PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851138

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851138

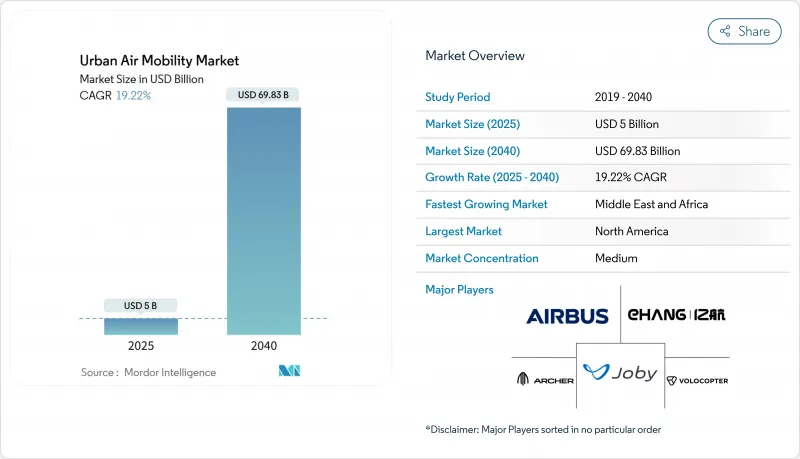

Urban Air Mobility - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2040)

The urban air mobility (UAM) market size is estimated at USD 5.00 billion in 2025, and is expected to reach USD 69.83 billion by 2040, at a CAGR of 19.22% during the forecast period.

Battery-energy-density breakthroughs have extended eVTOL range beyond 150 km, opening profitable intercity corridors and strengthening the business case for premium services. Faster certification, helped by the Federal Aviation Administration's powered-lift rule, lowers regulatory risk and encourages large capital deployments. Strategic alliances between aerospace pioneers and automotive manufacturers are compressing production costs, while public-private-partnership models are financing vertiport networks at a pace not seen in legacy aviation infrastructure. Together, these forces are positioning the UAM market for rapid global scale-up.

Global Urban Air Mobility Market Trends and Insights

Rapid Battery-Energy-Density Gains Push eVTOL Range Beyond 150 km

Solid-state cells now deliver 450-550 Wh/kg, up to 90% higher than earlier lithium-ion chemistries. Flight tests have shown 48-minute, single-charge missions, meeting the threshold for profitable intercity shuttles. Longer range lets operators aggregate demand across multiple city pairs and raises daily aircraft utilization, directly lowering cost per seat-mile. These performance gains also satisfy key safety metrics regulators require, smoothing the certification journey. As a result, intercity routes are forecast to capture a progressively larger slice of the UAM market revenue over the coming decade.

Automotive-Grade Supply Chains Drive Down eVTOL Unit Costs

Partnerships between eVTOL builders and automobile OEMs are embedding mass-production know-how into aerospace programs. Toyota's investment in Joby Aviation and shared component sourcing will cut airframe costs by 35% before 2028. Standardized parts, lean assembly lines, and automotive-quality control processes shorten ramp-up cycles and stabilize pricing. Lower acquisition costs feed through to reduced fares, expanding the accessible customer base and reinforcing demand across the UAM market.

Slow Vertiport Permitting in Tier-1 Cities

Approval processes in major metros routinely involve more than ten agencies, driving timelines well past two years and inflating holding costs. In Los Angeles, a single downtown site required coordination among zoning, environmental, and emergency-response departments before construction could start. Delays push operators toward suburban nodes, limiting early-stage route density and postponing the full value proposition of the UAM market.

Other drivers and restraints analyzed in the detailed report include:

- Vertiport PPP Financing Models Unlock Infrastructure Rollout

- Regulatory "Sandbox" Corridors Accelerate Certification Timelines

- Public-Acceptance Headwinds on Noise and Visual Pollution

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Piloted aircraft controlled 55.10% of 2024 revenue, reflecting regulators' preference for familiar cockpit concepts during the industry's opening phase. Joby Aviation's S4 advanced through three FAA certification stages in 2025, underscoring the near-term dominance of crewed platforms. This segment captured the largest slice of the UAM market, giving financiers confidence while larger infrastructure networks take shape. Operators also leverage existing pilot-training pipelines to scale services in premium airport-shuttle corridors, where customer willingness to pay offsets higher crew costs.

Autonomous craft, now a smaller category, is forecast to grow at a 21.51% CAGR to 2040, the fastest of any vehicle type. Wisk Aero's collaboration with NASA accelerates detect-and-avoid validation, a prerequisite for uncrewed commercial service. Removing pilots could cut direct operating expenses by about 26%, translating into wider geographic coverage and lower fares. As AI-enabled UTM platforms mature, autonomy is expected to alter operating models across the UAM market, shifting the competitive focus to software reliability and fleet orchestration.

Intracity segments under 100 km held 59.81% of the UAM market size in 2024, driven by congestion-relief routes linking city centers to airports. Skyports Infrastructure opened several downtown vertiports that year, anchoring early consumer awareness. Operators favor these short hops because battery reserves remain generous even with energy-intensive vertical phases, enabling predictable schedules and rapid asset turns.

Intercity missions above 100 km show the highest momentum, projected to rise at a 22.82% CAGR. Solid-state batteries and hybrid-electric propulsion now meet range and payload needs for linking close megacities and bypassing road bottlenecks. Regional governments in the Middle East see these corridors as enablers of tourism and decentralized economic zones, supporting accelerated deployment. Intercity adoption widens the addressable customer pool and magnifies network effects, reinforcing long-term expansion of the UAM market.

The Urban Air Mobility (UAM) Market Report is Segmented by Vehicle Type (Piloted and Autonomous), Range (Intracity and Intercity), Propulsion Type (Fully Electric, Hybrid Electric, and Gasoline), Application (Passenger Air Taxi, Intra-City Shuttle, and More), End User (Ride-Sharing Operators, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the largest region, accounting for 46.89% of 2024 revenue, supported by the FAA's clear certification pathway and deep venture funding pools. Fixed-base-operator chains Atlantic and Signature began constructing vertiport clusters at major airports during early 2025, adding operational depth across high-yield corridors. The United States Air Force's Agility Prime program further accelerates technology readiness, turning military test data into civilian certification evidence. These developments anchor the North American UAM market and provide a template for other regions.

The Middle East and Africa region shows the steepest growth curve, projected at a 28.21% CAGR from 2025 to 2040. Abu Dhabi finalized an agreement with Archer Aviation to launch the first commercial air-taxi services, positioning the UAE as a global showcase. Sovereign funds channel significant capital into vertiport infrastructure, and diverse geography creates compelling intercity use cases over desert and mountain terrain. Early mover advantage and cohesive regulatory backing promise to propel regional leadership within the UAM market.

Europe retains a strong position through progressive regulation and sustainability mandates. EASA adopted a comprehensive UAM framework in 2024, giving operators clear operational rules. Public-acceptance surveys published in 2025 indicate 83% positive sentiment when residents are informed about eVTOL noise and safety standards, easa.europa.eu. Cities like Paris and London aim to debut services before major international events, leveraging green mobility goals to attract infrastructure funding. This coordinated approach keeps Europe firmly embedded in the advancing UAM market.

- Airbus SE

- Joby Aero, Inc.

- Eve Holding, Inc.

- Volocopter Technologies GmbH

- Vertical Aerospace

- Archer Aviation, Inc.

- BETA Technologies, Inc.

- Wisk Aero LLC

- Guangzhou EHang Intelligent Technology Co., Ltd.

- Supernal, LLC

- Textron, Inc.

- Jaunt Air Mobility LLC

- Pivotal Aero, LLC.

- Ascendance Flight Technologies S.A.S

- AutoFlight Co. Ltd.

- SkyDrive Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid battery-energy-density gains push eVTOL range beyond 150 km

- 4.2.2 Automotive-grade supply chains drive down eVTOL unit costs

- 4.2.3 Vertiport PPP financing models unlock infrastructure rollout

- 4.2.4 Regulatory "sandbox" corridors accelerate certification timelines

- 4.2.5 Premium airport-shuttle demand from mega-hub expansions

- 4.2.6 AI-enabled UTM platforms de-risk high-density airspace operations

- 4.3 Market Restraints

- 4.3.1 Slow vertiport permitting in tier-1 cities

- 4.3.2 Public-acceptance headwinds on noise and visual pollution

- 4.3.3 Battery raw-material price volatility

- 4.3.4 Pilot-shortage bottleneck before full autonomy

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Vehicle Type

- 5.1.1 Piloted

- 5.1.2 Autonomous

- 5.2 By Range

- 5.2.1 Intracity ( Less than 100 km)

- 5.2.2 Intercity (Greater than 100 km)

- 5.3 By Propulsion Type

- 5.3.1 Fully Electric

- 5.3.2 Hybrid Electric

- 5.3.3 Gasoline

- 5.4 By Application

- 5.4.1 Passenger Air Taxi

- 5.4.2 Intra-city Shuttle

- 5.4.3 Emergency Medical Services

- 5.4.4 Cargo and Logistics

- 5.5 By End User

- 5.5.1 Ride-Sharing Operators

- 5.5.2 Corporate and VIP Clients

- 5.5.3 E-commerce and Logistics Firms

- 5.5.4 Healthcare Providers

- 5.5.5 Military and Government Agencies

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 South Korea

- 5.6.3.4 India

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Airbus SE

- 6.4.2 Joby Aero, Inc.

- 6.4.3 Eve Holding, Inc.

- 6.4.4 Volocopter Technologies GmbH

- 6.4.5 Vertical Aerospace

- 6.4.6 Archer Aviation, Inc.

- 6.4.7 BETA Technologies, Inc.

- 6.4.8 Wisk Aero LLC

- 6.4.9 Guangzhou EHang Intelligent Technology Co., Ltd.

- 6.4.10 Supernal, LLC

- 6.4.11 Textron, Inc.

- 6.4.12 Jaunt Air Mobility LLC

- 6.4.13 Pivotal Aero, LLC.

- 6.4.14 Ascendance Flight Technologies S.A.S

- 6.4.15 AutoFlight Co. Ltd.

- 6.4.16 SkyDrive Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment