PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851135

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851135

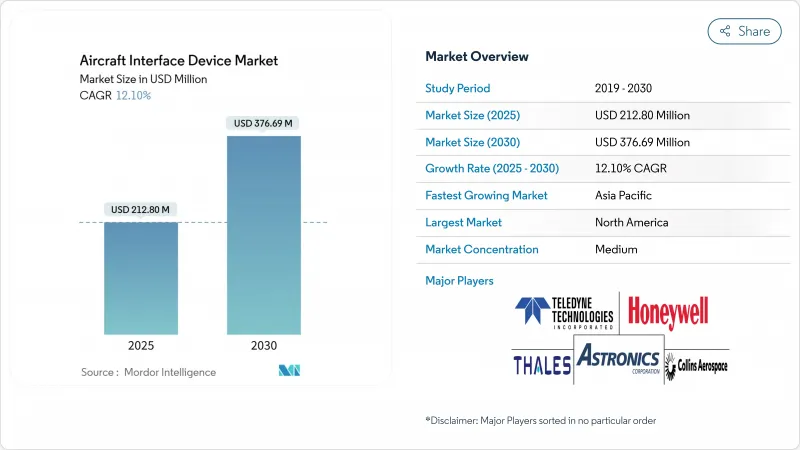

Aircraft Interface Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aircraft interface device (AID) market size is estimated at USD 212.80 million in 2025, and is expected to reach USD 376.69 million by 2030, at a CAGR of 12.10% during the forecast period.

Rising digital-first flight operations, real-time aircraft health-monitoring programs, and the rapid roll-out of high-throughput satellite networks are the primary forces propelling this expansion. Airlines and defense operators are replacing paper-based processes with connected electronic workflows relying on secure, high-bandwidth data gateways. At the same time, growing retrofit activity among aging commercial fleets and the accelerating adoption of open-architecture avionics standards have broadened the addressable customer base. Market participants differentiate on certification pedigree, cyber-resilience, and the ability to support multi-protocol data buses and multi-orbit connectivity pathways.

Global Aircraft Interface Device Market Trends and Insights

Digitized flight operations elevate demand for AIDs

Airlines have replaced paper charts and performance calculations with fully digital processes dependent on secure, high-capacity data bridges. Certified tablet interface modules like Collins Aerospace's InteliSight suite stream real-time avionics data to cloud analytics platforms for flight-crew decision support. Predictive-maintenance dashboards now draw directly from onboard sensors, increasing the required processing power of each interface device. Airbus's company-wide mandate for electronic flight bag usage accelerated global demand for certified gateways connecting legacy aircraft networks to modern apps. Operators also integrate these devices to comply with emerging performance-based navigation rules and real-time flight tracking initiatives.

Expansion of real-time aircraft health-monitoring and predictive-maintenance ecosystems

Edge-based computing capabilities inside modern AIDs filter and compress raw data before transmission to ground servers, reducing bandwidth costs while preserving diagnostic fidelity. Aireon's space-based ADS-B data stream combines with Boeing's analytics platform to monitor flight parameters beyond traditional maintenance limits, underscoring the strategic role of interface gateways in fleet-wide health programs. Astronics has responded with Smart Aircraft Interface Devices, integrating server and router functionality, incorporating Federal Information Processing Standards-level encryption to protect sensitive telemetry.

Escalating cybersecurity compliance burden

DO-326A and DO-356A standards add rigorous design, verification, and penetration-testing steps that can extend certification schedules by over a year. The FAA's Aircraft Network Security Program requires operators of connected aircraft to document threat models and mitigation strategies before receiving approvals, raising development costs for smaller suppliers. European research consortia such as AIDA are prototyping AI-driven cyber agents to monitor avionics networks in real time, reflecting the rapidly expanding scope of required defensive capabilities.

Other drivers and restraints analyzed in the detailed report include:

- Military ISR platforms require high-speed data exfiltration

- Adoption of open-architecture avionics standards

- Supply-chain volatility in multi-protocol data-bus components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Retrofit programs are outpacing new-build deliveries with a 14.88% CAGR through 2030, even though line-fit options still held 50.34% of the aircraft interface device market share in 2024. Airlines view cockpit upgrade packages as a cost-effective alternative to new airframes, particularly for regional and business jets approaching mid-life checks. Collins Aerospace offers Pro Line Fusion conversions that deliver synthetic vision and advanced flight-management functions while satisfying next-generation airspace mandates. Regulatory ADS-B and FANS 1/A requirements further stimulate retrofit demand across every continent.

Line-fit retains scale advantage because OEMs embed gateways during assembly, avoiding additional downtime and ensuring tight integration with other avionics suites. Yet delivery backlogs push operators toward immediate capability gains through retrofit, reinforcing the long-term growth advantage in that channel. The aircraft interface device market size for retrofit solutions is forecast to approach USD 200 million by 2030, underscoring how modernization schedules and certification paths shape buyer behavior.

Wired networks dominated with 65.75% revenue in 2024, benefitting from deterministic latency and proven electromagnetic compatibility. Nevertheless, wireless AIDs are growing at 16.75% CAGR as airlines adopt multi-orbit satellite and 5G air-to-ground links. Delta's selection of the Hughes Fusion platform, which can blend low-earth and geostationary bandwidth, illustrates how carriers expect seamless roaming across diverse networks.

Bombardier's continental 5G roll-out highlights a shift toward terrestrial links for high-density routes. Wireless gateways handle traffic prioritization, encryption, and antenna handovers that used to require multiple discrete boxes. Certification hurdles slow adoption for safety-critical applications, so wired backbones will remain essential inside fly-by-wire and navigation domains. The aircraft interface device market size attached to wireless solutions is projected to expand at double-digit rates through 2030, matching passenger demand for uninterrupted broadband.

The Aircraft Interface Device Market is Segmented by Fit (Line Fit and Retrofit), Connectivity (Wired and Wireless), Platform (Hardware and Software), Aircraft Type (Commercial, Military, General Aviation, and Unmanned Systems), and Geography (North America, Europe, Asia-Pacific, South America, and the Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the aircraft interface device market with a 36.21% share in 2024, supported by large fleets, strict FAA connectivity mandates, and robust defense spending. Military modernization contracts such as the UH-60M avionics upgrade sustain high unit volumes and guarantee long-term support revenues. The region's mature MRO ecosystem accelerates retrofit cycles, while the FAA's roadmap for next-generation air-traffic management further stimulates demand for certified gateways.

Asia-Pacific registers the strongest growth outlook, with a 13.56% CAGR to 2030. Expanding middle-class travel, rapid low-cost carrier fleet additions, and heightened regional security considerations drive commercial and military aircraft procurement. Recent multi-year modernization programs for Mi-17 rotary fleets showcase how operators across Southeast Asia and India prioritize glass-cockpit conversions that depend on advanced interface devices. National airworthiness authorities in Japan, China, and Australia now recognize standards such as DO-178C, making it easier for suppliers to transfer products across borders.

Europe maintains measured growth through joint defense initiatives and sustainability commitments that rely on granular flight-data analytics. EASA guidance harmonizes certification pathways, enabling coordinated adoption of open-architecture avionics. Corporate consolidation, highlighted by Thales's acquisition of Cobham Aerospace Communications, enhances local supply resilience and competitive positioning. South America, the Middle East, and Africa remain early-stage yet attractive, especially for retrofit solutions that extend asset life while meeting evolving navigation mandates.

- Astronics Corporation

- Collins Aerospace (RTX Corporation)

- Teledyne Technologies Incorporated

- Honeywell International Inc.

- Thales Group

- SKYTRAC Systems Ltd.

- Elbit Systems Ltd.

- SCI Technology, Inc. (Sanmina Corporation)

- Avionics Interface Technologies (Teradyne, Inc.)

- Curtiss-Wright Corporation

- Anuvu Operations LLC

- The Boeing Company

- L3Harris Technologies, Inc.

- Garmin Ltd.

- Panasonic Avionics Corporation

- Lufthansa Technik AG

- Safran S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digitized flight operations elevates demand for AIDs

- 4.2.2 Expansion of real-time aircraft health-monitoring and predictive-maintenance ecosystems

- 4.2.3 Military ISR platforms demand for high-speed data-exfiltration interfaces

- 4.2.4 Adoption of open-architecture avionics standards

- 4.2.5 Accelerating retrofit cycles for Electronic Flight Bag (EFB) upgrades across narrowbody and business jet fleets

- 4.2.6 Proliferation of high-throughput satellite constellations (GEO VHTS, LEO)

- 4.3 Market Restraints

- 4.3.1 Escalating cybersecurity compliance burden

- 4.3.2 Supply-chain volatility in multi-protocol data-bus components (ARINC 664)

- 4.3.3 Prolonged and expensive certification cycles (DO-178C/254, DO-160G, FAA/EASA STC)

- 4.3.4 Space-based ADS-B reducing need for on-board data gateways on new-gen aircraft

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Fit

- 5.1.1 Line Fit

- 5.1.2 Retrofit

- 5.2 By Connectivity

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.3 By Platform

- 5.3.1 Hardware

- 5.3.2 Software

- 5.4 By Aircraft Type

- 5.4.1 Commercial

- 5.4.1.1 Narrowbody Aircraft

- 5.4.1.2 Widebody Aircraft

- 5.4.1.3 Regional Jets

- 5.4.2 Military

- 5.4.2.1 Combat

- 5.4.2.2 Non-Combat

- 5.4.3 General Aviation

- 5.4.3.1 Business Jets

- 5.4.3.2 Helicopters

- 5.4.4 Unmanned Systems

- 5.4.1 Commercial

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Israel

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Astronics Corporation

- 6.4.2 Collins Aerospace (RTX Corporation)

- 6.4.3 Teledyne Technologies Incorporated

- 6.4.4 Honeywell International Inc.

- 6.4.5 Thales Group

- 6.4.6 SKYTRAC Systems Ltd.

- 6.4.7 Elbit Systems Ltd.

- 6.4.8 SCI Technology, Inc. (Sanmina Corporation)

- 6.4.9 Avionics Interface Technologies (Teradyne, Inc.)

- 6.4.10 Curtiss-Wright Corporation

- 6.4.11 Anuvu Operations LLC

- 6.4.12 The Boeing Company

- 6.4.13 L3Harris Technologies, Inc.

- 6.4.14 Garmin Ltd.

- 6.4.15 Panasonic Avionics Corporation

- 6.4.16 Lufthansa Technik AG

- 6.4.17 Safran S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment