welding aluminum body panels. Automation also mitigates skilled-worker shortages, letting one operator supervise multiple stations. This efficiency edge underpins the 14.6% CAGR projected for robotic laser work cells-well above the overall laser cleaning market trajectory. Vendors are integrating vision software and AI to auto-adjust parameters, reducing operator training time and widening adoption.

High Capital Expenditure Barriers in Developing Markets

High-power lasers above 1 kW cost USD 300,000-500,000, a sum that strains small manufacturers' budgets and delays orders in Indonesia, Brazil, and Kenya usni.org. Although falling diode prices reduce ownership costs each year, financing hurdles remain. Leasing programs are emerging, yet interest rates elevate total outlay. Governments that offer green-equipment tax credits improve affordability, but uptake is slow outside large industrial hubs. As a result, many buyers in emerging economies continue to rely on abrasive blasting for heavy-duty cleaning despite safety and environmental drawbacks, moderating laser cleaning market penetration.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Restoration Projects of Historical Monuments

- EV Battery Production Lines Necessitating Residue-free Electrode Cleaning

- Field Deployment Challenges for Remote Applications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fiber sources delivered 58% of 2024 revenue for the laser cleaning market because internal diode coupling yields 40% wall-plug efficiency and sealed optical paths avert contamination, letting units run 50,000 hours without realignment. Chinese job shops buy 300 W units for mold maintenance, while German EV factories deploy 3 kW heads for axle de-scaling, illustrating versatility across power classes. As diode prices dip below USD 10/W, even textile-machinery rebuilders in Vietnam join the customer roster, broadening global reach of the laser cleaning market.

Ultrashort-pulse machines, growing 6.6% CAGR, exploit cold-ablation to lift 20 nm oxides from silicon wafers without melting substrates.Vendors ship 50 W femtosecond heads for watch-movement restoration and 100 W picosecond rigs for high-density interconnect boards, highlighting expansion beyond academia into volume manufacturing. Solid-state and CO2 lasers maintain niche roles: stone sculpture cleaning makes use of longer wavelengths that couple efficiently into carbonate matrices, whereas plastics processors rely on 10.6 µm CO2 energy to avoid metal substrate heating.

Medium-power (100 W-1 kW) units controlled 46% of the 2024 laser cleaning market size, offering removal rates suitable for automotive subframes yet plugging into standard factory mains. Tier-1 suppliers report that 500 W handheld guns strip mill scale 60% faster than 120 grit sanding while eliminating consumable discs. This productivity sweet spot drives repeat orders and underpins market resilience when capital budgets tighten.

High-power segments above 1 kW grow 7.1% CAGR as shipyards and rail depots seek faster hull descaling. Precision Laser Cleaning in Australia demonstrates 20 m2/h removal of antifouling coatings, cutting dry-dock time and saving fuel on cleaned vessels.au. Gold Mark's 4-in-1 3 kW platform combines welding, cleaning, cutting, and texturing, persuading fabricators to replace multiple machines with a single multipurpose asset. Low-power (<100 W) devices cater to jewelers and archivists for sub-micron contaminant removal where heat sensitivity overrides cycle-time concerns.

The Laser Cleaning Market Report is Segmented by Laser Type (Fiber Lasers, Solid-State (Nd:YAG/Yb:YAG) Lasers, and More), Portability (Handheld/Portable Systems, and More), Pulse Duration (Continuous-Wave, and More), Application (Paint and Coating Removal, and More), Power Range (High, Medium, and Low), End-User Industry (Automotive and Transport, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific dominated 2024 revenue with 41%, reflecting dense electronics clusters and automotive supply chains in China, Japan, and South Korea. Regional governments promote high-tech manufacturing incentives that make capital spending on lasers easier to justify. The region's small-to-medium enterprises increasingly embrace 300 W fiber tools as diode prices fall. Pilot projects such as Mitsui O.S.K. Lines' InfraLaser rust-removal system confirm industry appetite for cleaner ship maintenance.

Europe follows with strong adoption across sustainable manufacturing and heritage conservation. Strict solvent bans align with laser cleaning market momentum. The EU's focus on net-zero industry policies creates funding channels for plant upgrades, while museums deploy femtosecond units to delicately restore frescoes. Germany's Fraunhofer ILT, through the IDEEL project, demonstrates roll-to-roll laser drying that complements electrode cleaning in battery lines.

North America leverages mature aerospace, defense, and nuclear sectors. Laser cleaning removes oxide films from turbine blades and decontaminates reactor vessels, supported by Department of Energy R&D grants. Mexico's auto clusters in Nuevo Leon and Guanajuato invest in 300 W handheld gear to upgrade welding jigs. The Middle East & Africa leads growth at 6.1% CAGR as national oil companies invest in corrosion control and heritage authorities restore archaeological sites. Latin America grows steadily in Brazil's auto plants and Chile's mining conveyors, but limited financing slows penetration in smaller economies.

- TRUMPF Group

- IPG Photonics Corporation

- Clean-Lasersysteme GmbH

- Laser Photonics Corporation

- P-Laser NV

- Laserax Inc.

- Adapt Laser Systems LLC

- Jinan Xintian Technology Co. Ltd (XT Laser)

- HGLaser Engineering Co. Ltd

- Han's Laser Technology Industry Group Co. Ltd

- Coherent Corp.

- Scantech Laser Pvt. Ltd

- Anilox Roll Cleaning Systems

- Shenzhen Riselaser Technology Co. Ltd

- Sukjin Laser Co.

- Allied Scientific Pro

- CyCleanLaser GmbH

- PharosQuartz (Light Conversion)

- Suresh Industech Pvt. Ltd

- RMA Technik GmbH

- Jinan Vmade CNC Machine Co., Ltd

- Shanghai Mactron Technology Co. Ltd

- Lynton Lasers Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Environmental Regulations Replacing Chemical Solvents in EU and North America

- 4.2.2 Rising Automation Demand for Non-contact Surface Preparation in Automotive Body Shops

- 4.2.3 Growth in Restoration Projects of Historical Monuments in Europe and Asia

- 4.2.4 Investments in Nuclear Facility Decommissioning Requiring Remote Laser Decontamination

- 4.2.5 EV Battery Production Lines Necessitating Residue-free Electrode Cleaning

- 4.2.6 Falling Cost-per-Watt of Fiber Lasers Broadening SME Adoption in Asia

- 4.3 Market Restraints

- 4.3.1 High Capital Expenditure for High-power Systems in Developing Economies

- 4.3.2 Limited Field Portability for Offshore Maintenance

- 4.3.3 Substrate Thermal Damage Risk on Heat-Sensitive Materials

- 4.3.4 Scarcity of Certified Laser Cleaning Technicians in Emerging Markets

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.5.1 Advances in Ultrashort-Pulse (Ps/Fs) Sources

- 4.5.2 Integration with Collaborative Robots

- 4.6 Regulatory Outlook

- 4.6.1 Global VOC and Hazardous-Chemical Directives

- 4.6.2 OSHA and IEC Laser-Safety Standards

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Laser Type

- 5.1.1 Fiber Lasers

- 5.1.2 Solid-state (Nd:YAG/Yb:YAG) Lasers

- 5.1.3 CO2 Lasers

- 5.1.4 Ultrashort-Pulse (Picosecond/Femtosecond) Lasers

- 5.2 By Power Range

- 5.2.1 High Power (Greater than 1 kW)

- 5.2.2 Medium Power (100 W-1 kW)

- 5.2.3 Low Power (Less than 100 W)

- 5.3 By Portability

- 5.3.1 Handheld/Portable Systems

- 5.3.2 Benchtop/Stationary Systems

- 5.3.3 Robotic/Automated Integrated Cells

- 5.4 By Pulse Duration

- 5.4.1 Continuous-Wave

- 5.4.2 Nanosecond Pulsed

- 5.4.3 Ultrashort-Pulse (Ps/Fs)

- 5.5 By Application

- 5.5.1 Paint and Coating Removal

- 5.5.2 Rust and Oxide Removal

- 5.5.3 Surface Pretreatment and Welding Preparation

- 5.5.4 Mold Cleaning and Tooling Maintenance

- 5.5.5 Cultural Heritage and Artwork Restoration

- 5.5.6 Micro-electronics and Precision Cleaning

- 5.5.7 Nuclear Decontamination

- 5.6 By End-user Industry

- 5.6.1 Automotive and Transport

- 5.6.2 Aerospace and Defense

- 5.6.3 Shipbuilding and Marine

- 5.6.4 Infrastructure and Construction

- 5.6.5 Energy and Power

- 5.6.5.1 Oil and Gas

- 5.6.5.2 Nuclear

- 5.6.5.3 Renewables

- 5.6.6 Electronics and Semiconductor

- 5.6.7 Cultural Heritage Institutions

- 5.6.8 Manufacturing and Industrial Machinery

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 South East Asia

- 5.7.3.6 Australia

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 United Arab Emirates

- 5.7.5.1.2 Saudi Arabia

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 TRUMPF Group

- 6.4.2 IPG Photonics Corporation

- 6.4.3 Clean-Lasersysteme GmbH

- 6.4.4 Laser Photonics Corporation

- 6.4.5 P-Laser NV

- 6.4.6 Laserax Inc.

- 6.4.7 Adapt Laser Systems LLC

- 6.4.8 Jinan Xintian Technology Co. Ltd (XT Laser)

- 6.4.9 HGLaser Engineering Co. Ltd

- 6.4.10 Han's Laser Technology Industry Group Co. Ltd

- 6.4.11 Coherent Corp.

- 6.4.12 Scantech Laser Pvt. Ltd

- 6.4.13 Anilox Roll Cleaning Systems

- 6.4.14 Shenzhen Riselaser Technology Co. Ltd

- 6.4.15 Sukjin Laser Co.

- 6.4.16 Allied Scientific Pro

- 6.4.17 CyCleanLaser GmbH

- 6.4.18 PharosQuartz (Light Conversion)

- 6.4.19 Suresh Industech Pvt. Ltd

- 6.4.20 RMA Technik GmbH

- 6.4.21 Jinan Vmade CNC Machine Co., Ltd

- 6.4.22 Shanghai Mactron Technology Co. Ltd

- 6.4.23 Lynton Lasers Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment