PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910627

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910627

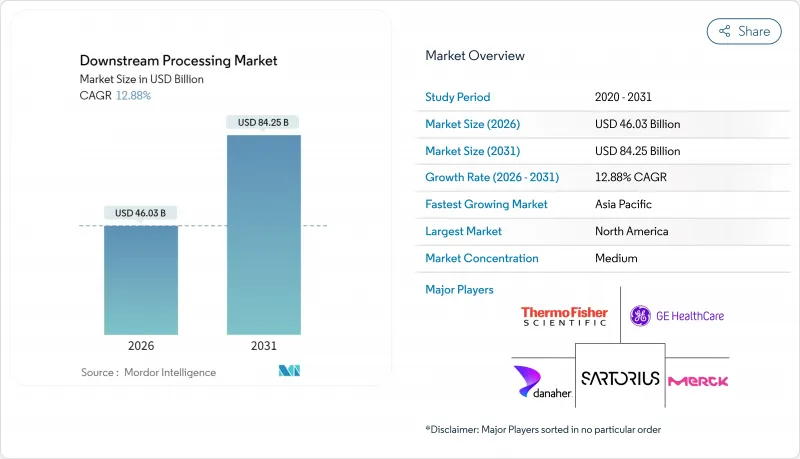

Downstream Processing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The downstream processing market is expected to grow from USD 40.78 billion in 2025 to USD 46.03 billion in 2026 and is forecast to reach USD 84.25 billion by 2031 at 12.88% CAGR over 2026-2031.

Capacity expansions valued above USD 50 billion in 2024-2025, including Eli Lilly's USD 9 billion Indiana site and Novo Nordisk's USD 4.1 billion North Carolina facility, have created unprecedented equipment demand and intensified competition for skilled labor. Single-use systems, continuous bioprocessing, and digital twins are now mainstream, cutting operating costs and shortening validation timelines, while suppliers race to introduce PFAS-compliant membranes before incoming regulations take effect. Outsourcing momentum further shapes pricing and technology adoption as CDMOs secure multi-year slots for niche modalities such as viral vector and lipid nanoparticle production. Meanwhile, manufacturers prioritize supply-chain resilience, driving regional sourcing strategies and dual-supplier frameworks for filters, bags, and resins.

Global Downstream Processing Market Trends and Insights

Rapid Expansion of Global Biologics Manufacturing Capacity

Samsung Biologics completed its fifth plant in April 2025, lifting global capacity to 784,000 L and reinforcing a volume race that lifts demand for large-scale chromatography systems and single-use bioreactors. Newly built lines favor continuous modalities that lower buffer consumption by as much as 40% and reduce water-for-injection requirements. Regional governments position biomanufacturing as a strategic growth engine, illustrated by Saudi Arabia's plan to add USD 34.6 billion to non-oil GDP by 2040. Capacity oversupply among some CDMOs temporarily suppresses utilization to below 50%, yet the throughput flexibility of intensified downstream skids allows quick re-scheduling without quality compromise. Vendors consequently bundle columns, resins, and analytical sensors to deliver integrated platforms that can switch between monoclonal and viral-vector products within hours.

Rising R&D Spending Among Big Pharma & Emerging Biotech

Large enterprises lift budgets even while smaller firms face capital rationing. Eli Lilly alone earmarked USD 4.5 billion for the Lilly Medicine Foundry to accelerate clinical supply, creating incremental orders for modular chromatography and tangential flow filtration systems. Venture-backed start-ups prioritise cell and gene therapy pipelines, which require low-shear clarification and nuclease removal steps that differ substantially from antibody workflows. The result is broadened demand diversity that benefits suppliers offering configurable skids and disposable flow paths. Continuous multicolumn chromatography, once niche, is now adopted by a growing number of programs because it offsets resin cost spikes with 50% smaller bed volumes per kilogram of product.

High Capital Cost of Large-Scale Chromatography Skids and Resins

Protein A resin still commands premium pricing, consuming up to 60% of downstream capital budgets. Purolite invested USD 200 million in a Pennsylvania plant to ease supply and blunt price volatility, yet smaller firms remain cost-constrained. Intensified multicolumn operations cut resin use by 50% and raise output per square foot, but they add automation complexity that demands trained staff. A two-tier market is emerging in which large pharma pays for premium capture resins while cost-sensitive players explore mixed-mode or continuous alternatives.

Other drivers and restraints analyzed in the detailed report include:

- CMO / CDMO Outsourcing Boom, Multi-Year Capacity Deals

- mRNA & Viral-Vector Vaccine Platform Scale-Up Post-COVID

- Purification Bottleneck Versus Upstream Titers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Purification techniques accounted for 32.05% of downstream processing market revenue in 2025, confirming their centrality to biologics quality. Cell disruption registers the fastest 14.88% CAGR as microbial and intracellular expression systems gain adoption. The downstream processing market size for purification surpassed USD 14.75 billion in 2026 and is poised to cross USD 27 billion by 2031, supported by resin capacity expansions and multicolumn innovations. In parallel, homogenisers and microfluidisers remain the workhorses for cell disruption, but low-frequency acoustic methods are attracting pilot-scale trials because they reduce heat generation.

Continuous chromatography reduces buffer use, aligning with sustainability objectives that influence procurement in Europe. Single-use centrifuges and depth-filtration cassettes improve clarification throughput and minimise contamination risk, a feature valued in multi-product CDMO suites. Integration software that harmonises sensor readings across clarification and capture stages shortens batch release times, offering a competitive edge to early adopters.

Chromatography columns and resins commanded 35.10% revenue share in 2025 and continue as the reference standard for antibody capture. Yet filtration and membrane devices exhibit the highest 14.12% CAGR as PFAS-free polymer advances spur replacement cycles. The downstream processing market size for filtration products reached USD 12.2 billion in 2026 and is projected to hit USD 23.6 billion by 2031. Multi-layer depth filters reduce step count by combining clarification and fine filtration in one housing, enhancing facility productivity.

Adaptive control valves and gamma-stable flow-paths facilitate modular skid reconfiguration, appealing to CMOs juggling varied client molecules. Chromatography suppliers respond with high-throughput resin screening kits that cut process development time by 30%. Single-use hardware adoption rises despite disposal cost debates, as operators value the reduced validation burden.

The Downstream Processing Market Report is Segmented by Technique (Purification Techniques, Solid-Liquid Separation, and More), Product (Chromatography Columns and Resins, and More), Application (Antibodies Production, Vaccines Production, and More), End User (Biopharmaceutical & Bio-Similar Manufacturers, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America recorded 32.50% revenue share in 2025, powered by large-scale investments such as Johnson & Johnson's USD 2 billion project in North Carolina. Regional producers adopt continuous manufacturing in 75% of new lines and plan artificial intelligence integration within three years. The downstream processing market benefits from the FDA's proactive stance on innovative manufacturing guidance, fostering investor confidence in novel purification platforms.

Asia-Pacific is the fastest growing region at 14.35% CAGR thanks to large-scale facilities in South Korea, China, Singapore, and India. Samsung Biologics adds 180,000 L capacity while Novartis expands its Singapore site, exemplifying a trend toward mega-facilities supporting global supply. Indian CDMOs position themselves as alternatives following the US Biosecure Act. Regional authorities subsidise workforce training to bridge process-engineering talent gaps and encourage local sourcing of filters and bags.

- Thermo Fisher Scientific

- Danaher

- Sartorius

- Merck

- GE Healthcare

- Solventum Corporation

- Lonza Group

- Repligen

- Eppendorf

- Pall

- Agilent Technologies

- FUJIFILM

- Corning

- Alfa Laval AB

- Parker Hannifin

- Novasep Holding SAS

- Asahi Kasei Corp.

- Meissner Filtration Products

- Kuhner Shaker AG

- BD Biosciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Expansion Of Global Biologics Manufacturing Capacity

- 4.2.2 Rising R&D Spending Among Big Pharma & Emerging Biotech

- 4.2.3 CMO/ CDMO Outsourcing Boom, Multi-Year Capacity Deals

- 4.2.4 mRna & Viral-Vector Vaccine Platform Scale-Up Post-COVID

- 4.2.5 Continuous Bioprocessing Adoption Reducing Capex/OPEX

- 4.3 Market Restraints

- 4.3.1 High Capital Cost Of Large-Scale Chromatography Skids & Resins

- 4.3.2 Purification Bottleneck Versus Upstream Titers

- 4.3.3 Supply-Chain Fragility For Single-Use Filters & Bags

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technique

- 5.1.1 Purification Techniques

- 5.1.2 Solid-Liquid Separation

- 5.1.3 Clarification / Concentration

- 5.1.4 Cell Disruption

- 5.2 By Product

- 5.2.1 Chromatography Columns & Resins

- 5.2.2 Filtration & Membrane Devices

- 5.2.3 Centrifuges

- 5.2.4 Evaporators

- 5.2.5 Other Products

- 5.3 By Application

- 5.3.1 Antibody Production

- 5.3.2 Vaccine Production

- 5.3.3 Insulin & Hormone Production

- 5.3.4 Cell & Gene-Therapy Products

- 5.3.5 Other Applications

- 5.4 By End User

- 5.4.1 Biopharmaceutical & Bio-similar Manufacturers

- 5.4.2 Contract Manufacturing / Development Organizations

- 5.4.3 Academic & Research Institutes

- 5.4.4 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Danaher Corporation (Cytiva)

- 6.3.3 Sartorius Stedim Biotech S.A.

- 6.3.4 Merck KGaA (Merck Millipore)

- 6.3.5 GE HealthCare

- 6.3.6 Solventum Corporation

- 6.3.7 Lonza Group AG

- 6.3.8 Repligen Corporation

- 6.3.9 Eppendorf AG

- 6.3.10 Pall Corporation

- 6.3.11 Agilent Technologies

- 6.3.12 Fujifilm Diosynth Biotechnologies

- 6.3.13 Corning Inc.

- 6.3.14 Alfa Laval AB

- 6.3.15 Parker Hannifin Corp.

- 6.3.16 Novasep Holding SAS

- 6.3.17 Asahi Kasei Corp.

- 6.3.18 Meissner Filtration Products

- 6.3.19 Kuhner Shaker AG

- 6.3.20 BD Biosciences

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment