PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851185

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851185

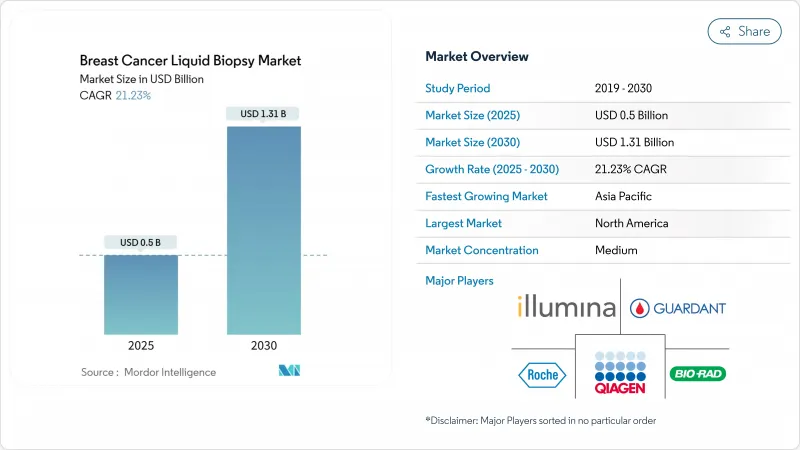

Breast Cancer Liquid Biopsy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The breast cancer liquid biopsy market was valued at USD 0.50 billion in 2025 and is forecast to touch USD 1.31 billion by 2030, advancing at a 21.23% CAGR.

Adoption accelerates as physicians switch from tissue sampling to blood-based molecular profiling, helped by FDA guidance that recognizes circulating tumor DNA (ctDNA) as an aid for early-stage drug development. Liquid biopsy-guided treatment now delivers clear survival gains, and reimbursement expansions in the United States have lifted per-test payment to USD 1,495, improving commercial viability. Asia-Pacific laboratories are scaling multi-omics workflows that pool genomic, epigenomic and protein data, setting a precedent for population-level screening. Competitive positioning centers on assay sensitivity: precision-scaled ctDNA tests and AI-driven data analytics cut false-negative rates, which broadens use in minimal residual disease (MRD) management and augments the attractiveness of the breast cancer liquid biopsy market for investors.

Global Breast Cancer Liquid Biopsy Market Trends and Insights

AI-guided multi-omics panels enter routine screening

AI brings together genomic, epigenomic and RNA information in a single blood draw, allowing laboratories to classify ER, PR and HER2 status without tissue. Smart liquid biopsy applications already subtype breast tumors with 99.5% specificity, which reduces reliance on surgical sampling. Algorithms also flag structural variants and methylation patterns, helping clinicians identify resistance pathways months before standard imaging picks them up. Clinical datasets show that recurring disease can be signaled 10.81 months ahead of radiology, giving oncologists time to adjust therapy. As payers see the value of earlier intervention, reimbursement frameworks increasingly support multi-omics panels, accelerating growth of the breast cancer liquid biopsy market.

Precision-scaled cfDNA assays slash false negatives

High-volume blood draws and ultrasensitive workflows detect ctDNA almost universally in pre-treatment samples, overcoming historical sensitivity gaps. Digital droplet PCR spots ESR1 mutations at very low allele frequencies, guiding endocrine therapy selection. FDA guidance released in 2024 sets uniform standards for assay validation, which narrows inter-laboratory variability. Tumor-informed methods compare new blood samples to a patient's baseline genomic profile, pushing detection thresholds even lower. When ctDNA changes trigger therapy adjustments-as shown in the SERENA-6 trial-progression risk falls by 56%, underscoring clinical value and strengthening the business case for the breast cancer liquid biopsy market.

High per-test cost versus tissue biopsy

List prices ranging from USD 949 to more than USD 3,000 create budget pressure, especially where payers reimburse tissue assays at USD 500-1,000. Cost-effectiveness studies show value in earlier recurrence detection, yet many emerging markets need sharply lower pricing to meet health-economic thresholds. Sequential tissue-plasma strategies are sometimes preferred to curb overall expense, delaying wide adoption of stand-alone liquid biopsy in cost-sensitive geographies and tempering growth of the breast cancer liquid biopsy market.

Other drivers and restraints analyzed in the detailed report include:

- Rising prevalence of breast cancer

- Demand for minimally invasive diagnostics

- Limited clinical evidence for early-stage benefit

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

cfDNA and ctDNA accounted for 43.25% of the breast cancer liquid biopsy market share in 2024, cementing their role as the anchor biomarkers for clinical decision making. Companion diagnostic approvals that target PIK3CA mutations have validated their therapeutic relevance, encouraging wider insurer coverage. Extracellular vesicles and exosomes post the fastest growth at a 23.25% CAGR, as their cargo of proteins and nucleic acids captures tumor heterogeneity unseen in cfDNA alone. Investigators now use four-miRNA panels in HER2-positive vesicles to achieve 88% classification accuracy. This multi-marker versatility underlines why the breast cancer liquid biopsy market values novel vesicle assays and predicts sustained double-digit expansion.

A multi-analyte future looms. Circulating tumor cells still provide prognostic power through enumeration metrics, and automated microfluidic systems raise capture efficiency toward 92%. miRNA and protein signatures complement nucleic acid tests, improving early detection where cfDNA copies are sparse. Combining these readouts in a single report improves diagnostic certainty, positioning full-spectrum platforms as favored options for oncologists looking to limit follow-up procedures. Hybrid strategies therefore deepen penetration of the breast cancer liquid biopsy market and widen the addressable clinical scenarios.

Reagent kits and consumables represented 45.53% of the breast cancer liquid biopsy market size in 2024, mirroring the routine need for plasma stabilization tubes and extraction reagents each time blood is collected. Yet complex analytics push healthcare providers to outsource, making services the quickest riser at a 23.35% CAGR through 2030. Central laboratories promise 14-day MRD turnaround and can handle 700-plus gene panels, a workload most hospitals cannot support in-house. This outsourcing trend places service providers at the heart of the breast cancer liquid biopsy market.

Instrument demand holds steady as laboratories modernize. Next-generation sequencers with higher throughput reduce per-sample cost, while cloud software packages enable AI-assisted variant calling. Point-of-care devices gain traction in community centers for single-mutation tracking, but large-scale profiling still migrates to centralized hubs. Data-as-a-service offerings bundle test results with longitudinal analytics, giving oncologists actionable dashboards without database management tasks, reinforcing the gravitation of revenue to service players within the breast cancer liquid biopsy market.

The Breast Cancer Liquid Biopsy Market Report is Segmented by Circulating Biomarkers (Circulating Tumor Cells (CTCs), and More), Product & Service (Reagent Kits & Consumables, and More), Technology (Next-Generation Sequencing (NGS), and More), Application (Diagnostics, and More), End-User (Reference Laboratories, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 38.42% of revenue in 2024, propelled by Medicare policies that reimburse multi-cancer detection at USD 1,495 and extend coverage to MRD monitoring in colorectal cancer, paving the way for breast indications. FDA guidance endorses ctDNA for early-stage drug development, and companion diagnostic approvals for PIK3CA mutations foster clinician trust. Over 12,000 oncologists have integrated liquid biopsy into decision making, underlining clinical mainstreaming in the region and anchoring the breast cancer liquid biopsy market.

Europe ranks second, benefiting from In Vitro Diagnostic Regulation certification that allows Guardant360 CDx to report 74-gene profiles across the bloc with 7-day turnaround. Harmonization efforts by the European Liquid Biopsy Society are writing standardized protocols, while national payers explore value-based purchasing linked to outcome data. Cross-border research consortia boost sample volumes for early detection studies, bolstering evidence needed for coverage expansion. This supportive environment advances the breast cancer liquid biopsy market across Europe.

Asia-Pacific posts the fastest projected growth at 23.12% CAGR. Japan's national genome initiative will analyze 100,000 cancer genomes, and clinical societies have published MRD testing guidelines that encourage routine ctDNA monitoring. China incorporates plasma assays into provincial precision-medicine programs, backed by state quotas for genomic sequencing. Sequential tissue-plasma strategies are cost-effective in many Asian payers' analyses, opening reimbursement pathways. High population density and rising disposable income amplify the revenue outlook for the breast cancer liquid biopsy market.

Middle East face slower uptake owing to patchy insurance and limited molecular lab capacity. Yet Gulf Cooperation Council states invest in BRCA and HER2 testing hubs, and select private systems in Brazil have adopted multi-cancer detection to differentiate oncology service lines. Partnerships with established North American vendors provide technology transfers and training, gradually extending reach of the breast cancer liquid biopsy market into these regions.

- Roche

- Guardant Health

- Illumina

- QIAGEN

- Bio-Rad Laboratories

- Myriad Genetics

- Natera

- Exact Sciences Corp.

- Thermo Fisher Scientific

- NeoGenomics Laboratories

- Angle plc

- Biocept

- Adaptive Biotechnologies

- Epic Sciences Inc.

- Fluxion Biosciences

- Biodesix Inc.

- Freenome Holdings Inc.

- Grail LLC

- Menarini-Silicon Biosystems

- Sysmex Inostics GmbH

- Lucence Diagnostics Pte Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Precision-Scaled cfDNA Assays Slash False-Negatives

- 4.2.2 AI-Guided Multi-Omics Panels Enter Routine Screening

- 4.2.3 Rising Prevalence Of Breast Cancer

- 4.2.4 Demand For Minimally Invasive Diagnostics

- 4.2.5 Rapid Reimbursement Expansion In OECD Economies

- 4.3 Market Restraints

- 4.3.1 Patchy Reimbursement In Emerging Economies

- 4.3.2 High Per-Test Cost Vs. Tissue Biopsy

- 4.3.3 Limited Clinical Evidence For Early-Stage Benefit

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Circulating Biomarkers

- 5.1.1 Circulating Tumor Cells (CTCs)

- 5.1.2 Circulating Cell-free DNA (cfDNA) / ctDNA

- 5.1.3 Extracellular Vesicles (EVs) / Exosomes

- 5.1.4 Other Biomarkers (miRNA, proteins)

- 5.2 By Product & Service

- 5.2.1 Reagent Kits & Consumables

- 5.2.2 Instruments & Software

- 5.2.3 Services (Testing, Data)

- 5.3 By Technology

- 5.3.1 Next-Generation Sequencing (NGS)

- 5.3.2 Digital / Droplet PCR

- 5.3.3 Other Technologies (Microarrays, Nanopore)

- 5.4 By Application

- 5.4.1 Diagnostics

- 5.4.2 Prognostics & Recurrence Monitoring

- 5.4.3 Therapy Selection / Companion Dx

- 5.4.4 Minimal Residual Disease (MRD)

- 5.5 By End-User

- 5.5.1 Reference Laboratories

- 5.5.2 Hospital & Physician Labs

- 5.5.3 Academic & Research Centers

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 F. Hoffmann-La Roche Ltd

- 6.3.2 Guardant Health Inc.

- 6.3.3 Illumina Inc.

- 6.3.4 QIAGEN N.V.

- 6.3.5 Bio-Rad Laboratories Inc.

- 6.3.6 Myriad Genetics Inc.

- 6.3.7 Natera Inc.

- 6.3.8 Exact Sciences Corp.

- 6.3.9 Thermo Fisher Scientific Inc.

- 6.3.10 NeoGenomics Laboratories

- 6.3.11 Angle plc

- 6.3.12 Biocept Inc.

- 6.3.13 Adaptive Biotechnologies

- 6.3.14 Epic Sciences Inc.

- 6.3.15 Fluxion Biosciences Inc.

- 6.3.16 Biodesix Inc.

- 6.3.17 Freenome Holdings Inc.

- 6.3.18 Grail LLC

- 6.3.19 Menarini-Silicon Biosystems

- 6.3.20 Sysmex Inostics GmbH

- 6.3.21 Lucence Diagnostics Pte Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment