PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851194

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851194

Over-The-Air (OTA) Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

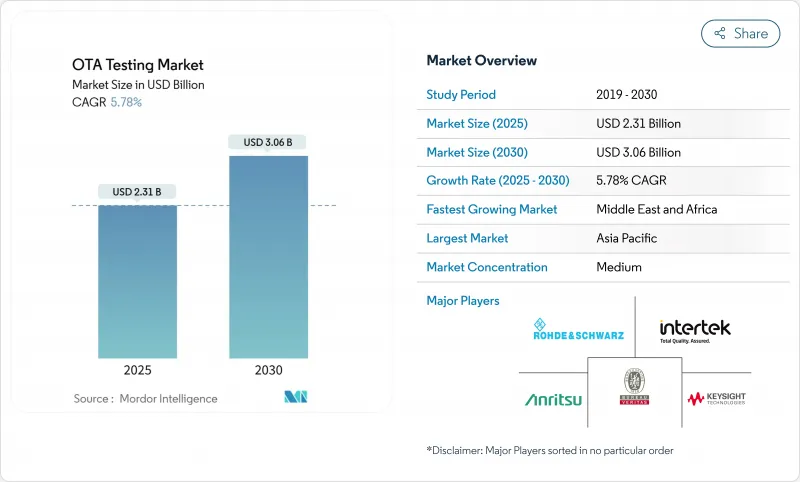

The OTA testing market stood at USD 2.31 billion in 2025 and is forecast to reach USD 3.06 billion by 2030, translating into a 5.78% CAGR over the period.

This expansion reflects wider adoption of 5G standalone networks, increasing integration of cellular V2X in vehicles, and escalating certification needs for cost-sensitive IoT modules. Heightened demand for mmWave compliance in consumer electronics, rising private-5G deployments inside factories, and stricter global conformance schemes from bodies such as CTIA and the Global Certification Forum also underpin growth. Hardware continues to anchor capital spending, but service outsourcing is accelerating as enterprises look to curb up-front investments in anechoic chambers. Regionally, Asia Pacific benefits from the world's densest 5G roll-outs, while the Middle East and Africa register the fastest trajectory thanks to aggressive digital-economy agendas.

Global Over-The-Air (OTA) Testing Market Trends and Insights

Proliferation of 5G Non-Standalone and Stand-Alone Deployments Requiring New Conformance Protocols

Expansion of 24-29 GHz coverage obliges phone and tablet makers to assure total radiated power and isotropic sensitivity across intricate antenna arrays. Pegatron invested USD 164 million in new lines for Wi-Fi 6E and 5G validation, underlining cap-ex pressures in device supply chains. Near-field measurement has become essential, because mmWave wavelengths shorten far-field test distances dramatically. Compact Antenna Test Range (CATR) platforms such as Anritsu MA8172A can be redeployed in under five days, reducing production downtime. Consequently, service providers offering portable CATR-based audits are experiencing higher booking rates.

Automotive OEM Shift to Software-Defined and V2X Connectivity Platforms in North America

C-V2X certification, developed by the Global Certification Forum with the 5G Automotive Association, formalizes dual communication modes that combine 5.9 GHz sidelink and network uplinks. Keysight and Rohde & Schwarz have partnered with tier-one suppliers to emulate dynamic traffic scenarios, validating emergency brake-light alerts and over-the-air software updates concurrently. The change from hardware-locked ECUs to cloud-upgradable platforms widens test matrices to include cybersecurity and functional-safety vectors. As these vehicles move toward production, the OTA testing market records deeper service revenues from in-plant and roadside evaluations.

Capital-Intensive Anechoic and Reverberation Chambers Discouraging Adoption by Tier-2 Labs

Anechoic facilities require fire-retardant pyramidal absorbers, precision cranes and multi-axis positioners that can cost several million dollars before instrumentation is added. Such budgets deter smaller labs, particularly in Latin America and Southeast Asia. Even when financing is secured, supply bottlenecks for ferrite tiles and carbon-loaded foam extend lead times beyond 20 weeks. Consequently, enterprises in those regions outsource to a limited pool of global facilities, lengthening project cycles and curbing the OTA testing market's service penetration. Vendors are responding with modular, lease-ready chambers, yet price points remain high relative to start-up cash flows.

Other drivers and restraints analyzed in the detailed report include:

- Surging OTA Compliance Demand for mmWave and Massive-MIMO Antennas in Consumer Devices

- Industrial Private-5G Roll-outs in Europe for Smart Factories Requiring Robust RF Validation

- Technical Skill Scarcity for mmWave Near-Field-to-Far-Field Transform Algorithms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware contributed 60.9 % of revenue in 2024 as laboratories invested in far-field chambers, CATR reflectors and wide-bandwidth signal generators required for 5G and Wi-Fi 7. Many facilities expanded capacity to accommodate larger device-under-test form factors such as automotive bumpers and smart-factory robots. Services nonetheless record the steepest curve at an 8.3 % CAGR, because enterprises prefer contracting accredited providers rather than owning full infrastructures. Those managed contracts frequently include calibration, standards consulting and report generation packaged under multi-year frameworks. Software and analytics, still nascent, benefit from AI-driven automation that cuts test cycles by as much as 40 %, unlocking further productivity.

LTE/LTE-A maintained 38.5 % of 2024 spending as operators kept validating legacy devices; however, 5G NR's 9.1 % CAGR underscores an industry pivot. mmWave certification demands dynamic beam-steering checks, driving upgrades in probe arrays and channel emulators. Meanwhile, Wi-Fi 6E and Wi-Fi 7 introduce tri-band throughput thresholds, prompting joint testing of cellular and WLAN coexistence. LPWAN formats such as NB-IoT increasingly incorporate non-terrestrial networks, compelling device makers to run satellite delay emulation during compliance sessions.

The Over-The-Air (OTA) Testing Market Report is Segmented by Offering (Hardware, Software and Analytics, and Services), Technology (Bluetooth and UWB, and More), Test Type (Antenna Performance (TRP, TIS, EIRP, EIS), and More), Application (Telecom and Consumer Electronics, Aerospace and Defense, and More), Test Environment (Far-Field Anechoic Chambers, and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific retained 34.6 % of global revenue in 2024 on the back of China's 80 % 5G SA coverage, Japan's satellite-IoT pilots and India's manufacturing incentives targeting USD 500 billion in economic impact from 5G by 2040. The OTA testing market in the region benefits from vertical integration between contract manufacturers and domestic test labs, shortening supply chains for smartphones and wearables. Government-backed spectrum auctions in India and Indonesia have further enlarged addressable volumes for certified devices.

Europe remains a powerhouse for industrial private-5G, even though only 2 % of cell sites operate in standalone mode. German, UK and Spanish regulators offer streamlined temporary licenses for 26 GHz industrial grids, encouraging machinery OEMs to prototype inside local labs. Joint research programs on 6G metrology sharpen documentation standards, forcing test houses to upgrade uncertainty budgets and traceability chains. Consequently, the OTA testing market records robust consultancy demand alongside hardware sales.

The Middle East and Africa is the quickest climber at a 6.8 % CAGR as operators in the Gulf expedite 5G and lay foundations for 6G before 2030. Crowdsourced performance tools increasingly guide spectrum policy, driving transparent benchmarks that require laboratory correlation. South Africa and Nigeria expand device subsidies tied to local conformance marks, enlarging throughput for regional certification centers. North America leverages federal funds for open-RAN and V2X corridors, whereas South America continues steady upgrades from 4G to 5G, particularly in Brazil's agritech zones.

- Keysight Technologies Inc.

- Rohde and Schwarz GmbH and Co. KG

- Anritsu Corporation

- SGS SA

- Intertek Group plc

- Bureau Veritas SA

- UL Solutions Inc.

- Eurofins Scientific SE

- Microwave Vision Group (MVG)

- CETECOM GmbH

- BluFlux LLC

- Element Materials Technology

- National Technical Systems Inc. (NTS)

- TUV Rheinland AG

- TUV SUD AG

- Spirent Communications plc

- VIAVI Solutions Inc.

- ETS-Lindgren Inc.

- Chotest Technology Inc.

- Shenzhen Sunwave Communications Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of 5G Non-Standalone and Stand-Alone Deployments Requiring New Conformance Protocols

- 4.2.2 Surging OTA Compliance Demand for mmWave and Massive-MIMO Antennas in Consumer Devices

- 4.2.3 Automotive OEM Shift to Software-Defined and V2X Connectivity Platforms in North America

- 4.2.4 Industrial Private-5G Roll-outs in Europe for Smart Factories Requiring Robust RF Validation

- 4.2.5 Rapid Certification Cycles Mandated by CTIA and GCF for IoT Modules Below USD-10 BOM

- 4.3 Market Restraints

- 4.3.1 Capital-Intensive Anechoic and Reverberation Chambers Discouraging Adoption by Tier-2 Labs

- 4.3.2 Technical Skill Scarcity for mmWave Near-Field-to-Far-Field Transform Algorithms

- 4.3.3 Lack of Harmonised Global Standards for LPWAN OTAs Delaying Market Convergence

- 4.3.4 Supply-Chain Volatility of RF Absorber Materials Inflating Test Infrastructure Costs

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 Standardisation Roadmap (3GPP Rel-17/18, CTIA OTA 5.x)

- 4.5.2 Emerging Test Methodologies (OTA for Reconfigurable Intelligent Surfaces, 6G Terahertz)

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.1.1 Chambers (Anechoic, Reverberation, Compact Range)

- 5.1.1.2 Instrumentation (Signal Generators, Spectrum Analysers, Controllers)

- 5.1.2 Software and Analytics

- 5.1.3 Services

- 5.1.3.1 Testing and Certification Services

- 5.1.3.2 Consulting and Integration

- 5.1.1 Hardware

- 5.2 By Technology

- 5.2.1 5G NR (Sub-6 GHz and mmWave)

- 5.2.2 LTE/LTE-A/LTE-M

- 5.2.3 UMTS/WCDMA

- 5.2.4 GSM/CDMA

- 5.2.5 Wi-Fi 6/7 and Wi-Fi HaLow

- 5.2.6 Bluetooth and UWB

- 5.2.7 LPWAN (NB-IoT, LoRaWAN, Sigfox)

- 5.3 By Test Type

- 5.3.1 Antenna Performance (TRP, TIS, EIRP, EIS)

- 5.3.2 Conformance and Certification

- 5.3.3 Compatibility/Inter-operability

- 5.3.4 Production/End-of-Line

- 5.4 By Application

- 5.4.1 Telecom and Consumer Electronics

- 5.4.2 Automotive and Transportation

- 5.4.3 Industrial and Manufacturing IoT

- 5.4.4 Aerospace and Defense

- 5.4.5 Healthcare Devices and Wearables

- 5.4.6 Smart Home and Building Automation

- 5.5 By Test Environment

- 5.5.1 Far-Field Anechoic Chambers

- 5.5.2 Compact Antenna Test Range

- 5.5.3 Near-Field Systems

- 5.5.4 Reverberation Chambers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 South America

- 5.6.3.1 Brazil

- 5.6.3.2 Rest of South America

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South-East Asia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Gulf Cooperation Council Countries

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Keysight Technologies Inc.

- 6.4.2 Rohde and Schwarz GmbH and Co. KG

- 6.4.3 Anritsu Corporation

- 6.4.4 SGS SA

- 6.4.5 Intertek Group plc

- 6.4.6 Bureau Veritas SA

- 6.4.7 UL Solutions Inc.

- 6.4.8 Eurofins Scientific SE

- 6.4.9 Microwave Vision Group (MVG)

- 6.4.10 CETECOM GmbH

- 6.4.11 BluFlux LLC

- 6.4.12 Element Materials Technology

- 6.4.13 National Technical Systems Inc. (NTS)

- 6.4.14 TUV Rheinland AG

- 6.4.15 TUV SUD AG

- 6.4.16 Spirent Communications plc

- 6.4.17 VIAVI Solutions Inc.

- 6.4.18 ETS-Lindgren Inc.

- 6.4.19 Chotest Technology Inc.

- 6.4.20 Shenzhen Sunwave Communications Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment

- 7.2 Emerging 6G Terahertz OTA Opportunities

- 7.3 Sustainability-Driven Low-Power OTA Protocols