PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851195

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851195

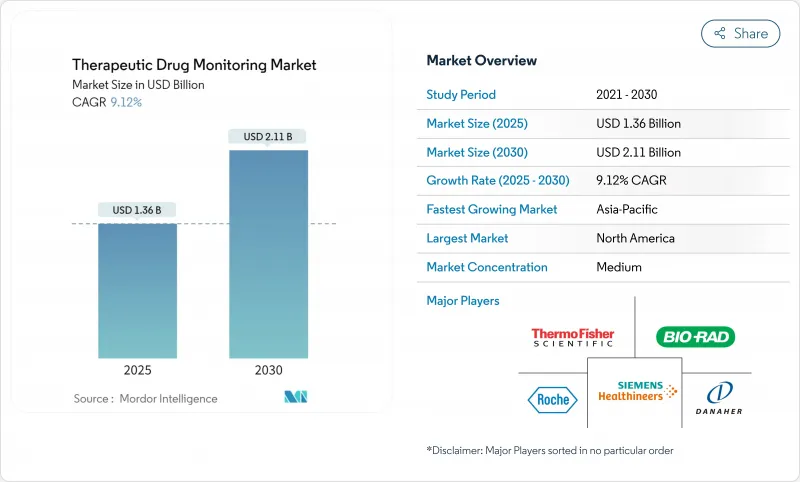

Therapeutic Drug Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The therapeutic drug monitoring market reached USD 1.36 billion in 2025 and is forecast to attain USD 2.11 billion by 2030, advancing at a 9.12% CAGR.

Rising adoption of precision-medicine programs, integration of pharmacogenomic decision tools, and expanding decentralized clinical-trial activity anchor this expansion, while cost-pressured hospital systems increasingly favor high-throughput core-lab automation to sustain routine testing volumes. Continuous biosensor platforms and dried-blood-spot sampling are widening access well beyond tertiary centers, enabling remote dose titration and reducing adverse-event risk across oncology, HIV, and autoimmune therapy protocols. Regulatory alignment, including the United States Food and Drug Administration's phased oversight of laboratory-developed tests, is expected to raise quality baselines and accelerate payer acceptance of broader test panels. Nonetheless, capital constraints in emerging markets continue to limit deployment of liquid-chromatography tandem mass-spectrometry (LC-MS/MS) analyzers, tempering penetration of highly specific assays.

Global Therapeutic Drug Monitoring Market Trends and Insights

Rising Prevalence of Oncology, HIV, Autoimmune & Cardiac Cases

Cancer protocols increasingly pair small-molecule kinase inhibitors with monoclonal antibodies, creating narrow therapeutic margins that mandate precise serum-level control to avoid suboptimal tumor inhibition or dose-limiting toxicity . Long-acting cabotegravir-rilpivirine combinations for HIV expand monitoring horizons beyond daily oral dosing, requiring confirmation of sustained trough concentrations over monthly or bi-monthly intervals. Autoimmune conditions now routinely employ biologic disease-modifying agents whose clearance rates vary with anti-drug antibody formation, and therapeutic drug monitoring provides an evidence-based path to differentiate primary non-response from immunogenic loss of efficacy. Cardiovascular cases driven by aging populations reinforce volume growth for digoxin and antiarrhythmic level checks to avert iatrogenic toxicity. Together, these disease burdens add consistent patient cohorts to the therapeutic drug monitoring market, underpinning predictable test-volume increases.

Expansion of Clinical Trials & Companion-Diagnostic Mandates

Regulators now expect dose-optimization evidence across diverse genotypes and comorbidity profiles during pivotal trials, firmly embedding therapeutic drug monitoring into study protocols. Sponsors therefore integrate sample-to-insight workflows that merge LC-MS/MS analytics with pharmacogenomic algorithms, enabling adaptive dosing arms and reducing late-stage attrition. Decentralized trial models accelerate adoption of mailed dried-blood-spot kits, preserving data fidelity while minimizing site visits. Positive experience in trials subsequently informs post-marketing label expansions that specify serum-level guidance, which in turn grows routine clinical demand. The feedback loop converts clinical-development spending into durable revenue streams for assay manufacturers and service laboratories across the therapeutic drug monitoring market.

Capital & Service-Contract Costs of LC-MS/MS Platforms

Entry-level triple-quadrupole systems list at USD 300,000-500,000, and annual maintenance contracts add USD 50,000, stretching budgets of secondary hospitals and private labs in low- and middle-income economies . Even in developed markets, fiscal stewardship committees demand robust utilization forecasts before approving purchases. High acquisition thresholds perpetuate send-out testing, lengthening turnaround times and diminishing immediate clinical value, which in turn slows routine test adoption. Pooled-purchasing consortia and reagent-rental models partially mitigate cash-flow constraints, yet many facilities remain reliant on less specific immunoassays, limiting cross-reactivity-sensitive applications such as kinase inhibitors and immunotherapies across the therapeutic drug monitoring market.

Other drivers and restraints analyzed in the detailed report include:

- Automation & High-Throughput Immunoassay Adoption in Core Labs

- Low-Cost Dried-Blood-Spot Sampling Enabling Remote TDM

- Shortage of Skilled Clinical Toxicologists in Emerging Nations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Immunoassays generated the largest revenue portion of the therapeutic drug monitoring market size, holding a 59.37% share in 2024. Integration into legacy chemistry lines, consistent reimbursement coding, and technician familiarity sustain this lead. However, biosensor and wearable platforms are recording a 9.87% CAGR, underpinned by electrochemical transduction advances that enable in-situ drug-level readouts from interstitial fluid. Mass-spectrometry-linked immunochemical hybrids widen menus to encompass small-molecule oncology agents, further reinforcing the incumbent technology's relevance.

Protein-binding interference, hook effects, and cross-reactivity limitations have propelled tertiary centers toward chromatographic and LC-MS/MS solutions for complex regimens, fortifying multivendor competition. Continuous wearables prototype pipelines, meanwhile, promise sub-minute sampling intervals, redefining therapeutic drug monitoring market paradigms from episodic draws to dynamic pharmacokinetic profiling. Venture-backed start-ups align with pharmaceutical sponsors to pair devices with long-acting injectables, accelerating clinical validation. As regulatory pathways clarify, competitive dynamics will increasingly hinge on usability, data-security architecture, and algorithmic dosing guidance rather than analytical sensitivity alone.

The Therapeutic Drug Monitoring Market is Segmented by Technology (Immunoassays, Proteomic, and More), Drug Class (Antiarrhythmic Drugs, Immunosuppressants, and More), End-User (Hospital Laboratories, Independent / Reference Laboratories, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 42.17% contribution to the therapeutic drug monitoring market size in 2024 stems from entrenched reimbursement, extensive transplant programs, and pharmacogenomic leadership. Europe mirrors this maturity, albeit under cost-containment pressures that prioritize consolidated procurement and outcome-based pricing. Asia-Pacific exhibits a 10.44% CAGR through 2030, reflecting hospital construction booms, clinical-trial inflows, and national precision-health initiatives.

China commands the region's volume uplift, coupling public-sector infrastructure funding with stringent regulatory reforms that encourage local LC-MS/MS manufacturing. Japan's super-aged demographics sustain high per-capita test ratios, while India's expanding health-insurance coverage widens patient access to essential monitoring panels. Middle East and South America show nascent yet accelerating adoption curves as laboratory automation vendors partner with government agencies to modernize diagnostic capabilities, an endeavor that incrementally enlarges the therapeutic drug monitoring market.

- Abbott Laboratories

- Thermo Fisher Scientific

- F. Hoffmann-La Roche Ltd (Roche Diagnostics)

- Siemens Healthineers

- Danaher Corp (Beckman Coulter)

- Bio-Rad Laboratories

- Chromsystems Instruments & Chemicals

- Randox Laboratories

- Alpco Diagnostics

- ARK Diagnostics

- DiaSorin

- bioMerieux

- Tecan Group

- Waters Corporation

- Agilent Technologies

- Hitachi High-Tech Corp.

- Bruker Corp.

- JEOL Ltd.

- Quotient Ltd.

- LabCorp (Covance Labs)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of oncology, HIV, autoimmune & cardiac cases

- 4.2.2 Expansion of clinical trials & companion-diagnostic mandates

- 4.2.3 Automation & high-throughput immunoassay adoption in core labs

- 4.2.4 Low-cost dried-blood-spot sampling enabling remote TDM

- 4.2.5 Integration of pharmacogenomic data with TDM algorithms

- 4.2.6 Wearable micro-fluidic biosensors for real-time drug-level tracking

- 4.3 Market Restraints

- 4.3.1 Capital & service-contract costs of LC-MS/MS platforms

- 4.3.2 Shortage of skilled clinical toxicologists in emerging nations

- 4.3.3 Fragmented reimbursement coding for TDM panels

- 4.3.4 Data-exchange gaps between LIS & decision-support software

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value - USD million)

- 5.1 By Technology

- 5.1.1 Immunoassays

- 5.1.1.1 ELISA

- 5.1.1.2 Chemiluminescence Immunoassay (CLIA)

- 5.1.1.3 Fluorescence & Other IA Formats

- 5.1.2 Proteomic / LC-MS/MS

- 5.1.3 Chromatography (GC, HPLC)

- 5.1.4 Biosensor-Based & Wearables

- 5.1.5 Other Technologies

- 5.1.1 Immunoassays

- 5.2 By Drug Class

- 5.2.1 Antiarrhythmic Drugs

- 5.2.2 Antiepileptic Drugs

- 5.2.3 Immunosuppressants

- 5.2.4 Antibiotics (e.g., Vancomycin, Aminoglycosides)

- 5.2.5 Antipsychotics & Mood Stabilizers

- 5.2.6 Oncology & Targeted Therapies

- 5.2.7 Other Drug Classes

- 5.3 By End-user

- 5.3.1 Hospital Laboratories

- 5.3.2 Independent / Reference Laboratories

- 5.3.3 Academic & Research Institutes

- 5.3.4 Point-of-Care / Patient Self-Testing

- 5.3.5 Contract Research & CRO Labs

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Thermo Fisher Scientific

- 6.3.3 F. Hoffmann-La Roche Ltd (Roche Diagnostics)

- 6.3.4 Siemens Healthineers

- 6.3.5 Danaher Corp (Beckman Coulter)

- 6.3.6 Bio-Rad Laboratories

- 6.3.7 Chromsystems Instruments & Chemicals

- 6.3.8 Randox Laboratories

- 6.3.9 Alpco Diagnostics

- 6.3.10 ARK Diagnostics

- 6.3.11 DiaSorin S.p.A.

- 6.3.12 bioMerieux SA

- 6.3.13 Tecan Group

- 6.3.14 Waters Corporation

- 6.3.15 Agilent Technologies

- 6.3.16 Hitachi High-Tech Corp.

- 6.3.17 Bruker Corp.

- 6.3.18 JEOL Ltd.

- 6.3.19 Quotient Ltd.

- 6.3.20 LabCorp (Covance Labs)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment