PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851125

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851125

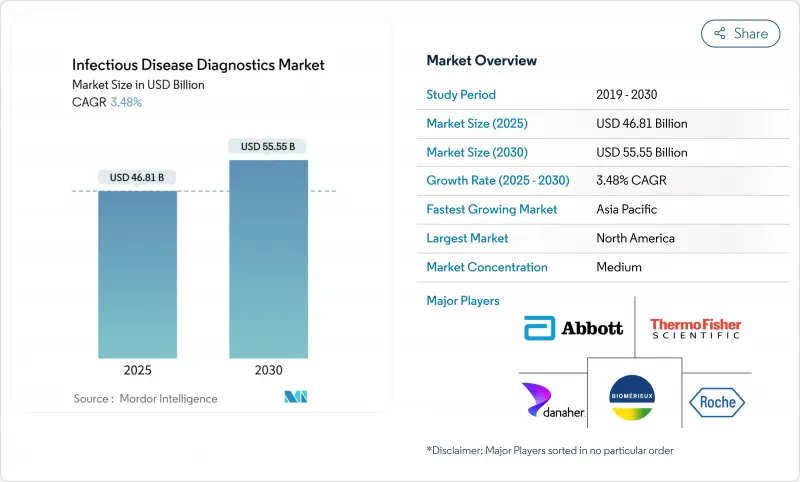

Infectious Disease Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The infectious disease diagnostics market stands at USD 46.81 billion in 2025 and is on course to reach USD 55.55 billion by 2030, growing at a 3.48% CAGR.

This steady trajectory shows how the infectious disease diagnostics market is moving from pandemic-driven demand toward long-term growth anchored in endemic disease management, climate-linked outbreaks, and ongoing technology upgrades. Spending is broadening beyond respiratory tests to include vector-borne, antimicrobial-resistant, and emerging pathogens, helping laboratories offset lower COVID-19 volumes. Reagent sales remain the revenue backbone, yet software-enabled workflow tools are scaling fast as labs seek automation efficiencies. Competitive intensity is rising because new entrants armed with CRISPR, isothermal, and AI capabilities are challenging incumbents for share in the infectious disease diagnostics market.

Global Infectious Disease Diagnostics Market Trends and Insights

Escalating Prevalence and Resurgence of Infectious Diseases

Vector-borne illnesses are climbing, with dengue cases running 15% above the five-year average in early 2025.Climate change is widening mosquito habitats, so providers now test for pathogens once restricted to the tropics. The World Health Organization classified mpox as a grade 3 emergency in August 2024, prompting a 160% jump in test demand over the prior year. Antimicrobial resistance adds pressure: the WHO's 2024 priority list highlights 15 resistant bacterial families that need rapid diagnostics. As new threats surface, laboratories must refresh menus frequently, creating recurring revenue for firms across the infectious disease diagnostics market.

Growing Demand for Point-of-Care and At-Home Testing

Regulators are green-lighting consumer tests at pace. In August 2024 the FDA cleared the first OTC syphilis assay, ushering retail diagnostics into mainstream practice. Syphilis incidence rose 80% from 2018 to 2022, so community pharmacies and e-commerce portals now stock rapid kits. Cepheid's finger-stick hepatitis C test adds same-visit viral confirmation, closing care gaps in primary clinics. Payers value earlier therapy starts that reduce downstream costs, so reimbursement processes are catching up, even as coding complexity persists.

Fragmented and Inadequate Reimbursement Frameworks

Payers insist on stringent coding before honoring claims, and the added paperwork stretches cash cycles for smaller labs. Government fee schedules, especially in low- and middle-income countries, rarely cover the full cost of advanced molecular platforms, limiting uptake. Laboratories in such settings rely on donor programs, slowing commercial momentum despite clear clinical need. Harmonized payment models would unlock wider adoption across the infectious disease diagnostics market.

Other drivers and restraints analyzed in the detailed report include:

- Continuous Innovation in PCR/NGS Platforms and Chemistries

- AI-Driven Laboratory Workflows for Testing

- Budget Squeeze After COVID-19 Testing Wind-Down

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Respiratory panels held 20.13% of infectious disease diagnostics market share in 2024, yet vector-borne and emerging pathogens are set to climb at a 5.78% CAGR to 2030. A record 13 million dengue cases in 2024-2025 forced hospitals to expand test menus. Mpox, hepatitis, HIV self-tests, and AI-assisted tuberculosis assays broaden the clinical mix. The infectious disease diagnostics market size attached to vector-borne testing will keep rising as global mobility and climate change alter transmission zones.

Growth relies on rapid antimicrobial susceptibility tools for hospital-acquired infections and FDA OTC clearances for STI home kits. Laboratories value platforms that update quickly when the WHO adds bacteria to its resistance list; such flexibility strengthens vendor stickiness inside the infectious disease diagnostics market.

Assays, kits, and reagents contributed 53.45% of infectious disease diagnostics market size in 2024 because consumables drive recurring revenue. Software and informatics, though smaller, will post the quickest 5.66% CAGR as labs digitize workflows. Instruments now compete on automation depth, sample-to-answer speed, and AI tie-ins rather than raw throughput alone.

Contract-testing services grow when hospitals outsource complex sequencing or drug-resistance panels. Cloud-based analytics link raw data to actionable reports, enhancing value per test. Vendors bundling reagents with informatics maintain share even as hardware margins tighten across the infectious disease diagnostics market.

The Infectious Disease Diagnostics Market Report is Segmented by Application (Hepatitis, HIV, and More), by Product & Service (Assays, Kits, & Reagents, and More), by Technology (PCR & QPCR, and More), End User (Hospital & Clinical Laboratories, and More), Test Setting (Laboratory-Based Testing, and More), Sample Type(Urine, Stool and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 45.26% of global revenue in 2024, supported by established reimbursement rules, fast FDA clearances, and high routine screening volume. However, the region is now confronting budget compression as COVID-19 testing revenues fade, prompting labs to broaden menus and accelerate automation.

Asia-Pacific is projected to grow at a 5.36% CAGR to 2030 owing to infrastructure investment and rising infectious-disease burdens. Government programs in China, India, and Japan subsidize rapid dengue, mpox, and antimicrobial-resistance panels, which shortens adoption cycles. Digital health pilots link remote kits to teleconsults, increasing reach in rural regions.

Europe maintains steady demand and leads syndromic multiplex adoption. Fragmented reimbursement and data-privacy legislation slow cross-border digital-health scaling, yet antimicrobial-stewardship initiatives keep pressure on hospitals to deploy rapid diagnostics. Middle East and Africa markets remain smaller but are receiving donor-funded upgrades that create footholds for suppliers seeking geographic diversification within the infectious disease diagnostics market.

- Abbott Laboratories

- Roche

- Danaher (Cepheid & Beckman Coulter)

- bioMerieux

- Thermo Fisher Scientific

- Beckton Dickinson

- Siemens Healthineers

- Bio-Rad Laboratories

- DiaSorin (Luminex)

- Quidel-Ortho

- Hologic

- QIAGEN

- Sysmex

- Seegene

- Quest Diagnostics

- Lucira Health

- GenMark Diagnostics

- Oxford Nanopore Technologies

- T2 Biosystems

- Sherlock Biosciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Prevalence & Resurgence Of Infectious Diseases

- 4.2.2 Growing Demand For Point-Of-Care & At-Home Testing

- 4.2.3 Continuous Innovation In Pcr/Ngs Platforms & Chemistries

- 4.2.4 Initiatives Taken By The Government For Prevention, Diagnosis, And Awareness Of Infectious Diseases

- 4.2.5 Expansion Of Molecular Diagnostics And Rapid Antigen Testing

- 4.2.6 AI-Driven Workflows For Testing

- 4.3 Market Restraints

- 4.3.1 Fragmented & Inadequate Reimbursement Frameworks

- 4.3.2 Budget Squeeze After Covid-19 Testing Wind-Down

- 4.3.3 Over-Capacity Of Swab/PCR Kit Manufacturing Assets

- 4.3.4 Regulatory Grey Zones For Multiplex CRISPR Assays

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Application

- 5.1.1 Hepatitis (A, B, C, D, E)

- 5.1.2 HIV / AIDS

- 5.1.3 CT/NG & Other STIs

- 5.1.4 Tuberculosis

- 5.1.5 Respiratory (Influenza, RSV, COVID-19, Others)

- 5.1.6 Vector-borne & Emerging Pathogens (Dengue, Zika, Mpox)

- 5.1.7 Hospital-Acquired Infections (MRSA, C. diff, etc.)

- 5.1.8 Others (Malaria, Lyme, Toxoplasmosis)

- 5.2 By Product & Service

- 5.2.1 Assays, Kits & Reagents

- 5.2.2 Instruments & Analyzers

- 5.2.3 Software & Informatics

- 5.2.4 Services & Contract Testing

- 5.3 By Technology

- 5.3.1 PCR & qPCR

- 5.3.2 Isothermal NAAT (LAMP, INAAT, TMA)

- 5.3.3 Immunodiagnostics (ELISA, CLIA, LFIA)

- 5.3.4 DNA/RNA Sequencing & NGS

- 5.3.5 Microarray & Multiplex Panels

- 5.3.6 CRISPR-based Diagnostics

- 5.3.7 Metagenomic & Shotgun Sequencing

- 5.4 By End User

- 5.4.1 Hospital & Clinical Laboratories

- 5.4.2 Reference / Central Laboratories

- 5.4.3 Point-of-Care / Decentralised Settings

- 5.4.4 Home-care & OTC Consumers

- 5.4.5 Academic & Research Institutes

- 5.5 By Test Setting

- 5.5.1 Laboratory-based Testing

- 5.5.2 Point-of-Care Testing

- 5.5.3 Over-the-Counter / At-Home Testing

- 5.6 By Sample Type

- 5.6.1 Blood / Plasma / Serum

- 5.6.2 Swab (NP/OP, Saliva)

- 5.6.3 Urine

- 5.6.4 Stool

- 5.6.5 Other Fluids (CSF, Sputum, etc.)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 Australia

- 5.7.3.5 South Korea

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East and Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche AG

- 6.3.3 Danaher (Cepheid & Beckman Coulter)

- 6.3.4 bioMerieux SA

- 6.3.5 Thermo Fisher Scientific

- 6.3.6 Becton, Dickinson and Company

- 6.3.7 Siemens Healthineers

- 6.3.8 Bio-Rad Laboratories

- 6.3.9 DiaSorin (Luminex)

- 6.3.10 Quidel-Ortho

- 6.3.11 Hologic Inc.

- 6.3.12 Qiagen N.V.

- 6.3.13 Sysmex Corporation

- 6.3.14 Seegene Inc.

- 6.3.15 Quest Diagnostics

- 6.3.16 Lucira Health

- 6.3.17 GenMark Diagnostics

- 6.3.18 Oxford Nanopore Technologies

- 6.3.19 T2 Biosystems

- 6.3.20 Sherlock Biosciences

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment