PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851155

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851155

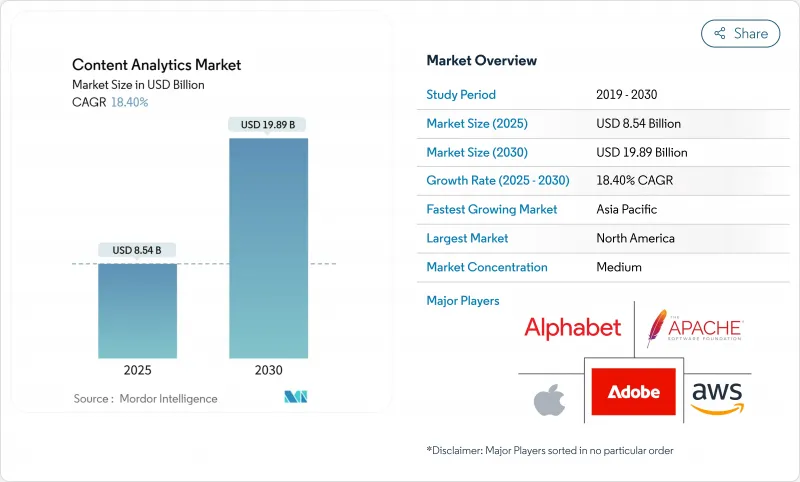

Content Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Content Analytics Market size is estimated at USD 8.54 billion in 2025, and is expected to reach USD 19.89 billion by 2030, at a CAGR of 18.40% during the forecast period (2025-2030).

Accelerating cloud migration, rapid adoption of multimodal AI, and the convergence of vector search with semantic embedding technologies are reshaping how enterprises extract value from unstructured information. Public cloud deployments, real-time social listening, and large-language-model-powered "knowledge mining" pipelines are lowering entry barriers and encouraging experimentation. At the same time, demand is rising for hybrid architectures that balance data-sovereignty mandates with the scale advantages of hyperscale AI platforms. Intensifying competition among retail, media, and BFSI incumbents is pushing vendors toward verticalized solutions that promise faster time-to-value and measurable productivity gains. Together, these factors suggest that the content analytics market will keep outpacing broader enterprise-software spending through the forecast window.

Global Content Analytics Market Trends and Insights

Exponential Growth of Unstructured Enterprise Data

Unstructured information already represents the majority of corporate memory, with 80% of the 175 zettabytes expected in 2025 originating outside relational systems. Health-care providers, for example, digitized millions of images and charts to unlock real-time clinical insight while eliminating physical storage costs. These volumes are pushing enterprises toward lakehouse architectures that embed vector functions inside familiar SQL engines, allowing knowledge workers to ask semantic questions against documents, chat logs, and medical scans in the same query.

Surging Adoption of Cloud-Based Analytics Platforms

Public-cloud AI services let enterprises rent transformer-scale models on demand, avoiding capital expenditure on specialized hardware. Amazon Web Services recorded USD 33.5 billion in Q1 2025 sales, up 17% year on year, driven largely by analytics workloads. Hybrid patterns are now mainstream as firms split workloads across providers to optimize for latency, cost, and jurisdictional compliance. Google BigQuery and Microsoft Knowledge Mining pipelines are anchoring this shift by abstracting infrastructure while exposing vector search APIs.

Shortage of Data-Literate Workforce and Change Management Gaps

Only 37% of technology leaders judge generative AI as valuable today, largely because firms struggle to translate prototypes into scaled workflows. Federal Reserve research shows AI uptake ranging from 5% to 40% across companies, highlighting the skills dispersion in data engineering, model governance, and domain-specific prompt design. Without targeted reskilling programs, analytics value realisation risks stalling despite abundant vendor offerings.

Other drivers and restraints analyzed in the detailed report include:

- Real-Time Social Media Listening for Brand Reputation

- Vector Search and Semantic Embedding Unlock Deeper Insights

- Escalating Data-Privacy and Sovereignty Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Public-cloud services captured 56.2% revenue in 2024 as enterprises sought frictionless access to transformer-class models. This share underscores the cost-efficiency and elasticity advantages that cloud hyperscalers continue to refine. The content analytics market size for public-cloud workloads is projected to climb steeply on the back of managed feature stores, model hubs, and enterprise prompts libraries. Hybrid and multi-cloud deployments are on a 21.3% CAGR trajectory because firms must reconcile latency-sensitive use cases with data-residency statutes. In regulated sectors, on-premise appliances remain indispensable for workloads requiring deterministic throughput or sovereign control.

Enterprises increasingly position vector indexes at the edge while offloading heavy embedding generation to cloud GPUs, achieving policy compliance without sacrificing insight depth. Vendors now bundle observability dashboards that score pipeline health across private and public endpoints, a trend that strengthens the content analytics market's resilience to single-provider outages.

Social media monitoring retained a 33.6% share in 2024, reflecting mature adoption of brand-listening suites and influencer tracking modules. Yet contact-center automation, real-time transcription, and voice biometrics are pushing speech and audio analytics toward a 20.5% CAGR, the fastest among tracked segments. The content analytics market size for speech-centric tools is scaling as voice assistants proliferate across banking, travel, and healthcare kiosks. High-quality automatic speech recognition feeds multi-modal dashboards where tone, sentiment, and intent scores guide agent coaching or trigger escalation workflows.

Text analytics remains essential for contractual review and compliance flagging, while video-centric pipelines serve loss-prevention and streaming-content optimisation. Convergence is gaining speed as social-video clips, call-center transcriptions, and user-posted images are routed into the same model garden. The industry narrative, therefore, shifts away from siloed products toward cohesive experience engines, reinforcing long-term growth prospects for the content analytics market.

Content Analytics Market is Segmented by Deployment Type (On-Premise, Public Cloud, and Hybrid/Multi-Cloud), Application (Text Analytics, Video Analytics, and More), End-User Industry (BFSI, Healthcare and Life Sciences, and More), Organisation Size (Large Enterprises and Small and Medium-Sized Enterprises), Content Type (Text, Image, Audio, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 38.1% revenue share in 2024 because early cloud adoption produced mature data-science talent pools and extensive third-party marketplace ecosystems. Major providers like AWS drove double-digit percentage growth by bundling advanced vector search primitives into serverless databases, raising the entry barrier for regional challengers. Technology buyers benefit from a stable regulatory backdrop, although impending European ESG-reporting mandates already affect thousands of US multinationals that must align disclosure pipelines accordingly. The region's spend mix spans financial services, health-tech, and direct-to-consumer retail, ensuring diversified momentum for the content analytics market.

Asia-Pacific is the fastest-growing territory, expected to clock a 21.7% CAGR through 2030. Government-backed infrastructure projects, including Hong Kong's 3,000-petaflops supercomputing centre and India's USD 1.3 billion compute strategy, provision the GPU density required for multimodal and large-language model workloads. Social-media penetration across WeChat, LINE, and Douyin ensures abundant vernacular data that accelerates fine-tuning cycles. Regional cloud providers are racing to deliver sovereign AI zones to meet localisation rules, a move likely to preserve high services revenue inside domestic value chains.

Europe advances steadily despite fragmented privacy regimes. Seventy-five percent of professionals cite regulation as their biggest AI hurdle, yet the region leads in privacy-preserving analytics such as federated learning. Automotive, industrial, and energy sectors align with academic labs to commercialise lightweight multimodal models that run on embedded hardware, reinforcing manufacturing competitiveness. Private investment still trails North American and Chinese levels, motivating policy debate on strategic AI autonomy.

Middle East and Africa show emerging momentum in public-sector digitalisation and fintech. Limited local GPU availability has spurred interest in edge accelerators that minimise data egress. Latin America mirrors this trend, with retail payment disruptors and urban-safety agencies embracing SaaS voice analytics. Although smaller in absolute terms, these regions contribute incremental demand that diversifies vendor revenue streams and mitigates geographic concentration risk in the global content analytics market.

- Adobe Inc.

- Alphabet Inc. (Google Cloud)

- Amazon Web Services, Inc.

- Apache Software Foundation (OpenSearch)

- Apple Inc. (Apple Analytics)

- Bazaarvoice, Inc.

- Cision Ltd. (Brandwatch)

- Clarabridge, Inc. (a Qualtrics company)

- ContentSquare S.A.S.

- Databricks, Inc.

- Hootsuite Inc.

- IBM Corporation

- Meltwater B.V.

- Microsoft Corporation

- NetBase Quid, Inc.

- NICE Ltd.

- OpenText Corporation

- Oracle Corporation

- Palantir Technologies Inc.

- SAS Institute Inc.

- Sprinklr, Inc.

- Talkwalker S.A.

- Teradata Corporation

- TIBCO Software Inc.

- Verint Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exponential growth of unstructured enterprise data

- 4.2.2 Surging adoption of cloud-based analytics platforms

- 4.2.3 Real-time social media listening for brand reputation

- 4.2.4 Vector search and semantic embedding unlock deeper insights

- 4.2.5 Multimodal (text-image-video) analytics in GenAI workflows

- 4.2.6 e-Discovery compliance pressures in regulated industries

- 4.3 Market Restraints

- 4.3.1 Shortage of data-literate workforce and change management gaps

- 4.3.2 Escalating data-privacy/sovereignty regulations

- 4.3.3 High energy and carbon footprint of large-scale AI pipelines

- 4.3.4 Fragmentation of content formats and lack of standardisation

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment Type

- 5.1.1 On-Premise

- 5.1.2 Public Cloud

- 5.1.3 Hybrid/Multi-Cloud

- 5.2 By Application

- 5.2.1 Text Analytics

- 5.2.2 Video Analytics

- 5.2.3 Social Media Analytics

- 5.2.4 Speech/Audio Analytics

- 5.2.5 Web and Document Analytics

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Healthcare and Life Sciences

- 5.3.3 Retail and Consumer Goods

- 5.3.4 IT and Telecom

- 5.3.5 Manufacturing

- 5.3.6 Government and Public Sector

- 5.3.7 Media and Entertainment

- 5.3.8 Other End-user Industries

- 5.4 By Organisation Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium-sized Enterprises (SMEs)

- 5.5 By Content Type

- 5.5.1 Text

- 5.5.2 Image

- 5.5.3 Audio

- 5.5.4 Video

- 5.5.5 Multimodal/Composite

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Singapore

- 5.6.4.6 Malaysia

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adobe Inc.

- 6.4.2 Alphabet Inc. (Google Cloud)

- 6.4.3 Amazon Web Services, Inc.

- 6.4.4 Apache Software Foundation (OpenSearch)

- 6.4.5 Apple Inc. (Apple Analytics)

- 6.4.6 Bazaarvoice, Inc.

- 6.4.7 Cision Ltd. (Brandwatch)

- 6.4.8 Clarabridge, Inc. (a Qualtrics company)

- 6.4.9 ContentSquare S.A.S.

- 6.4.10 Databricks, Inc.

- 6.4.11 Hootsuite Inc.

- 6.4.12 IBM Corporation

- 6.4.13 Meltwater B.V.

- 6.4.14 Microsoft Corporation

- 6.4.15 NetBase Quid, Inc.

- 6.4.16 NICE Ltd.

- 6.4.17 OpenText Corporation

- 6.4.18 Oracle Corporation

- 6.4.19 Palantir Technologies Inc.

- 6.4.20 SAS Institute Inc.

- 6.4.21 Sprinklr, Inc.

- 6.4.22 Talkwalker S.A.

- 6.4.23 Teradata Corporation

- 6.4.24 TIBCO Software Inc.

- 6.4.25 Verint Systems Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment