PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851133

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851133

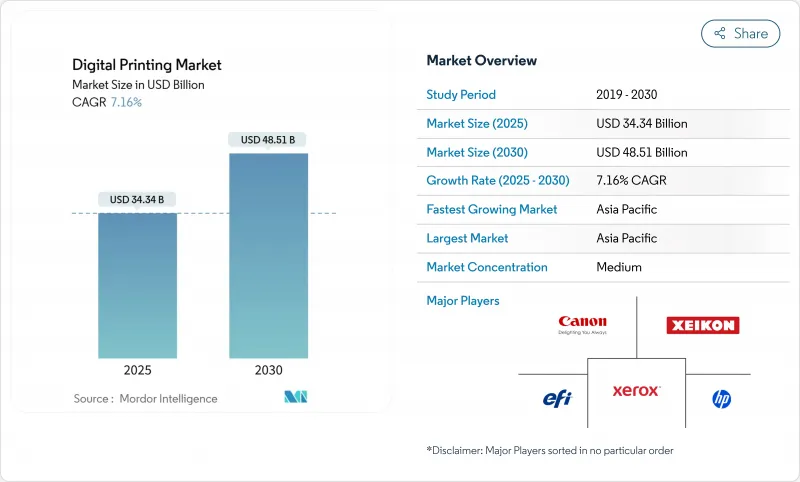

Digital Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The digital printing market size is valued at USD 34.34 billion in 2025 and is forecast to reach USD 48.51 billion by 2030, advancing at a 7.16% CAGR over 2025-2030.

Robust demand for on-demand production, AI-driven workflow orchestration, and the pivot from analog to digital manufacturing keep growth resilient even as supply chains remain volatile. The market's capability to profitably execute micro-batch runs, eliminate plate-making delays, and shorten turnaround times attracts converters and brand owners seeking mass customization at scale. Regulatory scrutiny of volatile organic compounds and PFAS accelerates migration toward water-based pigment and UV-curable chemistries, while advances in drop-on-demand printheads push resolution, speed, and substrate versatility frontiers. Competitive strategies increasingly revolve around quantum-resistant security modules, autonomous maintenance algorithms, and partnerships that pool R&D assets to spread capital costs. These factors collectively widen the addressable base for the digital printing market across packaging, textile, industrial, commercial, and decor segments.

Global Digital Printing Market Trends and Insights

Booming Short-Run Customized Packaging Demand

Brand owners in food, beverage, and personal care increasingly request lot sizes below 10,000 units to support limited-edition releases and region-specific labeling requirements. Converters leveraging HP Indigo 200K presses achieve plate-free changeovers that slash lead times and inventory risk, transforming the digital printing market into a vital enabler of agile supply chains. E-commerce's growth multiplies SKU complexity, pushing printers toward workflow configurations that switch substrates and box formats without downtime. Retailers also value variable data for track-and-trace and anti-counterfeit coding, functions executed inline with no added tooling. These advantages reinforce the preference for digital workflows whenever seasonal or promotional cycles intensify.

Rapid AI-Enabled Workflow Automation for Micro-Batch Orders

HP's Nio AI agent optimizes ink laydown, nozzle health, and substrate advance in real time, enabling unattended operation and predictable color across shifts. Japanese facilities implementing AI-driven job ganging now see 30% fewer setup sheets and double-digit uptime gains. Predictive maintenance models forecast head replacements weeks in advance, preventing unplanned stops and stabilizing quality for demanding packaging accounts. Machine learning also refines ICC profiles per substrate, reducing waste on premium foils and synthetics. By collapsing labor inputs and materials overruns, AI broadens profit pools even at micro-volume tiers, enlarging the accessible digital printing market for SME converters.

High Capex and R&D Outlays for High-End Presses

Industrial inkjet lines capable of multi-layer varnish and white ink routinely exceed USD 1 million per unit. Initial spend escalates when climate-controlled rooms, inline inspection cameras, and RIP servers are included, locking smaller converters out of top-tier throughput. Rapid obsolescence compounds risk; head generations refresh within five-year windows, forcing continuous capex or risk margin erosion. Larger groups finance upgrades via syndicated loans and shared service centers, widening the technology gap. Consolidation thus accelerates, trimming the tail of the provider curve and concentrating volume among well-funded players.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Digital Textile Micro-Factories in EU and US

- Declining Per-Unit Print Cost and Faster Turnaround

- Stricter PFAS/Solvent-Ink Regulations Causing Re-Qualification Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Inkjet technology commanded 68.12% of the digital printing market share in 2024 and is projected to grow at 11.7% CAGR through 2030. The segment's leadership stems from ever-smaller drop volumes, native 1,200 dpi heads, and closed-loop meniscus control that reduce banding on porous and non-porous media alike. Electrophotography maintains relevance for office documents and photo books where toner's gloss finish appeals, yet its adoption plateaus because toner fusing limits substrate diversity and energy efficiency.

Epson's Direct-to-Shape system mates six-axis robotics with PrecisionCore heads, enabling registration accuracy within 35 µm on curved plastics and glass. This expansion into 3-D objects broadens addressable applications from automotive knobs to beverage tumblers, reinforcing the segment's contribution to overall digital printing market growth. Inkjet also pairs readily with water-based pigment sets that comply with looming solvent bans, future-proofing capex for converters. As waveforms adapt dynamically to viscosity fluctuations, uptime rises and printhead life extends, counteracting historical consumables cost concerns and deepening inkjet's entrenchment.

Solvent formulations delivered 49.43% revenue in 2024 thanks to robust adhesion on vinyl banners and fleet wraps. Yet water-based pigment systems are climbing at a 9.34% CAGR as buyers favor low-VOC credentials for indoor graphics and food packaging. UV-curable inks carve share in folding carton and direct-to-object arenas where instant curing curtails wait times and labor, while latex blends balance green profile with outdoor durability.

Ink makers accelerate R&D cycles to purge PFAS and aromatic hydrocarbons; Mimaki's 2025 UV sets show the path toward CMR-free chemistry. As certification bodies impose stricter migration thresholds, solvent platforms must re-qualify, dampening volume expansion despite historical dominance. Conversely, aqueous pigments gain from inline dryers and advanced primers that open plastics and metalized films once considered out-of-reach. Over the forecast period, the digital printing market size for water-based inks is expected to close the gap with legacy solvent lines, reshaping supplier power dynamics and procurement strategies.

The Digital Printing Market Report is Segmented by Printing Process (Electrophotography, and Inkjet), Ink Type (Water-Based Pigment, Solvent, UV-Curable and More), Substrate (Paper and Paperboard, Plastics and Films, Textiles/Fabrics and More), Application (Books and Publishing, Commercial Printing, Packaging and More), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa).

Geography Analysis

Asia-Pacific retained 38.56% share of global revenue in 2024 and is set to post the highest 10.88% CAGR through 2030 thanks to state incentives supporting Industry 4.0 and additive manufacturing ecosystems. China's push toward high-value exports channels capital into label and carton lines that deliver variable data and colorful embellishments for premium consumer goods. Japan nurtures AI-infused workflows that synchronize presses with MES and ERP stacks, optimizing job sequencing across factory clusters. India's fast-growing middle class drives flexible packaging demand, attracting global OEMs to partner with local integrators on turnkey digital hubs.

North America represents a mature but lucrative arena where converters pivot from long-run flexo to agile digital lines to satisfy SKU proliferation in club stores and e-commerce packaging. The United States spearheads adoption of quantum-resistant printer security that shields brand assets and consumer data. Canada's regulatory focus on carbon transparency propels migration toward water-based inks and closed-loop color calibration, while Mexico benefits from near-shoring that routes previously Asia-bound assemblies through regional fulfillment centers requiring localized print.

Europe emphasizes sustainability and circular-economy compliance under the EU Green Deal. The Digital Product Passport for textiles and packaging necessitates item-level encoding, a function naturally embedded within high-resolution inkjet lines. Germany's mechanical engineering base integrates print modules into robotized finishing cells, while France's luxury sector insists on exacting spot-color reproduction and tactile varnish effects. The United Kingdom exploits creative industries' demand for bespoke limited-run prints, encouraging SMEs to buy compact B2 inkjet units. Collectively, these regional dynamics reinforce the digital printing market as a cornerstone of next-generation manufacturing worldwide.

- HP Inc.

- Canon Inc.

- Xerox Holdings

- Ricoh Company

- Electronics For Imaging (EFI)

- Konica Minolta

- Xeikon NV

- Smurfit WestRock

- Mondi PLC

- DS Smith PLC (International Paper)

- Amcor PLC

- Multi-Color Corporation

- Avery Dennison Corporation

- Quad/Graphics Inc.

- Durst Phototechnik

- Landa Digital Printing

- Domino Printing Sciences

- Screen Holdings Co.

- Fujifilm Holdings

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Booming short-run customised packaging demand

- 4.2.2 Rapid AI-enabled workflow automation for micro-batch orders (under-the-radar)

- 4.2.3 Expansion of digital textile micro-factories in EU and US (under-the-radar)

- 4.2.4 Declining per-unit print cost and faster turnaround

- 4.3 Market Restraints

- 4.3.1 High capex and RandD outlays for high-end presses

- 4.3.2 Stricter PFAS/solvent-ink regulations causing re-qualification delays (under-the-radar)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Printing Process

- 5.1.1 Electrophotography (Toner)

- 5.1.2 Inkjet

- 5.2 By Ink Type

- 5.2.1 Water-based pigment

- 5.2.2 Solvent

- 5.2.3 UV-curable

- 5.2.4 Latex

- 5.2.5 Dye-Sublimation

- 5.3 By Substrate

- 5.3.1 Paper and Paperboard

- 5.3.2 Plastics and Films

- 5.3.3 Textiles/Fabrics

- 5.3.4 Glass and Ceramics

- 5.3.5 Metals

- 5.4 By Application

- 5.4.1 Books and Publishing

- 5.4.2 Commercial Printing

- 5.4.3 Packaging

- 5.4.3.1 Labels

- 5.4.3.2 Corrugated Packaging

- 5.4.3.3 Cartons

- 5.4.3.4 Flexible Packaging

- 5.4.3.5 Rigid Plastic Packaging

- 5.4.3.6 Metal Packaging

- 5.4.4 Textile Printing

- 5.4.5 Photographic and Merchandise

- 5.4.6 Signage and Large-Format Graphics

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Russia

- 5.5.2.9 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Kenya

- 5.5.4.2.3 Nigeria

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 HP Inc.

- 6.4.2 Canon Inc.

- 6.4.3 Xerox Holdings

- 6.4.4 Ricoh Company

- 6.4.5 Electronics For Imaging (EFI)

- 6.4.6 Konica Minolta

- 6.4.7 Xeikon NV

- 6.4.8 Smurfit WestRock

- 6.4.9 Mondi PLC

- 6.4.10 DS Smith PLC (International Paper)

- 6.4.11 Amcor PLC

- 6.4.12 Multi-Color Corporation

- 6.4.13 Avery Dennison Corporation

- 6.4.14 Quad/Graphics Inc.

- 6.4.15 Durst Phototechnik

- 6.4.16 Landa Digital Printing

- 6.4.17 Domino Printing Sciences

- 6.4.18 Screen Holdings Co.

- 6.4.19 Fujifilm Holdings

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment