PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851181

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851181

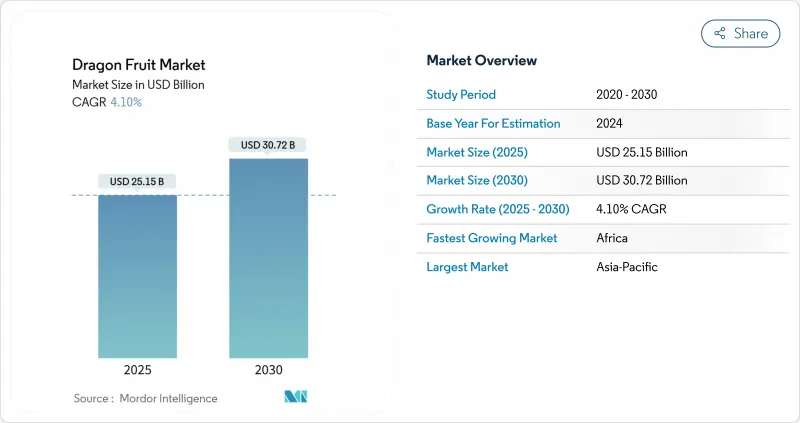

Dragon Fruit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Dragon Fruit Market size is estimated at USD 25.15 billion in 2025 and is projected to reach USD 30.72 billion by 2030, at a CAGR of 4.10% during the forecast period (2025-2030).

Rising health-oriented diets, expanding retail agreements, and steady technology adoption are moving the fruit from a niche item toward mainstream functional food status. Growers are benefiting from drought tolerance and carbon-sequestration traits that align with climate-resilient farming, a critical advantage as producers navigate erratic weather patterns. Precision agriculture tools such as remote-sensing yield maps and off-season LED lighting are improving productivity and lowering unit costs for export-grade fruit. Premiumization, led by yellow-skin and purple-flesh varieties that exceed 20 degrees Brix, is boosting grower margins and reshaping cultivar choices. Finally, the shift of supply chains toward Africa and South America is easing pressure on saturated Asian hubs, giving the dragon fruit market new cost bases and diversified risk profiles.

Global Dragon Fruit Market Trends and Insights

Expanded global retail supply agreements

Retailers are revising exotic-fruit sourcing to secure year-round volumes as demand outpaces supply. J&C Tropicals Inc. reported persistent stock-outs despite prices of USD 2.00-2.49 per lb, prompting direct contracts with growers that cut 200-300% wholesale mark-ups. Dole has added a weekly cold-chain vessel to the U.S. Northeast, improving transit reliability for Central American dragon fruit. Fresh Del Monte's 2024 net sales of USD 2.61 billion show broad distributor appetite for specialty fruit lines. These moves shrink lead times, reduce shrinkage, and stabilize pricing, which supports consistent shelf placement-a key step in mainstreaming the dragon fruit market. Retail certainty, in turn, encourages growers to invest in higher-yield cultivars and post-harvest systems.

Health-centric demand surge in the functional food segment

Clinical research confirms that regular dragon fruit intake lowers blood pressure and improves insulin response in pre-diabetic adults, reinforcing its "superfruit" branding. High levels of betacyanins and betalains are entering nutraceutical powders, beverage mixes, and cosmetic extracts, expanding revenue beyond fresh produce. Patent activity in Australia and the U.S. around standardizing bioactive content suggests an emerging regulatory baseline for functional claims. Demand grows fastest in markets where shoppers prioritize documented health outcomes, steering the dragon fruit market toward premium formats with traceable phytochemical levels. This positioning also buffers growers against commodity price swings because verified functionality commands enduring shelf premiums.

Stricter pesticide-residue enforcement thresholds

FDA Import Alert 99-05 enables automatic detention of non-compliant shipments, raising U.S. re-testing costs for exporters. EU inspections on Vietnamese consignments may rise from 10% to 30%, and rejection can erase an exporter's margin. Growers must prove field-to-fork traceability, triple-wash fruit, and pay for third-party audits that add 15-20% to production expenditure. Australia's biosecurity has listed eight quarantine pests for Philippine fruit, underscoring global vigilance. Smaller farms struggle with paperwork and laboratory fees, potentially accelerating consolidation inside the dragon fruit market toward large, tech-enabled operators.

Other drivers and restraints analyzed in the detailed report include:

- Off-season LED lighting yield boosts

- Premiumization through yellow and purple varieties

- Margin squeeze from production oversupply cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Red-skin and white-flesh fruit held a 57.2% dragon fruit market share in 2024, buoyed by entrenched consumer habits and mature logistics. Yellow-skin and white-flesh commands premiums: Ecuador exported 56,807 metric tons in 2024, 60% bound for the U.S., where sweetness above 20 degrees Brix backs upscale positioning. This segment's 6.20% CAGR illustrates robust demand elasticity as shoppers trade up for a taste. Red-skin and red-flesh sit in the middle, marrying vibrant colors with moderate sugars that appeal to Asian gift-fruit buyers.

Purple-flesh hybrids are emerging, pitched on antioxidant density that eclipses white pulp twofold. Genome-assisted breeding shortens cultivar release cycles and enables disease-resistant lines, broadening the dragon fruit market size for specialty niches. Growers now weigh higher field costs against superior FOB prices, recalibrating orchards toward mixed-variant strategies that stabilize income.

The Dragon Fruit Market Report is Segmented by Variety (Red-Skin and White-Flesh and More) and by Geography (North America, Europe, and More). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Asia-Pacific dominates with 70.1% of dragon fruit market share in 2024, reflecting decades of cultivation expertise, dense export infrastructure, and strong domestic demand in China and Vietnam. Vietnam alone shipped nearly 1 million metric tons valued at USD 895.70 million, while China's 1.6 million metric tons harvest in 2021 cemented the region's scale advantage. Governments across Thailand and Indonesia are supporting new acreage, and the spread of LED night-lighting allows year-round output even in foothill zones once deemed marginal. Technology leadership, combined with large buyer networks, helps the region capture the most premium contracts despite rising compliance costs for pesticide testing. Reliance on a few gateway buyers, chiefly China, leaves exporters exposed to sudden policy or phytosanitary shifts that can redirect volumes overnight.

Africa, the fastest growing region, is expanding at a 5.10% CAGR through 2030, yet still accounts for less than 5% of the dragon fruit market share. Kenya illustrates the upside as smallholders earn USD 1.90-3.90 per kg and branch into juice and powder lines that lift rural incomes. The crop's drought tolerance suits semi-arid countries, and early trials in South Africa point to broader continental uptake once cold-chain gaps close. Turkey and Israel are applying greenhouse know-how from tomatoes to pitahaya, targeting premium windows when Asian supply ebbs. These initiatives diversify global sourcing and reduce the market's over-reliance on Asian orchards.

North America and Europe remain high-value import markets, backed by irradiation protocols in the United States and wellness-focused shoppers across Germany, France, and the United Kingdom. Domestic plots in Florida and California cover roughly 500-600 acres but satisfy only niche demand, keeping ports busy with South American shipments. EU residue checks are tightening, pushing suppliers to invest in full-chain traceability and third-party audits. In South America, Ecuador leverages biodiversity to export premium yellow fruit, while Colombia and Peru evaluate pitahaya as a rotation crop after coffee. Collectively, widening geographic spread strengthens supply resilience and enlarges the overall dragon fruit market size.

- Market Overview

- Market Drivers

- Market Restraints

- Value / Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Key Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanded global retail supply agreements

- 4.2.2 Health-centric demand surge in the functional food segment

- 4.2.3 Off-season LED lighting yield boosts

- 4.2.4 Premiumization through yellow and purple varieties

- 4.2.5 Precision-ag remote-sensing yield mapping

- 4.2.6 Carbon-credit revenue from semi-arid orchards

- 4.3 Market Restraints

- 4.3.1 Stricter pesticide-residue enforcement thresholds

- 4.3.2 Margin squeeze from production oversupply cycles

- 4.3.3 Light-pollution curbs on night-lighting farms

- 4.3.4 Trans-boundary cactus-moth infestation risk

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts

- 5.1 By Variety

- 5.1.1 Red-skin and White-flesh

- 5.1.2 Red-skin and Red-flesh

- 5.1.3 Yellow-skin and White-flesh

- 5.1.4 Purple-flesh hybrids

- 5.2 By Geography (Production Analysis, Consumption Analysis by Volume and Value, Import Analysis by Volume and Value, Export Analysis by Volume and Value, and Price Trend Analysis)

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Netherlands

- 5.2.2.5 Russia

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Vietnam

- 5.2.3.3 Cambodia

- 5.2.3.4 India

- 5.2.3.5 Thailand

- 5.2.3.6 Indonesia

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Colombia

- 5.2.4.3 Argentina

- 5.2.5 Middle East

- 5.2.5.1 Israel

- 5.2.5.2 Turkey

- 5.2.6 Africa

- 5.2.6.1 South Africa

- 5.2.1 North America

6 Competitive Landscape

- 6.1 List of Key Stakeholders

- 6.1.1 Song Nam Dragon Fruit

- 6.1.2 Hoang Hau Dragon Fruit

- 6.1.3 Dole plc

- 6.1.4 Del Monte International GmbH

- 6.1.5 Amazon Dragon Fruit

- 6.1.6 Natural Fruit Company

- 6.1.7 Minh Phuong Fruit

- 6.1.8 Mekong Export

- 6.1.9 V.A.F Agriculture Food Co., LTD

- 6.1.10 Delina Inc.

- 6.1.11 Goldenberry Farm

- 6.1.12 Deccan Exotics

- 6.1.13 Dave and Sons Agro LLP

- 6.1.14 Lee's Dragonfruit Plantation

- 6.1.15 Rare Dragon Fruit

7 Market Opportunities and Future Outlook