PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851203

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851203

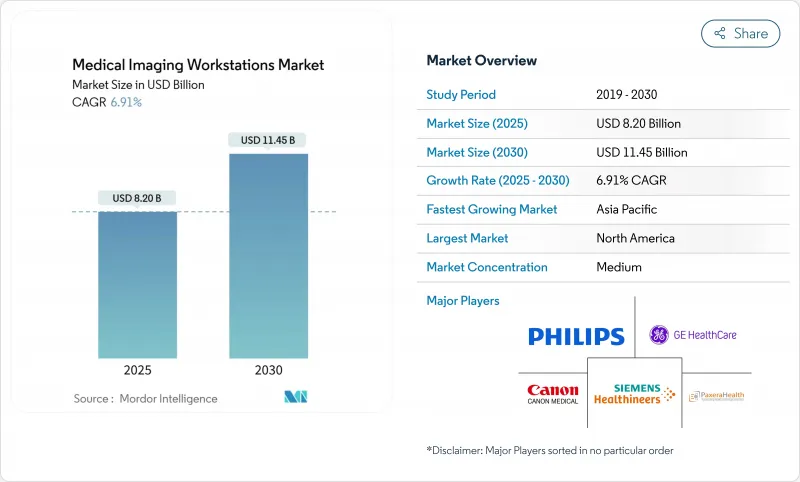

Medical Imaging Workstations - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Medical Imaging Workstations Market size is estimated at USD 8.20 billion in 2025, and is expected to reach USD 11.45 billion by 2030, at a CAGR of 6.91% during the forecast period (2025-2030).

Faster replacement cycles, enterprise picture-archiving migrations, and rising multi-modality procedure complexity collectively lift demand for advanced visualization platforms. Regulatory clarity, such as the FDA's re-classification of computer-assisted detection software into Class II, has shortened innovation lead times and lowered entry barriers. Vendors now prioritize AI-ready designs and cloud-hosted delivery models that cut on-premises hardware costs, an approach that also helps hospitals cope with workforce shortages. North America keeps a performance edge through early AI adoption and mature reimbursement pathways, yet Asia Pacific records the fastest usage expansion on the back of large-scale digitization projects. Meanwhile, semiconductor supply constraints continue to throttle GPU availability, stretching lead times for high-end configurations and forcing some buyers toward thin-client alternatives.

Global Medical Imaging Workstations Market Trends and Insights

Rapid technological evolution in imaging modalities

Photon-counting CT, whole-body MRI screening, cone-beam breast CT, and autonomous ultrasound together raise the computational ceiling for every workstation refresh cycle. Photon-counting scanners cut radiation exposure by as much as 80% while quadrupling raw data volume, demanding GPUs that support real-time 3-D reconstructions. GE HealthCare and NVIDIA's collaboration shows how vendors are embedding AI inference at the image-acquisition layer, which in turn obliges workstation software to orchestrate automated segmentation, triage, and quality control. Prenuvo's AI-enabled whole-body MRI platform reinforces the shift toward multi-organ analysis, compelling vendors to design workstations with higher throughput, larger cache, and multi-monitor ergonomics.

Growing imaging procedure volumes in emerging markets

Continual CT and MRI installation programs across Asia Pacific generate follow-on demand for visualization upgrades. Demographic aging lifts per-capita scan rates, particularly for oncology and cardiac imaging, which rely on sophisticated post-processing. Canon Medical's India strategy signals manufacturers' broader pivot to mid-income countries whose health ministries are funding picture-archiving rollouts alongside hardware refresh cycles. Ethiopia's 71% reduction in patient waiting time after teleradiology deployment underscores how thin-client workstations connect remote hospitals to scarce radiologists. Scalable cloud access therefore becomes a core purchasing criterion for facilities that lack on-site IT teams.

High upfront and lifecycle costs of premium workstations

Capital budgets still favor direct patient-care devices over support infrastructure. Total cost of ownership often doubles initial price once multiyear service contracts and software renewals are included. Smaller facilities look at certified refurbished hardware, yet those bargains often lack modern GPUs, throttling AI performance. Subscription software can smooth out capital spikes; however, cumulative fees sometimes exceed perpetual licenses over a seven-year horizon. Reimbursement erosion in radiology magnifies financial scrutiny, stretching procurement cycles.

Other drivers and restraints analyzed in the detailed report include:

- Rising healthcare expenditure coupled with disease burden

- Accelerated healthcare digitization-enterprise PACS/VNA migrations

- Shortage of radiologists / advanced visualization specialists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Visualization software generated 57.83% of 2024 revenue, illustrating how functionality now sits in code rather than bespoke hardware. That dominance will widen as vendors decouple algorithm licenses from display purchases, allowing rapid over-the-air updates. Subscription AI-segmentation plug-ins create recurring revenue streams and shorten feature lead times. Display units, in contrast, post the fastest 7.85% CAGR because 4 K and 8 K resolutions reduce diagnostic uncertainty in microcalcification and lung-nodule review. EIZO's RadiForce RX670 with six-megapixel resolution and USB-C docking typifies ergonomic gains that minimize cable clutter.

Component convergence also guides procurement: thin-client setups shift value from local GPUs into centralized processing nodes, while auto-calibration and comfort-lighting features lift display ASPs. As more facilities aim for remote reading, zero-footprint viewers embedded in the hospital information system remove the last dependency on proprietary graphics cards. Consequently, software's proportion of the medical imaging workstations market will continue to grow more rapidly than any hardware line item.

Computed tomography workstations controlled 30.73% of 2024 revenue on the back of multi-organ utility and photon-counting upgrades. The segment benefits from enterprise standardization, as a single CT viewer can serve trauma, oncology, and cardiac cases. Mammography platforms, however, register the fastest 8.13% CAGR as national screening programs expand and 3-D tomosynthesis becomes common. Cone-beam breast CT's elimination of breast compression will further raise data loads and justify workstation refresh investments.

MRI workstations gain momentum from helium-free magnet launches that ease siting constraints. Ultrasound, historically attached to hardware consoles, now leverages cloud-based post-processing that extracts automated measurements from raw cine loops. Nuclear-medicine workstation innovation hinges on digital detectors, which reduce recon time and cut dose while enabling total-body PET acquisitions.

The Medical Imaging Workstations Market Report is Segmented by Component (Visualization Software, Display Units, and Others), Modality (Computed Tomography (CT), Magnetic Resonance Imaging (MRI), and More), Usage Mode (Thick-Client Workstations, Thin-Client / Web-Streaming Workstations), End User (Hospitals, and More), and Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 37.81% of 2024 revenue as U.S. and Canadian providers remained early adopters of AI triage tools and autonomous image acquisition. The region benefits from well-defined CPT codes that reimburse advanced procedures, allowing hospitals to recoup workstation investments quickly. A mature vendor ecosystem accelerates innovation cycles, with 300+ FDA-cleared AI algorithms already available for integration.

Asia Pacific recorded an 8.33% CAGR outlook driven by ongoing hospital build-outs, government cloud-health programs, and rapidly aging populations. China continues to scale provincial teleradiology hubs that connect county hospitals to tertiary centers, while India's Ayushman Bharat scheme boosts diagnostic volumes in secondary cities. Many new facilities bypass legacy PACS and deploy cloud-native archives from day one, favoring thin-client architectures that minimize local IT staffing.

Europe shows steady expansion as the European Health Data Space initiative encourages cross-border image exchange, nudging hospitals toward interoperable viewers. National breast-screening extensions in Germany and France stimulate adoption of 3-D mammography workstations, while UK NHS modernization funds support AI-assisted CT lung-screening pilots. In the Middle East and Africa, public-private partnerships fund flagship imaging centers, yet political volatility and exchange-rate swings can delay procurement. Latin America gains traction through regional trade agreements that cut import duties on diagnostic hardware, though inconsistent broadband coverage limits thin-client rollouts in rural sites.

- GE Healthcare

- Siemens Healthineers

- Canon

- Koninklijke Philips

- Hologic

- Carestream Health

- Sectra

- PaxeraHealth

- Agfa HealthCare

- Barco NV

- FUJIFILM

- Esaote

- Intelerad Medical

- Aycan Medical

- EIZO Corp.

- Viztek

- eRAD Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid technological evolution in imaging modalities

- 4.2.2 Growing imaging procedure volumes in emerging markets

- 4.2.3 Rising healthcare expenditure coupled with rising disease burden

- 4.2.4 Accelerated healthcare digitization-enterprise PACS/VNA migrations

- 4.2.5 Ongoing innovations in hospital and diagnostic center infrastructure in emegring economies

- 4.2.6 Vendor-neutral API ecosystems enabling SaaS visualization plug-ins

- 4.3 Market Restraints

- 4.3.1 High upfront & lifecycle costs of premium workstations

- 4.3.2 Shortage of radiologists / advanced visualization specialists

- 4.3.3 Escalating zero-trust cybersecurity & HIPAA compliance expenses

- 4.3.4 GPU foundry capacity constraints & supply-chain shocks

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Component

- 5.1.1 Visualization Software

- 5.1.2 Display Units

- 5.1.3 Others

- 5.2 By Modality

- 5.2.1 Computed Tomography (CT)

- 5.2.2 Magnetic Resonance Imaging (MRI)

- 5.2.3 Ultrasound

- 5.2.4 Mammography

- 5.2.5 Others

- 5.3 By Usage Mode

- 5.3.1 Thick-Client Workstations

- 5.3.2 Thin-Client / Web-Streaming Workstations

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Imaging Centers

- 5.4.3 Specialty Clinics

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GE HealthCare

- 6.3.2 Siemens Healthineers AG

- 6.3.3 Canon Medical Systems Corporation

- 6.3.4 Koninklijke Philips N.V.

- 6.3.5 Hologic Inc.

- 6.3.6 Carestream Health

- 6.3.7 Sectra AB

- 6.3.8 PaxeraHealth

- 6.3.9 Agfa HealthCare

- 6.3.10 Barco NV

- 6.3.11 Fujifilm Healthcare

- 6.3.12 Esaote SpA

- 6.3.13 Intelerad Medical

- 6.3.14 Aycan Medical

- 6.3.15 EIZO Corp.

- 6.3.16 Viztek

- 6.3.17 eRAD Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment