PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851127

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851127

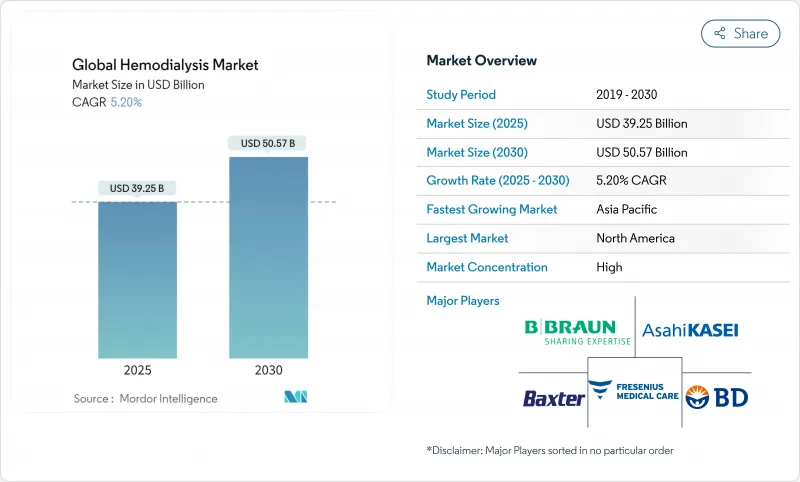

Global Hemodialysis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hemodialysis market reached USD 39.25 billion in 2025 and is forecast to climb to USD 50.57 billion by 2030, advancing at a 5.2% CAGR.

A growing pool of end-stage renal disease and chronic kidney disease patients, now topping 800 million worldwide, sustains long-term demand for renal replacement therapy bmcnephrology.biomedcentral. Population aging in high-income countries, together with rising diabetes and hypertension prevalence, widens the clinical base. Artificial intelligence already predicts intradialytic hypotension with 96% accuracy, trims avoidable complications, and improves anemia dosing decisions versus traditional protocols nature. Reimbursement stability in the United States-Medicare lifted the ESRD base rate to USD 273.82 for 2025-keeps in-center clinics financially viable even as home programs expand . Meanwhile, sustainability directives and bundled-payment changes compress margins, intensifying competition among large networks and technology suppliers.

Global Hemodialysis Market Trends and Insights

Rising Prevalence of ESRD & CKD

Nearly 6 million additional patients are projected to reach kidney failure by 2030, enlarging the hemodialysis market. Climate-related heat stress and toxins accelerate kidney damage, especially in emerging Asian economies. Saudi Arabia already posts 4.76% CKD prevalence, soaring to 50.94% among people aged 90 plus. Machine-learning tools flag progression earlier, swelling the monitored patient pool even as they delay the need for dialysis.

Aging Population & Diabetes/Hypertension Burden

Every 5 years, Brazil adds roughly 6.6% more dialysis patients; diabetes drives 51% of local ESKD cases and absorbs 4% of the health budget. Mexico mirrors the clinical load but lags in coverage, with almost half of citizens uninsured, curbing revenue capture. Nations with universal insurance monetize disease progression more fully, explaining Asia-Pacific's outsized growth as insurance schemes mature.

Other drivers and restraints analyzed in the detailed report include:

- Favorable Reimbursement for In-Center Dialysis in OECD

- AI-Driven Predictive Analytics Optimizing Dialysis Dosing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services accounted for 58.95% of 2024 revenue, while equipment is forecast to register a 6.67% CAGR, the strongest among offerings. Advanced systems such as Fresenius 5008X, cleared by the FDA in 2024, promise 23% mortality reduction, prompting fleet upgrades . Dialyzer shortages-FDA warns bloodline supply will remain tight until late 2025-heighten focus on inventory resilience. As AI-driven monitoring expands, integrated service packages generate stickier revenue streams for operators.

Conventional therapy still holds 69.07% of the hemodialysis market share, yet nocturnal sessions are growing 7.12% annually on the back of lifestyle fit and improved biochemical clearance cjasn. Optimized ultrafiltration profiles cut symptomatic hypotension from 55% to 15%, boosting patient tolerance bmcnephrology.biomedcentral. Treatment choice now hinges on individualized care pathways rather than pure reimbursement calculus.

The Hemodialysis and Peritoneal Dialysis Market is Segmented by Product Type (Equipment and Consumables), Modality (Conventional Long-Term Hemodialysis, Short Daily Hemodialysis, and Nocturnal Hemodialysis), and Geography (North America, Europe, Asia Pacific, Middle-East, and Africa, and South America). The Market Size and the Value (in USD Million) for the Above Segments.

Geography Analysis

North America represented 40.70% of 2024 revenue. Medicare's 2025 base rate uplift and abundant clinic infrastructure sustain volume, although environmental regulations raise compliance costs. Nipro's USD 397.8 million North Carolina plant underscores near-shoring trends that secure supply chains.

Asia-Pacific delivers the fastest 7.34% CAGR through 2030 as governments expand coverage and populations age. However, only a fraction of the 2.9 million people needing dialysis receive it because of funding and facility limitations. Japanese firms such as Terumo push export platforms to penetrate high-growth markets and aim for 20-25% regional share terumo.

Europe maintains stable adoption under universal insurance yet faces strict water and PFAS rules that inflate operating costs. B. Braun invested EUR 1.2 billion in R&D during 2024 to develop resource-efficient devices. Clinics have begun sustainability audits, but only one-third have formal programs in place .

- Fresenius

- Baxter

- DaVita

- Nipro

- B. Braun

- Asahi Kasei

- Nikkiso Co., Ltd.

- Toray Medical Co., Ltd.

- JMS Co. Ltd.

- Outset Medical, Inc.

- Quanta Dialysis Technologies

- Dialife SA

- NxStage Medical (Fresenius subsidiary)

- Mar Cor Purification (Cantel)

- Toray Medical

- US Renal Care, Inc.

- Satellite Healthcare

- Dialysis Clinic, Inc.

- Medtronic plc (vascular access solutions)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of ESRD & CKD

- 4.2.2 Aging population & diabetes/hypertension burden

- 4.2.3 Favorable reimbursement for in-center dialysis in OECD

- 4.2.4 Rapid adoption of home hemodialysis programs

- 4.2.5 AI-driven predictive analytics optimizing dialysis dosing

- 4.2.6 Portable sorbent-based HD systems enabling resource-poor settings

- 4.3 Market Restraints

- 4.3.1 High overall treatment & infrastructure cost

- 4.3.2 Shortage of skilled vascular-access professionals

- 4.3.3 Sustainability pressure on water & power-intensive HD clinics

- 4.3.4 PFAS regulation impacting dialyzer membrane supply chain

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Billion)

- 5.1 By Product & Service

- 5.1.1 Equipment

- 5.1.1.1 Dialysis Machines

- 5.1.1.2 Hemodialysis Water Treatment Systems

- 5.1.1.3 Other Hemodialysis Equipment

- 5.1.2 Consumables

- 5.1.2.1 Dialyzers

- 5.1.2.2 Catheters

- 5.1.2.3 Other Hemodialysis Consumables

- 5.1.3 Services

- 5.1.1 Equipment

- 5.2 By Type

- 5.2.1 Conventional Hemodialysis

- 5.2.2 Short Daily Hemodialysis

- 5.2.3 Nocturnal Hemodialysis

- 5.3 By Dialysis Site

- 5.3.1 In-Center Dialysis

- 5.3.2 Home Hemodialysis

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Free-Standing Dialysis Centers

- 5.4.3 Home-Care Settings

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Fresenius Medical Care AG & Co. KGaA

- 6.3.2 Baxter International Inc.

- 6.3.3 DaVita Inc.

- 6.3.4 Nipro Corporation

- 6.3.5 B. Braun Melsungen AG

- 6.3.6 Asahi Kasei Medical Co., Ltd.

- 6.3.7 Nikkiso Co., Ltd.

- 6.3.8 Toray Medical Co., Ltd.

- 6.3.9 JMS Co. Ltd.

- 6.3.10 Outset Medical, Inc.

- 6.3.11 Quanta Dialysis Technologies

- 6.3.12 Dialife SA

- 6.3.13 NxStage Medical (Fresenius subsidiary)

- 6.3.14 Mar Cor Purification (Cantel)

- 6.3.15 Toray Medical

- 6.3.16 US Renal Care, Inc.

- 6.3.17 Satellite Healthcare

- 6.3.18 Dialysis Clinic, Inc.

- 6.3.19 Medtronic plc (vascular access solutions)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment