PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851176

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851176

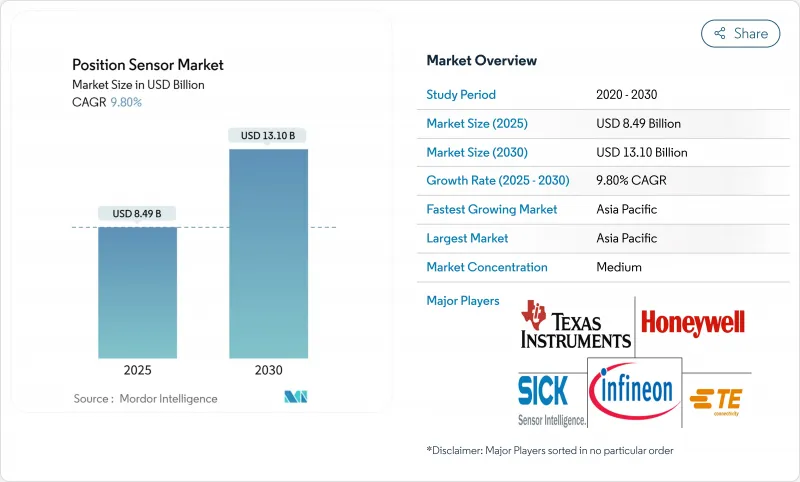

Position Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The agricultural position sensor market is currently valued at USD 8.49 billion, and it is forecast to advance at a 9.80% CAGR, lifting revenue to USD 13.10 billion by 2030.

Growth is propelled by the rapid move from basic mechanization toward fully automated field operations that require micrometer-level feedback for steering, hydraulics, and implement control. OEMs are embedding ruggedized angle and linear sensors into autonomous tractors, sprayers, and conveyors to comply with emerging safety rules, while semiconductor suppliers are shrinking MEMS packages to cut power budgets and ease integration. Supply chain pressure on rare-earth magnets is nudging buyers to evaluate inductive, optical, and time-of-flight alternatives that can survive harsh dust, vibration, and temperature cycles. At the same time, on-edge AI routines and energy harvesting are extending sensor life in remote acreage where broadband coverage is unreliable.

Global Position Sensor Market Trends and Insights

Rising Automation in Industry 4.0 Settings

Smart-factory principles are reshaping machinery design, demanding continuous, sub-millimeter positional data that links seamlessly with digital twins. Tractor and combine builders now preload telematics gateways that stream sensor outputs into cloud dashboards, enabling real-time fleet coordination and remote diagnostics. Precision seeding systems adjust planter depth on the fly using magnetostrictive rods that report cylinder position to within 10 µm, saving fuel and inputs during tight planting windows. In parallel, manufacturers are fusing lidar, radar, and angle sensing to create 360-degree situational awareness for driverless vehicles. This momentum strengthens the agricultural position sensor market as OEMs standardize smart interfaces across new model platforms.

Electrification and Functional-Safety Needs

Transitioning to high-voltage drivetrains forces designers to specify sensors that remain accurate despite electromagnetic interference and large temperature swings. Rotor position in electric traction motors must be measured to within 1° for peak efficiency, and redundant channels are mandatory to meet ISO 26262 Automotive Safety Integrity Level D. Infineon's USD 2.5 billion purchase of Marvell's automotive Ethernet business underscores the strategic value of tightly coupled sensing and networking stacks. The push toward certified, dual-die architectures boosts content per vehicle and deepens supplier engagement, adding momentum to the agricultural position sensor market through retrofit kits that electrify legacy fleets.

High ASPs of Non-Contact Linear Sensors

Magnetostrictive and optical encoders often list three to five times above potentiometric rods, stretching capital budgets for small farms. Neo Performance Materials links quarter-on-quarter price swings in neodymium magnets to volatility in gross margins that cascade into sensor pricing. While longer life and zero recalibration lower the total cost of ownership, the upfront premium slows replacements in older hydraulic cylinders and restrains near-term conversion within the agricultural position sensor market.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturization of MEMS Position Sensors

- On-Chip Diagnostics for ISO 26262 Compliance

- Combo-IC Inertial Sensors Substituting Dedicated Line

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Linear devices generated 41% of 2024 revenue within the agricultural position sensor market, reflecting their indispensability in-depth control for tillage, seeding, and sprayer boom leveling. Magnetostrictive rods endure hydraulic pressures above 350 bar and resist abrasive soil, extending service intervals beyond 20,000 hours. Rotary encoders followed at 33%, essential for steering knuckles and power take-off shafts that demand accurate angular data for closed-loop guidance. Proximity and displacement models accounted for the significant share, thriving in header height detection and obstacle avoidance use cases.

Laser displacement technology is the breakout niche, projected to climb at a 13.8% CAGR to 2030 as prices fall and optical contamination mitigation improves. This pace outstrips overall agricultural position sensor market growth, helped by conveyor-type harvester yield monitors and fruit grading systems that require sub-millimeter distance measurement to classify crops.

Non-contact architectures, Hall, TMR, inductive, optical, and lidar, secured a 62% slice of 2024 revenue, confirming their suitability for mud, shock, and vibration that degrade wiper-arm potentiometers. Hall-based angle devices with integrated T-code interfaces now ship in tractors exceeding 600 hp, where contact wear poses failure risks. Contact solutions still occupy 38% of the agricultural position sensor market because they offer adequate accuracy in grain cart augers and feed mixer slides at a fraction of the cost.

The non-contact segment is forecast to expand at 12.7% annually, supported by automotive cross-over platforms and automated optical inspection lines that share silicon and optical designs. SICK and Endress+Hauser's cooperation transfers industrial ruggedness into smart implements, multiplying addressable volume and pushing the agricultural position sensor market size for non-contact solutions toward double-digit billions by decade's end.

The Position Sensor Market is Segmented by Type (Linear Sensors, Rotary Sensors, and More), Technology (Contact and Non-Contact), Output Interface (Analog and Digital), Application (Agricultural Vehicles/Self-Propelled Machinery, Livestock Position and Health Monitoring, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 46% of 2024 sales, boosted by China's quest for 75% farm mechanization by 2025 and India's USD 6 billion allocation for digital platforms under its Digital Agriculture Mission. The region's projected 11.6% CAGR will keep it the growth engine for the agricultural position sensor market size through 2030. Imports of agricultural machinery into China rose 14.6% year on year, while India's budget carved out USD 6 billion for remote-sensing infrastructure linking farm registries to credit and insurance engines. The region's sustained double-digit expansion signals continual upgrades from basic GPS guidance to fully autonomous fleets, cementing Asia-Pacific's role as the fulcrum of the agricultural position sensor market.

Europe ranked second at 25%, spreading precision sprayers and autonomous weeding robots to meet Green Deal pesticide-reduction targets. The European Commission earmarked EUR 15 million (USD 16.5 million) under Horizon Europe to pilot agrobotics in 2025. North America held 21% thanks to large contiguous fields that unlock economies of scale for fully automated equipment, reinforced by the 2024 Farm, Food, and National Security Act, which launched a Federal Precision Agriculture Task Force.

North America contributed 21%, driven by early adopter farms that routinely deploy 30-meter boom sprayers, auto-guided planters, and fully autonomous grain carts. Water-scarce regions demonstrated tangible payback, as Florida's smart irrigation program saved 164 million gallons in 2024 by integrating soil-moisture probes with valve position sensors. The region's growth is steadier than Asia-Pacific's but remains firmly positive thanks to incremental upgrades, tax incentives, and a thriving ecosystem of retrofit kit suppliers that keep the agricultural position sensor market on a rising curve.

- Honeywell International Inc.

- TE Connectivity Ltd.

- Texas Instruments Incorporated

- SICK AG (Sick Holding GmbH)

- Infineon Technologies AG

- STMicroelectronics N.V.

- Balluff GmbH

- Renishaw plc

- Omron Corporation

- Allegro MicroSystems, Inc.

- Baumer Holding AG

- Pepperl+Fuchs SE

- ifm electronic gmbh (Ifm Stiftung & Co. Kg)

- ams-OSRAM AG (ams AG)

- Panasonic Industry Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising automation in Industry 4.0 settings

- 4.2.2 Electrification and functional-safety needs

- 4.2.3 Miniaturization of MEMS position sensors

- 4.2.4 On-chip diagnostics for ISO 26262 compliance

- 4.2.5 AI-enabled edge sensing for predictive O&M

- 4.2.6 Ultra-low-power energy-harvesting sensors

- 4.3 Market Restraints

- 4.3.1 High ASPs of non-contact linear sensors

- 4.3.2 Combo-IC inertial sensors substituting lines

- 4.3.3 Complex supply chain for specialty magnetics

- 4.3.4 Certification bottlenecks for ASIL-D designs

- 4.4 Technological Outlook

- 4.4.1 Hall-effect vs. AMR vs. TMR architectures

- 4.4.2 Magnetostrictive and optical encoder roadmaps

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Linear Sensors

- 5.1.2 Rotary Sensors

- 5.1.3 Proximity/Displacement Sensors

- 5.1.4 Other Types

- 5.2 By Technology

- 5.2.1 Contact

- 5.2.2 Non-contact

- 5.3 By Output Interface

- 5.3.1 Analog

- 5.3.2 Digital

- 5.4 By Agricultural Application

- 5.4.1 Agricultural Vehicles/Self-propelled Machinery

- 5.4.2 Livestock Position and Health Monitoring

- 5.4.3 Indoor/Vertical Farming Automation

- 5.4.4 Other Agricultural Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Australia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 TE Connectivity Ltd.

- 6.4.3 Texas Instruments Incorporated

- 6.4.4 SICK AG (Sick Holding GmbH)

- 6.4.5 Infineon Technologies AG

- 6.4.6 STMicroelectronics N.V.

- 6.4.7 Balluff GmbH

- 6.4.8 Renishaw plc

- 6.4.9 Omron Corporation

- 6.4.10 Allegro MicroSystems, Inc.

- 6.4.11 Baumer Holding AG

- 6.4.12 Pepperl+Fuchs SE

- 6.4.13 ifm electronic gmbh (Ifm Stiftung & Co. Kg)

- 6.4.14 ams-OSRAM AG (ams AG)

- 6.4.15 Panasonic Industry Co., Ltd.

7 Market Opportunities and Future Outlook