PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851154

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851154

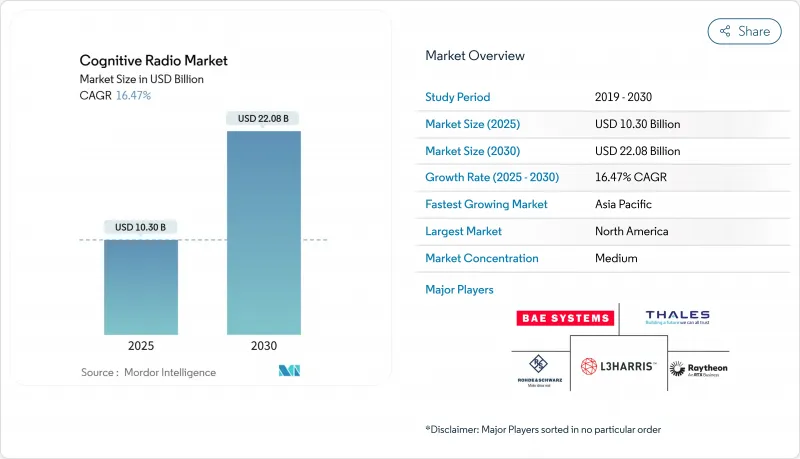

Cognitive Radio - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cognitive Radio Market size is estimated at USD 10.30 billion in 2025, and is expected to reach USD 22.08 billion by 2030, at a CAGR of 16.47% during the forecast period (2025-2030).

Accelerated growth comes from widening mid- and high-band spectrum shortages, progress in artificial-intelligence-based sensing algorithms, and the pressing need to orchestrate 5G and early 6G networks on a dynamic, shared-spectrum basis. Governments endorse spectrum-sharing mandates and channel sizable research budgets toward testbeds, while defense agencies validate large-scale demonstrations that de-risk commercial adoption. Semiconductor incentives under the CHIPS Act bolster domestic hardware capacity, and millimeter-wave 5G rollouts push demand for radios capable of agile beam steering and split-second spectrum hand-offs. As chipset prices rise and AI workloads shift from the cloud to the radio edge, suppliers answer with vertically integrated designs and diversified raw-material sourcing strategies to preserve margins.

Global Cognitive Radio Market Trends and Insights

Growing Need to Optimize Spectrum Utilization

Traffic growth is exhausting legacy allocations, prompting regulators to prioritize dynamic sharing policies that hinge on cognitive sensing. Citizens Broadband Radio Service rule updates alone unlocked service to 72 million more U.S. users without harming incumbent radars. New sensing engines scan wide swaths in milliseconds, and a USD 1.6 billion federal budget backs research aimed at reducing federal-commercial conflicts. Mid-band corridors remain the epicenter because they hold favorable propagation for 5G smartphones yet also host weather radars and defense systems. Vendors showcase chipsets that couple direct-RF sampling with on-chip AI inference to spot spectral holes on the fly. These advances let operators raise capacity without expensive new licenses, supporting the cognitive radio market's long-run expansion.

Rising Deployment of 5G Service Applications

Dense 5G footprints require agile frequency management to sustain throughput targets within finite spectrum blocks. China surpassed 228,700 base stations and is headed for 60% user penetration by 2025, relying on cognitive scheduling to coordinate mid- and high-band carriers. Japan issued 153 local 4.7 GHz licenses for private 5G, proving how context-aware radios enable factory networks inside tightly zoned channels. Integrated Sensing and Communication concepts for 6G merge radar and data links, further tightening spectral budgets. Vendors funnel multi-billion-dollar R&D into AI-native core software that uses real-time spectrum intelligence to steer traffic. As these deployments mature, the cognitive radio market secures a larger role in mobile-network reference designs.

Lack of Robust Computational Security Infrastructure

Dynamic radios broaden the attack surface because adversaries can spoof sensing data or tamper with machine-learning models. Early blockchain-based sharing pilots achieve limited transaction throughput, slowing spectrum trades. Defense agencies test electromagnetic decoys to mask activity, but adversarial-AI countermeasures remain under active research. Quantum key distribution shows promise yet currently secures only kilobit-level streams over short ranges, falling short of field requirements. Until scalable, low-latency safeguards arrive, critical-infrastructure owners adopt wait-and-see postures that temper near-term uptake.

Other drivers and restraints analyzed in the detailed report include:

- Government Mandates for Dynamic Spectrum Sharing Frameworks

- AI-Powered Spectrum Sensing Algorithms Mature

- Regulatory Ambiguity on Secondary Spectrum Usage Rights

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Spectrum Sensing & Allocation controlled 38% of global 2024 revenue, solidifying its role as the prerequisite layer that every deployment must integrate. High-speed detectors satisfy FCC rules that demand incumbent radar protection within milliseconds. Mission-critical performance needs pushed vendors to combine direct-RF sampling with edge AI accelerators, gifting operators near-instant insight into spectrum occupancy. Cognitive Routing, while smaller today, is scaling at an 18.70% CAGR as AI engines start to correlate link quality, user mobility, and latency budgets during path selection. Dynamic route adjustment becomes indispensable to vehicle-to-everything (C-V2X) rollouts, where split-second channel variation can jeopardize road-safety alerts. Enterprises extend these principles to factory floor robots, ensuring reliable wireless coverage in metal-dense halls.

In quantitative terms, the cognitive radio market size contributions from sensing surpass routing for now yet routing augments overall system value because it turns raw occupancy data into actionable decisions. As 6G testbeds merge sensing and communications, vendors bundle both features within a single stack, expanding average selling prices. Location Detection and QoS Optimization also post double-digit growth, aided by frameworks such as RadioLLM that forecast congestion before it happens. Emergency and satellite applications round out the portfolio, benefiting from multi-orbit handover mechanisms that let first responders switch from terrestrial to space links when terrestrial networks falter.

Hardware collected 46% of 2024 sales thanks to continued demand for wideband converters, field-programmable gate arrays, and beam-steered antenna arrays. Direct-RF sampling chips such as the AD9084 now digitize hundreds of megahertz of spectrum in a single step, shrinking system footprints. That hardware base enables rapid gains in software value, explaining the 17.10% CAGR booked by Software & Firmware. Vendors embed containerized microservices that continuously retrain spectrum models onsite, moving intelligence from the cloud to the edge. Services revenue rises as carriers seek system integrators to calibrate AI models for local propagation realities.

Over the forecast horizon, software gains steadily erode hardware-only differentiation because competing radio modules deliver similar noise figures and power outputs. Suppliers therefore, highlight firmware update pipelines that extend field lifetimes without swapping boards. For users, this converts capex into opex and smooths upgrade paths that keep the cognitive radio market share of software on an upward glide path. Antenna innovation also marches ahead: electronically steerable arrays packaged with dual-band feeds support multi-orbit satellite roaming.

Cognitive Radio Market Report is Segmented by Application (Spectrum Sensing and Allocation, Location Detection, Cognitive Routing, and More), Component (Hardware, Software and Firmware, and Services), Spectrum Band (HF/VHF/UHF [Less Than 1 GHz], SHF [1-6 GHz], and EHF [More Than 6 GHz, Mmwave]), End-User Industry (Telecommunications, IT and ITes, Government and Defense, Transportation and Logistics, and More), and Geography.

Geography Analysis

North America held 37% of 2024 revenue and remains the reference market in regulatory innovation. The National Spectrum Strategy earmarks USD 6.6 billion for semiconductor buildouts and pilots that vet dynamic sharing across low-, mid-, and high-bands. Defense contractors such as L3Harris carry order backlogs topping USD 33 billion that include spectrum-aware platforms for joint-all-domain operations. High civilian uptake mirrors aggressive fixed-wireless rollouts that bridge rural broadband gaps while preserving incumbent public-safety services.

Asia Pacific is projected to rise at a 17.60% CAGR as operators chase large addressable subscriber bases and governments treat 6G leadership as a strategic asset. China's dense 5G macro-cell layer and 6G testbeds require radios able to juggle mid- and millimeter-wave assets, while Japan and South Korea incentivize private-5G licenses for factories and ports. Tri-lateral technology pacts among the three nations concentrate research funding on resilient supply chains and open-RAN experimentation.

Europe advances on the strength of vendor R&D and pan-EU harmonization. Ericsson allocated EUR 4.4 billion to AI-native architectures in 2024, and Thales secured EUR 25.3 billion in orders tied to defense communications. The EU's Horizon Europe projects partner with Keysight to validate 6G radio prototypes, accelerating lab-to-field transition timelines. Cross-border alignment under ETSI reduces certification costs and supports multi-market equipment release strategies, cementing steady but less volatile regional growth.

- BAE Systems plc

- Thales Group

- Raytheon Technologies Corp.

- Rohde and Schwarz GmbH and Co KG

- Shared Spectrum Company

- L3Harris Technologies

- Huawei Technologies Co. Ltd.

- NuRAN Wireless Inc.

- Keysight Technologies

- Vecima Networks Inc.

- Northrop Grumman Corp.

- Ericsson AB

- Nokia Corp.

- Qorvo Inc.

- Analog Devices Inc.

- National Instruments Corp.

- Curtis-Wright Corp.

- Viasat Inc.

- Cobham Ltd.

- Elbit Systems Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing need to optimize spectrum utilization

- 4.2.2 Rising deployment of 5G service applications

- 4.2.3 Surge in IoT-connected devices driving dynamic spectrum demand

- 4.2.4 Government mandates for dynamic spectrum sharing frameworks

- 4.2.5 AI-powered spectrum sensing algorithms mature

- 4.2.6 Private 6G testbeds accelerating research and development funding

- 4.3 Market Restraints

- 4.3.1 Lack of robust computational security infrastructure

- 4.3.2 Regulatory ambiguity on secondary spectrum usage rights

- 4.3.3 High capex for cognitive-enabled RF front-ends

- 4.3.4 Scarcity of field-proven cognitive radio chipsets

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Spectrum Sensing and Allocation

- 5.1.2 Location Detection

- 5.1.3 Cognitive Routing

- 5.1.4 QoS Optimisation

- 5.1.5 Other Applications

- 5.2 By Component

- 5.2.1 Hardware (RF Transceivers, SDR Modules, Antennas)

- 5.2.2 Software and Firmware

- 5.2.3 Services

- 5.3 By Spectrum Band

- 5.3.1 HF/VHF/UHF (Less than 1 GHz)

- 5.3.2 SHF (1-6 GHz)

- 5.3.3 EHF (More than 6 GHz, mmWave)

- 5.4 By End-user Industry

- 5.4.1 Telecommunication

- 5.4.2 IT and ITeS

- 5.4.3 Government and Defense

- 5.4.4 Transportation and Logistics

- 5.4.5 Energy and Utilities

- 5.4.6 Other Industries

- 5.5 By Network Type

- 5.5.1 Opportunistic Spectrum Access (OSA)

- 5.5.2 Spectrum Sharing

- 5.5.3 Cooperative Networks

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 UAE

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BAE Systems plc

- 6.4.2 Thales Group

- 6.4.3 Raytheon Technologies Corp.

- 6.4.4 Rohde and Schwarz GmbH and Co KG

- 6.4.5 Shared Spectrum Company

- 6.4.6 L3Harris Technologies

- 6.4.7 Huawei Technologies Co. Ltd.

- 6.4.8 NuRAN Wireless Inc.

- 6.4.9 Keysight Technologies

- 6.4.10 Vecima Networks Inc.

- 6.4.11 Northrop Grumman Corp.

- 6.4.12 Ericsson AB

- 6.4.13 Nokia Corp.

- 6.4.14 Qorvo Inc.

- 6.4.15 Analog Devices Inc.

- 6.4.16 National Instruments Corp.

- 6.4.17 Curtis-Wright Corp.

- 6.4.18 Viasat Inc.

- 6.4.19 Cobham Ltd.

- 6.4.20 Elbit Systems Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment