PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851213

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851213

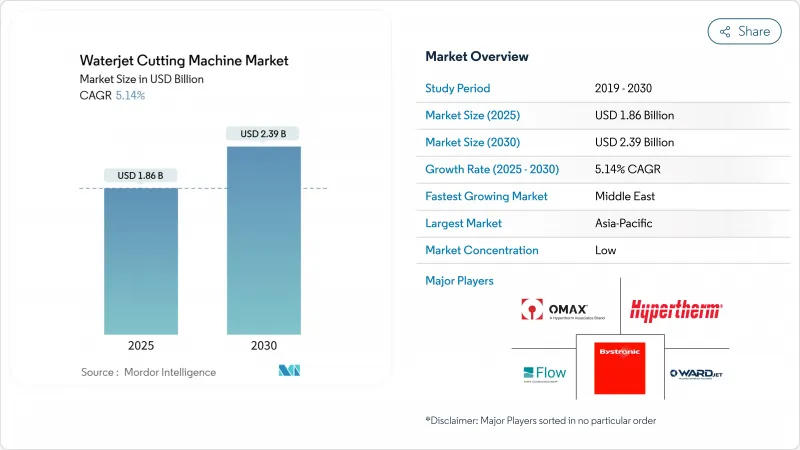

Waterjet Cutting Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Waterjet Cutting Machine Market size is estimated at USD 1.86 billion in 2025, and is expected to reach USD 2.39 billion by 2030, at a CAGR of 5.14% during the forecast period (2025-2030).

The waterjet cutting machine market stood at USD 1.86 billion in 2025 and is forecast to reach USD 2.39 billion in 2030, advancing at a 5.14% compound annual growth rate. Consistent demand for non-thermal, high-precision cutting in aerospace, automotive, and medical manufacturing sustains expansion even as the technology matures. Ultra-high-pressure systems above 6,000 bar set the performance frontier, enabling rapid processing of carbon-fiber composites and hard-to-machine EV alloys. Asia-Pacific retains volume leadership, while Middle East industrial diversification drives the fastest regional upswing. Competitive differentiation pivots on pump efficiency, automation software, and service reach instead of headline price.

Global Waterjet Cutting Machine Market Trends and Insights

Rapid Penetration of 5-Axis & Robotic Waterjet Systems in Precision Fabrication

Advanced motion control transforms conventional 2D cutting into true 3D manufacturing, allowing a single setup to replace multiple downstream operations. Dynamic Waterjet heads equipped with active tolerance compensation now deliver 2-4 X faster cycle times while preserving edge quality. Articulated robots running at 90,000 PSI integrate beveling and piercing in automotive cell production, easing labor-skill constraints and enabling lights-out shifts. Demonstrations of +-2 µm tolerances in micro-waterjet platforms extend the application envelope to surgical implants, reflecting the tool-room precision now achievable on shop floors.

Rising Adoption for Hard-to-Machine Alloys in EV & E-Mobility Parts

Battery housings, structural beams, and motor cores fabricated from titanium, high-strength steels, and composite stacks benefit from the waterjet's cold-cut attribute that avoids heat-affected zones. Cut thickness capability up to 24 inches removes secondary milling, lowering takt times for EV chassis components. Pump pressures of 90,000 PSI provide the energy density needed for thick stack piercing, while integrated nesting software maximizes material utilization amid elevated alloy costs.

Intensifier Seal-Life Limitations in Greater Than 6 k Bar Systems

Seal fatigue accelerates with rising jet pressures, triggering maintenance cycles after only 250,000 strokes and complicating high-volume composite machining. Predictive diagnostics mitigate unscheduled stops yet do not fully resolve the materials-science hurdle that restrains full-shift utilization of 90,000 PSI pumps.

Other drivers and restraints analyzed in the detailed report include:

- Reshoring-Led Capex Cycle in North American Metal Shops

- Modular Intensifier Pumps Reducing Operating Cost Per Cut

- Facility-Level Noise & Slurry Disposal Compliance Costs (EU)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Abrasive platforms captured 82.54% of 2024 revenue, reinforcing their status as the workhorse of the waterjet cutting machine market. Their capability to slice 24-inch-thick Inconel plates at +-0.001-inch tolerances underpins adoption in aerospace skins and heavy equipment frames. Conversely, pure-water variants gain ground in sanitary packaging lines, advancing at a 7.5% CAGR as USDA-compliant designs avoid cross-contamination and reduce wash-down time.

Growth trajectories diverge because abrasive jets excel on rigid substrates whereas nozzle-only systems target delicate food, pharma film, and foam tasks. Regulatory emphasis on hygiene, plus lower consumables cost, positions pure waterjet as an entry path for processors seeking gentle, residue-free cutting. The cross-segment dynamic ensures that the waterjet cutting machine market continues broadening its addressable base without cannibalizing its industrial stronghold.

Three-axis tables still represent half of global shipments, reflecting entrenched demand for flat-plate profiling in job shops. Yet 5-axis machines post a 7.8% CAGR as beveling, taper compensation, and 3D sculpting shrink fixture counts and boost first-part accuracy. Automated tilt heads linked to CAD-CAM suites now contour CFRP wing spars in one pass, replacing costly, multi-station milling.

Robotic cells sit in the premium tier, pairing articulated arms with ultra-high-pressure pumps to deliver endless reach for dashboard trimming, battery pack venting, and pie-shaped rotor slots. Micro-waterjet systems, meanwhile, push into sub-50-µm kerf widths, bridging the gap between EDM and mechanical micro-milling. Collectively, motion complexity upgrades are redefining the capability ceiling of the waterjet cutting machine market.

The Waterjet Cutting Machine Market is Segmented by Product Type (Abrasive and Pure (Non-Abrasive)), by Axis/Configuration (3-Axis, and Others), by Pressure Range (Low, Medium, and Ultra-High), by Pump Type (Direct-Drive and Hydraulic Intensifier), by End-User Industry (Automotive, and Others), by Material Cut (Metals, and Others), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 37.8% of worldwide revenue in 2024, underpinned by dense manufacturing ecosystems in China, India, Japan, and the ASEAN bloc. Government initiatives championing localized high-value production, together with surging EV output, anchor long-term demand. Domestic OEMs offer cost-competitive models, but Western brands retain share in ultra-high-precision installations, illustrating a two-tier import-local mix.

The Middle East is poised to outpace all regions at a 7.3% CAGR to 2030. Sovereign programs such as Saudi Vision 2030 funnel capital into aerospace, shipbuilding, and renewable infrastructure, each requiring advanced cutting methods. Localization agreements between global pump specialists and Gulf manufacturers signal an emergent regional supply chain for the waterjet cutting machine market.

North America sustains high installed-base value through reshoring tailwinds and defense procurement. Aerospace composite wingskins, naval propulsion housings, and custom vehicle mods keep demand stable, while Mexico's maquiladora corridors add greenfield opportunities. Europe remains technology-intensive yet price-pressured, with strict environmental directives steering buyers toward energy-efficient, closed-loop systems that satisfy EU waste and noise norms.

- Flow International Corporation

- OMAX Corporation

- Hypertherm Inc.

- Bystronic Group

- WardJet LLC

- Techni Waterjet

- KMT Waterjet Systems

- Jet Edge Inc.

- Resato International BV

- Dardi International Corp.

- Waterjet Sweden AB

- Semyx LLC

- Hornet Cutting Systems

- Lincoln Electric (Torchmate)

- Koike Aronson Inc.

- CMS SpA (SCM Group)

- Mitsubishi Electric Corp.

- APW (Shenyang)

- Kennametal Inc.

- GMA Garnet Pty Ltd.

- CERATIZIT SA*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid penetration of 5-axis & robotic waterjet systems in precision fabrication

- 4.2.2 Rising adoption for hard-to-machine alloys in EV & a-mobility parts

- 4.2.3 Reshoring-led cap-ex cycle in North American metal shops

- 4.2.4 Modular intensifier pumps reducing operating cost per cut

- 4.2.5 Growing use of ultra-high-pressure (greater than 6 k bar) jets in aerospace composites

- 4.2.6 ESG-driven shift away from plasma & laser in food and pharma packaging

- 4.3 Market Restraints

- 4.3.1 Intensifier seal-life limitations in greater than 6 k bar systems

- 4.3.2 Facility-level noise & slurry disposal compliance costs (EU)

- 4.3.3 Availability of low-cost CO2 laser tables in Asia

- 4.3.4 Rising abrasive procurement/ logistics costs due to supply chain volatility

- 4.3.5 Scarcity of garnet abrasives in Nordic quarries post-2023 bans

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Geopolitical Trends on Waterjet Cutting Machine Market

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Product Type

- 5.1.1 Abrasive Waterjet Cutting Machines

- 5.1.2 Pure (Non-abrasive) Waterjet Cutting Machines

- 5.2 By Axis / Configuration

- 5.2.1 3-axis Tables

- 5.2.2 5-axis Tables

- 5.2.3 Others (Robotic (Articulated-arm) Waterjet Cells, Micro-precision Waterjet Systems)

- 5.3 By Pressure Range

- 5.3.1 Low Pressure (Less than 4200 bar | Less than ~60,000 psi)

- 5.3.2 Medium Pressure (4200 - 6000 bar | ~60,000-87,000 psi)

- 5.3.3 Ultra-High Pressure (Greater than 6000 bar | Greater than ~87,000 psi)

- 5.4 By Pump Type

- 5.4.1 Direct-drive Pumps

- 5.4.2 Hydraulic Intensifier Pumps

- 5.5 By End-user Industry

- 5.5.1 Automotive

- 5.5.2 Aerospace & Defense

- 5.5.3 Electronics & Semiconductors

- 5.5.4 Metal Fabrication

- 5.5.5 Construction & Mining

- 5.5.6 Medical Devices

- 5.5.7 Others (Textile & Leather, Food & Beverage Processing)

- 5.6 By Material Cut

- 5.6.1 Metals

- 5.6.2 Stone, Ceramic & Tiles

- 5.6.3 Glass

- 5.6.4 Others (Plastics & Composites, Rubber, Foam, etc.)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Peru

- 5.7.2.4 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.7.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.7.3.8 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 Australia

- 5.7.4.5 South Korea

- 5.7.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.7.4.7 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 Qatar

- 5.7.5.4 Kuwait

- 5.7.5.5 Turkey

- 5.7.5.6 Egypt

- 5.7.5.7 South Africa

- 5.7.5.8 Nigeria

- 5.7.5.9 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, ...)}

- 6.4.1 Flow International Corporation

- 6.4.2 OMAX Corporation

- 6.4.3 Hypertherm Inc.

- 6.4.4 Bystronic Group

- 6.4.5 WardJet LLC

- 6.4.6 Techni Waterjet

- 6.4.7 KMT Waterjet Systems

- 6.4.8 Jet Edge Inc.

- 6.4.9 Resato International BV

- 6.4.10 Dardi International Corp.

- 6.4.11 Waterjet Sweden AB

- 6.4.12 Semyx LLC

- 6.4.13 Hornet Cutting Systems

- 6.4.14 Lincoln Electric (Torchmate)

- 6.4.15 Koike Aronson Inc.

- 6.4.16 CMS SpA (SCM Group)

- 6.4.17 Mitsubishi Electric Corp.

- 6.4.18 APW (Shenyang)

- 6.4.19 Kennametal Inc.

- 6.4.20 GMA Garnet Pty Ltd.

- 6.4.21 CERATIZIT SA*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment