PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851205

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851205

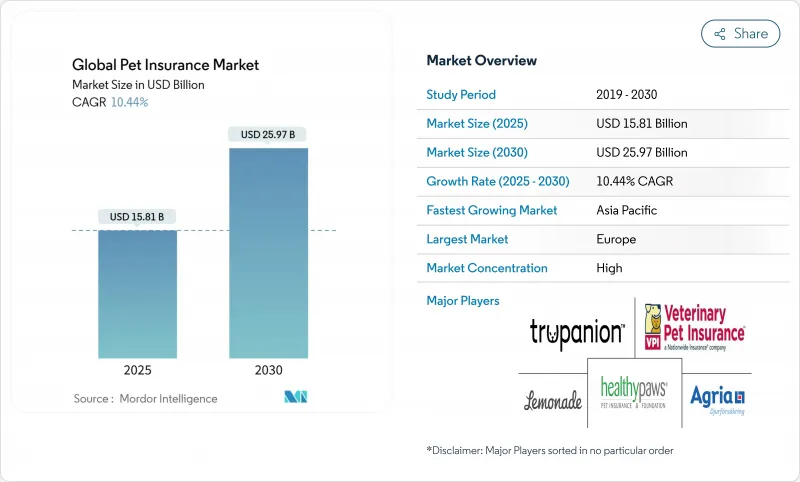

Global Pet Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global pet insurance market stands at USD 15.81 billion in 2025 and is projected to reach USD 25.97 billion by 2030, reflecting a 10.44% CAGR.

This solid growth outlook underscores how rising global pet ownership, escalating veterinary inflation, and improved regulatory clarity keep premiums expanding even as some legacy players trim policy counts. Premium uptake remains resilient because comprehensive coverage offsets high out-of-pocket veterinary bills, which are rising faster than general inflation. Digital-native insurers accelerate adoption by reducing acquisition frictions, while embedded distribution inside pet-care ecosystems captures customers at moments of high intent. Parallel advances in AI-driven claims automation lower processing costs and improve service speed, reinforcing positive perceptions of the pet insurance market among new policyholders.

Global Pet Insurance Market Trends and Insights

Rising Pet Adoption and Pet-Humanization

Pet ownership growth and the view of pets as family members fuel steady premium demand. Global spending on pet care reached USD 147 billion in 2023, with veterinary services as the fastest-growing component, prompting owners to seek financial protection. Millennials and Gen Z drive adoption rates and show high willingness to pay for advanced treatments such as oncology or orthopedic surgery. China illustrates this demographic shift, where 80% of owners maintained or raised spending following the pandemic, strengthening the cat economy. The emotional bond between owners and pets translates into relatively price-inelastic demand for the pet insurance market, underpinning its long-term expansion.

Escalating Veterinary Costs Outpacing CPI

The U.S. Bureau of Labor Statistics recorded an 8.1% year-over-year increase in the Veterinary Services CPI for 2024, more than double the general CPI growth rate. Contributing factors include staffing shortages-veterinary vacancies rose 24% in 2024, per the AVMA Workforce Dashboard, and ongoing consolidation that concentrates pricing power among large chains such as Mars Veterinary Health, which now operates more than 2,500 hospitals worldwide. Average invoice values for canine cruciate-ligament repair surpassed USD 4,700 in 2024, a 19% jump in two years, based on aggregated Trupanion claims data. These sharply rising costs make risk transfer increasingly attractive; NAPHIA notes that claims reimbursements exceeded USD 4 billion in North America for the first time in 2024, up 23% yearly. While higher bills pressure player loss ratios, they simultaneously expand the perceived value of comprehensive coverage, sustaining premium growth.

High Premium Inflation Versus Disposable Income

Premium growth continues to outstrip wage gains for many households. The California Department of Insurance approved rate filings showing average statewide increases of 12-15% for 2024, with some coastal counties exceeding 20%. Lemonade's Q4 2024 shareholder letter disclosed a 14% price rise for its Pet product, citing veterinary inflation and higher medicine costs. With U.S. median real wages up only 4% in the same period, affordability gaps widen, prompting a 2.3% decline in wellness-visit frequency recorded by the AVMA Practice Metrics program. In lower-income EU regions, FEDIAF's 2024 survey found that 26% of owners forewent insurance due to cost, up from 19% in 2022. Unless income growth rebounds or new low-cost products appear, penetration may stall among price-sensitive segments, particularly in emerging markets.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Micro-chipping & NAIC Model Act Rollout

- Embedded Insurance in Pet-Care Ecosystems

- Insurer Exits Triggered by Adverse Loss Ratios in Certain Breeds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Accident & illness policies represented 64.1% of premiums in 2024, anchoring the pet insurance market, supported by clear catastrophic risk transfer. This segment enjoys steady renewals as owners value protection from high-ticket emergencies where bills surpass USD 20,000. Wellness add-ons, projected to grow 13.23% CAGR, broaden the product beyond catastrophe to encompass routine check-ups and vaccinations. That positioning attracts younger demographics who prefer budgeting predictable monthly fees over lump-sum vet bills. The pet insurance market size for wellness coverage is projected to expand rapidly as more carriers bundle preventive services with illness coverage to differentiate offerings and stabilize claim severity.

The comprehensive model also addresses hereditary and chronic conditions, reducing surprise exclusions that once hampered customer satisfaction. Data from Q1 2024 shows recurring costs such as special diets at USD 421 and X-rays at USD 819, reinforcing consumer appetite for inclusive plans. As risk pools mature and AI-driven underwriting refines pricing, carriers can maintain margins even while offering broader benefits packages that mirror human health insurance.

Dogs accounted for 78.2% of premiums in 2024, a level reflecting entrenched canine ownership and higher average vet spend. Large dog populations in the United States, Germany, and the United Kingdom sustain deep actuarial datasets that underpin accurate pricing, keeping the pet insurance market share for canines stable. Cats follow, though lower transaction values make feline policies more price-sensitive, influencing benefit calibration.

Exotic pets form the fastest-growing slice at 12.21% CAGR through 2030 as specialty coverage emerges for birds, rabbits, and reptiles. Nationwide's 2024 launch of avian and exotic plans with up to 90% reimbursement illustrates market response to the estimated 15% of U.S. households owning non-traditional animals. Higher average treatment costs, driven by scarce specialist vets, enhance the value proposition, boosting uptake. The result is diversified premium growth that broadens the overall pet insurance market beyond traditional dog-and-cat segments.

The Global Pet Insurance Market is Segmented by Policy Type (Accident and Illness, Accident-Only, Wellness/ Preventive-Care Add-Ons, and More), Animal Type (Dog, Cat, Other Pets), Provider Type (Private Insurers, Mutual/Cooperative Insurers and More), Sales Channel (Agency/Brokers, Bancassurance, Direct and More), and Region. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe generated 44.1% of 2024 global premiums, reflecting decades of regulatory support and cultural normalization of pet insurance. Sweden pioneered the category more than a century ago, creating a foundation of consumer trust. Germany, the United Kingdom, and France account for the bulk of regional premiums, aided by stringent animal-welfare statutes and high disposable incomes. Digital channels captured 19% of non-life sales in 2024, according to the regional regulator, signaling growing online momentum that will lift the pet insurance market further in the coming years.

Asia-Pacific ranks as the fastest-growing region at 10.50% CAGR through 2030. China drives this trajectory, with its pet-care economy expanding at 12.9% CAGR amid rising middle-class income and the cat boom in major cities. Although penetration remains low, large addressable pet populations position the pet insurance market for outsized gains as awareness and regulatory clarity improve. Japan sustains a mature customer base, while Australia mirrors North American consumer behavior with a high willingness to insure pets. India and Southeast Asian countries offer long-run potential once disposable incomes rise and cultural attitudes toward pet healthcare evolve.

North America continues to deliver sizeable volume, anchored by 6.25 million insured pets at end-2023, a 16.7% annual increase. Advanced veterinary infrastructure supports high-value policy designs, yet intense competition compresses margins. Implementation of the NAIC Model Act across multiple states standardizes disclosures, reduces compliance variance, and simplifies multi-state product launches. Canada contributes incremental growth, whereas Mexico's expanding middle class signals future upside. Ongoing premium inflation remains a near-term headwind but also enhances perceived value of coverage among pet owners confronting steep vet bills.

- Trupanion Inc.

- Nationwide (VPI)

- Anicom Holdings Inc.

- Embrace Pet Insurance Agency LLC

- Figo Pet Insurance LLC

- Hartville Group (ASPCA)

- Healthy Paws Pet Insurance LLC

- Lemonade Inc.

- ManyPets Ltd.

- Agria Djurforsakring AB

- RSA Group (MORE THAN)

- Petplan (Fetch)

- Pets Best Insurance Services LLC

- MetLife Pet Insurance (PetFirst)

- Dotsure.co.za

- Oneplan (South Africa)

- PetSure (Australia)

- iPet Insurance (Japan)

- Chewy / Trupanion Pet-Partner Plans

- Pumpkin Pet Insurance (Zoetis)

- Allianz (Petplan Germany)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising pet adoption & pet-humanization trend

- 4.2.2 Escalating veterinary costs outpacing CPI

- 4.2.3 Mandatory micro-chipping & NAIC Model Act rollout

- 4.2.4 Embedded insurance in pet-care ecosystems (retailers, wellness apps)

- 4.2.5 Employer-sponsored pet-benefit programs

- 4.2.6 AI-driven dynamic underwriting & real-time claims automation

- 4.3 Market Restraints

- 4.3.1 High premium inflation vs. disposable income

- 4.3.2 Lack of unified global veterinary procedure coding

- 4.3.3 Insurer exits triggered by adverse loss ratios in certain breeds

- 4.3.4 Low awareness & cultural barriers in emerging markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Policy Type

- 5.1.1 Accident & Illness

- 5.1.2 Accident-Only

- 5.1.3 Wellness / Preventive-Care Add-ons

- 5.1.4 Chronic / Hereditary Conditions

- 5.2 By Animal Type

- 5.2.1 Dog

- 5.2.2 Cat

- 5.2.3 Other Pets (Birds, Exotics, Equine, etc.)

- 5.3 By Provider Type

- 5.3.1 Private Insurers

- 5.3.2 Mutual / Cooperative Insurers

- 5.3.3 Insurtech-Only Providers

- 5.3.4 Government-linked / Public Schemes

- 5.4 By Sales Channel

- 5.4.1 Direct-to-Consumer (Digital & Phone)

- 5.4.2 Intermediated ( Included Agency / Broker, Bancassurance and other Traditional Third-Party Channels)

- 5.4.3 Embedded (Pet Retailers, Vet Clinics, E-commerce)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics (Sweden, Norway, Denmark, Finland)

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East & Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Trupanion Inc.

- 6.4.2 Nationwide (VPI)

- 6.4.3 Anicom Holdings Inc.

- 6.4.4 Embrace Pet Insurance Agency LLC

- 6.4.5 Figo Pet Insurance LLC

- 6.4.6 Hartville Group (ASPCA)

- 6.4.7 Healthy Paws Pet Insurance LLC

- 6.4.8 Lemonade Inc.

- 6.4.9 ManyPets Ltd.

- 6.4.10 Agria Djurforsakring AB

- 6.4.11 RSA Group (MORE THAN)

- 6.4.12 Petplan (Fetch)

- 6.4.13 Pets Best Insurance Services LLC

- 6.4.14 MetLife Pet Insurance (PetFirst)

- 6.4.15 Dotsure.co.za

- 6.4.16 Oneplan (South Africa)

- 6.4.17 PetSure (Australia)

- 6.4.18 iPet Insurance (Japan)

- 6.4.19 Chewy / Trupanion Pet-Partner Plans

- 6.4.20 Pumpkin Pet Insurance (Zoetis)

- 6.4.21 Allianz (Petplan Germany)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment