PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851218

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851218

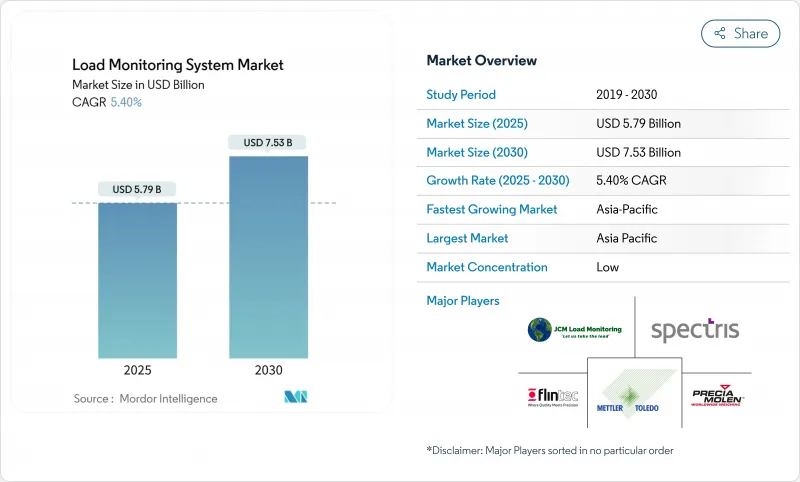

Load Monitoring System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Load Monitoring Systems Market is valued at USD 5.79 billion in 2025 and is forecast to reach USD 7.53 billion by 2030, expanding at a 5.40% CAGR.

Demand is broadening from traditional crane safety into renewable-energy, battery-electric vehicle (BEV) assembly, and autonomous factories where predictive maintenance and regulatory compliance converge. Operators now specify platforms that combine certified load indication with edge analytics, creating new revenue pools for hybrid and intelligent systems. Analog and wired installations still dominate unit volumes, yet AI-driven, IoT-connected architectures capture the bulk of current capital expenditure. Competitive intensity is rising as global automation majors acquire software specialists to shorten time-to-market for integrated solutions. Asia-Pacific's infrastructure boom, coupled with tightening OSHA and EU directives, anchors both current demand and future growth potential.

Global Load Monitoring System Market Trends and Insights

Tightening OSHA & EU Lifting-Safety Mandates Energizing Certified Load-Monitoring Adoption

Regulatory scrutiny is escalating as OSHA logged a surge in safety complaint forms from 68,896 to 94,529 in consecutive reporting periods, prompting construction and maritime operators to retrofit cranes with devices accurate within 95%-110% of actual load. EU directives mirror this stance, harmonizing standards and raising penalties for non-compliance. Insurers increasingly price premiums on documented sensor usage, pushing voluntary adoption toward compulsory rollout across high-risk sectors. Heightened enforcement thus redirects procurement toward systems that combine certified hardware with digital records, accelerating the replacement of obsolete analog indicators.

Digital Load Cells Enabling Real-Time Monitoring of Offshore Wind Turbine Lifts

Dual-axis shear pin sensors coupled with accelerometers now form the backbone of offshore lift supervision, preventing cable fatigue that can shut down multi-MW turbines. Edge devices analyze vibration signatures locally, then forward anomalies through software-defined networks for fleet-wide visualization. Because a single cable failure risks multi-million-dollar revenue loss, operators prioritize predictive algorithms even at higher upfront cost. Uptake intensifies as installations move into deeper waters where manual inspections are unfeasible, cementing digital load cells as critical infrastructure for next-generation wind farms.

High Upfront Cost of Multi-Axis Retrofits for Legacy Cranes

Multi-axis sensor packages, control-panel swaps, and operator training can push retrofit budgets beyond USD 100,000 per crane, forcing small and mid-size contractors to weigh capital outlay against regulatory penalties and insurance premiums. Downtime during installation compounds the hurdle because revenue-generating lifts pause while electrical rewiring and structural reinforcements take place. Financing options remain limited; most commercial lenders classify the upgrades as discretionary, so interest rates run higher than standard equipment loans. Vendors are responding with subscription models that bundle hardware, installation, and predictive-maintenance software under multi-year service agreements, but uptake is still concentrated among top-tier fleet owners. Until sensor prices fall or leasing spreads into smaller fleets, the high early-stage cash requirement will continue to damp adoption, shaving an estimated 0.8% from forecast CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Battery-Electric Vehicle Pack Assembly Requiring High-Precision Force Feedback

- Modular Construction Boom Demanding Synchronized Multi-Lift Monitoring

- Calibration Drift & Downtime in Corrosive Marine Settings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Load cells retained the largest 48.67% revenue slice of the load monitoring systems market in 2024, underscoring hardware's foundational role in safety compliance. Indicators, controllers, and accessories sustain steady replacement volumes tied to crane refurbishment cycles. However, software for data logging, visualization, and analytics is set to grow at a 7.2% CAGR, becoming the sector's revenue accelerant. Vendors embed machine-learning models that flag anomalous force signatures hours before failure, turning historical sensor data into actionable intelligence. Subscription licensing further stabilizes cash flows and strengthens customer lock-in.

Industrial Internet of Things integration fuels this trajectory by enabling centralized command centers that supervise global crane fleets from a single dashboard. Telemetry modules leveraging LTE-M and 5G backhaul reduce the cost of remote sites. As predictive-maintenance contracts proliferate, software revenues magnify each hardware sale, shifting competitive focus from component margins to lifecycle services within the load monitoring systems market.

Systems rated above 20 tons accounted for 68.78% of the load monitoring systems market size in 2024, a testament to heavy construction, mining, and shipyard requirements. These high-capacity platforms emphasize overload alarms and redundant circuitry to satisfy insurance mandates. Mid-range 20-100 ton devices serve generalized building and manufacturing activities, offering a balance of price and robustness. Sub-20 ton units, though smaller, deliver precision essential for BEV battery assembly, medical robotics, and electronics fabrication.

The sub-20 ton category posts the fastest 6.5% CAGR as lightweight cobots and patient-lifting equipment proliferate. Miniaturized multi-axis load cells capture deflection down to single-newton increments, enabling quality control for spot welds and ensuring patient safety in hospital settings. Vendors differentiate through material science innovations-such as titanium housings-to fight fatigue, thereby broadening adoption across industries where micrometer accuracy outweighs brute strength.

The Load Monitoring System Market is Segmented by Product (Load Cell, and Others), by Load-Cell Capacity (Less Than 20 T, and Others), by Technology (Analog Load Monitoring Systems, and Others), by Connectivity (Wired, and Others), by Industry (Automotive, and Others), and by Geography (North America, and Others). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated the load monitoring systems market in 2024, capturing 38% of worldwide revenue and growing at a projected 7.3% CAGR. China's mega-projects, from high-speed rail to offshore wind, anchor demand, while India's Smart Cities Mission funnels public spending into advanced construction technologies. Southeast Asian economies embrace modular high-rise techniques, importing synchronized multi-lift monitoring as part of turnkey packages. Government incentives for BEV supply chains accelerate adoption in battery and component plants, further expanding the regional customer base.

North America represents a mature yet innovation-driven arena. OSHA's enforcement surge, combined with aggressive offshore wind targets along the Atlantic seaboard, sustains replacements and greenfield opportunities. The United States leads in BEV gigafactory construction, applying high-precision load measurement to welding lines. Canada's mining sector adds steady demand for heavy-duty units that withstand extreme cold.

Europe balances stringent safety statutes with environmental imperatives. The North Sea offshore-wind corridor spearheads the deployment of digital load cells capable of autonomous diagnostics. Germany's Industrie 4.0 programs finance IoT retrofits in brownfield factories. Meanwhile, the Middle East and Africa leverage oil and gas projects to pilot wireless monitoring on offshore platforms, and South America's commodity extraction sites adopt heavy-capacity systems as part of modernization drives.

- Flintec Inc.

- Mettler Toledo International Inc.

- Spectris plc (HBM, NMB)

- Vishay Precision Group Inc.

- Precia Molen

- Straightpoint (The Crosby Group)

- Dynamic Load Monitoring Ltd

- JCM Load Monitoring Ltd

- LCM Systems Ltd

- Keli Electric Manufacturing Co. Ltd

- Wirop Industrial Co. Ltd

- Futek Advanced Sensor Technology Inc.

- Siemens AG

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd

- Eaton Corporation plc

- Strainstall Ltd (BES Group)

- Mantracourt Electronics Ltd

- Interface Inc.*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening OSHA & EU lifting-safety mandates energizing certified load-monitoring adoption

- 4.2.2 Digital load cells enabling real-time monitoring of offshore wind turbine lifts

- 4.2.3 Battery-electric vehicle pack assembly requiring high-precision force feedback

- 4.2.4 Modular construction boom demanding synchronized multi-lift monitoring

- 4.2.5 Hospital automation (patient-handling robotics) embedding smart load sensors

- 4.2.6 Micro-grid deployment needing dynamic power-line tension monitoring

- 4.2.7 Integration of load sensors into predictive maintenance platforms

- 4.3 Market Restraints

- 4.3.1 High upfront cost of multi-axis retrofits for legacy cranes

- 4.3.2 Calibration drift & downtime in corrosive marine settings

- 4.3.3 Fragmented certification schemes delaying cross-border approvals

- 4.3.4 Cyber-security risk in wireless load-monitoring for critical assets

- 4.3.5 Shortage of skilled personnel to interpret advanced load data

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Product

- 5.1.1 Load Cell

- 5.1.2 Indicators & Controllers

- 5.1.3 Load Monitoring Software (Data logging)

- 5.1.4 Others (Accessories (Mounting Plates, Shackles, Cables), Telemetry, etc.)

- 5.2 By Load-Cell Capacity

- 5.2.1 Less than 20 t

- 5.2.2 20 - 100 t

- 5.2.3 More than 100 t

- 5.3 By Technology

- 5.3.1 Analog Load Monitoring Systems

- 5.3.2 Digital Load Monitoring Systems

- 5.3.3 Hybrid / Intelligent

- 5.4 By Connectivity

- 5.4.1 Wired

- 5.4.2 Wireless

- 5.4.3 IoT-Enabled (Cloud Connected)

- 5.5 By Industry

- 5.5.1 Automotive

- 5.5.2 Construction, Infrastructure & Civil Engineering

- 5.5.3 Oil & Gas / Offshore

- 5.5.4 Aerospace & Defense

- 5.5.5 Marine & Shipbuilding

- 5.5.6 Healthcare & Biomedical

- 5.5.7 Manufacturing, Heavy Equipment & Industrial Automation

- 5.5.8 Energy & Utilities (Wind, Solar, Hydro)

- 5.5.9 Other Industries (Mining, Entertainment Rigging, Trasport & Logistics, Testing, etc.)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Peru

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 South Korea

- 5.6.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Qatar

- 5.6.5.4 Kuwait

- 5.6.5.5 Turkey

- 5.6.5.6 Egypt

- 5.6.5.7 South Africa

- 5.6.5.8 Nigeria

- 5.6.5.9 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, Recent Developments)}

- 6.4.1 Flintec Inc.

- 6.4.2 Mettler Toledo International Inc.

- 6.4.3 Spectris plc (HBM, NMB)

- 6.4.4 Vishay Precision Group Inc.

- 6.4.5 Precia Molen

- 6.4.6 Straightpoint (The Crosby Group)

- 6.4.7 Dynamic Load Monitoring Ltd

- 6.4.8 JCM Load Monitoring Ltd

- 6.4.9 LCM Systems Ltd

- 6.4.10 Keli Electric Manufacturing Co. Ltd

- 6.4.11 Wirop Industrial Co. Ltd

- 6.4.12 Futek Advanced Sensor Technology Inc.

- 6.4.13 Siemens AG

- 6.4.14 Schneider Electric SE

- 6.4.15 Honeywell International Inc.

- 6.4.16 ABB Ltd

- 6.4.17 Eaton Corporation plc

- 6.4.18 Strainstall Ltd (BES Group)

- 6.4.19 Mantracourt Electronics Ltd

- 6.4.20 Interface Inc.*

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment