PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851196

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851196

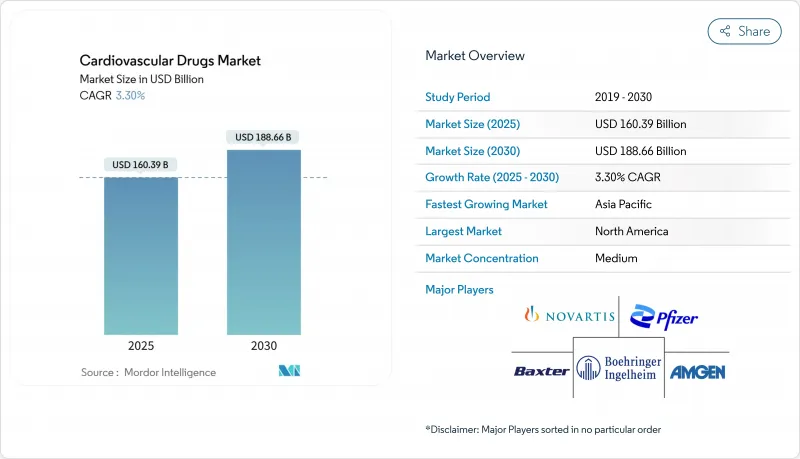

Cardiovascular Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cardiovascular drugs market size reached USD 160.39 billion in 2025 and is projected to advance to USD 188.66 billion by 2030, registering a 3.30% CAGR during the forecast window.

Steady top-line growth conceals deep changes shaped by population ageing, accelerated innovation cycles, and policy shifts that reward real-world evidence over traditional trial endpoints. Demand remains dominated by anticoagulants; yet factor XI inhibitors, mineralocorticoid receptor antagonists, and GLP-1 receptor agonists are redefining therapeutic boundaries. Digital distribution, supply-chain localisation, and AI-enabled discovery tools are widening competitive gaps between data-driven multinationals and smaller firms. At the same time, mounting patent-expiration risks and single-region API dependence temper near-term optimism, obliging manufacturers to balance lifecycle-management investments with next-generation pipeline bets.

Global Cardiovascular Drugs Market Trends and Insights

Rising Prevalence of CVDs in Ageing Populations

Heart-failure cases are projected to reach 8.5 million Americans by 2030, up from 6.7 million in 2025. Older patients often present with multiple comorbidities, driving uptake of combination regimens and personalised dosing strategies. Asia-Pacific mirrors this demographic trend, reinforcing chronic-disease management demand. Payers in developed markets already reimburse advanced agents for complex cases, implying durable volume growth across the cardiovascular drugs market.

Rapid Uptake of NOACs & SGLT2 Inhibitors

Novel oral anticoagulants continue to displace warfarin, while SGLT2 inhibitors move beyond diabetes care into heart-failure management, evidenced by finerenone's 16% event-reduction in FINEARTS-HF. GLP-1 agonists such as semaglutide secured FDA approval for cardiovascular death-risk reduction, underscoring the convergence of metabolic and cardiovascular treatment pathways. This therapeutic overlap opens new addressable niches within the cardiovascular drugs market

Patent Expiries & Generic Erosion of Blockbuster Brands

Lupin's generic rivaroxaban launch may capture up to 60% share in its first year, trimming brand revenues and placing pricing pressure across the anticoagulant class. Similar dynamics await Entresto and Corlanor, compelling incumbents to pursue value-based contracting and indication diversification.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Reliance on Real-World Data for Label Expansions

- Expanding Reimbursement in Emerging Markets

- High Cost of Biologic & Gene-Based CV Therapies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Anticoagulants held 45.14% cardiovascular drugs market share in 2024, underscoring their central role in thromboembolic prophylaxis across diverse indications. The cardiovascular drugs market size for anticoagulants is expected to face near-term revenue compression once additional rivaroxaban generics arrive, pushing branded players toward next-generation factor XI inhibitors. Abelacimab reduced bleeding 62-69% versus rivaroxaban, positioning the agent as a differentiated alternative. Meanwhile, heart-failure drugs' 3.70% CAGR reflects clinician confidence in mineralocorticoid receptor antagonists and SGLT2 inhibitors for preserved-ejection-fraction patients.

Second-tier categories show diverging paths. Antihypertensives enjoy broadened guideline thresholds, supporting steady volume growth. Lipid-lowering agents experience renewed momentum thanks to oral PCSK9 candidates like MK-0616 now in Phase 3 trials. Pulmonary-hypertension drugs benefit from rare-disease incentives, while antiarrhythmics gain relevance through device-drug integration that improves adherence and monitoring.

Hypertension maintained 28.90% share of the cardiovascular drugs market size in 2024, mirroring its broad prevalence across age cohorts. Yet heart-failure therapeutics are set to expand at 4.01% CAGR, anchored by finerenone and GLP-1 agents that address previously unmet needs. The cardiovascular drugs market is expected to see GLP-1 agonists such as tirzepatide deliver meaningful outcomes in non-diabetic heart-failure patients, widening the eligible population. Coronary-artery-disease treatments adopt anti-inflammatory strategies to tackle residual risk, and dyslipidemia care evolves toward RNA-based modalities targeting lipoprotein(a).

The Cardiovascular Drugs Market Report Segments Into by Drug Class (Anti-Hyperlipidemics, Anti-Hypertensives and More), by Indication (Hypertension, Coronary Artery Disease and More), by Route of Administration (Oral, Injectable / IV and More) By Distribution Channel (Hospitals, Pharmacies and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the cardiovascular drugs market with 34.35% share in 2024, and its 5.25% CAGR outpaces all other regions thanks to China's procurement reforms and India's infrastructure expansion. Local firms now secure 71% of new NRDL listings, signalling stronger domestic competitive pressure for multinationals. Japan's streamlined approval timelines further ease market entry for cutting-edge therapies, promoting steady uptake of GLP-1 agents and next-generation anticoagulants.

North America remains a pivotal innovation hub, underpinned by reimbursement frameworks that quickly absorb breakthrough therapies. Nonetheless, the Inflation Reduction Act introduces price-negotiation uncertainty that may reshape launch-sequence strategies for high-value cardiovascular assets.

Europe benefits from harmonised regulatory pathways that accelerate parallel submissions, though Brexit-related logistics adjustments persist. Latin America's policy moves toward domestic production-exemplified by Brazil's preference margins-create dual imperatives of localisation and cost control. The Middle East and Africa record incremental gains aligned with cardiovascular-disease awareness campaigns, yet infrastructure gaps still limit high-cost biologic penetration.

- Pfizer

- Bristol-Myers Squibb

- Novartis

- AstraZeneca

- Johnson & Johnson

- Merck

- Bayer

- Eli Lilly and Company

- Boehringer Ingelheim

- Sanofi

- Abbvie

- Amgen

- Daiichi Sankyo

- Novo Nordisk

- GlaxoSmithKline

- Takeda Pharmaceuticals

- Abbott Laboratories

- Roche

- Servier

- Otsuka Pharma

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of CVDs in ageing populations

- 4.2.2 Rapid uptake of NOACs & SGLT2 inhibitors

- 4.2.3 Expanding reimbursement in emerging markets

- 4.2.4 Regulatory reliance on real-world data for label expansions

- 4.2.5 AI-driven in-silico repurposing accelerating CV pipeline

- 4.3 Market Restraints

- 4.3.1 Patent expiries & generic erosion of blockbuster brands

- 4.3.2 High cost of biologic & gene-based CV therapies

- 4.3.3 Single-region API sourcing creating supply-chain risk

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Drug Class (Value)

- 5.1.1 Antihypertensives

- 5.1.2 Anticoagulants

- 5.1.3 Antiplatelet Agents

- 5.1.4 Lipid-Lowering Drugs

- 5.1.5 Heart-Failure Drugs

- 5.1.6 Antiarrhythmics

- 5.1.7 Pulmonary Hypertension Drugs

- 5.2 By Disease Indication (Value)

- 5.2.1 Hypertension

- 5.2.2 Coronary Artery Disease

- 5.2.3 Heart Failure

- 5.2.4 Arrhythmia

- 5.2.5 Dyslipidemia

- 5.2.6 Venous Thrombo-Embolism

- 5.3 By Route of Administration (Value)

- 5.3.1 Oral

- 5.3.2 Injectable / IV

- 5.3.3 Transdermal & Others

- 5.4 By Distribution Channel (Value)

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Pfizer

- 6.4.2 Bristol Myers Squibb

- 6.4.3 Novartis

- 6.4.4 AstraZeneca

- 6.4.5 Johnson & Johnson

- 6.4.6 Merck & Co.

- 6.4.7 Bayer

- 6.4.8 Eli Lilly

- 6.4.9 Boehringer Ingelheim

- 6.4.10 Sanofi

- 6.4.11 AbbVie

- 6.4.12 Amgen

- 6.4.13 Daiichi Sankyo

- 6.4.14 Novo Nordisk

- 6.4.15 GSK

- 6.4.16 Takeda

- 6.4.17 Abbott Laboratories

- 6.4.18 Roche

- 6.4.19 Servier

- 6.4.20 Otsuka Pharma

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment