PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851153

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851153

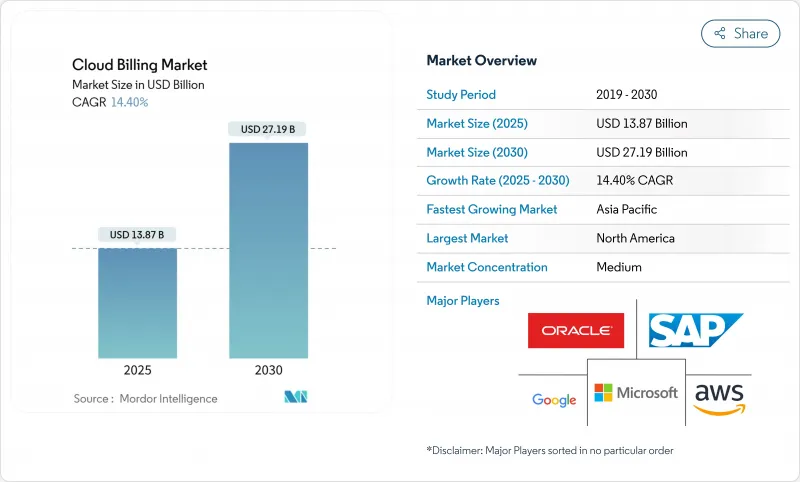

Cloud Billing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cloud Billing Market size is estimated at USD 13.87 billion in 2025, and is expected to reach USD 27.19 billion by 2030, at a CAGR of 14.40% during the forecast period (2025-2030).

Enterprises are diverting spending toward usage-aligned commercial models that can translate millions of metering records into invoices without latency. Migration toward multi-cloud environments and the attendant demand for granular cost attribution are the pivotal forces behind this double-digit expansion. Heightened infrastructure outlays by hyperscalers, advances in real-time metering, and a pronounced shift from capacity-based to outcome-based purchasing have all amplified the relevance of the cloud billing market. In parallel, specialized vendors that embed machine-learning cost-optimization features are compressing implementation timelines and easing the skills burden on enterprise FinOps teams.

Global Cloud Billing Market Trends and Insights

Accelerating Multi-Cloud Adoption

Multi-cloud strategies are rising as organizations distribute workloads to balance resilience, pricing, and data-residency mandates. Policy-driven resource controls inside Kubernetes have demonstrated that finely tuned autoscaling curbs unpredictable spend while maintaining governance. Billing platforms now reconcile divergent price books, currencies, and taxonomies in real time and supply chargeback reports that promote unit-level accountability. The cloud billing market gains tailwinds as hyperscalers publish consumption APIs that shorten data-ingestion cycles and as enterprises escape single-vendor risk by embracing provider diversity. Demand, therefore, concentrates on billing engines that normalise multi-cloud telemetry and present unified dashboards.

Expansion of E-Commerce Subscription Models

Subscription commerce no longer applies exclusively to SaaS. Retailers integrate physical goods, content bundles, and hybrid memberships that require intricate proration, tiered add-ons, and cyclical promotions. Platforms must orchestrate price adjustments triggered by customer behaviour and localise checkout in line with country-specific payment methods, PSD2 mandates, and GDPR obligations. Growth in recurring commerce strengthens the cloud billing market by broadening the user base from software publishers to merchants that ship tangible products.

Migration Complexities from Legacy On-Premises Billing

Long-standing on-prem billing stacks often carry undocumented business logic, making data mapping and rule translation difficult. Enterprises in regulated verticals simultaneously uphold PCI-DSS, SOX, or HIPAA mandates during cut-over, obliging dual-run environments that inflate project budgets. The resource burden deters some organisations from full transition and tempers the near-term expansion pace of the cloud billing market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Real-Time Usage-Based Pricing

- Token-Based Cloud Consumption Models in Web3 Startups

- Data-Sovereignty and Cross-Border Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hybrid environments are recording a 16.3% CAGR as organisations pair on-prem assets with hyperscale elasticity. The cloud billing market size for hybrid solutions is projected to expand at a 16.3% CAGR between 2025-2030. Enterprises value the capacity to shift workloads without forfeiting data residency or latency-sensitive processing, yet they encounter fractured cost structures. Billing vendors respond by releasing adapters that harmonise private-cloud telemetry with public-cloud rate cards.

Public deployment retains a 66.7% revenue lead thanks to simplicity and broad tooling ecosystems. Nevertheless, compliance triggers, edge use cases, and geopolitics strengthen the case for hybrid spend governance. The cloud billing market, therefore, pivots toward unified orchestration engines that calculate blended effective rates and surface variance reports across locations.

Services revenue is climbing at 17.1% CAGR as enterprises outsource roadmap planning, integration, and optimisation. Providers bundle advisory, implementation, and managed operations that target rapid payback. Platforms continue to dominate with a 60.8% share, yet service-led engagement secures footholds in regulated domains where bespoke controls are pivotal.

The cloud billing market benefits because service specialists translate domain nuances into configuration baselines that shrink deployment risk. Bundled offerings that pair platform licences with lifecycle services foster stickier contracts and unlock expansion into adjacent cost-governance modules such as carbon tracing and partner settlement.

Cloud Billing Market is Segmented by Deployment (Public Cloud, Private Cloud, and Hybrid Cloud), Component (Platform and Services), Billing Model (Subscription-Based, Usage-Based, and Hybrid), Cloud Service Model (SaaS Billing, Paas Billing, and IaaS Billing), Organization Size (Large Enterprises and Small and Medium Enterprises), End-User Industry (Retail and E-Commerce, BFSI, and More), and Geography.

Geography Analysis

North America generated 37.2% of 2024 revenue and continues to benefit from a concentration of hyperscalers, venture funding, and FinOps talent. The region rewards vendors that comply with frameworks such as SOX and state-level privacy statutes. High usage of AI workloads also catalyses the adoption of token-metered services, reinforcing demand for real-time rating.

Asia-Pacific posts the fastest 16.8% CAGR due to public-sector digitisation, mobile-first consumer bases, and sovereign AI compute initiatives. India's national GPU programme exemplifies how government grants catalyse cloud capacity that must be monetised through scalable billing. Japan's carbon-linked battery network highlights regional appetite for merging cost with environmental KPIs. Providers that bundle localisation and language support gain early footholds.

Europe balances GDPR leadership with emerging digital sovereignty plans. Enterprises require local data centres and transparent data-processing chains, so billing platforms that guarantee regional residency gain preference. Initiatives encouraging carbon-aware scheduling drive the cloud billing market toward environmental chargeback reports. Fragmented national rules prolong procurement cycles, yet they also amplify barriers for newcomers and solidify loyalty to vendors adept at navigating compliance nuances.

- Amazon Web Services (AWS) Inc.

- Microsoft Corporation (Azure)

- Google Cloud Platform

- Oracle Corporation

- SAP SE

- Salesforce Inc. (Revenue Cloud)

- Zuora Inc.

- Aria Systems Inc.

- BillingPlatform LLC

- FinancialForce LLC

- IBM Corporation

- Comarch SA

- Tencent Cloud

- Huawei Cloud

- Alibaba Cloud

- CloudBlue (An Ingram Micro Co.)

- CloudHealth (Vmware)

- Chargebee Inc.

- Recurly Inc.

- Stripe Billing

- Paddle.com Market Ltd.

- ChargeOver LLC

- Vertex Inc.

- GoCardless Ltd.

- Orb Inc.

- SaaSOptics (An Ramped Co.)

- LogiSense Corp.

- Gotransverse LLC

- Rev.io Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating multi-cloud adoption

- 4.2.2 Expansion of e-commerce subscription models

- 4.2.3 Rising demand for real-time usage-based pricing

- 4.2.4 Token-based cloud consumption models in Web3 startups

- 4.2.5 Carbon-aware workload scheduling incentives

- 4.3 Market Restraints

- 4.3.1 Migration complexities from legacy on-prem billing

- 4.3.2 Data-sovereignty and cross-border compliance costs

- 4.3.3 Rising FinOps tooling cannibalising native billing margins

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Generative AI for automated invoicing)

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment

- 5.1.1 Public Cloud

- 5.1.2 Private Cloud

- 5.1.3 Hybrid Cloud

- 5.2 By Component

- 5.2.1 Platform

- 5.2.2 Services

- 5.3 By Billing Model

- 5.3.1 Subscription-based

- 5.3.2 Usage-based

- 5.3.3 Hybrid (Subscription + Usage)

- 5.4 By Cloud Service Model

- 5.4.1 SaaS Billing

- 5.4.2 PaaS Billing

- 5.4.3 IaaS Billing

- 5.5 By Organization Size

- 5.5.1 Large Enterprises

- 5.5.2 Small and Medium Enterprises (SMEs)

- 5.6 By End-user Industry

- 5.6.1 Retail and E-commerce

- 5.6.2 BFSI

- 5.6.3 Telecommunications

- 5.6.4 Healthcare and Life Sciences

- 5.6.5 Energy and Utilities

- 5.6.6 Government and Public Sector

- 5.6.7 Media and Entertainment

- 5.6.8 Other End-user Industries

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Chile

- 5.7.2.4 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Singapore

- 5.7.4.6 Malaysia

- 5.7.4.7 Australia

- 5.7.4.8 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 United Arab Emirates

- 5.7.5.1.2 Saudi Arabia

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Egypt

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services (AWS) Inc.

- 6.4.2 Microsoft Corporation (Azure)

- 6.4.3 Google Cloud Platform

- 6.4.4 Oracle Corporation

- 6.4.5 SAP SE

- 6.4.6 Salesforce Inc. (Revenue Cloud)

- 6.4.7 Zuora Inc.

- 6.4.8 Aria Systems Inc.

- 6.4.9 BillingPlatform LLC

- 6.4.10 FinancialForce LLC

- 6.4.11 IBM Corporation

- 6.4.12 Comarch SA

- 6.4.13 Tencent Cloud

- 6.4.14 Huawei Cloud

- 6.4.15 Alibaba Cloud

- 6.4.16 CloudBlue (An Ingram Micro Co.)

- 6.4.17 CloudHealth (Vmware)

- 6.4.18 Chargebee Inc.

- 6.4.19 Recurly Inc.

- 6.4.20 Stripe Billing

- 6.4.21 Paddle.com Market Ltd.

- 6.4.22 ChargeOver LLC

- 6.4.23 Vertex Inc.

- 6.4.24 GoCardless Ltd.

- 6.4.25 Orb Inc.

- 6.4.26 SaaSOptics (An Ramped Co.)

- 6.4.27 LogiSense Corp.

- 6.4.28 Gotransverse LLC

- 6.4.29 Rev.io Technologies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment