PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851124

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851124

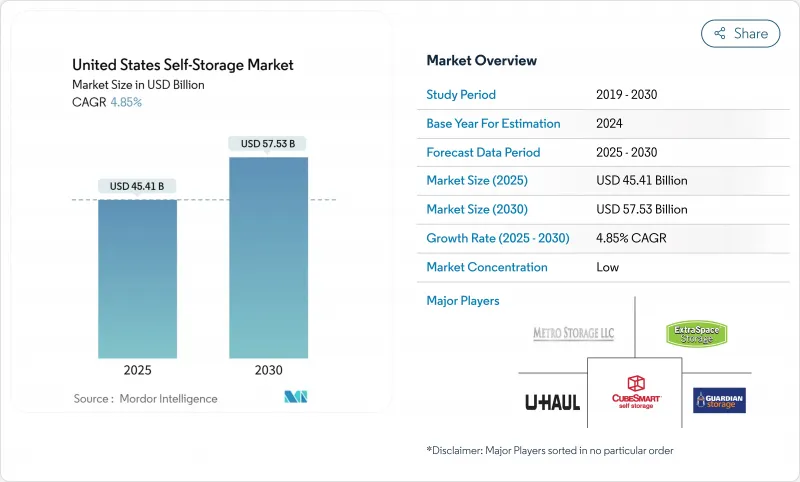

United States Self-Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States self-storage market size generated USD 45.41 billion in 2025 and is projected to reach USD 57.53 billion by 2030, advancing at a 4.85% CAGR.

Sustained demand stems from urban population growth, shrinking living spaces, and the expanding e-commerce ecosystem that needs micro-fulfillment hubs. Rising adoption of climate-controlled units, adaptive reuse of vacant retail and office buildings, and digital booking platforms add structural resilience and pricing power. Institutional capital continues to reshape competitive dynamics as public REITs deepen market penetration and standardize technology adoption, while zoning constraints and construction-cost inflation temper new supply in densely populated corridors.

United States Self-Storage Market Trends and Insights

Increased Urbanization & Shrinking Dwelling Size

Housing underproduction of 3.85 million units and 1.1% metropolitan population growth magnify space constraints, pushing residents toward external storage solutions. Limited housing supply relative to population gains sustains premium rents for centrally located facilities, ensuring utilization beyond traditional moving spikes. Urban zoning that limits new housing inadvertently lifts long-term storage demand, reinforcing the importance of high-density footprints for operators.

Growth in E-commerce Micro-Fulfillment Demand

E-commerce businesses increasingly deploy the United States self-storage market as an affordable urban micro-warehouse network, driving the business segment's 5.8% CAGR. Container-based sites offer flexible staging for seasonal inventory and rapid market entry, complementing same-day delivery expectations in congested metro areas. Facilities that integrate fulfillment-friendly layouts and extended access hours achieve higher revenue per square foot compared with purely personal-use models.

Zoning & Land-Use Restrictions in Urban Cores

Cities such as Pasco County impose stringent design and landscaping standards, steering developers to less regulated suburbs. Approval delays inflate carrying costs and curb supply growth where demand is strongest, elevating occupancy in existing facilities but reducing incremental expansion potential.

Other drivers and restraints analyzed in the detailed report include:

- Rising Residential Mobility & Migration Rates

- Adaptive Reuse of Distressed Retail/Office Assets

- Escalating Land & Construction Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Personal customers accounted for 73% of the United States self-storage market in 2024, providing a dependable revenue floor rooted in life-event storage needs. Business users, however, are scaling at 5.8% CAGR as online retailers leverage urban units to shorten delivery distances. The United States self-storage market size attributable to business tenants is projected to expand by 2030, signaling a durable shift toward commercial utilization.

Expanding same-day delivery commitments elevate the importance of near-consumer inventory nodes. Operators that design flexible unit mixes, integrate 24/7 digital access, and provide loading docks position themselves to capture structurally higher revenue per square foot from small-business clients.

Small units (<=100 sq ft) captured 44% of 2024 revenue, benefiting from urban density and high turnover. Climate-controlled lockers-spanning all size bands-registered a 5.9% CAGR, outpacing non-conditioned counterparts due to tenant willingness to pay 20-50% premiums for temperature and humidity control. The United States self-storage market share for these premium units is set to climb as ESG mandates drive institutional investors toward energy-efficient, solar-integrated HVAC systems.

Energy management advancements moderate operating costs, allowing operators to maintain premium pricing without margin erosion. Marketing campaigns that highlight protection benefits for electronics and documents further solidify demand among both households and businesses.

United States Self Storage Companies is Segmented by User Type (Personal and Business), Unit Size (<= 100 Sq Ft (Small), 101-200 Sq Ft (Medium), and More), Property Type (Purpose-Built Facilities, Converted Commercial Buildings, and More), Booking Channel (Offline, Online Aggregators & Operator Portals), End-Use Duration (Short-Term, Long-Term), and by Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Metro Storage LLC

- Guardian Storage Solutions

- CubeSmart LP

- Extra Space Storage Inc.

- U-Haul International Inc.

- Life Storage Inc.

- National Storage Affiliates Trust

- Public Storage

- StorageMart

- Simply Self Storage Management LLC

- KO Storage

- Global Self Storage Inc.

- Prime Storage Group

- Storage Asset Management LLC

- SmartStop Self Storage REIT Inc.

- A-American Self Storage

- StorQuest Self Storage

- Safeguard Self Storage

- SpareBox Storage

- Mini U Storage

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased urbanization and shrinking dwelling size

- 4.2.2 Growth in e-commerce micro-fulfilment demand

- 4.2.3 Rising residential mobility and migration rates

- 4.2.4 Adaptive reuse of distressed retail/office assets

- 4.2.5 Emergence of on-demand valet storage platforms

- 4.2.6 Weather-related loss-mitigation storage needs

- 4.3 Market Restraints

- 4.3.1 Zoning and land-use restrictions in urban cores

- 4.3.2 Escalating land and construction costs

- 4.3.3 ESG scrutiny on energy-intensive climate units

- 4.3.4 Margin pressure from REIT consolidation wave

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Pricing Analysis (Rent / sq-ft)

- 4.9 Operational Metrics Benchmarking

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By User Type

- 5.1.1 Personal

- 5.1.2 Business

- 5.2 By Unit Size

- 5.2.1 ? 100 sq ft (Small)

- 5.2.2 101-200 sq ft (Medium)

- 5.2.3 > 200 sq ft (Large/Vehicle)

- 5.2.4 Climate-controlled lockers

- 5.3 By Property Type

- 5.3.1 Purpose-built facilities

- 5.3.2 Converted commercial buildings

- 5.3.3 Container-based/mobile sites

- 5.4 By Booking Channel

- 5.4.1 Offline (walk-in / phone)

- 5.4.2 Online aggregators and operator portals

- 5.5 By End-use Duration

- 5.5.1 Short-term (< 6 months)

- 5.5.2 Long-term (> 6 months)

- 5.6 By Region

- 5.6.1 Northeast

- 5.6.2 Midwest

- 5.6.3 South

- 5.6.4 West

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes global level overview, market level overview, core segments, financials as available, strategic information, market rank/share for key companies, products and services, and recent developments)

- 6.4.1 Metro Storage LLC

- 6.4.2 Guardian Storage Solutions

- 6.4.3 CubeSmart LP

- 6.4.4 Extra Space Storage Inc.

- 6.4.5 U-Haul International Inc.

- 6.4.6 Life Storage Inc.

- 6.4.7 National Storage Affiliates Trust

- 6.4.8 Public Storage

- 6.4.9 StorageMart

- 6.4.10 Simply Self Storage Management LLC

- 6.4.11 KO Storage

- 6.4.12 Global Self Storage Inc.

- 6.4.13 Prime Storage Group

- 6.4.14 Storage Asset Management LLC

- 6.4.15 SmartStop Self Storage REIT Inc.

- 6.4.16 A-American Self Storage

- 6.4.17 StorQuest Self Storage

- 6.4.18 Safeguard Self Storage

- 6.4.19 SpareBox Storage

- 6.4.20 Mini U Storage

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment