PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851204

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851204

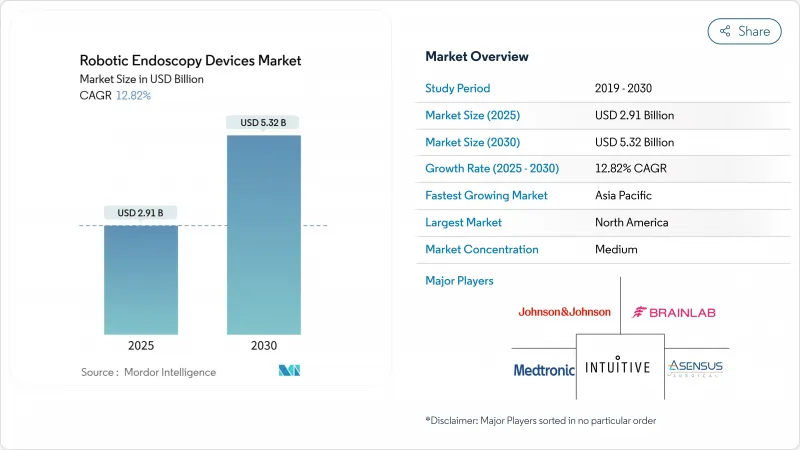

Robotic Endoscopy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The robotic endoscopy devices market reached USD 2.91 billion in 2025 and is forecast to climb to USD 5.32 billion by 2030, reflecting a sturdy 12.82% CAGR over the period.

Growing adoption of minimally invasive surgery, rapid integration of artificial intelligence into imaging and navigation, and the need to curb hospital-acquired infection rates collectively propel demand. Health systems also view robotic technology as a route to shorten hospital stays and lower total procedure costs, creating favorable economics for capital investment. Competitive intensity is rising as patent cliffs democratize core technologies and modular, lower-cost platforms reach the market. Meanwhile, mounting evidence that single-use scopes eliminate cross-contamination risk strengthens the value proposition for outpatient settings. Together, these forces position the robotic endoscopy devices market for sustained double-digit expansion through the decade.

Global Robotic Endoscopy Devices Market Trends and Insights

Rapid Adoption Of Minimally-Invasive Robotic Procedures

Clinical evidence shows robotic-assisted surgeries cut complication rates by 50% and trim recovery times by 40% compared with traditional techniques. Hospitals increasingly prioritize these outcomes to meet value-based care mandates, leading to wider platform installs and broader procedural menus. Intuitive Surgical reported 17% procedure growth in Q1 2025, underscoring global momentum. Enhanced 3-D vision, tremor filtration, and ergonomic consoles also mitigate surgeon fatigue, allowing longer and more complex cases in outpatient settings. Collectively, these gains expand the eligible patient pool and reinforce the economic attractiveness of the robotic endoscopy devices market.

AI-Augmented Navigation & Imaging Boosts Diagnostic Yield

Deep-learning models now lift diagnostic yield in robotic bronchoscopy to over 85%, well above the 67.8% baseline of conventional scopes. Johnson & Johnson's MONARCH QUEST platform integrates 260% more compute power with AI-driven path-planning, improving lesion targeting in real time. Cloud-based systems such as Olympus CADDIE extend similar benefits to colorectal screening, where AI raises adenoma detection without extra procedure time. Higher accuracy reduces repeat procedures and accelerates therapeutic decision-making, giving platform owners a clear competitive edge.

High Capital & Per-Procedure Cost of Robotic Platforms

System list prices between USD 1.5 million and USD 2.5 million, plus annual service fees above USD 100,000, impose steep hurdles for smaller centers. Comparative studies show robotic inguinal hernia repair costs EUR 2,810 (USD 3,242.01) versus EUR 726 (USD 837.62) for laparoscopic alternatives, underscoring payback challenges where reimbursement lags. New entrants like CMR Surgical target this gap with modular architecture priced below legacy systems, yet widespread budget constraints in lower-income regions continue to suppress uptake.

Other drivers and restraints analyzed in the detailed report include:

- Favorable Reimbursement for Robotic GI & Pulmonary Interventions

- Demand for Single-Use Robotic Endoscopes to Curb Infections

- Stringent Regulatory Approvals for Patient Safety

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Therapeutic robotic endoscopes accounted for 55.52% of the robotic endoscopy devices market in 2024, underscoring provider demand for systems that combine diagnosis and intervention in a single sitting. Leading products execute complex maneuvers such as endoscopic submucosal dissection and natural-orifice transluminal surgery, enabling scar-free outcomes that appeal to both patients and payers. Johnson & Johnson's MONARCH platform illustrates this premium positioning, while EndoQuest pursues flexible, single-port concepts for GI procedures. Although therapeutic dominance prevails, diagnostic devices show greater headroom; AI-enhanced visualization lifts early cancer detection, pushing diagnostic unit sales at a 15.25% CAGR. Capsule systems and hybrid imaging robots widen access, hinting at future convergence where one console manages full care pathways. The robotic endoscopy devices market size for therapeutic systems is projected to broaden steadily, but diagnostic innovation is set to outpace as preventive medicine becomes policy priority.

Diagnostic platforms remain a smaller slice, yet investors funnel capital into wireless capsule robots and cloud-enabled analytics that shorten procedure times. Early-stage projects such as swallowable pump-jet cameras expand the reach of gastrointestinal screening, particularly in rural regions where full theaters are scarce. As these devices secure regulatory clearance, the robotic endoscopy devices market share for diagnostic solutions is expected to climb, narrowing the revenue gap versus therapeutic peers.

The Robotic Endoscopy Devices Market Report is Segmented by Product (Diagnostic Robotic Endoscopes [Capsule Robots and Imaging Robots], Therapeutic Robotic Endoscopes), Application (Laparoscopy, Bronchoscopy, and More), End User (Hospitals, Ambulatory Surgical Centers, and Specialty Clinics) and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.82% of 2024 revenue, supported by Medicare payment clarity and a mature surgeon talent pool. Flagship centers in the United States routinely adopt next-generation consoles within months of clearance, sustaining robust upgrade cycles. Canada follows similar patterns, while Mexico's private hospitals court medical tourists to finance advanced installations.

Europe holds significant share but confronts regulatory headwinds and green-policy scrutiny of single-use plastics. Germany, France, and the United Kingdom dominate installed bases, yet multi-year conformity assessments under the Medical Device Regulation delay market entry for new entrants. Nordic health systems investigate robotic hernia repair benefits, but cost-effectiveness questions remain open, tempering rapid scale-up.

Asia-Pacific exhibits the fastest regional CAGR at 13.62%. China anchors momentum through domestic champions offering consoles at discounts of 30%-40% relative to Western peers, spurring adoption across tertiary hospitals. Japan pioneers unique platforms and 5G-enabled telesurgery demonstrations, while South Korea emphasizes robotics in national cancer-screening protocols. Emerging ASEAN economies and India's private chains invest aggressively, seeing robotics as a differentiator for inbound medical tourism. Consequently, the robotic endoscopy devices market size for Asia-Pacific is forecast to overtake Europe near the end of the outlook window.

Middle East & Africa record nascent but promising uptake, led by Gulf Cooperation Council projects that bundle robotics into flagship hospital build-outs. South Africa spearheads sub-Saharan adoption. Latin America witnesses steady installations in Brazil and Chile, though currency volatility constrains wider diffusion. Across these regions, vendor financing and procedure-based leasing models are critical in unlocking incremental demand.

- Intuitive Surgical

- Johnson & Johnson (Auris Health)

- Medtronic

- Olympus

- Asensus Surgical

- CMR Surgical

- Medrobotics

- Brain Lab

- Avatera Medical

- AKTORmed

- Virtuoso Surgical

- Noah Medical

- EndoQuest Robotics

- Microbot Medical

- Titan Medical

- Fujifilm Holdings Corp.

- SHINVA Medical

- Apollo Endosurgery

- Stryker

- Karl Storz SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption Of Minimally-Invasive Robotic Procedures

- 4.2.2 Rising Geriatric, Obese & Diabetic Population

- 4.2.3 Favorable Reimbursement For Robotic GI & Pulmonary Interventions

- 4.2.4 AI-Augmented Navigation & Imaging Boosts Diagnostic Yield

- 4.2.5 Surge In Dedicated Outpatient Robotic Bronchoscopy Suites

- 4.2.6 Demand For Single-Use Robotic Endoscopes To Curb Infections

- 4.3 Market Restraints

- 4.3.1 High Capital & Per-Procedure Cost Of Robotic Platforms

- 4.3.2 Stringent Regulatory Approvals For Patient-Safety

- 4.3.3 Shortage Of Surgeons Trained On Robotic Endoscopy

- 4.3.4 Sustainability Push Against Disposable Robotic Scopes

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Diagnostic Robotic Endoscopes

- 5.1.1.1 Capsule Robots

- 5.1.1.2 Imaging/Visualization Robots

- 5.1.2 Therapeutic Robotic Endoscopes

- 5.1.2.1 Surgical Endoscopy Platforms

- 5.1.2.2 Robotic Bronchoscopes

- 5.1.2.3 NOTES & Transluminal Robots

- 5.1.1 Diagnostic Robotic Endoscopes

- 5.2 By Application

- 5.2.1 Laparoscopy

- 5.2.2 Bronchoscopy

- 5.2.3 Colonoscopy

- 5.2.4 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Clinics

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Intuitive Surgical Inc.

- 6.3.2 Johnson & Johnson (Auris Health)

- 6.3.3 Medtronic PLC

- 6.3.4 Olympus Corporation

- 6.3.5 Asensus Surgical Inc.

- 6.3.6 CMR Surgical Ltd

- 6.3.7 Medrobotics Corporation

- 6.3.8 Brainlab AG

- 6.3.9 Avatera Medical GmbH

- 6.3.10 AKTORmed GmbH

- 6.3.11 Virtuoso Surgical

- 6.3.12 Noah Medical

- 6.3.13 EndoQuest Robotics

- 6.3.14 Microbot Medical

- 6.3.15 Titan Medical

- 6.3.16 Fujifilm Holdings Corp.

- 6.3.17 SHINVA Medical

- 6.3.18 Apollo Endosurgery

- 6.3.19 Stryker Corp.

- 6.3.20 Karl Storz SE

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment