PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851137

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851137

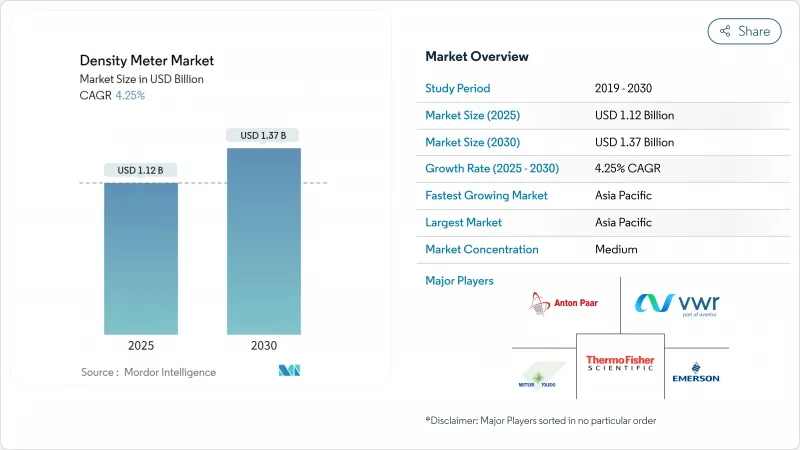

Density Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The density meter market size reached USD 1.12 billion in 2025 and will advance to USD 1.38 billion by 2030, reflecting a steady 4.26% CAGR and confirming resilient demand for instruments that deliver precise in-process measurements across critical industries.

Growing investment in Industry 4.0 platforms, stricter custody-transfer rules in hydrocarbons, and the expansion of continuous bioprocessing collectively sustain long-term purchasing momentum. Asia-Pacific anchors global unit volumes thanks to rapid industrialization, while the Middle East and Africa accelerates fastest on the back of desalination and mining projects. Coriolis designs dominate the installed base, yet ultrasonic systems are registering the strongest uptake as mining operators seek non-invasive monitoring for abrasive slurries. Handheld meters are reshaping field work practices, and software-enabled predictive maintenance is emerging as a key differentiator for premium brands.

Global Density Meter Market Trends and Insights

Digital Transformation in Process Industries Elevating Demand for Real-Time Density Monitoring in North America

Factories across North America now embed smart density sensors within MES and LIMS networks, enabling predictive models that cut idle time and tighten product-quality distributions. Cloud-hosted analytics combine density, viscosity, and flow data to optimize refinery set-points, as demonstrated at Ergon Refining's specialty plants. Inline meters deliver continuous verification that supersedes lab batch tests, and embedded AI algorithms now alert technicians to drift long before off-spec batches appear. Regulatory regimes in food and pharma further accelerate uptake because digital audit trails simplify compliance reporting.

tricter Custody Transfer Regulations in Global Oil and Gas Sector Boosting Inline Density Meter Installations

Fiscal metering rules now cap uncertainty at below 0.1% for hydrocarbon custody transfers, positioning Coriolis meters as the default solution for pipelines and floating storage units.ADNOC's sales-gas network validated lower OPEX and wider turndown versus legacy ultrasonic devices, while AGA and ISO standards have been amended to reference Coriolis performance benchmarks. Emerging producers in Africa and Latin America are copying these standards, enlarging the addressable pool for advanced inline instruments that deliver simultaneous mass-flow and density readings.

Radioactive-Source Licensing Challenges Limiting Nuclear Density Meter Uptake in Europe

Directive 2013/59/Euratom tightened safety standards, adding recurrent audits and mandatory operator training that raise lifecycle costs for nuclear gauges. Device makers must secure Part 32 licenses and track sealed sources through detailed inventory logs, discouraging small processors that once relied on gamma-ray instruments. Users now gravitate toward ultrasonic or microwave alternatives that eliminate radiological liabilities, accelerating technology substitution across bulk-solids handling and asphalt-mix plants.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption of Inline Quality Control in Craft Beverage Industry Across Europe

- Rising Adoption of Inline Quality Control in Craft Beverage Industry Across Europe

- High Initial Calibration Costs for Coriolis Density Meters in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Benchtop units held 44.8% of 2024 revenue, anchored in pharma QC and chemical formulation labs that value multi-parameter analysis and stringent documentation. Conversely, handheld instruments posted a 6.5% CAGR and will surpass USD 300 million by 2030, driven by remote pipeline surveys, on-the-spot beverage checks, and mobile mining crews. The density meter market size for portable devices is on a clear upswing as manufacturers add temperature compensation, RFID sample tracking, and Bluetooth export to LIMS platforms.

A broader push toward decentralized decision-making reinforces the shift. Operators now validate product density at the point of fill, avoiding lab queues and catching deviations early. Rugged ABS housings withstand dust and splash, while on-board lithium packs deliver eight-hour autonomy. Enhanced firmware performs automatic viscosity correction, enabling field accuracy within +-0.001 g/cm3. This versatility is expanding addressable use cases from dairy plants to biodiesel terminals, tightening quality loops and curbing rework rates.

Coriolis instruments commanded 34.9% density meter market share in 2024, cemented by unmatched ability to capture mass-flow and density simultaneously-a boon for fiscal custody and recipe control. High-end models achieve +-0.05% density accuracy and self-diagnose coating or two-phase flow, lowering unplanned outages. Feature-rich firmware reduces recalibration frequency from yearly to triennial, trimming ownership costs.

Ultrasonic variants, however, are advancing at a 7.1% CAGR on the strength of clamp-on designs that avert downtime and sanitation worries in dairy, pulp, and mining pipelines. MEMS-powered micro-Coriolis prototypes also surface for micro-reactor and drug-delivery applications where sample volumes are measured in microliters. Suppliers that blend digital twins with inline diagnostics are best positioned as buyers prioritize predictive maintenance over mere sensor accuracy.

The Density Meter Market Report is Segmented by Type (Benchtop, Module/Inline, and Portable/Hand-held), Application (Coriolis, Nuclear, Ultrasonic, Microwave, Vibrating U-Tube, and More), Fluid Medium (Liquids, Gases, and Slurries and Suspensions), End-User Industry (Water and Wastewater, Chemicals and Petrochemicals, Mining and Metal Processing, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 34.1% revenue in 2024, propelled by China's vast refining and chemical complexes, India's surging biologics capacity, and South Korea's semiconductor investments. The density meter market continues to benefit from government programs that reward smart-factory retrofits and sustainability reporting. Japan's focus on zero-defect automotive fluids further sustains premium laboratory instrument sales.

Middle East & Africa, though smaller, delivers top-line acceleration at 6.4% CAGR as desalination, green hydrogen, and remote pipeline monitoring gain steam. Saudi Aramco's upstream projects specify Coriolis meters in multiphase separators, while UAE utilities deploy density-based control loops to increase reverse-osmosis recovery ratios. South African platinum miners retrofit ultrasonic probes to cut water use in tailings thickeners.

North America maintains robust replacement demand as chemical and food processors digitize legacy plants. Government incentives for IIoT adoption amplify orders for Ethernet-IP enabled meters. Europe's stringent carbon and alcohol-tax frameworks underpin steady upgrades, despite energy-cost headwinds. South America's focus on tailings dam safety catalyzes slurry-meter retrofits in Chilean copper and Brazilian iron-ore operations.

- Anton Paar GmbH

- Mettler-Toledo International Inc.

- Emerson Electric Co.

- Endress+Hauser Group

- Siemens AG

- Yokogawa Electric Corporation

- Vega Grieshaber KG

- Krohne Messtechnik GmbH

- Ametek Inc.

- Thermo Fisher Scientific Inc.

- Berthold Technologies GmbH and Co. KG

- Rhosonics Analytical B.V.

- Rudolph Research Analytical

- KRUSS Optronic GmbH

- Red Meters LLC

- Toshiba Infrastructure Systems and Solutions Corporation

- VWR International (Avantor)

- Schmidt + Haensch GmbH and Co.

- Micromeritics Instrument Corp.

- Beijing ZhongKe Analytical Instruments Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital Transformation in Process Industries Elevating Demand for Real-Time Density Monitoring in North America

- 4.2.2 Stricter Custody Transfer Regulations in Global Oil and Gas Sector Boosting Inline Density Meter Installations

- 4.2.3 Rising Adoption of Inline Quality Control in Craft Beverage Industry Across Europe

- 4.2.4 Mining Industry's Shift to Slurry Density Optimization in South America

- 4.2.5 Growth of Biopharmaceutical Continuous Manufacturing Necessitating High-Precision Density Measurement in Asia-Pacific

- 4.2.6 Water-Scarcity Driven Desalination Projects Fuelling Density Meter Demand in Middle East

- 4.3 Market Restraints

- 4.3.1 Radioactive Source Licensing Challenges Limiting Nuclear Density Meter Uptake in Europe

- 4.3.2 High Initial Calibration Costs for Coriolis Density Meters in Emerging Economies

- 4.3.3 Performance Drift of Ultrasonic Density Meters in High-Temperature Slurries

- 4.3.4 Fragmented Low-Cost Chinese Suppliers Intensifying Price Pressure Globally

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Benchtop

- 5.1.2 Module/Inline

- 5.1.3 Portable/Hand-held

- 5.2 By Measurement Technology

- 5.2.1 Coriolis

- 5.2.2 Nuclear (Gamma)

- 5.2.3 Ultrasonic

- 5.2.4 Microwave

- 5.2.5 Vibrating U-Tube

- 5.2.6 Gravimetric (Hydrometer Replacement)

- 5.3 By Fluid Medium

- 5.3.1 Liquids

- 5.3.2 Gases

- 5.3.3 Slurries and Suspensions

- 5.4 By End-user Industry

- 5.4.1 Water and Wastewater

- 5.4.2 Chemicals and Petrochemicals

- 5.4.3 Mining and Metal Processing

- 5.4.4 Food and Beverage

- 5.4.5 Healthcare and Pharmaceuticals

- 5.4.6 Electronics and Semiconductors

- 5.4.7 Oil and Gas (Upstream, Midstream, Downstream)

- 5.4.8 Power and Utilities

- 5.4.9 Research and Academic

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Anton Paar GmbH

- 6.4.2 Mettler-Toledo International Inc.

- 6.4.3 Emerson Electric Co.

- 6.4.4 Endress+Hauser Group

- 6.4.5 Siemens AG

- 6.4.6 Yokogawa Electric Corporation

- 6.4.7 Vega Grieshaber KG

- 6.4.8 Krohne Messtechnik GmbH

- 6.4.9 Ametek Inc.

- 6.4.10 Thermo Fisher Scientific Inc.

- 6.4.11 Berthold Technologies GmbH and Co. KG

- 6.4.12 Rhosonics Analytical B.V.

- 6.4.13 Rudolph Research Analytical

- 6.4.14 KRUSS Optronic GmbH

- 6.4.15 Red Meters LLC

- 6.4.16 Toshiba Infrastructure Systems and Solutions Corporation

- 6.4.17 VWR International (Avantor)

- 6.4.18 Schmidt + Haensch GmbH and Co.

- 6.4.19 Micromeritics Instrument Corp.

- 6.4.20 Beijing ZhongKe Analytical Instruments Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment